Part

01

of one

Part

01

Diamond Industry Overview Follow-Up

Key Takeaways

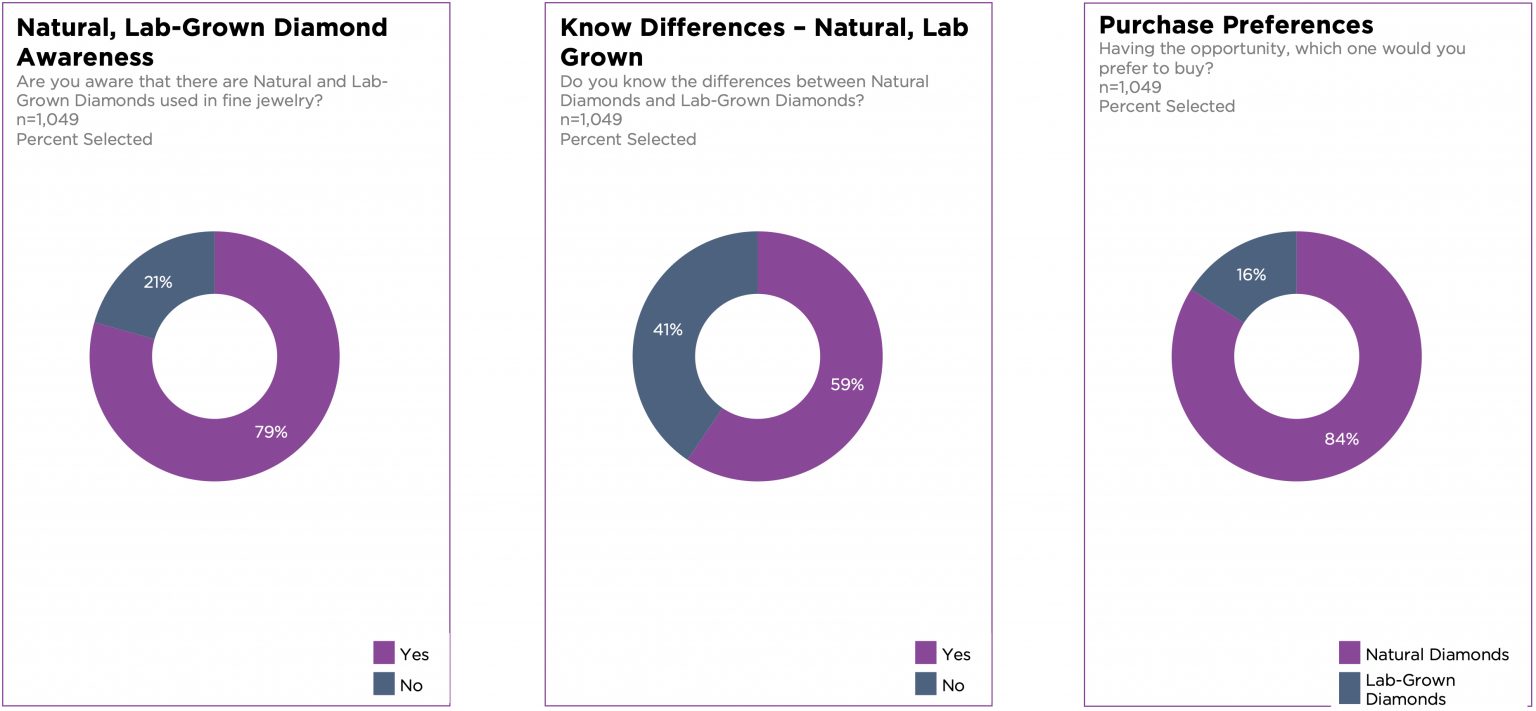

- The Plumb Club Industry and Market Insights 2021 Consumer Study that was conducted in the US revealed that 79% of consumers are aware that natural and lab-grown diamonds exist and are being used in fine jewelry.

- About 84% of US consumers prefer to buy natural diamonds over lab-grown diamonds.

- Bloomberg reported that the prices of small rough diamonds had increased by about 20% since March 2022, when the sanctions were imposed. The deficit in supply caused an increase in the price of rough diamonds.

Introduction

This research presents two parts. The first part includes insights into consumer opinions and attitudes surrounding the diamond industry, while the second part presents insights into the impact of sanctions against Russia on the global diamond industry. Insights into consumer attitudes include consumer preference and awareness of natural and lab-grown diamonds. The details are outlined below.

I. Consumer Opinions and Attitudes Surrounding the Diamond Industry

Diamonds are Highly Desired by Millennials and Gen Zs

- The Natural Diamond Council's 2020 Desirability Research revealed that diamond jewelry has the highest desirability among millennials and Gen Zs.

