Part

01

of one

Part

01

Exceptional Customer Experience (CX): Finance Industry - United States

Customer experience is a key area that all businesses need to focus on, however, while there are many companies focusing on the customer experience, there are others that choose to ignore it. It is becoming increasingly apparent that consumers no longer can be counted on their loyalty based on price or product. Consumers are increasingly becoming attracted, and ultimately devoted, to companies due to the experience and service they receive. If a business does not acknowledge this and fails to keep up with increasing superior CX demands from consumers, there will be an exodus of customers from that company.

We have curated three additional examples of global finance companies that are providing exceptional customer experiences. For each example, we have provided the name of the company, along with its website link, what it is doing surrounding an exceptional customer experience, 1-2 quotes from senior leadership in that company commenting on customer experience, and when available, any success metrics. Additionally, we have leveraged the Forbes article found in the initial hour of research and we have presented information for each of the ten finance companies that were identified as extremely consumer-focused. Those ten financial companies are Citizens, Ally Bank, Navy Federal Credit Union, Huntington National Bank, Charles Schwab, Edward Jones, Discover, Capital One, ING, and Chase. For each one of those ten companies, we have provided what it is doing surrounding an exceptional customer experience, 1-2 quotes from senior leadership in that company commenting on customer experience, and, when available, any success metrics. We felt that the first two suggested projects were best presented in a custom Google spreadsheet for ease of viewing and comparison. The full research for that can be accessed here. We placed the Forbes selections in one tab, and the other separately curated examples of finance companies in another tab. To round out this project, we also presented eight pieces of information, data, and/or statistics surrounding how consumers across the globe feel about customer experience. Where it was possible, we narrowed the focus to consumer sentiment when it comes to customer experience with financial companies. That part of the research can be viewed below.

Examples of Global Finance Companies: Superior Customer Experience

- Full research can be viewed here. To enhance the client experience, we also brought over the two abbreviated case studies from the initial hour of research (Voya and Metro Bank) and placed them in this tab.

Forbes Article: Leveraging the Examples

Consumer Sentiment: Customer Experience

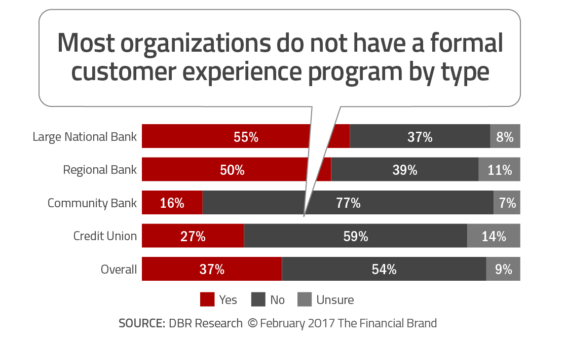

- Just 37% of large national banks had a formal customer experience (CX) plan in place in 2017, according to a global digital banking report called "Improving the Customer Experience". This is puzzling, as good customer service is regarded as extremely important to consumers when choosing a bank, according to a 2018 survey by Forrester Research. This was a rather large survey that asked the opinions of more than 110,000 consumers. Clearly there appears to be a disconnect between companies in the financial sector and consumers.

- Every industry has its customer experience challenges, and those challenges can affect the bottom line. According to American Express, over 50% of Americans have decided against a planned purchase due to bad customer service, and further, 33% of Americans will switch companies after one instance of bad customer service. The financial services' industry has felt the impact of today’s experience economy, where the growth of mobile devices and constant connectivity means that not only are the customers in the driver's seat, earning their loyalty is key. According to McKinsey, “Of the 50 largest global banks, three out of four now pledge themselves to some form of customer-experience transformation.”

- "The payoffs for valued, great experiences are tangible: up to a 16% price premium on products and services, plus increased loyalty." In return, among U.S. consumers, there’s a sharp increase in willingness to give up personal data: 63% say they’d share more information with a company that offers a great experience.

- Efficiency, convenience, helpful employees and friendly service matter most to American consumers. Each of those criteria measured around 80% in importance to them. It follows, then, that companies should be ensuring that they are implementing technologies that provide these benefits, according to PwC.

- According to an ABA/Morning Consult survey, almost 70% of banking is done digitally, rather than in a brick and mortar branch. This indicates that the customer's digital experience is extremely important. Financial service companies need easy-to-use digital platforms that should be accessible across multiple devices, but the focus should be on mobile. To bolster that statement, this PwC survey reveals that 15% of banking customers were heavy mobile users in 2018. That percentage is up from 10% in 2017. "Customers expect a full range of features on a mobile app. Accenture reports that 37% of customers seeking a quality banking experience even want instant access to face-to-face advice. Omnichannel is very much the name of the game. In that same Accenture report, mixing physical and digital services together seamlessly is what 50% of quality-seeking banking customers want."

- Consumers have more choices than ever when deciding upon a financial institution, which means that customer service is integral for maintaining loyalty. Accenture reveals that "up to 49% of people say that high-quality customer service is key in keeping them loyal." Customer service and the company reputation were two of the most mentioned must have qualities in a financial institution according to this Trustpilot survey of 15,000 banking customers. "More than 50% of consumers surveyed felt that their interactions with the company were even more important than service fees." Qualtrics found that poor service is a bigger pain point for customers than a poor product.

- Almost thirty-four percent of consumers will make it a point to tell people about a bad experience with a brand. With most people belonging to one or more social media platforms, and certainly not afraid to write about a bad experience on a review platform, customers are now more likely to share the experiences they have had with brands, both good and bad. The good news is that while more people (36.7%) share their good experiences in this way, it is arguably the negative experiences that people keep talking about. When drilling down to social media sites, 10.7% of consumers will write about a bad experience on Facebook, 4.5% will complain via Twitter and 9.9% will post a rating or comment on a third-party website. Only 20.1% will complain directly to the company, with just 19.3% revealing that they would just not say anything at all.

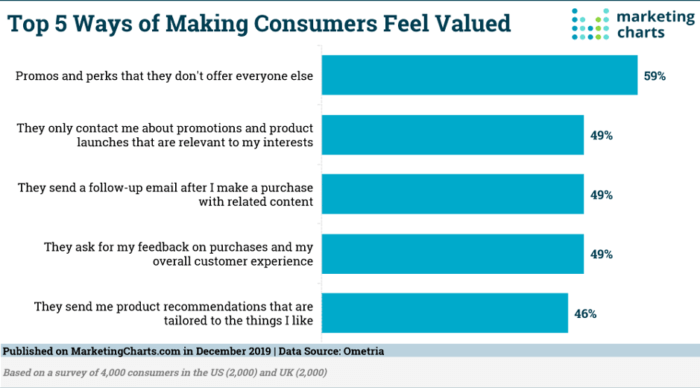

- According to an Ometria report (free download required), 59% of consumers want brands to offer them promotions and perks that they don’t offer everyone else. While general offers can help encourage engagement and further conversion, personalization delivers a better experience and will keep consumers engaged for longer. Other ways to make consumers feel valued include only contacting them about promotions or products that are relevant (49%), sending relevant content after a purchase (49%), asking for customer feedback (49%) and sending relevant product recommendations (46%). This shows that personalization is a huge part of good CX in 2020.