Part

01

of one

Part

01

Crypto Asset Management Trends

Trends

Increase in Institutional Crypto Investments

- In a recent Evertas survey, 26% of institutional investors reported they plan on dramatically increasing their crypto asset investments over the next 5 years. "The research also found that a further 64% anticipate a "slight" rise in allocation. For hedge funds, the dramatic increase is expected by an even larger percentage (32%)."

- Similarly, a survey from Fidelity Investments of almost 800 institutional investors showed approximately "a third of large institutional investors own digital assets such as Bitcoin", an increase of at least 5% from 2019. Specifically, an estimated 27% of U.S. institutional investors hold crypto under management, while 45% of investors in Europe have invested in digital assets.

- Tom Jessop, president of Fidelity Digital Assets stated, "These results confirm a trend we are seeing in the market toward greater interest in and acceptance of digital assets as a new investible asset class."

- The results of the Fidelity Investments survey clearly demonstrate "Digital assets are gaining in favorability and appeal amongst institutional investors, with almost 80% of investors surveyed finding something appealing about the asset class."

- "Of all U.S. and European investors who have exposure to digital assets, over 60% buy digital assets directly. Fifty-nine percent of U.S. investors who currently invest are invested directly, up from 55% in the 2019 survey. And amongst the backdrop of recent market growth in the number of crypto native and incumbent service providers offering cash and physically settled futures contracts, 22% of U.S. respondents invested in digital assets have exposure via futures, which is a substantial increase relative to 9% of U.S. investors surveyed in 2019."

- The survey also detailed, "Looking out five years, 91% of respondents who are open to exposure to digital assets in a portfolio expect to have at least 0.5% of their portfolio allocated to digital assets. Amongst U.S. respondents, this number is up by 9 percentage points vs. 2019 from 79% to 88%."

- In fact, "The corporate appetite for bitcoin (BTC) is at an all-time high with companies and mutual funds pumping big capital. Companies from the United States, Canada, Australia, Switzerland, and Germany, for example, have already invested $20 billion in the first cryptocurrency. Cases reviewed show corporations are getting closer to bitcoin without fear and acquiring large quantities. These are two elements that could outline a growing trend for 2021."

- John Lee Quigley of HASHR8 stated, "Institutional investors are 'scrambling' to gain exposure to BTC, which is increasingly being promoted as an effective long-term store of value."

- "Prominent Wall Street investors are also increasingly bullish on BTC. Bill Miller, mutual fund legend and chief investment officer of Miller Value Partners, has recently summed up his bullish thesis for BTC." He stated, "Bitcoin's supply is growing around 2.5 per cent a year and the demand is growing faster than that".

- According to a crypto research firm Messari, more than 81,000 BTC belongs to “the treasuries of publicly traded companies".

- "According to a report from cryptocurrency derivatives platform Zubr, institutional investors are moving toward holding Bitcoin in “physical” form instead of cash-settled futures. The integration of institutional investors into the crypto ecosystem and their interest in holding is a positive sign for mainstream adoption. The similarities these investors share with holders indicate an easy transition from traditional finance to the digital economy, instilling trust in Bitcoin and representing an understanding and belief in the technology."

