Part

01

of one

Part

01

Delta-8 THC Market

Key Takeaways

- The market for Delta-8 THC products began to surge in the latter half of 2020 and continues to experience strong consumer interest, new companies and innovations entering the space, and corresponding sales growth.

- The regulatory environment around Delta-8 THC has created a "murky" and evolving landscape, however, with many states banning or otherwise restricting products containing Delta-8 THC.

- The environment of growth and expanding regulations leads to a mixed view of the future for Delta-8 THC, with some experts calling the market "unsustainable" and some more optimistic about its future prospects.

- There have been several innovations in the Delta-8 beverage market, and data on the broader cannabis beverage market indicates that the beverage form has experienced considerable growth due to its convenience, social acceptability, and alternative to alcoholic beverages.

Introduction

- The below research includes an overview of the current state of the Delta-8 THC market, including the recent sales estimates, product types, key suppliers/retailers, innovation examples, and a discussion of regulations impacting the industry. Several insights have also been included on the broader cannabis beverage market to provide perspective on the size and potential of the beverage form.

Delta-8 THC Current Market State

- Delta-8 THC, a "hemp-cannabis derivative" exists "on the border" between marijuana and hemp-based CBD, experiencing a surge in national popularity beginning in the latter half of 2020 and a corresponding emergence of Delta-8 THC products.

- Offering benefits including "pain relief, anxiety relief, and relaxation," Delta-8 THC is considered a less potent form of Delta-9, the prominent form of THC in cannabis. Defined as a "hemp extract", with the amount of THC less than .3%, Delta-8 THC is currently federally legal, though its legality remains somewhat "murky" at the state level, with individual state Delta-8 THC regulations evolving rapidly.

- New Frontier Data (a cannabis industry-focused analytics company) estimates that retail sales for Delta-8 THC products exceeded $10 million in 2020, disrupting the cannabis market. A Hemps Benchmark report suggested growing demand for Delta-8 THC in 2021, with Delta-8 products representing the fastest-growing segment of the "hemp-derived" products market.

- Cannabis data provider, Headset, reported that sales of products with Delta-8 grew 144% compared to April 2020.

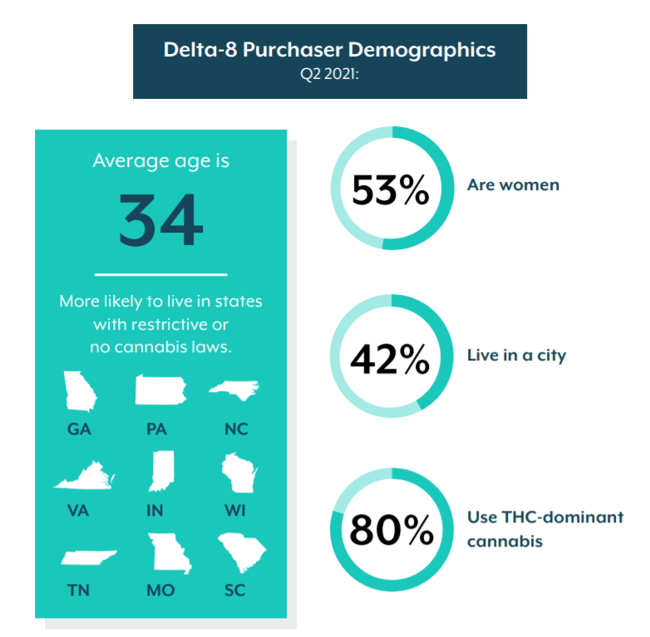

- While Delta-8 THC products have experienced strong sales in states in which recreational cannabis products are legal, its current classification as a derivative of Hemp CBD indicates that Delta-8 THC products have further potential to reach consumers in states in which cannabis products are still illegal. A 2021 survey indicates that Delta-8 purchasers are more likely to reside in states in which cannabis laws are more restrictive.

