Part

01

of two

Part

01

How does canceling student loan debt affect taxpayers?

Key Takeaways

- According to Forbes Advisor, canceling student loans will not be free, it will cost the federal government hundreds of billions of dollars which means that it is the general public who will end up footing the bill.

- This statement was echoed by many other people including Jason Furman, the Aetna Professor of the Practice of Economic Policy at Harvard, who said the forgiveness plan will not be free and that it will be paid for by “the 87% of Americans who do not benefit but lose out from inflation and future spending cuts & tax increases.”

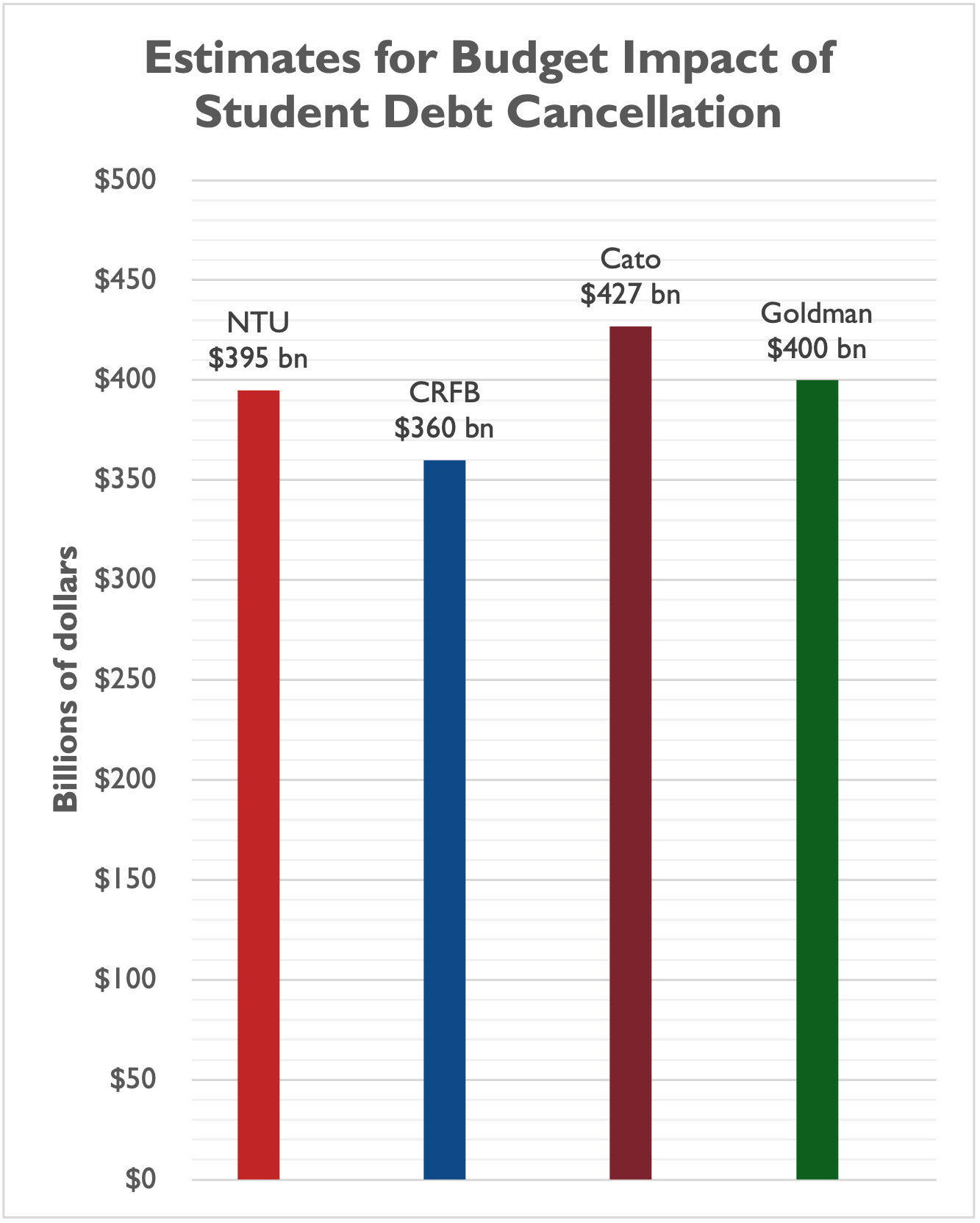

- Other institutions such as the NTU Foundation estimate that the forgiveness program will cost taxpayers approximately $395 billion (a figure that is close to the estimates from Goldman Sachs, the Committee for a Responsible Federal Budget (CRFB), and the Cato Institute), with the average burden per taxpayer in the country being $2,503.22.

