Part

01

of one

Part

01

ESG and Fortune 500

Key Takeaways

- ESG targets reflect a global trend in the changing nature of value and a growing appreciation for the interdependent nature of business.

- Some 25% of the Fortune 500 aim to be carbon neutral by 2030.

- Companies are putting more effort into the form, content, and extent of their ESG or sustainability disclosures and ESG assurance is becoming more common.

- While Nvidia has an ESG score of 72.19, profits as % of stockholder equity of 22.9% and a 52-week stock change of 144.57%, Tesla has a high ESG risk score of 30 and an ESG ranking of 29. It has profits as % of stockholder equity of -13% and a 52-week stock change of 75.24%.

- There are financial benefits to implementing ESG standards, as that practice in turn promotes better risk management and more innovation.

Introduction

The below report looks at what ESGs are and what ESG means today, the impact of the ESG trend on Fortune 500 companies and businesses more broadly, the potential evolution and growth of this impact, and how high scoring ESG Fortune 500 companies compare to lower scoring ones. The research focuses on Fortune 500 companies, but many of the impacts are global and apply to all large corporations and multinationals - so those have been considered as well.

WHAT ESGS ARE

- ESGs are three key factors used to measure a company's impact; environmental, social and governance factors.

- Socially conscious investors are using ESG ratings to help them decide where they want to invest.

- ESG was cemented as a concept in 2000 by the UN Global Compact - a framework for sustainability. Its goal was to encourage the integration of ESGs into capital markets. From there, the UN developed the Principles for Responsible Investing in 2005. These principles have grown to be a way for investors to understand the consequences of their investing.

- Over the past few years however, ESG goals have become more mainstream.

- Broadly, ESG reflects a global trend in the changing nature of value and a growing understanding of the interdependent nature of business. The forces that affect businesses and investors' perception of their risks and opportunities now include ESG factors. Investors are understanding that the resilience of a company relates to people, society, and the environment, particularly as climate change becomes more prominent in the news.

- For example, in 2019, 181 of the top CEOs in the US signed a Statement on the Purpose of a Corporation that said companies should "deliver value to their customers, invest in employees, deal fairly with suppliers and support the communities in which they operate." The action reflects the changing expectations towards businesses. People and investors want companies to be transparent and to demonstrate a broader purpose.

CURRENT IMPACT OF ESGS

- Around the world, the ESG factors are having a big impact on what investors focus on. Between January and October last year, £7.8 billion went into responsible investment funds in the UK, accounting for nearly 50% of all money placed into funds.

- Investors are willing to take action if companies don't implement ESG standards. The main actions they are willing to take or are taking, in order, are entering into a dialogue with the company, voting against executive pay agreements, trying to get ESG targets connected to executive pay, voting against director appointments, and divesting (selling their investment).

Improved accounting performance and governance

- Companies are putting more effort into the form, content, and extent of their ESG or sustainability disclosures. They are increasingly measuring, managing, and disclosing ESG performance. An increased number of S&P 500 companies publish some form of sustainability disclosure.

- These companies are referring to broader non financial measures more and more in their financial findings. From 2011 to 2018, the number of S&P 500 companies providing sustainability reports with external assurance grew from 20% to 86%.

- ESG assurance is becoming more common, though not all companies feel they have to do it yet. Of the 90% of S&P 500 companies that release sustainability information, only 29% had third-party assurance. Fortune 500 auditors report that the number of companies using such assurance is growing.

- Investors are evaluating ESG at the onset of a possible investment in order to understand a company's long term strategies. Then after making an investment, they are using ESG to monitor performance. A 2018 survey of institutional investors found the top five ways institutions are implementing ESG information is through ESG integration, negative screens, active ownership, best-in-class strategies, and impact investing. Having internal controls around ESG processes and data quality are becoming important. Also, narratives and context should match the metrics companies are focusing on, and that entails more coordination between board and management.

- Formal non financial disclosures are replacing or augmenting nonbinding frameworks. Companies are looking at everything from carbon emissions, to gender and racial issues, and the sustainability of their resource sourcing strategies.