- Cannabis industry consultancy, Brightfield Group, suggests that CBD products sold through convenience stores or vape shops are particularly vulnerable to competition from Delta-8 THC. One Tennessee processer reported that 20% of their CBD customers have shifted their purchases to Delta-8, while CBD retailers reported a sharp spike in sales of Delta-8 THC in 2020, which was partially attributed to pandemic-related stress.

- One of the largest hemp companies, Hometown Hero CBD, noted a "huge boost in sales" following the introduction of Delta-8 products, which CEO Lukas Gilkey considers "more of a wellness product" compared to Delta-9 products.

- Despite the "surge in popularity" in 2020, some hemp industry experts consider the market for Delta-8 unsustainable. Michael McGuffin, president of the American Herbal Products Association, says there is a "near inevitability" for a federal crackdown on Delta-8 THC and predicts that Delta-8 THC products "won’t stay on the market very long."

- Delta-8 THC manufacturers are more optimistic about the industry's future even with evolving regulations, noting that Delta-8 will occupy a segment of the market regardless of legislation and regulations. Craig Henderson, CEO of Extract Labs in Boulder, Colorado, says, "I don’t like delta-9; I don’t like the anxiety. But I do like relief of inflammation. I do like sleeping better. I do like having a slight mood change, maybe feeling a little better during the day. And there’s a lot of people like me."

Delta-8 THC Consumer

- Given the recent emergence of Delta-8 THC, current awareness is relatively low among CBD users. Only 23% of American CBD users as of Quarter 2, 2021 were aware of Delta-8 THC, while half of those who are aware claimed to have purchased a Delta-8 THC product.

- These "early adopters" tend to be those who have used CBD longer.

- Delta-8 purchasers are more likely to be younger (average age of 34) and living in metro areas. The vast majority (80%) of these buyers use THC-dominant cannabis.

Market Evolution (1-2 years)

- Delta-8 THC was "arguably" legalized in the December 2018 Farm Bill, in which "all hemp-derived cannabinoids fall within the definition of hemp, which is a legal crop and no longer a controlled substance."

- In September 2019, 3Chi, an online cannabis retailer, "became the first company to sell Delta-8-THC cartridges, gummies, tinctures, and concentrates in all of the 38 states where it’s legal — both online and in retail stores."

- Product innovation increased throughout 2020, particularly in the latter half of the year. Some mid-year innovations included Lifted's delta-8 THC nano drops and a line of "infused, natural sparkling beverages" launched by WUNDER.

- DeltaVera, an award-winning company exclusively focused on Delta-8 THC products (smokables, expanding into edibles) exemplifies industry interest in capitalizing on a rapidly growing market, with the brand launching in late 2020 and currently expanding its distribution networks (e-Commerce, brick-and-mortar, and partnerships) and social presence.

- Some industry experts view late 2020 as the period in which Delta-8 THC "officially entered the game," gaining popularity among consumers seemingly "out of nowhere."

- The Delta-8 THC landscape in 2021 has been evolving rapidly, illustrated by a continued surge in new product introductions coupled with increasing scrutiny of delta-8 TCH. In June 2021, CannaCraft launched a new line of women-focused sparkling beverages with a Delta-8 ingredient, while Hemp Grower reported in June that four additional states (New York, North Dakota, Vermont, and Washington) had taken some action against Delta-8 THC.

Products

- Some notable categories that offer products with Delta-8 THC include vape juices, gummies, tinctures, and oils, though there has also been innovation in the beverage space, with WUNDER noting its unique combination of delta-8 and a low dose of delta-9 in its product line. The company notes beverages as a fast and efficient form to deliver the desired effects.

- With the uncertain legal status of Delta-8 THC a caveat, GreenEntrepeneur predicts the number of products on the market may triple between 2021 and 2025. The number of current products available in the market was unavailable.

