Part

01

of one

Part

01

Current Trends in Independent Medical Practice in the US

Key Takeaways:

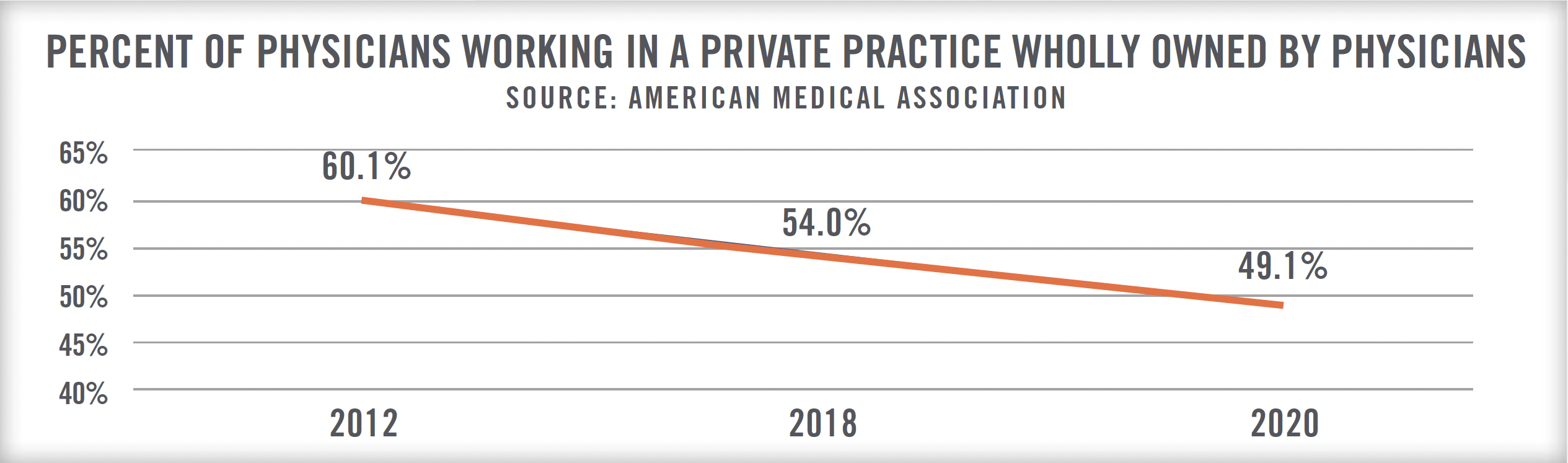

- Surveys show that independent medical practices are increasingly shifting to larger practices. In 2020, the share of physicians who worked in physician-owned practices dropped by 5% from about 54% in 2018 to 49.1% in 2020. Also, in 2020, about 17.2% of physicians worked in practices with 50-plus physicians, compared to 14.7% in 2018.

- Also, there has been a significant uptick in acquisitions of independent medical practices by non-traditional entities such as large employers, private equity firms, Medicare Advantage-focused providers, and health/insurance plans. From January 2019 to January 2022, 31,300 independent medical practices were acquired by corporate entities.

- Both trends have led to the reduction of the share of independently-owned practices from about 61.2% of physician practices in January 2019 to about 46.4% in January 2022.

Introduction

- This report provides two current trends in independent medical practice in the United States. The trends were identified because they were mentioned by authoritative and reputable surveys. Below is an overview of the findings.

Summary of Findings

Shift Toward Larger Practices

- A survey by the American Medical Association (AMA) showed that independent medical practices are increasingly shifting to larger practices. In 2020, the share of physicians who worked in physician-owned practices dropped by 5% from about 54% in 2018 to 49.1% in 2020. Also, in 2020, about 17.2% of physicians worked in practices with 50-plus physicians, compared to 14.7% in 2018.

- The survey further found that self-employed physicians made up 44% of all medical physicians in 2020, compared to 45.9% and 53.2% in 2018 and 2012, respectively. Healthcare Appraiser explained that the shift is driven by several common factors, including unfavorable insurance and government policies as well as rampant reimbursement cuts and penalties facing independent practices.