- There are five key areas of disclosure and the majority of Fortune 500 companies disclose information based on at least four of the five frameworks below:

- Currently only a third of investors think that reporting is good enough. They are struggling with trust and with the relevancy, reliability, completeness, and timeliness of the information in reports.

- Investors are wary of cherry picked information - selectively including the best data, and in the absence of a united global standard for ESGs, and they want companies to adhere to frameworks issued by recognized bodies, such as the Task Force on Climate-related Financial Disclosures.

Strategic decision-making in order to be more attractive to institutional investment

- Businesses are implementing new strategies and directions in order to satisfy ESG demands. Some 50% of investors in one survey said they were willing to divest from companies that weren't sufficiently acting on ESG issues. And 75% believe companies should act on ESG issues even if profitability is affected in the short term.

- Many Fortune 500 companies are adopting climate goals. Some 25% of the Fortune 500 aim to be carbon neutral by 2030. Companies include Apple, IBM, IKEA, Intuit, Microsoft, Starbucks, Unilever, LG and Siemens, while General Motors, Honeywell, Amazon, Fedex, PepsiCo, Toyota, Verizon, Walmart and Schneider Electric want to be carbon neutral by 2040.

Challenges

- In surveys, businesses have noted that they are facing a range of challenges in implementing ESG standards. These include (in order) balancing ESG with growth targets, frustrations with the lack of reporting standards, volatility in regulatory requirements, and the difficulty in quantifying ROI after implementation of standards.

Pressure to increase gender and racial representation among leadership

- Fortune 500 companies are under pressure from ESG expectations to increase the diversity of their boards and leadership. Negative media coverage such as this NYT articleis contribute to that pressure.

- Nevertheless, the number of female CEOs among the Fortune 500 has reached a record high, though it is far from being representative. Some 37 of the CEOs of the 500 companies were women in 2020.

Examples

- BP: When the company announced a plan to increase environmental spending ten fold, putting US$5 billion a year into renewable energy, investors rewarded the company. Though it reported a US$16.8 billion quarterly loss, on the day of the announced spending, BP's share price jumped by more than 7%. Jennifer C. Rowland, an analyst at Edward Jones said the risk to BP for inaction on environmental issues was greater than the risk of moving to lower carbon strategies. BP's relevance in the energy world was at stake.

- Microsoft: This company started off with "citizenship" as its version of corporate social responsibility, then that evolved into CSR, but now it manifests as ESG. ESG is represented among the senior leadership of the company, and "hundreds" of people work solely on ESG issues, according to the company's ESG engagement director. Microsoft is a signatory of UN Global Compact, and follows the UN Guiding Principles on Business and Human Rights. It produces publications that make it a thought leader in ESG, such as a book – The Future Computed: Artificial Intelligence and Its Role in Society – which provides an ethical framework for evaluating AI. Every operational group and geographical subsidiary has a lawyer evaluating legal risk, branding and reputation, and stakeholder interests. The engagement director admits that reporting is difficult, but says that with time the process has been smoothed out and has become more routine.

FUTURE OF ESGS

- Evidence increasingly suggests that companies with strong ESG policies do better in the long term, cope better with economic instability or downturns, and handle the issues that stem from climate change more resiliently. Companies with high ESG ratings also tend to have higher client retention rates (in the UK, 10-year client retention was reported by 82% of ESG adopters compared to 52% for non-ESG companies).

- Some corporate experts however believe that the impact of ESG could wain. They argue that ESG is "green washing" and "compliance-based, checking the box.” They argue that optimism around the impact of ESG and corporations becoming more responsible is misplaced.

- On the other hand, stake holder attention also fluctuates and is impacted by trends or changes in the news, movements, and other factors. The pandemic, for example, saw stakeholder attention shift away from hunger and gender towards peace and justice:

Predicted change in type of influence

- The EU regulatory frameworks coming from the EU Green Deal and EU Action Plan could also accelerate ESG adoption.

- Companies' business strategies, in order to meet ESG expectations, will likely have to shift from environmental impact to making product changes - from carbon mapping and greenhouse gas reduction to actual low-carbon products.