Introduction

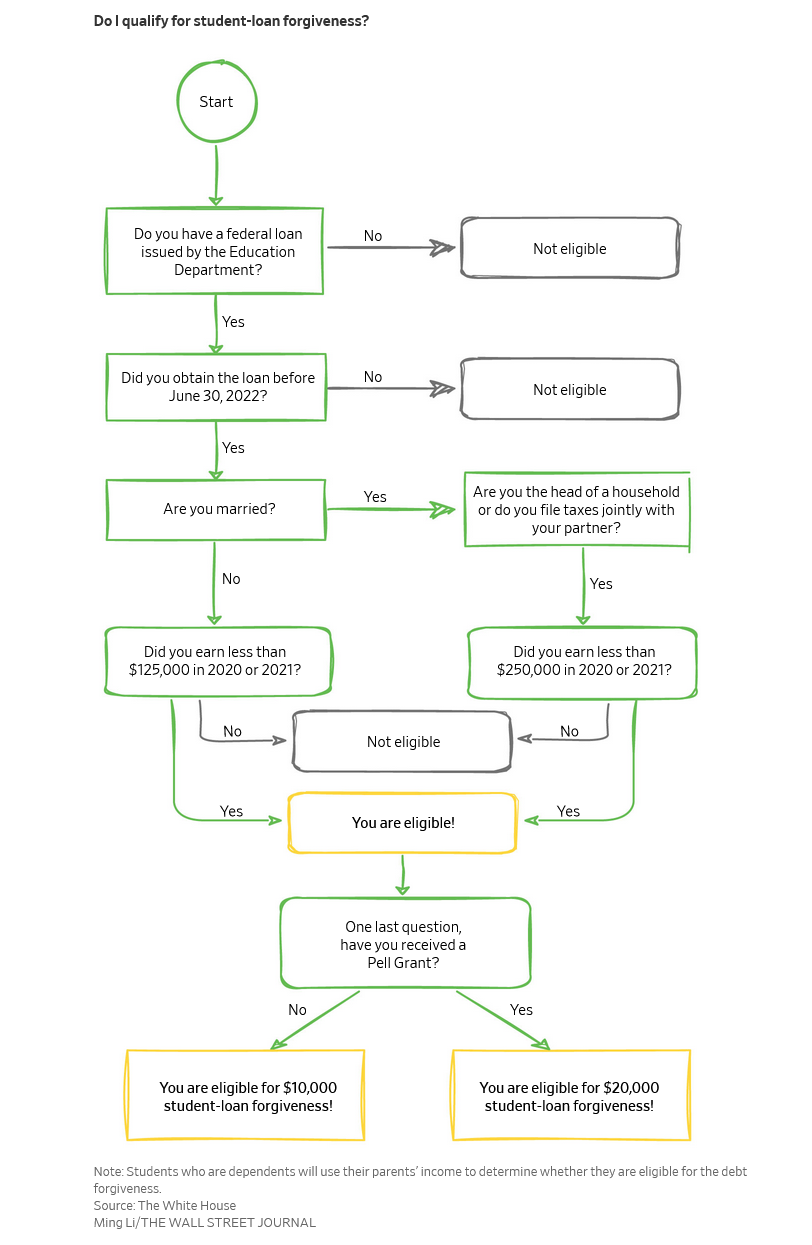

On Wednesday, August 24, President Joe Biden announced a student loans forgiveness plan in the hope that it will “give families breathing room as they prepare to start repaying loans after the economic crisis brought on by the pandemic.” According to the plan, the Department of Education will cancel up to $20,000 in federal student loans for Pell Grant recipients and up to $10,000 to non-Pell Grant recipients with incomes under $125,000. This announcement elicited reactions all across the nation and some policy experts such as Andrew Lautz of the National Taxpayers Union were quick to sound an alarm. This report provides insights into how canceling student loan debt will affect taxpayers.