- About 70% of millennials and Gen Zs think natural diamonds are unique or "one of a kind." Consumers' affinity for diamonds has mainly been attributed to the diamond's uniqueness.

- Consumers also value the symbolism carried by diamonds for connection and love. About 80% of consumers had purchased "diamond jewelry as a gift" in the last two years.

- Consumers' leading reason for buying diamonds to be given as a gift was the diamond's lasting value.

79% of Consumers are Aware of Natural and Lab-Grown Diamonds

- The Plumb Club Industry and Market Insights 2021 Consumer Study that was conducted in the US revealed that 79% of consumers are aware that natural and lab-grown diamonds exist and are being used in fine jewelry.

- Consequently, 21% of consumers are unaware of lab-grown diamonds, and 41% are unaware of the differences between the two types of diamonds (lab-grown and natural).

- More than half (59%) have knowledge about the differences between lab-grown and natural diamonds. The image below shows a diagram from the 2021 Consumer Study.

- A 2022 survey by MVI Marketing also revealed that 72% of Gen Z consumers are aware of lab-grown diamonds and are buying them.

84% of US Consumers Prefer to Buy Natural Diamonds

- The Plumb Club Industry and Market Insights 2021 Consumer Study also revealed that 84% of US consumers prefer to buy natural diamonds over lab-grown diamonds.

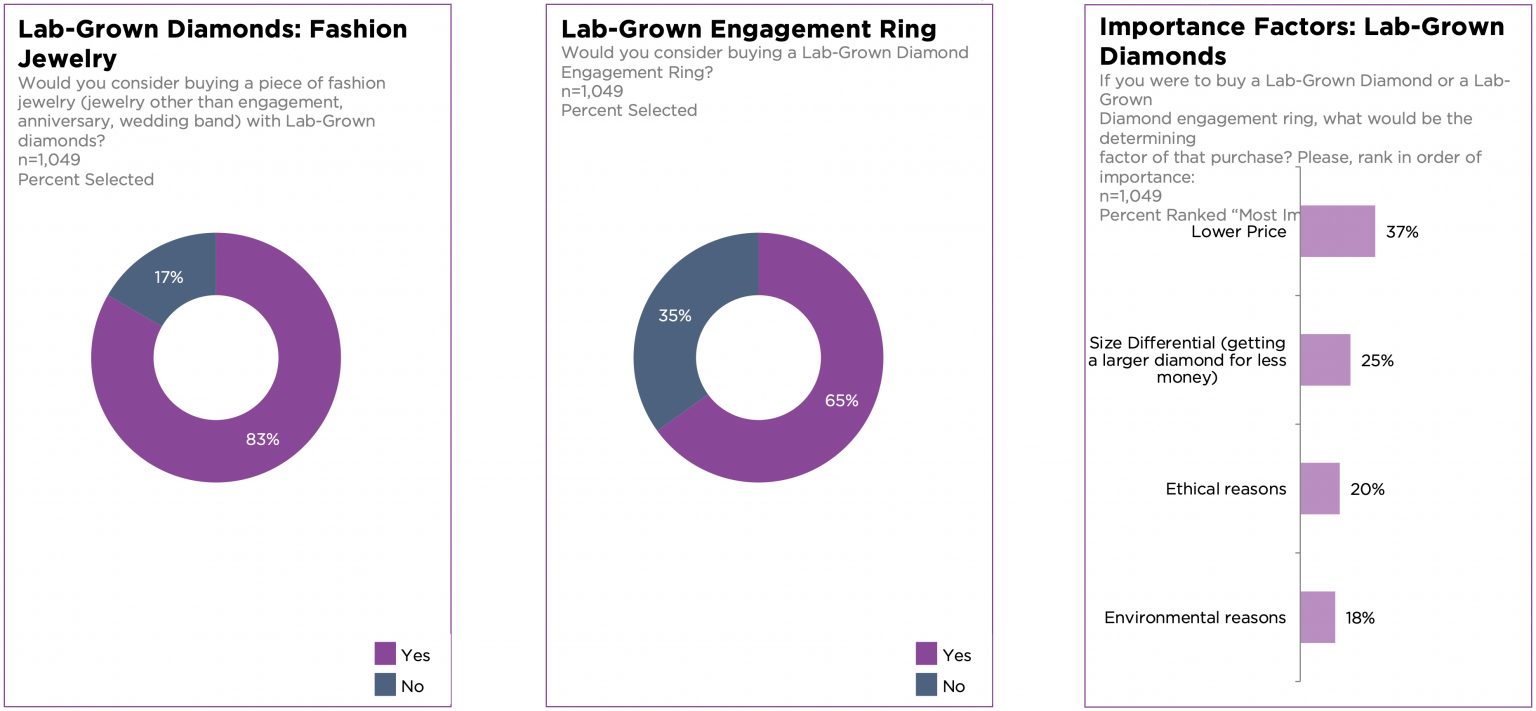

- Consumers' purchase preference tends to be affected by the type of jewelry they intend to buy. About 83% of consumers said they would consider purchasing fashion jewelry with lab-grown diamonds if the jewelry is not an engagement ring, anniversary ring, or wedding band.