- ESG discourse and reporting will likely shift from targets to benchmarks. Businesses will need to understand the critical metrics and establish baselines for their reporting.

How ESG could evolve

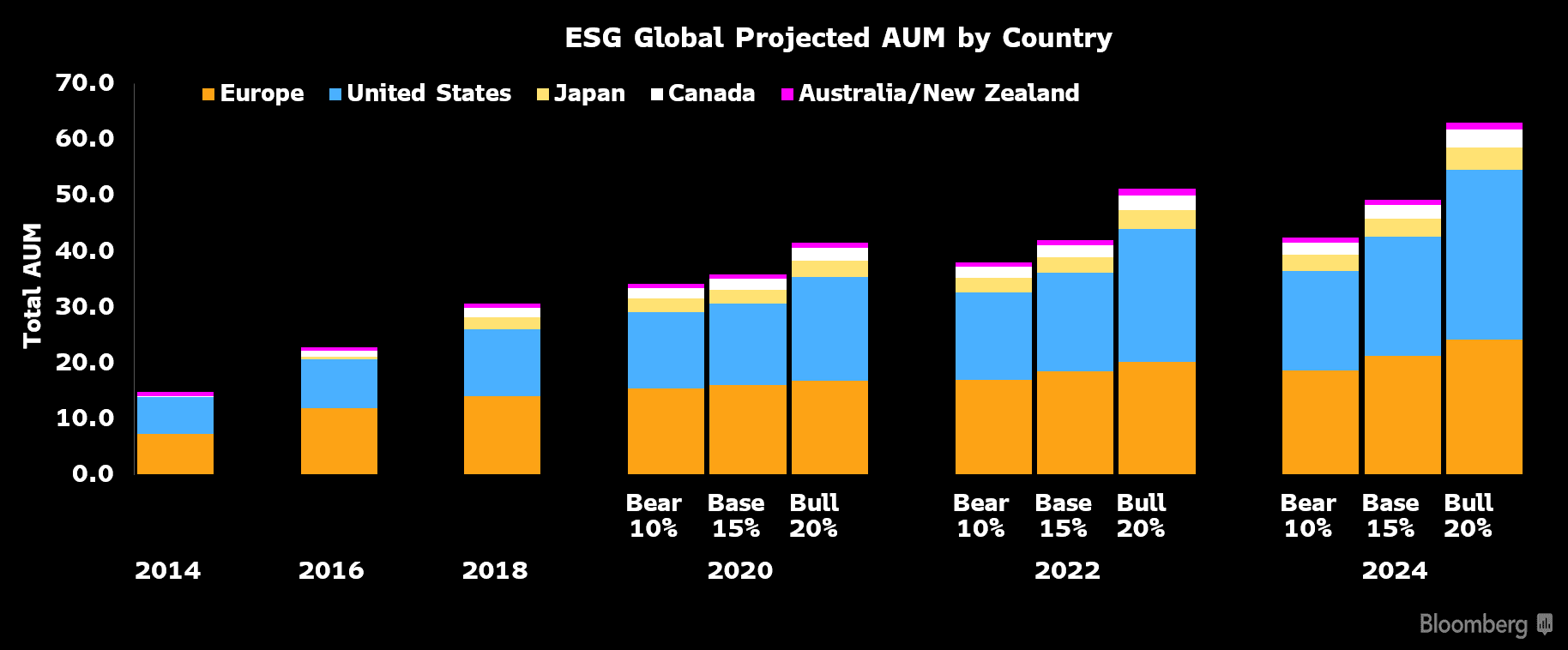

- The popularity of ESG does vary significantly by region. While Europe currently accounts for half of global ESG assets, the US was predicted to grow the most this year, and to dominate going into next year. Bloomberg analysts suggest the next big growth wave could come from Asia, particularly Japan. As of September 2020, the US ESG ETF market had increased by 318% that year.