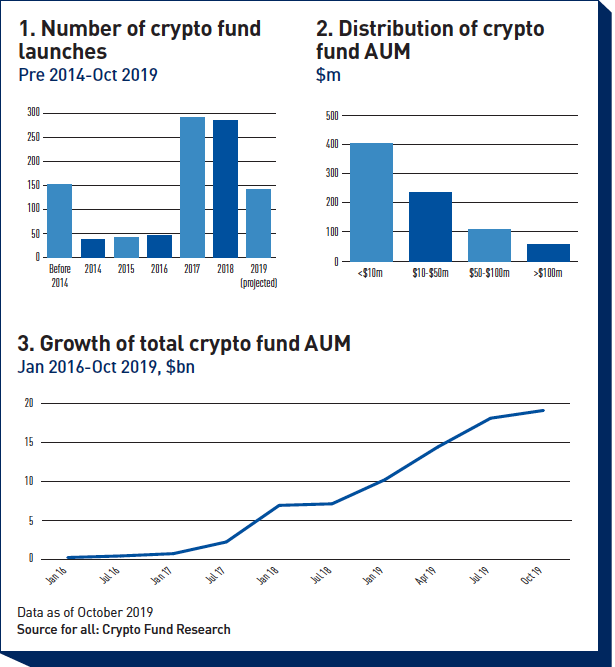

- "The current size of the crypto-asset market, according to Aaro Capital, a company that facilitates investment in the technology, is about $200bn (€180bn) compared with $18bn at the beginning of 2017. In the past three years over 500 funds have been launched in the distributed ledger technologies (DLT) and crypto-assets sector."

The Emergence of Crypto Asset Management Solutions

- The difficulty of understanding cryptocurrency investments kept many institutional investors out of the digital block-chain investment space during crypto's infancy. A prominent trend directly related to the issue resulted in the emergence of crypto asset management solutions. These solutions are designed "to help individuals and firms alike take advantage of crypto without having to worry about the ins and outs or technical procedures involved."

- Investopedia explains, "The process of purchasing cryptocurrencies is still harder than buying regular equities. As cryptocurrencies attract new users, more market participants are becoming aware of the need for straightforward tools designed to manage crypto portfolios for traders of all skill levels." Blox CEO Alon Muroch states, "keeping track and managing your crypto assets is no walk in the park, even, or especially for the more experienced traders. Knowing where your coins are kept, how they performed and what their real-time status is, can be a challenge."

- "Until recently, the wider crypto ecosystem was also severely lacking in institutional-grade crypto asset custodial solutions. With an urgent need for adequate custodians to secure the growing amount of crypto assets and an increase in clarity around regulatory guidelines for operating and investing in cryptocurrencies, a sector of institutional-grade custodian solutions was born."

- Hedge Trade details, "Rather than having to manage several accounts and wallets, crypto asset management platforms take a different approach. They are instead simplifying the process. They carry this out by helping users strengthen their diverse holdings while simultaneously providing better portfolio management tools." They list Blox, Binance, and Ledger Nano S among the best crypto asset management tools.

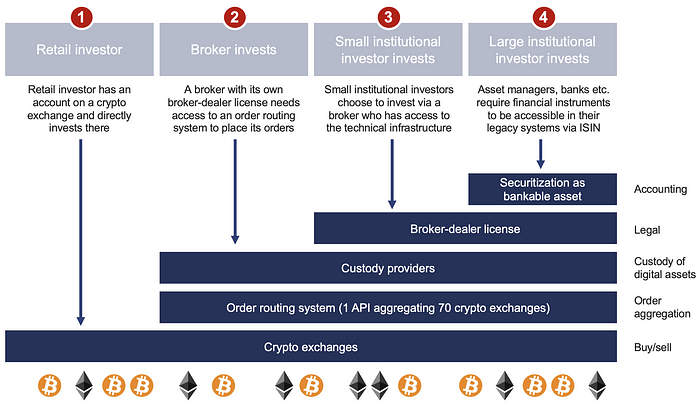

- Professor at the Frankfurt School of Finance & Management, Philipp Sandner, says the emergence of institutional investors in crypto requires solutions for the regulatory requirements, risk management, and traditional investment processes that these investors must have in order to invest in the nascent asset class.

- "Banks have also received the green light to custody crypto companies. In a note to the public, senior deputy comptroller and senior counsel of the U.S. Office of the Comptroller of the Currency Jonathan Gould wrote back in July: “We conclude a national bank may provide these cryptocurrency custody services on behalf of customers, including by holding the unique cryptographic keys associated with cryptocurrency"."

- Large financial services companies, such as KPMG, are entering the solutions segment. "Targeting institutional clients, the new KPMG Chain Fusion product lets customers manage their data in compliance with regulations around financial reporting, security and processing needs. The suite allows these customers to collect and organize data from both traditional systems as well as blockchain databases." KPMG created the crypto solutions to assist both traditional finance companies and fintech startups in managing their crypto-asset services.

