Part

01

of one

Part

01

Broiler Industry Market Analysis

Key Findings

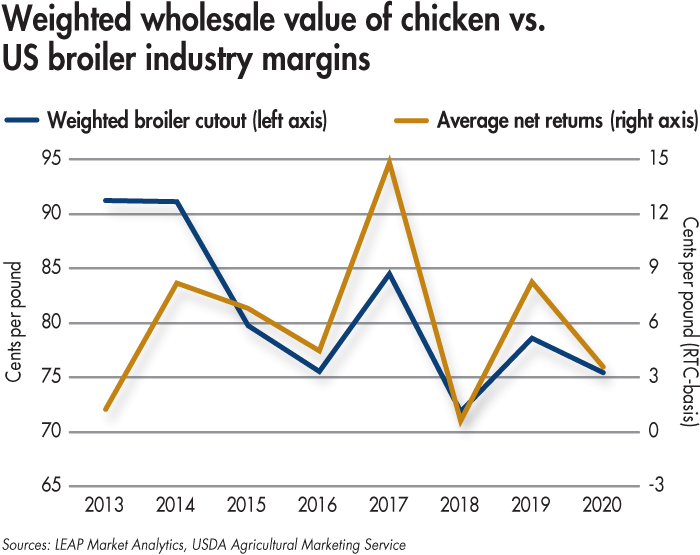

- The United States broiler industry has been in a super cycle of profitability since 2013. Profit margins were impressive in 2017, featuring an average net return of $0.15 per pound (on an RTC basis).

- The number of broilers grow-out coops in the U.S. averaged between 3,000 and 6,000 during 2007-2011.

- According to EU Legislative requirements for broiler coop systems, each should contain no more than 4,800 birds and measure from 400 square meters to 1600 square meters per coop.

- Industry experts estimate that broiler feed costs account for at least 65–75% of the overall production costs, making it a critical input for the broiler industry.

- According to several industry experts, broiler diseases continue to be the primary problem for the broiler industry and its future.

Introduction

A comprehensive analysis of the broiler industry in the U.S. and Europe, including the qualitative and quantitative insights, in addition to the profit-cost ratio, the key costs, and major problems faced by broiler farmers during the growth process, has been provided below. Although the outbreak of diseases was identified as the primary concern for most in the broiler industry, there wasn't sufficient information to establish the second and third main problems facing the sector since the available studies were "region-specific" and featured challenges specific to those regions. We presented helpful findings to this end. Further, details on the logic can be found in the Research Strategy section.

The Broiler Industry in the United States

- The U.S. broiler industry has been in a super cycle of profitability since 2013, promoted by falling feed costs and production cutbacks. According to Mark Jordan, the Executive Director at LEAP Market Analytics, "the threat of feed costs soaring back close to 2012 levels anytime soon appears remote."

- A study by LEAP Market Analytics demonstrates that feed costs in the industry have held relatively stable since 2015, "averaging between $0.18 and $0.21 per live pound produced."

- Profit margins were impressive in 2017, featuring an average net return of $0.15 per pound (on an RTC basis). There was a noticeable drop-off in 2019, headlining an average net return of more than $0.08 per pound since 2017, "but still far better than 2018 with an average profit margin of less than $0.01 per pound."

- In 2020, Mark Jordan predicted that feed costs could rise from 2019 levels to weaken profit margins but still maintain "a successful pattern of positive average annual net returns in place since 2013." The Executive Director for animal protein at Rabobank, Christine McCracken, predicts that the industry will be profitable on average in 2021 as "increased COVID-19 vaccination in the U.S. revives foodservice demand." However, she advises that the industry will need to monitor feed costs and prices.

- The National Chicken Council (U.S.) states that a flock of broilers constitutes around 20,000 birds in a grow-out coop "that measures 400 feet long and 40 feet wide, thus providing an area of about 16,000 square feet or eight-tenths of a square foot per bird." The birds grow into the space as they age.

- Further guidelines from the National Chicken Council (NCC) offer that broiler chickens "should have space to express normal behaviors such as dust bathing, preening, eating, drinking, etc."

- There is no official count on the current number of grow-out coops or the percentage of coops that are managed remotely in the U.S. broiler chicken industry. However, a 2012 study by the USDA's National Agricultural Statistics Service found that the number of grow-out coops averaged between 3,000 and 6,000 during 2007-2011.