- Investors want more standardized ESG reporting. The lack of such standards in investor-grade reporting prevents them from easily evaluating ESG and incorporating that into their decision processes. Investors also want sustainability reports to undergo auditing, so this is something that may increasingly happen in the future.

- Guidelines on the issue from the Biden administration seem to be in the pipeline. SEC Chair Gary Gensler is prioritizing ESG rule standardization. In September, the agency proposed new rules on transparency into "how funds disclose shareholder votes and decision-making processes on a range of ESG themes." The US government is also looking at tightening climate reporting standards in order to prevent green washing or misrepresentations of environmental impacts.

- Public policy will likely increasingly impact ESG standards. Governments’ commitments to limit carbon emissions are more and more backed by new regulations and new taxes, which affect companies. Many shareholders are advocating for net-zero policies and for stronger ties between ESG targets and executive compensation packages.

- Investors, while still concerned about climate impact, have become more interested in human capital management over the past two years. Companies are realizing that their own employees are "the strongest advocates and enablers of ESG strategy." And, 58% of workers consider a company’s ESG commitments when choosing where to work. Metrics in this area relate to succession planning, talent development, diversity and inclusion, employee engagement and culture

Predicted growth of ESG investment

- More investors are planning to take social responsibility into account. A 2020 investor poll found that 28% said their investment framework was already aligned with the UN Sustainable Development Goals, but 42% said they had plans to align.

- According to a Bloomberg analysis, ESG assets globally will exceed US$53 trillion by 2025 and will make up over a third of the US$140.5 trillion in projected total assets.

- ESG investments could become a $1 trillion category by 2030, according to one expert. Funds have grown significantly over the past four years; ESG funds raked in $21 billion in the first quarter of 2021, while in 2020 they earned $51 billion for the year; in 2019, they earned $21.4 billion; and 2018, they were worth $5.4 billion in inflows.

- Growth in the ESG debt market will continue. It is driven by "companies, development projects and central banks — with pandemic and green-recovery efforts helping to scale up the market in the short term."

- Analysts also argue that Europe can serve as a prediction for what will happen globally. Growth in ESG mutual funds and ETFs there were driven by client demand and massive levels of product development. 330 ESG funds were launched in the region in 2020.

ESG RATING V STOCK VALUATION

7 of the top Fortune 500 companies by ESG rating

- Microsoft: The company tops the overall ESG rating (score: 67.9) and scores at least 65 points in each rating category, going by the CSRHub system. Microsoft has profits of US$44.3 billion, earnings per share of 5.76, return to investors of 42.7%, and profits as % of stockholder equity of 37.4%. It has a price/sales ratio of 14.35, enterprise value/revenue of 13.81 and a 52-week stock change of 57.07%.

- Linde: ESG score of 76. It has profits of US$$2.5 billion and profits as % of stockholder equity of 4.7%. It has a price/sales ratio of 5.73, enterprise value/revenue of 6.00 and a 52-week stock change of 33.60%.

- Accenture: A Fortune Global 500 company worth including, with an ESG score of 75.95. It has profits of US$5.107.8 billion. It has a price/sales ratio of 4.63, enterprise value/revenue of 4.44 and a 52-week stock change of 52.35%.

- J.B. Hunt: Ranked 315 in the Fortune 500, the company has an ESG score of 74.14. It has profits of US$$2.5 billion and profits as % of stockholder equity of 22.8%. It has a price/sales ratio of 1.83, enterprise value/revenue of 1.87 and a 52-week stock change of 41.62%.

- Texas Instruments: Ranked 210 in the Fortune 500, the company has an ESG score of 73.14. It has profits of US$5.595 billion and profits as % of stockholder equity of 56.3%. It has a price/sales ratio of 10.28, enterprise value/revenue of 10.04 and a 52-week stock change of 22.28%.

- Salesforce: Has an ESG score of 72.92. It has profits of US$4.442 billion and profits as % of stockholder equity of 0.4%. It has a price/sales ratio of 10.14, enterprise value/revenue of 10.61 and a 52-week stock change of 19.73%.