- Companies such as BitGo and Genesis Trading have launched new crypto asset management services like prime brokerages that are geared toward institutional investors.

- HedgeGuard is another crypto asset management solution widely used by institutional crypto investors and crypto brokers to organize their digital assets and keep track of their portfolios.

- Forbes, in detailing BitGo's entry into the solutions segment, explains, "Institutional grade trading services makes it easier for institutions to participate in cryptocurrency investing and that’s important as while institutional money has been the backbone of global equity and bond markets, the cryptocurrency market hasn’t yet seen large inflows of institutional money and that’s held the market back. Many of the early institutional custody and trading platforms had significant limitations which made them unappealing for institutional investors because of their lack of regulatory oversight and operational controls."

- Even London’s Standard Chartered bank has recently entered the crypto asset management solutions segment targeting institutional investors.

- FinExtra reported recently, "The growing number of startups offering crypto investment services will be buoyed by news that institutional investors are set to increase the amount of capital they spend on crypto assets."

Crypto & Institutional Investment Drivers

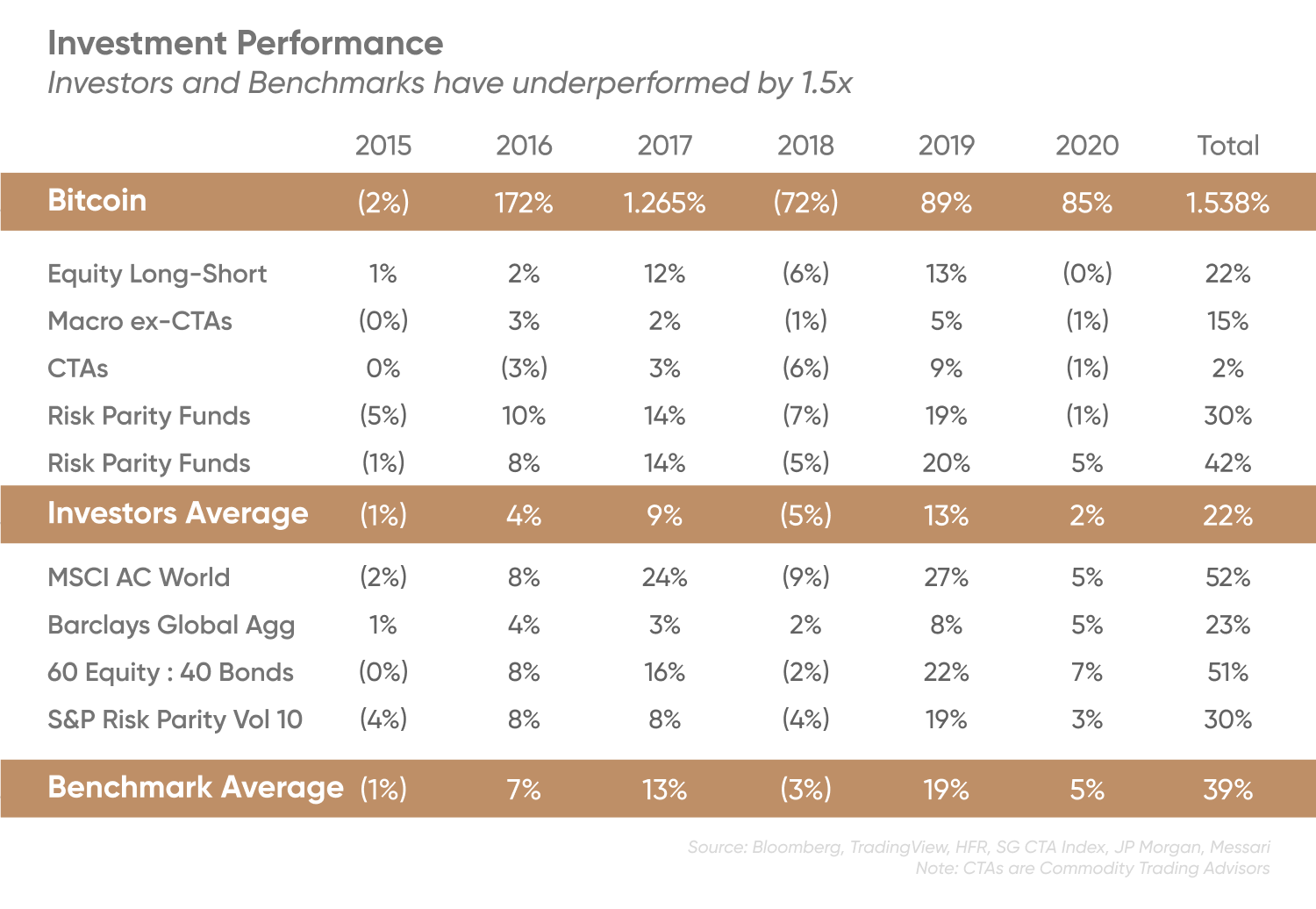

Predominately, institutional investors now view crypto assets as a hedge against inflation and a store of value. "After years of negative comments, Nouriel Roubini finally admitted that BTC could be a partial store of value. Even JP Morgan recently turned bullish, recognizing Bitcoin's 'potential long-term upside'." The narrative driving institutional investors to crypto assets runs hand-in-hand with the strategies employed by these same investors.