Debt Forgiveness Cost

- Since the student loan forgiveness plan announcement, a number of groups have tried to approximate how much it will cost. According to the Committee for a Responsible Federal Budget (CRFB), over the next ten years, the plan will cost between $330 billion and $390 billion, with an average estimate of $360 billion. On the other hand, Goldman Sachs, Cato Institute, and the National Taxpayers Union (NTU) Foundation believe the plan will cost taxpayers approximately $400 billion, $427 billion, and $395 billion, respectively.

- However, even though the White House will not have an official estimate of how much the plan will cost until later this winter, according to the New York Times, officials say that these outside estimates are far too high.

Debt Forgiveness Impact on Taxpayers

- According to Forbes Advisor, canceling student loans will not be free, it will cost the federal government hundreds of billions of dollars which means that it is the general public who will end up footing the bill.

- This statement was echoed by many other people including Jason Furman, the Aetna Professor of the Practice of Economic Policy at Harvard, who said the forgiveness plan will not be free and that it will be paid for by “the 87% of Americans who do not benefit but lose out from inflation and future spending cuts & tax increases.”

- Other institutions such as the NTU Foundation, Goldman Sachs, the CRFB, and the Cato Institute also believe that this plan will cost taxpayers. Therefore, if policymakers will indeed have to find ways to offset the total cost of the forgiveness through borrowing, increasing taxes, spending cuts, or a mixture of these strategies, then taxpayers will feel the heat.