- In addition, the NCC approximates that there are 30 federally licensed companies involved with raising and processing broiler chickens in the U.S. However, only 5% of broiler chickens are produced on company-owned farms. The majority (95%) of the birds are produced on family farms that have contracts with these federally licensed companies. "About 25,000 family farmers have production (grow-out) contracts with the companies."

- There are about 195 broiler chicken slaughter plants in the region.

- Approximately 409,000 people are directly employed in the broiler industry. About 1.6 million workers are indirectly employed.

- China, Mexico, Canada, Taiwan, Vietnam, and Cuba ranked as the top six U.S. broiler chickens export destinations in terms of value and volume in 2020.

- According to data from USDA, "the top 5 broiler producing states are Georgia, Arkansas, North Carolina, Alabama, and Mississippi."

The Broiler Industry in Europe

- According to a study commissioned by the Association of Poultry Processors and Poultry Trade (AVEC) in the EU, the production costs, after slaughter, of broiler chicken in the region ranges between €0.134 to €0.155 per kg carcass with an average of 146 euro cents per kg.

- Concerning animal welfare, broiler production standards and legislation in the EU are stringent in the world. "No country outside Europe has such detailed and strict regulations to protect the welfare of poultry for meat production."

- The total broiler chicken meat production in the EU is roughly 12 million tonnes. The production rose by 1.6% in 2019, "driven by increased domestic EU-28 consumption and higher than anticipated exports."

- The leading producers of broiler chicken meat in the region are Poland, France, the UK, Germany, Spain, the Netherlands, and Italy, representing 74% of the EU's broiler meat production.

- More than 90% of broilers in the EU are reared in flocks of about 50,000 birds, in standard intensive coops "with controlled temperature, light, and ventilation; there is litter on the floor, and often the houses are windowless."

- There is no official count on the number of coops or the percentage of coops that are managed remotely in the EU broiler chicken sector. However, according to EU Legislative requirements for broiler coop systems, each should contain no more than 4,800 birds and measure from 400 square meters to 1600 square meters per coop.

- Additionally, based on Eurostat's most recent data published in 2018 on broiler chicken farms, there are approximately 2.1 million broiler farms in EU-27 (and the U.K.). However, only about 20,000 are professional farms with over 5,000 birds. There are roughly 2 million farms with less than 99 broilers and around 11,000 farms with more than 100 broilers.

- Approximately 90% of broilers in the EU are raised in intensive indoor coops, "around 5% in less intensive indoor coops, up to 5% in free-range systems and 1% in organic systems."

Major Broiler Costs

1) Feed Costs

- Industry experts estimate that broiler feed costs account for at least 65–75% of the overall production costs, making it a critical input for the broiler industry.

- Broilers are raised for 6-7 weeks before being marketed. Therefore, a conventional broiler breed chicken will consume on average about 5.3kg of feeds in 6-7 weeks of rearing, according to the Broiler Management Guide published by Livestock Feed Ltd.

- There are three feed stages for broiler birds, including starter feed, grower feed, and finisher feed.

- "Finisher feeds account for most of the total feed intake and cost of feeding a broiler." However, starter feed only accounts for a small portion of the total feed cost.

- The two chief ingredients in broiler feeds are corn and soybean. Corn accounts for approximately 50%-70% of feeds ingredients and soybean 10%-30%.

2) Labor Costs

- Labor is the single second-largest cost component for broiler producers in most regions, including the EU and the U.S., according to the findings of a journal of poultry science. Based on the most recent data available, labor costs average 3.4 euro cents per kg live weight broiler in the EU and 2.7 euro cents per kg live weight in the U.S.

- Small and large broiler farms express labor in different ways. According to the most recent findings from the Agricultural Resource Management Survey on the labor commitments in contract broiler production, whereas the smallest broiler farms (1-2 houses) virtually employ no hired labor, large farms rely on large amounts of hired workers.

- As such, labor costs represent "about 10% of average production contract fees."

- Another study conducted in Finland found that labor expenses were by far the largest cost variance in preventive biosecurity during the growth process of broilers.

- Although industry consultant, Christian Renault, foresee labor costs diminishing as a major component of broiler production costs due to automation of plants around the world, others like Mark Jordan predict that labor expenses will soon experience more upward pressure than usual in regions like the U.S.