- Nvidia: An ESG score of 72.19. It has profits of US$8.206 billion and profits as % of stockholder equity of 22.9%. It has a price/sales ratio of 31.82, enterprise value/revenue of 31.09 and a 52-week stock change of 144.57%.

7 of the bottom Fortune 500 companies by ESG rating

- Berkshire Hathaway: An ESG score of 13. It has profits of US$42.521 billion and profits as % of stockholder equity of 19.2%. It has a price/sales ratio of 1.88, enterprise value/revenue of 1.97 and a 52-week stock change of 25.68%.

- Tesla: Has a high ESG risk score of 30 and an ESG ranking of 29. It has profits of US$721 million and profits as % of stockholder equity of -13%. It has a price/sales ratio of 25.93, enterprise value/revenue of 22.79 and a 52-week stock change of 75.24%.

- Thor Industries: An ESG score of 44. It has profits of US$223 million and profits as % of stockholder equity of 6.4%. It has a price/sales ratio of 0.50, enterprise value/revenue of 0.59 and a 52-week stock change of 9.67%.

- Ford: Has an S&P Global ESG Score of 27. It has profits of -US$.279 billion and profits as % of stockholder equity of 0.1%. It has a price/sales ratio of 0.57, enterprise value/revenue of 1.31and a 52-week stock change of 119.62%.

- McKesson: An S&P Global ESG score of 30. It has profits of -US$4.539 billion and profits as % of stockholder equity of 17.7%. It has a price/sales ratio of 0.14, enterprise value/revenue of 0.16 and a 52-week stock change of 29.78%.

- Walmart: An S&P Global ESG score of 39. It has profits of US$13.510 billion and profits as % of stockholder equity of 19.9%. It has a price/sales ratio of 0.68, enterprise value/revenue of 0.74 and a 52-week stock change of -6.70%.

- Mattel: An S&P Global ESG score of 28. It has profits of US$4.583.7 billion and profits as % of stockholder equity of -43.4%. It has a price/sales ratio of 1.44, enterprise value/revenue of 1.97 and a 52-week stock change of 37.18%.

Analysis

- After examining 1000 individual studies, this meta study concluded, "Improved financial performance due to ESG becomes more marked over longer time horizons." Further, ESG is more effective as an integration strategy than negative screening. According to the meta study, ESG investing provides downside protection, especially in the face of economic or social crises. Sustainability initiatives promote better risk management and more innovation. Finally, while ESG disclosure on its own hasn't been found to improve financial outcomes, managing for a low carbon future has.

- Beyond stock valuations, CEOs of companies with formal decarbonization targets are more confident in the forecasting ability and resilience of their company.

- Though the influence of ESG ratings is growing, investors still consider performance and return for investment as more important. "OVTLYR data showed that returns on ESG stocks and funds were hard to distinguish from those of the broader market," said one expert, while Martin Whittaker of JUST Capital argues that investors don't have to sacrifice their values for profit and that companies with ESG standards "outperform by a considerable margin." In a survey this year of 325 investors, 81% expressed reluctance to take a hit on their returns of more than 1% in the pursuit of ESG standards.

- As early as 2004, Fortune 500 companies with the most women board directors had a significantly higher financial performance.

- From 2017 to 2019, 80% of the top ESG rated companies had better financial results, going by their annual revenues.

- A meta study of 245 studies found that the correlation between ESG and financial outcomes is generally positive: (see image below)

Research Strategy

This research was based on various studies, reports, and articles, primarily written by Fortune 500 company experts, ESG experts, and financial reporting companies. In many cases the impacts on Fortune 500 companies were similar or the same as big businesses generally. In order to cover the biggest companies like the Fortune 500, we also referred to adjacent categories of the biggest corporations, such as S&P 500 companies.

To compile the lists for the last section, we looked at rankings of top and bottom ESG companies and found the Fortune 500 companies from among them by cross-referencing the Fortune site. There are numerous rankings or scorings of ESG, and we focused on those that include all three factors.

Insight/2021/03.2021/03.08.2021_SDG/Social_Human_Capital_SDGs_NEW.png?width=2012&name=Social_Human_Capital_SDGs_NEW.png)