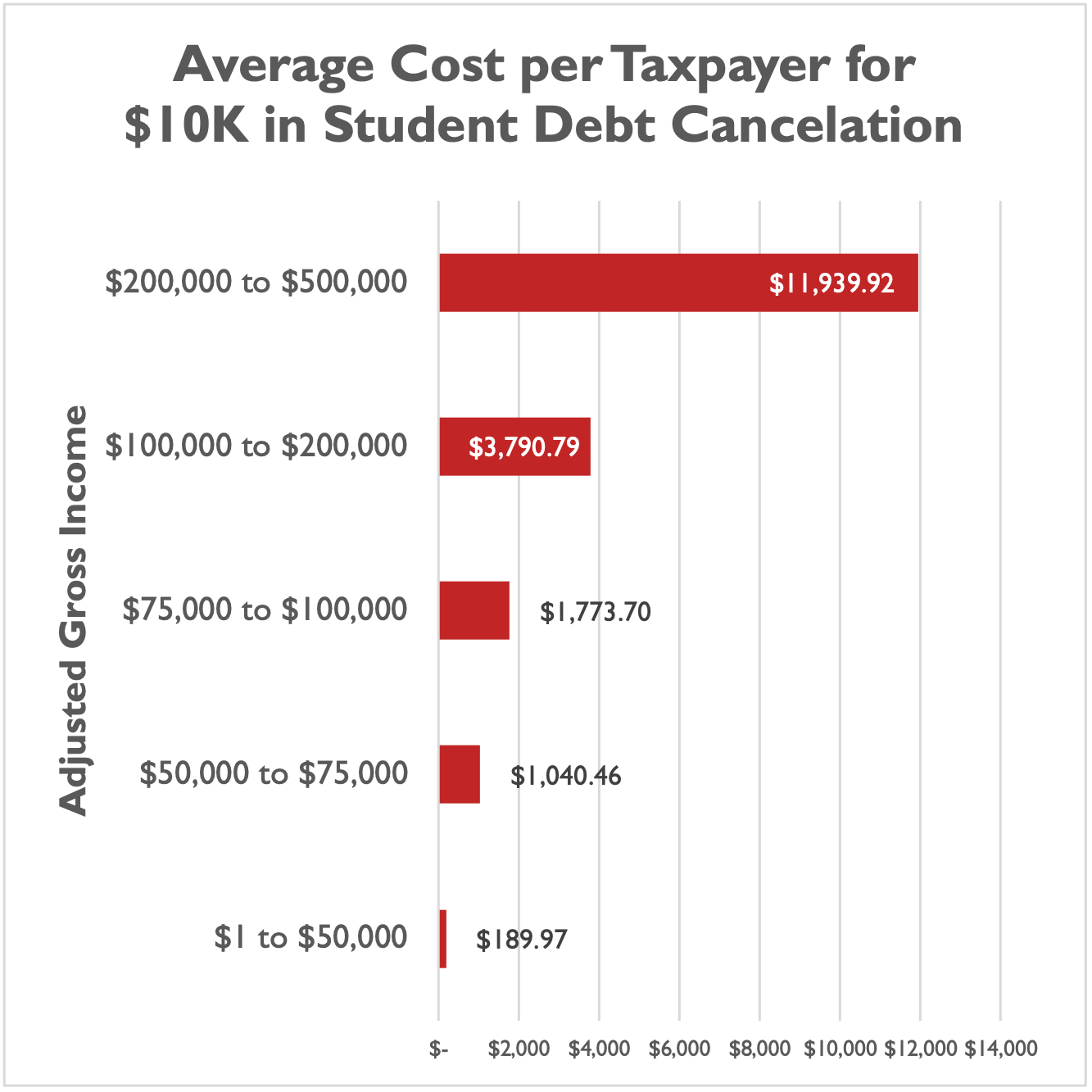

- For instance, the NTU estimates that the forgiveness program will cost taxpayers approximately $395 billion (a figure that is close to the estimates from Goldman Sachs, the Committee for a Responsible Federal Budget (CRFB), and the Cato Institute), with the average burden per taxpayer in the country being $2,503.22.

- Moreover, according to NTU calculations, this burden will not be evenly distributed across different income levels. Some income levels will feel the impact more than others with taxpayers earning the highest incomes getting the short end of the stick. Based on NTU calculations this is how the average tax burden will be spread across different income levels;

- Taxpayers earning between $1 to $50,000 average burden: $190

- Taxpayers earning between $50,000 and $75,000 average burden: $1,040

- Taxpayers earning between $75,000 and $100,000 average burden: $1,774

- Taxpayers earning between $100,000 and $200,000 average burden: $3,790

- Taxpayers earning between $200,000 to $500,000 average burden: $11,940

Managing Deficit Without Burdening Taxpayers

- Although most believe that at the end of it all the taxpayer will be the one to foot the bill, it might be possible for the US government to cancel the student loans without affecting taxpayers. While sources such as the Wharton Budget Model estimate that the forgiveness plan will add around $519 billion to the federal deficit over the next decade, President Biden said at a recent press briefing that his government cut the deficit by more than $350 billion in 2021 and is on its way to cut it by more than $1.7 trillion by the end of 2022, and so there’s “plenty of deficit reduction to pay for the programs — cumulative deficit reduction — to pay for the programs many times over.”

- Since the canceled federal student loans will be added to the federal deficit, to better manage the increasing debt without increasing taxes, the government can implement some of the options that were recommended by the Congressional Budget Office on how to reduce the nation's deficit. Some of them include "reducing the size of the nuclear triad, canceling the long-range standoff weapon, reducing funding for international affairs programs, limiting states’ taxes on health care providers, and making the social security’s benefit structure more progressive".

Research Strategy

For this research on how canceling student loan debt affects taxpayers, we leveraged the most reputable sources of information that were available in the public domain, including the Committee for a Responsible Federal Budget (CRFB), Goldman Sachs, Cato Institute, and the National Taxpayers Union (NTU) Foundation.

It should be noted that since canceling federal student loans will add to the federal deficit, we assumed that any actions or policies that can potentially reduce the budget deficit are applicable to the part on how the impact on taxpayers could be avoided, even if they are not directly mentioned in relation to canceling student loan debt. Thus, we provided some of the methods recommended by the Congressional Budget Office on how to reduce the nation's deficit.