Part

01

of one

Part

01

Global Market Size of Market Research Services Segments

Key Takeaways

- In 2020, the global business intelligence tools market recorded a market size of $23.1 billion and is expected to reach $33.3 billion by 2025.

- As of 2020, the top 10 players of the global business intelligence tools market accounted for 62.5% of the market size, which amounted to $14.9 billion in revenue.

- In terms of company type, tier 1 companies hold a market size of $4.38 billion, tier 2 companies hold a market size of $8.08 billion, and tier 3 companies hold $23.56 in revenue.

Introduction

This research identifies and presents the market size of the global business intelligence tools market. It was noticed that direct information on the breakdown of this segment’s market size in terms of organization size, service, platform, and geography are hidden behind paywalls. Therefore, with the available data on the global business intelligence tools’ market size and the market share, the revenues held by large enterprises and small businesses have been estimated.

Market Size of the Global Business Intelligence Tools Market

- According to a report published by Markets and Markets, the global business intelligence market is expected to reach $33.3 billion in revenue by 2025 from $23.1 billion in 2020, with a CAGR of 7.6% during the period 2020-2025.

- A report published by Verified Market Research predicted that the global business intelligence market will reach $35.18 billion by 2026 at a CAGR of 8.45% during the forecast period 2018-2026.

- Along with analytics tools, the global business intelligence market is expected to hit $17.6 billion by 2024. Furthermore, in combination with big data, the global business intelligence tools market is expected to reach $420.98 billion by 2027, with a growth rate of 10.9% (CAGR) during the forecast period 2020-2027. (Allied Market Research, 2020)

- Due to increasing technological advancements, North America currently holds the largest market in the business intelligence tools sector. Within the global business intelligence tools market, cloud analytics is found to be the fastest-growing segment that recorded a revenue of $23.2 billion in 2020 and is expected to reach $65.4 billion in 2025.

Market Size Breakdown by Organization Size

- Analysis conducted by Fortune Business Insights indicates that large enterprises will hold a substantial share of the global business intelligence market. Some key drivers include the availability of IT infrastructure and ample investments. On the other hand, small and medium-sized enterprises are “expected to deploy BI software to gain maximum market share” and improve customer satisfaction. (FBI)

- According to an article published by Apps Run the World, the top 10 business intelligence software enterprises accounted for 62.5% of the global business intelligence market’s revenue in 2019. With a market size of $23.1 billion in 2020, it is found that the world’s top 10 players had a combined revenue of about $14.9 billion. These enterprises include SAS Institute, SAP, Salesforce, Microsoft, IBM, Oracle, Qlik, Teradata Corporation, Informatica, and Palantir Technologies.

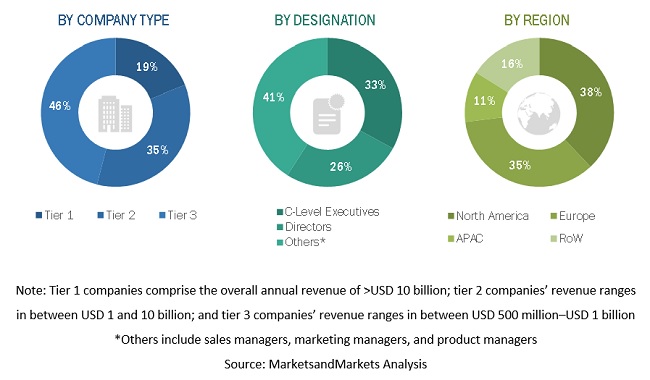

- In terms of company type, the market size of the global business intelligence market is segregated into three tiers. Tier 1 comprises companies with an annual revenue that’s greater than $10 billion. Tier 2 companies have a revenue that ranges between $1 billion and $10 billion. Also, tier 3 companies have revenues that range between $500 million and $1 billion.

- According to Markets and Markets, Tier 1 companies hold 19% of the market share while tier 2 holds 35% of the market share. Finally, tier 3 holds 46% of the market share. Therefore, the breakdown of the market size by organization type is presented as follows,

- Market size held by tier 1 companies = [Market share held by tier 1 companies x market size of the global business intelligence market in 2020]

- Market size held by tier 1 companies = [19% of $23.1 billion] = $4.38 billion

- Market size held by tier 2 companies = [Market share held by tier 2 companies x market size of the global business intelligence market in 2020]

- Market size held by tier 2 companies = [35% of $23.1 billion] = $8.08 billion

- Market size held by tier 3 companies = [Market share held by tier 3 companies x market size of the global business intelligence market in 2020]

- Market size held by tier 3 companies = [46% of $23.1 billion] = $23.56 billion.

- Based on website traffic, TrustRadius revealed that in 2020 over 60% of business intelligence buying activity is from large enterprises. Therefore, about 40% of the BI buying activity is from small businesses.

- In 2018, the market share of the global business intelligence market, in terms of organization size, was 70.34% held by large enterprises and 29.66% controlled by small and medium-sized enterprises.

- Since the market size was recorded to be $20.81 billion in 2018, the market size held by large enterprises and small and medium-sized enterprises can be estimated as follows,

- According to the report published by IDC in 2019, the share of the global business intelligence market was segregated by industry as follows:

Research Strategy

For this research on the market size of the global business intelligence tools market, we leveraged the most reputable sources of information that were available in the public domain, including Markets and Markets, Verified Market Research, Finance Online, Apps Run the World, and Fortune Business Insights. While there were several industry reports that stated the market size of the global business intelligence tool market, information on the breakdown of the market size by enterprises and small businesses was limited. With the available data, we were able to estimate the market size of large (tier 1), medium (tier 2), and small (tier 3) businesses in 2020.