Suppliers

- According to Hemp Benchmarks, the two channels accounting for the majority of delta-8 THC sales are online (direct-to-consumer) and smaller, independent retailers (most notably, smoke shops).

- Brightfield Group corroborates this channel analysis, noting that smoke & vape and CBD Specialty retailers are key channels for Delta-8 distribution. CBD users interested in Delta-8 products report a higher likelihood to leverage these channels for purchase, possibly due in part to earlier availability of Delta-8 THC in these outlets.

- Notably, national pharmacy and grocery chains that carry CBD products have not begun to offer Delta-8 THC products.

Regulations

- Delta-8 is banned or restricted in 16 states (with New York the most recent) as of June 18, 2021, while regulations are under review in an additional 5 states.

- Some specific actions states are taking with respect to regulating the sale and use of Delta-8 THC products include enacting or considering full bans to restrict access or setting potency limits.

- In 2020, the US Drug Enforcement Administration (DEA) issued an "Interim Final Rule", stating "[all] synthetically derived tetrahydrocannabinols remain schedule 1 controlled substances." The agency then classified Delta-8 THC in its "Orange Book" (list of controlled substances) as "another name for tetrahydrocannabinols," seemingly putting this classification of Delta-8 THC in conflict with the 2018 Farm Bill, which considers delta-8 a legal, hemp-derived substance. However, industry experts suggest that the DEA inclusion of Delta-8 THC doesn't legally classify it as a controlled substance, but instead has been included as a means of providing guidance on the substance and to indicate that Delta-8 THC is on its radar.

- While the case is pending, a smoke-shop operator in south Texas was criminally charged for selling Delta-8 THC products.

- A coalition of cannabis producers is also lobbying federal and state regulators to prohibit Delta-8 sales, because of the competitive threat presented by price undercutting among unregulated Delta-8 manufacturers and health issues associated with unregulated products that may cast a negative halo on related products not containing Delta-8. Steve Hawkins, interim chief executive officer of the U.S. Cannabis Council, said regulators "should look to clamp down and stop this unregulated market" with the Council issuing a statement emphasizing their concerns: "This represents a major consumer safety issue, posing dangers greater than the ‘vape crisis’ of 2019."

- In June 2021, the Hemp Industries Association (HIA) indicated their support for hemp-derived delta-8 tetrahydrocannabinol (THC), supported by a legal opinion written by attorneys Rod Kight and Philip Snow of Kight Law. In discussing its priorities, the HIA "has identified safe market expansion as a core focus for its early efforts."

- The FDA has been criticized for its lack of action in providing guidance and regulations for hemp-derived CBD, resulting in the hesitancy of larger CPG companies and retailers to enter the CBD market, as well as confusion and mixed messages regarding delta-8 THC. Josh Schneider, CEO of San Diego-based Cultivaris Hemp, remarks on the growth of the Delta-8 THC market, "Delta-8 seems to me to be entirely a market response to the failure to take action by the FDA."

THC Beverage Industry

- Edibles account for 15% of the cannabis market in the US, with beverages representing just 5% of edibles sales (.75% of the total cannabis market).

- With the total US cannabis market measured at $17.5 billion in 2020, the beverage form would be estimated at approximately $131.2 million ($17.5 billion x .75%).

- Survey results indicate that the appeal for cannabis beverages is growing. Nearly 20% of US cannabis consumers say they consume beverages, while 8% prefer this form. Bethany Gomez, managing director of Brightfield Group, expects sales of cannabis-infused beverages to grow as multi-packs become more prominent in the marketplace: "We do expect this growth trajectory to continue year over year, but given that products are generally sold as a single-serve product, the percentage of the overall market is quite low."

- D8 Seltzer features a Lime 4 pack ($24.99) as "now available" on their website, with other multi-pack flavors (mango, berry) highlighted as "coming soon."

