Part

01

of one

Part

01

Corporate Loans

Key Takeaways

- The US corporate loan default rate in 2022 was 2%. However, a much higher figure is expected by the end of 2023 (about 6%).

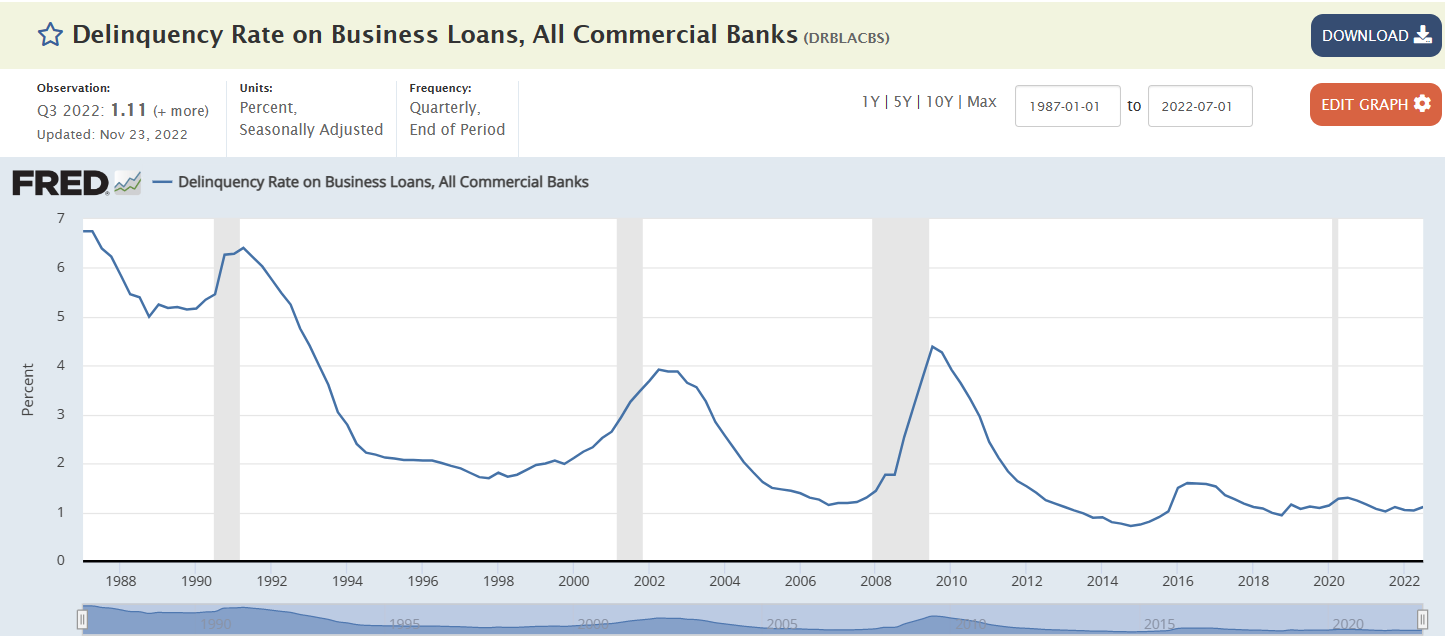

- Between 2007 and 2022, the US experienced the highest rate of corporate loan delinquencies in the third quarter of 2009 at 4.39%.

- The least delinquency rate obtained was 0.73% in the fourth quarter of 2014 and the first quarter of 2015.

Introduction

The rate of corporate loan delinquencies in the US from the first quarter of 2007 to the third quarter of 2022 has been provided in the attached spreadsheet. Data on corporate loan default rates by quarter is unavailable in the public domain. Corporate loan delinquencies have been used as a proxy for corporate loan defaults in this research. Further details on our logic can be found in the research strategy section.

Selected Findings

- In 2007, the corporate loan delinquency rate in the US was between 1.19% and 1.30%.

- The highest rate of business loan delinquencies was obtained in 2009, with figures ranging from 3.17% to 4.39%.

- The most recent delinquency rate, documented in the fourth quarter of 2022, is 1.03%.

- While experts predict that business loan defaults may reach 6% by the end of 2023, there are indications that the figure may be much higher (up to 17.7%) depending on the progression and outcome of "rising interest rates, the Russia-Ukraine military conflict, China's economic slowdown, and pandemic concerns."

- The default rate on high-yield corporate loans was at 0.5% in 2021, while leveraged loans were at 0.6%. However, these figures are expected to reach 3.5% and 3%, respectively, in 2023. The factors responsible for the rise are weaker macroeconomic growth and rising interest rates.

Research Criteria

In answering this request, the research team consulted credible sources, such as the US Federal Reserve Systems and other independent reports from reliable data providers like FRED Economic Data. However, we found that rather than default rates, delinquency rates are reported. Both terms are defined below.

Default: A default occurs when there is a failure to make required interest or principal repayments on a debt, whether that debt is a loan or a security.

While both words are used to describe missing payments, a loan becomes delinquent upon a late or missed payment, while a loan becomes in default upon extended delinquencies.

Therefore, delinquencies have been used as a proxy for defaults. The rates of corporate loan delinquencies from 2007 to 2022 have been provided in the attached spreadsheet.