- "From MicroStrategy and Grayscale to JPMorgan and Goldman Sachs, Bitcoin has solidified its place in investment portfolios as the asset to hold as a hedge against inflation and currency devaluation."

- "Two major areas where Bitcoin and blockchain technologies offer the most value to institutional investors include secure, borderless transactions and access to new opportunities that can’t exist in traditional financial markets."

- "With U.S. dollar inflation on the horizon, notable investors like Ray Dalio and Paul Tudor Jones are also beginning to “like Bitcoin more and more” and have identified it as the “best inflation hedge,” comparing it to gold and copper. As banks and technology providers continue to invest heavily in research and development projects related to verifying and recording finance transactions, such as JPMorgan’s new business blockchain and digital currency house Onyx, we will continue to see institutions increase their presence within the space."

- A report by Big Four audit firm KPMG found that major banks, asset managers and qualified custodians are launching a new wave of institutional-grade crypto products and services. The institutional investments into cryptocurrency confirms trust in the digital asset from a significant place of power.

- "When asked why they believe institutional investors will increase their exposure to cryptocurrencies and crypto assets, 84 per cent of the survey respondents said it was because they expect the regulatory infrastructure for the market to improve, and this is followed by 80 per cent who say it is because the crypto market will become much bigger, providing greater liquidity. Three in four (76 per cent) say it is because they expect more mainstream fund managers and financial services companies to enter this market, and there will be more funds and investment vehicles in this area to choose from."