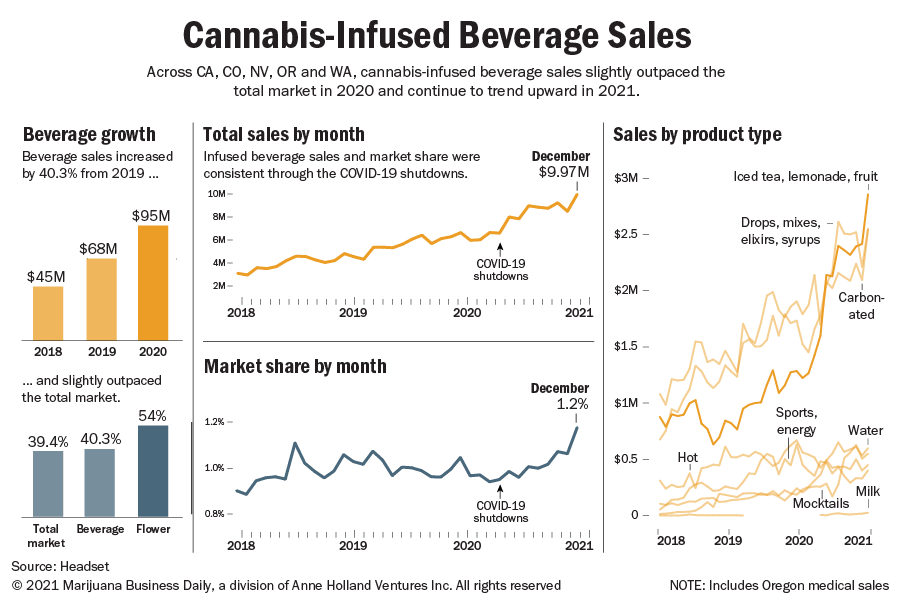

- A regional analysis (CA, CO, NV, OR, WA) of cannabis-infused beverages based on Headset data also indicated strong (40%) growth between 2019 ($68 million sales) and 2020 ($95 million sales). Carbonated beverages were one of the fastest-growing beverage segments.

- Growth drivers include the convenience of the form, a desire for an alternative to alcoholic beverages, and relatedly, health trends (e.g., an alternative during dry January). Increased interest in a beverage form may also be driven in part by greater social acceptability of consuming a beverage versus smoking.

- Beverage Industry notes that new, functional CBD and THC innovations will continue to drive growth in the cannabis beverage market. Several recent launches include AKESO Hemp Powered Hydration (from NXT water) and Quatreau (a CBD-infused, low-calorie, zero-sugar sparkling water).

Research Strategy

We leveraged reputable trade journals (e.g., Hemp Industry Daily, Hemp Benchmarks, Bevnet), survey insights (Brightfield Group, industry consultancy reports (Brightfield Group), industry data providers (Headset, New Frontier Data), prominent news publications (Forbes, Newsweek, Rolling Stone), and legal expert insights (e.g., JD Supra) to provide an analysis of the current state of the Delta-8 THC market. While we were able to determine a market size estimate at the end of 2020 (as well as a monthly growth estimate from April 2021 vs year prior), and that it is growing into 2021 despite the complex regulatory environment, we did not find granular information on the number of products or suppliers. Instead, we were able to determine key channels for delta-8 THC products, identify several recent innovations, and understand the key product categories for delta-8 (along with uncovering a growth projection for the number of products). We were also able to provide detail on regulations impacting the industry. While not part of the primary request, we did provide several insights to provide visibility into the THC beverage market, providing quantitative insights on total beverage market size and regional size and growth potential, as well as a qualitative perspective indicating multi-packs may be a key driver of cannabis beverage growth in the near-term.

.png?width=650&name=Q221_US%20CBD_Insights%20Emerging%20Delta-8%20Consumer_Chart%201_FINAL%20(1).png)

.png?width=650&name=Q221_US%20CBD_Insights%20Emerging%20Delta-8%20Consumer_Chart%202_FINAL%20(1).png)

.jpg)