- Only 65% of consumers would consider buying engagement rings that contain lab-grown diamonds. The image below shows a diagram of the purchase preference percentages.

Diamond Purchase Decisions Among Men and Women

- Men's primary consideration in their diamond purchase decision is the cost, followed by design. When men buy engagement rings with diamonds, the cost is considered first.

- However, the case is different for women. Women think the design is of primary importance, followed by the carat size and the cost.

- A survey from Beyond4Cs also revealed that diamond quality is only a third consideration (next to cost and design) in men's and women's purchase decisions.

Consumers Value Sustainability

- The De Beers' 2021 Diamond Insight Report revealed that about 60% of consumers globally would choose a sustainable natural diamond over a natural diamond with no sustainability assurance. Consumers would purchase diamonds that have "been produced in line with environmental, social, and governance goals."

- Consumers would choose the sustainable diamond even if it is more expensive. The De Beers Report revealed that "85% of those willing to select the sustainable options are open to paying an average premium of 15%."

- WD Lab Grown Diamonds is a "leading lab-grown diamond producer in the US" that has been given a Certification Standard for Sustainable Diamonds by SCS Global Services, a global audit and standards firm.

- About 20% of consumers consider ethical reasons as a key factor for buying a lab-grown diamond, while 18% consider environmental reasons as another key factor.

II. Impact of Sanctions Against Russia on the Global Diamond Industry

Sanctions Caused Crisis in the Diamond Industry

- Russia is one of the major diamond producers in the world. It has the largest reserves of natural diamonds in 2021, about 1.1 billion carats.

- About "30% of the world's supply of diamonds" comes from Russia, and the Russian company Alrosa mines about 90% of those. Thus, the sanctions given to Alrosa caused a crisis in the diamond industry as it caused a deficit in the diamond resource.

- Particularly, there are shortages in the supply of diamonds up to 0.29 carats, and inventories of polished diamonds up to 0.99 carats also went down.

- Due to the deficit in supply, the price of rough diamonds increased. Bloomberg reported that the prices of small rough diamonds had increased by about 20% since March 2022, when the sanctions were imposed.

Loss of About 10,000 Jobs

- According to the AWDC, if the diamonds Russia normally sells to Europe would go to other diamond hubs because of the sanctions, it would cause the loss of about 10,000 jobs.

- Aside from the loss of jobs, money laundering is another issue. The AWDC said, "If 30% of the market goes to Dubai, then you have thrown away 20 years of transparency and compliance and due diligence into the garbage can, and you have no control anymore. We are opening the door to money laundering. We are opening the door to financing terrorism in large volumes."

Supply Chain Issues

- The sanctions on Russia caused a shortage of rough diamonds in the market, which led to the shortage of small polished diamonds.

- Alrosa has over 50% market share in diamonds. The shortage in supply of rough diamonds, and consequently polished diamonds, may also lead to a shortage of radiants and emeralds.

India's Response Regarding the Sanctions

- In April 2022, India's response is to evaluate and study the stricter sanctions imposed on Alrosa. Alrosa is India's largest supplier of rough diamonds and thus plays a major role in India's jewelry industry.

- Accepting the sanctions against Russian diamonds could be crippling to India's industry since diamonds are its "third-largest source of export revenue." In addition, about a million people in India are employed in the diamond cutting and polishing industry.

- According to Anoop Mehta, Bharat Diamond Bourse president, "What's happening in Ukraine is terrible, and we stand with the people there. But surely the solution can't be to punish innocent and poor workers who have nothing to do with Russia or its war."

- Foreign minister Jaishankar of the Indian Parliament shared in April 2022 that New Delhi and Moscow had been discussing a rupee-rouble arrangement.

Russia's Plan to Mitigate the Effects

- According to Alrosa CEO Sergei Ivanov, Alrosa will not suspend diamond production amidst sanctions. Alrosa also has no plans to lay off employees.

- Ivanov said, "We don't intend to suspend our production operations. I am sure that throughout the year, we will also fully abide by our social obligations. We do not see any prerequisites today to start any cuts or tighten our belts."

- Alrosa plans to continue production by piloting new machines and underground complexes to mitigate the effects of the sanctions.

- In addition, Gokhran, Russia's state gem depository and "a unit of Russia's Ministry of Finance," considers buying diamonds from Alrosa this year.

Research Strategy

For this follow-up research on the diamond industry, we leveraged the most reputable sources of information in the public domain, including Forbes, Natural Diamonds, Statista, Transparency Market Research, Al Jazeera, and Time.