Part

01

of one

Part

01

Customer Attitudes Towards Consumer Permissioned Data

Key Takeaways

- A 2021 study conducted by BCG and Google revealed that 49% of consumers are most willing to share information on their gender, 40% are most willing to share their zip code, 28% are willing to give email addresses, and 27% are willing to share their age.

- The study also revealed that Zoomers or those 18 to 24 years old are "57% more likely to share their email activity" but "52% less willing to share their activity on other websites."

- MeasureOne offers access to consumer-permissioned data by providing hosted web experiences through its hosted portal.

- Consumer permissioned data are used for user segmentation and providing tailored consumer experiences. Companies collect consumer permissioned data to categorize the users so that users can be given personalized experiences.

Introduction

This research report has four parts. The first part presents four statistics regarding consumer attitudes toward consumer permissioned data. The second part presents five consumer permissioned data providers in the US. These data providers are Argyle, MeasureOne, Akoya, Plaid, and Truv. The third part presents two trends regarding the use of consumer permissioned data, and the fourth part presents two use cases of consumer permissioned data. The details are outlined below.

I. Consumer Attitudes Toward Consumer Permissioned Data

A Factor Resulting in Brand Mistrust for 30% of Consumers

- A study by Jebbit, a zero-party data platform, on US consumers' trust in brands revealed that "asking for too much information" is the number 1 factor resulting in brand mistrust for 30% of consumers.

- Thus, brands need to be strategic and thoughtful regarding the data points they're collecting from consumers.

- Brands also have to deliver value to consumers using the information they have collected. According to Tom Coburn, Jebbit's CEO, "Brands stand to gain a better chance of gaining consumer trust by proactively communicating how they collect and use their data, and demonstrating they are using the information in a way that delivers value back to the customer."

49% of Consumers are Most Willing to Share Gender Information

- A 2021 study conducted by BCG and Google regarding consumer privacy and preferences revealed that consumers are "more willing to share" particular types of data such as their gender, zip code, email address, and age or birthdate.

- The study revealed that 49% of consumers are most willing to share information on their gender, 40% are most willing to share their zip code, 28% are willing to share their email address, and 27% are willing to share their age.

- On the other hand, consumers are less likely to share certain data such as income, phone number, real-time location, and social media profile details.

- The BCG and Google study revealed that only 11% of consumers are willing to share information on their income, phone number, and real-time location, while only 9% are willing to share their social media profiles.

- In addition, consumers are least willing for companies to record their conversations. Only 5% of consumers are willing to share their recorded conversations.

New Parents are "70% More Likely to Share" Income Information

- The 2021 BCG and Google study also revealed that the type of information consumers are most willing to share with companies differs across consumer segments. The study revealed that new parents 18 to 40 years old are "70% more likely to share their income than the average consumer." However, they are also "43% less willing to share their activity on the company's website."

- In addition, Zoomers or those 18 to 24 years old are "57% more likely to share their email activity" but "52% less willing to share their activity on other websites."

- On the other hand, the Young Urban Professionals or those who are 25 to 40 years old urban professionals with bachelor's degrees or higher are "113% more likely to share their social media activity" than the average consumer. However, they are "36% less willing to share their gender."

Consumer Attitudes in 2019 and 2020

- In 2019, as revealed by a 2019 McKinsey study, consumers were unwilling to share their data "for transactions they don't view as important."

- In 2020, through data from e-commerce marketing platform Yotpo, the majority of consumers (87%) were found to be open about "brands monitoring details of their activity if it leads to more personalized rewards."

II. US Consumer Permissioned Data Providers

Argyle

- The website of Argyle can be accessed here.

- Argyle is a platform that provides "consumer-permissioned income data."

- Argyle enables users to "share their employment records" without having to leave the app or website.

- Argyle provides a holistic view of users' income, profile, and work history. This is done by allowing users to find "their employers by searching Argyle's comprehensive database." Users will then connect their employment account, and Argyle, in turn, connects the employer to the user's employment records.

MeasureOne

- The website of MeasureOne can be accessed here.

- MeasureOne offers access to consumer-permissioned data by providing hosted web experiences through its hosted portal.