- He bases this on the "minimum wage increases that went into effect in several states beginning 2020 and the persistently low unemployment, which has created stiff competition for workers."

3) Other Variable Costs

- Other variable expenses, which include heating, electricity, litter, animal health, and catching, are the major broiler production costs after feed prices in several regions, including the EU and the U.S.

- Based on the most recent data available, other variable costs average 7.9 euro cents per kg live weight broiler in the EU and 5.5 euro cents per kg live weight in the U.S.

- A study by the Poultry Science Association (PSA) found that "heating fuel and electricity costs account for almost 60 percent of a typical contract broiler grower's variable production costs."

- The authors also estimated that the electrical costs for a broiler coop measuring 20,000 square feet would range from $1,620 to $5,148.

Major Broiler Problems

1) Outbreak of Diseases

- According to several industry experts, broiler diseases continue to be the primary problem for the broiler industry and its future.

- A survey of professors seeking to determine the most important production problems facing the broiler industry identified "sudden death syndrome, ascites, scabby hip syndrome, and one very old problem-leg abnormalities" as the most frequently caused by disease organisms.

- Respiratory diseases, possibly caused by E. coli, Newcastle disease, avian metapneumovirus, avian influenza, and infectious bronchitis, are currently the most important problems of broiler production, according to Professor Hafez, Head of the Institute of Poultry Diseases.

- About 95.61% of the total economic loss to the broiler industry is attributed to coccidiosis, a parasitic disease, based on estimations published by the Agricultural Economics Research.

Helpful Findings Concerning Major Broiler Problems

- There are no precompiled data or expert mentions concerning the other major problems faced by the broiler industry during the growth process of the birds. However, each region seems to have "regional specific challenges." For example, a study based on a sample survey of randomly selected 30 broiler farms in Bangladesh revealed problems such as "outbreak of diseases, high price of feed, lack of steady supply of electricity, lack of veterinary care and service facilities, inadequate knowledge on poultry husbandry, and lack of credit."

- The results of a survey conducted in Nigeria identified the major constraints faced by broiler farmers in the study area as the outbreak of diseases, high cost of feed, lack of improved technology, lack of formal education, high cost of veterinary services, diseases, and high cost of labor.

- In the U.S., the factors affecting profitability in broiler production are "bird weights, livability, contract agreements/payments, and cash operating factors like fuel, litter, electricity, maintenance, and repair."

- A study conducted in Brazil identified the production problems that most affected broiler farming as "environmental challenges, poor feed conversion, management problems, and low-quality chicks."

Profit-Cost Ratio of Broiler Production

- According to a study sample from 60 broiler producers, the following costs: the livability percentage, average feed conversion rate, average body weight, and age of broilers at marketing, were used to determine the profitability of broiler production.

- The study determined the average cost of production at 64 rupees ($0.86) per broiler, with fixed costs and variable costs accounting for about 84.5% and 15.5% of overall production costs, respectively.

- Depreciation on grow-out coops (10.7%), chick costs (21.5%), and feed costs (58.6%) were the major cost components. Therefore, the net profit per broiler was found to be approximately 7.20 rupees ($0.097).

- The study estimated the profit-cost ratio to be 1.11, "and it increases with an increase in farm size, indicating that as farm size increases, the net margin over the dollar invested on broilers also increases."

Research Strategy

Our thorough research of academic databases, reliable media sites, market reports, and government sources divulged large amounts of information about the broiler industries in the U.S. and Europe. In addition to the key broiler costs and major problems faced during the growth process. Some academic reports, news publications, and government sources identified include WATTPoultry, the National Chicken Council, USDA, European Parliamentary Research Service, and more. However, most of the information was from past studies (more than two years ago) or did not address some aspect of the question in detail. Where possible, we sought to obtain and use the most recent data available. Although we provided a comprehensive reply, highlighting the qualitative and quantitative aspects of the broiler industry in the U.S. and the EU, endeavoring to address the profitability of the segments, the number of broiler coops, the average number of broilers in a coop, and more. Delivering direct answers for some insights (I.e. profitability in the EU) proved challenging due to inadequate information. We faced a similar challenge when researching the major problems broiler farmers face during the broilers' growth process. We identified outbreaks of diseases as the primary concern for most in the broiler industry. However, there wasn't sufficient information to establish the second and third main problems facing the sector for the available studies were "region-specific," and featured challenges specific to those regions. We presented helpful findings to this end.