Part

01

of one

Part

01

Europe Corporate Health Market

Key Takeaways

- As an upper limit, Europe's workplace wellness industry can be estimated at a value of approximately $19.7 billion in 2021, per data from the latest available reporting by the Global Wellness Institute.

- This approximation is consistent with a separate, slightly lower value for the market in Europe of $17.1 billion in 2021, per publicly available data from MarketsAndMarkets.

- Although credible information on the segmentation of the European corporate wellness industry is limited in the public domain, the Global Wellness Institute reported in 2019 that Europe as well as the global workplace wellness market at large was led on a country basis by Germany, the United Kingdom, France, Italy and Spain, which ranked 3rd, 4th, 5th, 7th and 9th, respectively, in terms of size worldwide.

- Meanwhile, on an overall regional basis, Europe's workplace wellness market is projected to grow steadily at a CAGR of 6.51% between 2022 and 2030, given that companies in the region are investing in workplace wellness programs to help employees manage workplace stress, and are doing so through "significant expenditures" in employee health/fitness programs.

Introduction

The research team has provided two estimates for the market size of Europe's workplace wellness industry, as well as available information on the segmentation of this market and other relevant insights. As stated during the initial phase of this research, pre-compiled data on the size of the region's corporate wellness market was unavailable in the public domain. This is likely due to the highly specific nature of the market and geography of interest. As such, the market value was triangulated using the latest, credible resources, while slightly dated reports (published in 2019) were included in select cases to add robustness and/or corroboration to the provided findings. Full details of this analysis are available directly below, while the associated research strategy and underlying calculations can be viewed within the Research Strategy section at the end of this brief.

I. Europe Workplace Wellness Market Size

Triangulation #1

- Europe's workplace wellness industry can be valued at approximately $17.1 billion in 2021, per publicly available data from MarketsAndMarkets.

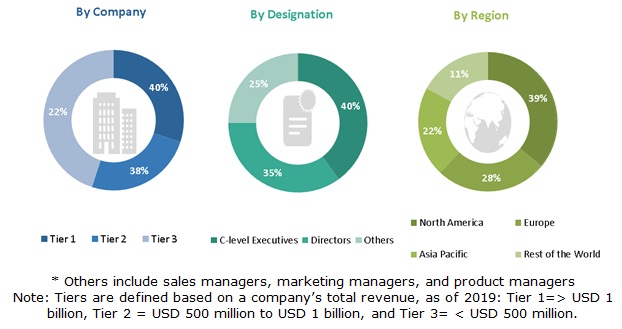

- Specifically, the industry researcher reports that the global corporate wellness market generated $61.2 billion in revenue as of 2021, with Europe comprising 28% or $17.1 billion of total industry sales.

- While Europe's relative scale in percentage terms is visualized within the Methodology section of the report and pictured directly below, the calculation associated with the estimated market size figure ($17.1 billion) is available within the Research Strategy section at the end of this brief.

- Meanwhile, slightly dated market research published in Medgadget corroborates the MarketsAndMarkets report, by similarly stating that the global corporate wellness market was sized at $49.7 billion in 2017, with Europe expected to "hold the second largest market position [through 2026]."

Triangulation #2

- In parallel, Europe's workplace wellness industry can be estimated at approximately $19.7 billion in 2021, per the latest available reporting by the Global Wellness Institute.

- The nonprofit association published market value(s) for Europe's corporate wellness industry within its 2018 Global Wellness Economy Monitor, noting that Europe's portion of the workplace wellness market was sized at $17.74 billion as of 2017, up from $16.10 billion as of 2015. This represents a CAGR of 2.62% over the two year period.

- If we assume that the CAGR for this industry remained constant from 2015 through 2021, Europe's corporate wellness market can be estimated at $19.7 billion as of that latter year. The calculation associated with this figure is available within the Research Strategy section at the end of this brief.

II. Europe Workplace Wellness Segmentation & Other Relevant Insights

- Although credible information on the segmentation of the European corporate wellness is limited in the public domain, the Global Wellness Institute reported in 2019 that Europe as well as the global workplace wellness market at large was led on a country basis by Germany, the United Kingdom, France, Italy and Spain, which ranked 3rd, 4th, 5th, 7th and 9th, respectively, in terms of size worldwide.

- Separately, on an overall regional basis, Europe's workplace wellness market is projected to grow steadily at a CAGR of 6.51% between 2022 and 2030, per reporting by Inkwood Research and Medgadget.

- Consistent with the market's postitive, historic growth trajectory since 2016, companies in the region are investing in workplace wellness programs to help employees manage workplace stress, and are doing so through "significant expenditures" in employee health/fitness programs.

Research Strategy

For this research on Europe's workplace wellness industry, the research team leveraged the most reputable sources available in the public domain, including the Global Wellness Institute, MarketsAndMarkets and Inkwood Research. In select cases, slightly dated reports (published in 2019) were included to add robustness and/or corroboration to the provided findings.

As stated during the initial phase of this research, pre-compiled data on the size of the region's corporate wellness market was unavailable in the public domain. This was likely due to the highly specific nature of the market and geography of interest. Estimates for the size of the region's corporate wellness market were triangulated based on the following calculations:

Calculation for Triangulation #1

- Europe's workplace wellness industry in 2021 = Global workplace wellness market of $61,200,000,000 in 2021 * Europe representing 0.28 of the global market = $17,136,000,000.

Calculation for Triangulation #2

- Europe's workplace wellness industry in 2021 = Europe's workplace wellness market of $17,740,000,000 in 2017 * growth over four years at the same CAGR (1 + 0.0262)^4 = 19,673,501,200.