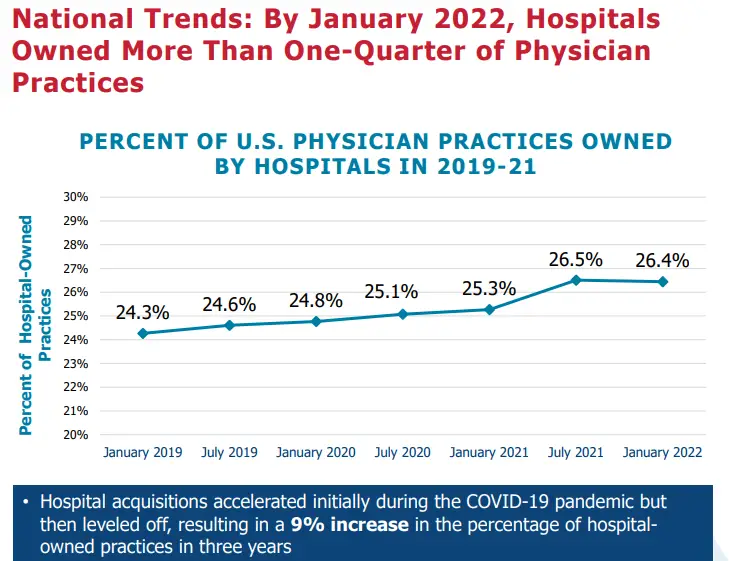

- However, the report by the AMA and another by the Physician Advocacy Institute (PAI) report that COVID-19 accelerated the shift of independent medical practices toward larger practice. PAI reported that about 3,200 independent practices were acquired by hospitals from January 2019 to January 2021. In fact, many of those acquisitions were made after the onset of the COVID-19 pandemic causing the number of hospital-owned independent medical practices to rise by 5% during the period.

- Another PAI report stated that a total of 4,800 were acquired from January 2019-January 2022, increasing the number of hospital-owned practices by 8% during the period.

- This trend has significantly reduced the number of independently-owned medical practices since about 26.4% of physician practices were owned by hospitals as of January 2022. This is considered a trend because it has been mentioned by the aforementioned authoritative and reputable surveys.

- The President of AMA, Susan R. Bailey, MD, is among industry experts that have discussed the trend. According to Joseph Sellers, MD, the Medical Society of New York State, "There has been a change from physicians working in solo practice into group practices, into larger groups, and into groups affiliated or groups owned by a health system, similar to the consolidation of our hospitals from individual hospitals into systems."

Acquisitions by Non-Traditional Entities

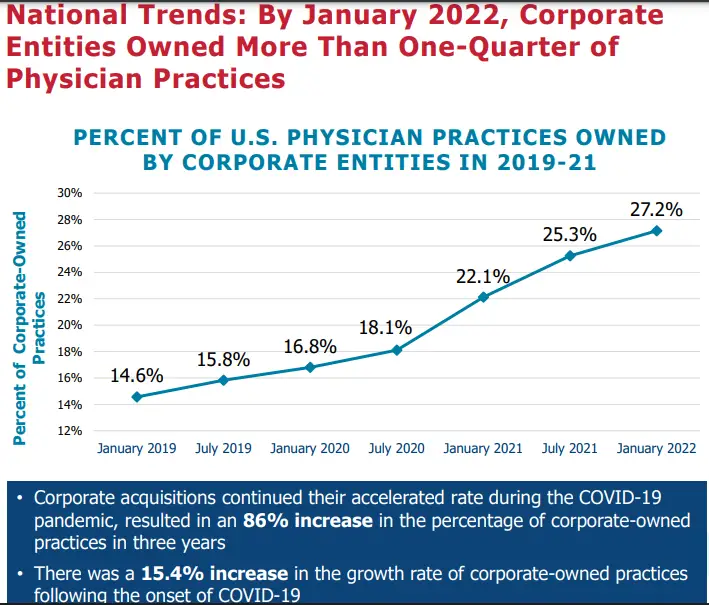

- Also observed by the AMA and PAI reports was a significant uptick in acquisitions of independent medical practices by non-traditional entities such as large employers, private equity firms, Medicare Advantage-focused providers, and health/insurance plans. From January 2019 to January 2022, 31,300 independent medical practices were acquired by corporate entities, which increased the number of corporate-owned physician practices by 86% during the period, a much larger percentage than the 8% growth in hospital-owned practices highlighted above.

- Depending on the type of corporation, physicians are motivated to sell their practices because of the benefits offered, including capital access, contracting leverage, reduced administrative burden, equity payouts, and the ability to innovate. The financial impact of COVID-19 also accelerated this trend with the growth rate of corporate-owned practices increasing by about 15.4% after COVID-19.

- Notably, PAI found that corporate entities owned about 27.2% of physician practices as of January 2022. Combined with the 26.4% owned by hospitals, about 53% of physician practices were owned by corporates and hospitals as of the beginning of 2022. The uptick in the interest of corporations in the acquisition of physician practices further reduced the share of independently-owned practices from about 61.2% in January 2019 to about 46.4% in January 2022.

- According to Robert Seligson, North Carolina Medical Society's CEO doubling as PAI's President, "the continued trend of hospital-driven consolidation is dramatically reshaping the healthcare system." This is considered a trend because it has been mentioned by the aforementioned authoritative and reputable surveys.

Research Strategy

The trends above were identified as such because they are mentioned by authoritative and reputable surveys from sources such as PAI and AMA. They have also been corroborated by several publications from WebMD, Medical Economics, and MedPage.