- MeasureOne also offers easy integration and deployment through its integration with 3rd party platforms. MeasureOne's API also integrates "consumer experience natively into" the company's application, allowing results to automatically populate the platform.

Akoya

- The website of Akoya can be accessed here.

- Akoya offers seamless integration that enables authorized "direct connections with data aggregators and fintech that will use the Akoya Data Access Network."

- Akoya offers consumer permissioned data for payment enablement, personal financial management, business financial management, credit enhancement, wealth management, and investing.

Plaid

- The website of Plaid can be accessed here.

- Plaid enables users to have improved financial health through categorized transactions. Plaid does this by consolidating financial data from various sources and categorizing "with typically 24 months of history."

- Plaid can be integrated into an app or digital service. Users will then "be prompted to connect their bank account, which will launch the Plaid module."

Truv

- The website of Truv can be accessed here.

- Truv offers consumer permissioned data that allows employment history verification and database verification.

- Truv does this by allowing users to select their employer. Truv then connects to the user data as the users enter their credentials. The data will then be delivered to the employer through API or the Truv dashboard.

III. Trends Regarding the Use of Consumer Permissioned Data

Preference for Hard-Value Incentives

- One of the trends in the use of consumer permissioned data is the consumers' preference for hard-value incentives. Hard-value incentives include free samples and discounts.

- Consumers see hard-value incentives as "more compelling reasons to share their data than soft-value incentives." Soft-value incentives include access to newsletters, games, or communities.

- Consumers' preference for discounts and free samples is a trend because consumers are seeing discounts and free samples as a right value exchange for their data.

- In contrast, about "75% of consumers don't feel incentivized by newsletters." Compared to newsletter access, discounts are found to be over twice as effective.

- This trend causes consumers to embrace consumer permissioned data, given that they get something of value in return. BCG notes that about 90% of consumers are willing to share their data with a particular company "when presented with the right value exchange."

Consumers Like to Answer Interactive Surveys

- Another trend is the answering of interactive surveys. Companies pose these surveys on their websites, and consumers who visit the website can answer the survey there.

- This is a trend because studies discovered that "people love answering questions about themselves."

- Some facial brands' interactive surveys or quizzes ask consumers about their facial skin type and facial skin concern. Consumers may choose dry, normal, oily, or a combination for the facial skin type. For the facial skin concern, they may select redness, aging, pigmentation, sun protection, or blemishes.

- As a result, this trend enables consumers to have personalized experiences through the answers they've given in the interactive surveys.

- In addition, interactive surveys also increase conversion rates and average order value.

IV. Use Cases of Consumer Permissioned Data

For User Segmentation and Tailored Experiences

- Consumer permissioned data are used for user segmentation and providing tailored consumer experiences. Companies collect consumer permissioned data to categorize the users so that users can be given personalized experiences.

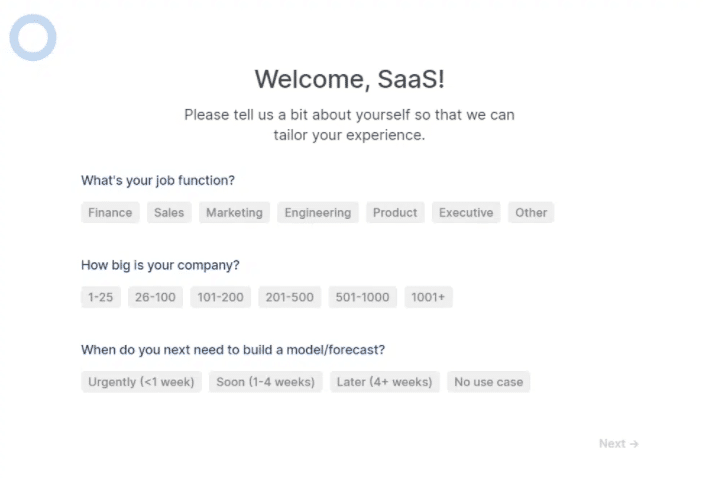

- Causal, "a business planning platform that builds financial models," is one of the companies implementing this. Causal is a startup operating "on a freemium acquisition model."

- Causal collects consumer permissioned data during onboarding. Before showing the different available templates, Causal asks users three questions. The questions are shown in the image below.

- Data providers are not involved in the collection of these data because Causal collects the data on its own.

For Determining Pain Points and Buying Journey

- Consumer permissioned data are also used for identifying consumer pain points and the buying journey.

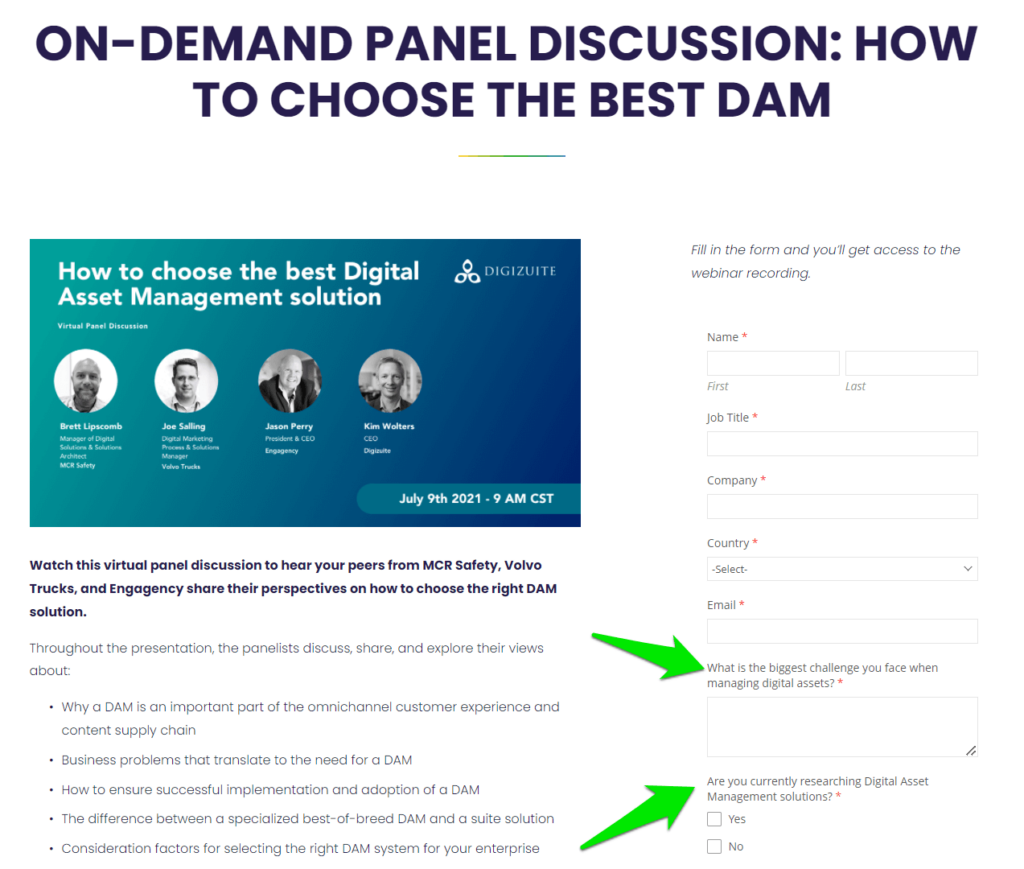

- Digizuite is one of the companies implementing this. Digizuite is a company that offers digital asset management (DAM) solutions by organizing marketing assets and distributing them to various channels.

- Digizuite does not use data providers in the collection of consumer permissioned data. This is because Digizuite collects consumer permissioned data through its own lead magnet.

- Digizuite's webinar landing page is shown in the image below. Digizuite asks for the user's job title and contact information, followed by two questions posed to determine the user's buying journey and pain points. The two questions are: "What is the biggest challenge you face when managing digital assets?" and "Are you currently researching Digital Asset Management solutions?"

- This is an interesting use case because the two questions presented allow prospective customers to "envision what it's like to use Digizuite's DAM solution." This is an effective way to educate people and showcase the product in its early stages.

Research Strategy

For this research on Consumer Attitudes Towards Consumer Permissioned Data, we leveraged the most reputable sources of information in the public domain, including Retail Customer Experience, Web Assets, Glossy, McKinsey, LXA Hub, and Marketing Brew.