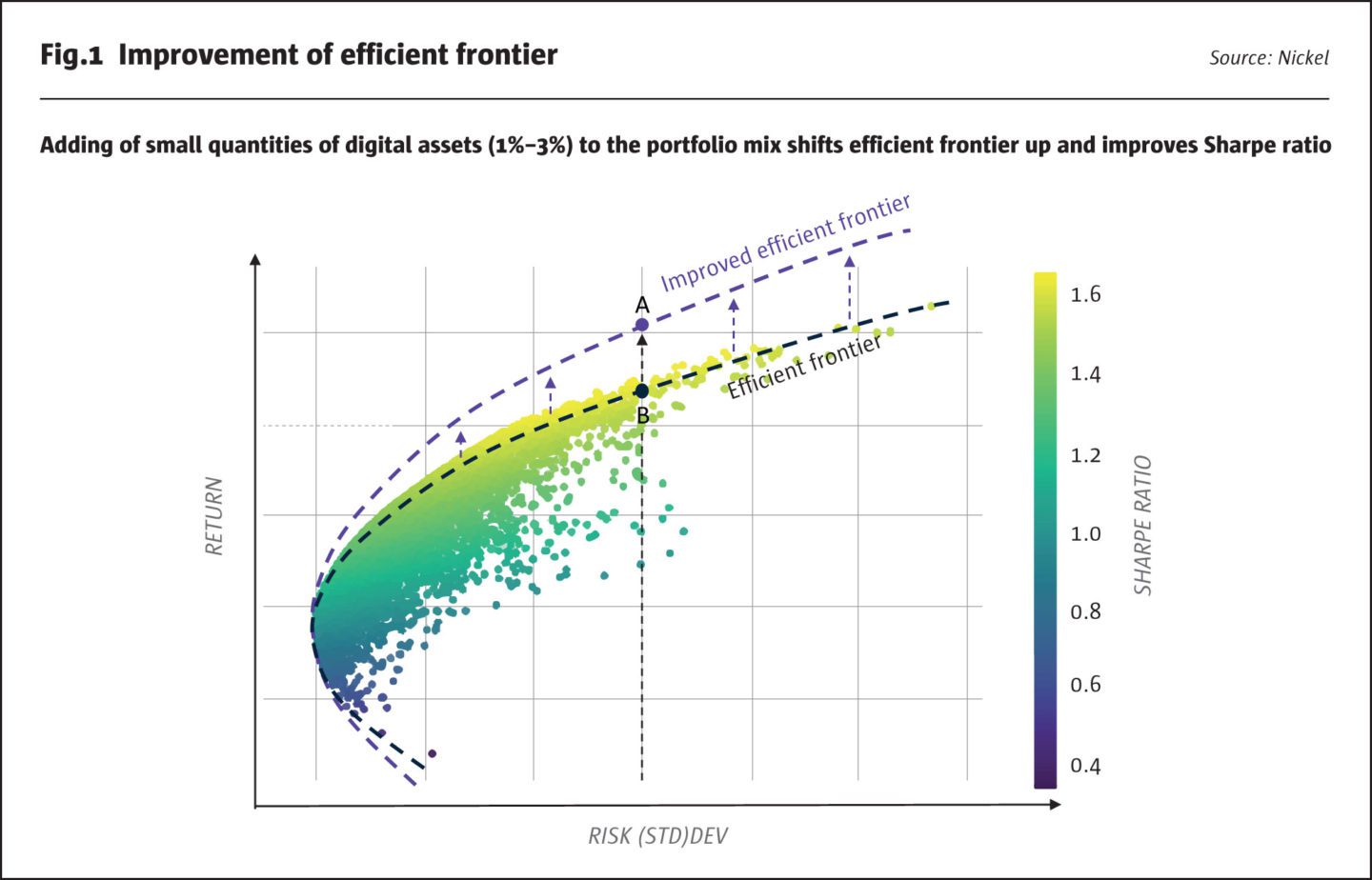

- The case for institutional allocations to digital assets : "Bitcoin has demonstrated a meaningful diversification effect for institutional portfolios, over a statistically significant seven-year period since reliable crypto trading and pricing data has existed. The addition of an uncorrelated asset, like Bitcoin, to a diversified investment portfolio results in an upward shift of the efficient frontier and an improvement in the Sharpe ratio (see Fig.1). Furthermore, Bitcoin could offer a hedge against inflationary risks, which may be growing due to the extraordinary policy responses to unprecedented economic and financial conditions triggered by the Covid-19 economic downturn."

Institutional Cryptocurrency Asset Management Strategies

Many institutional investors hold Bitcoin (BTC) as their primary asset in crypto.

- PWC's 2020 Crypto Hedge Fund Report details: "The most common crypto hedge fund strategy is quantitative (48% of funds), followed by discretionary long only (19%), discretionary long/short (17%), and multi-strategy (17%)."

- In addition, "Most crypto hedge funds trade Bitcoin (97%) followed by Ethereum (67%), XRP (38%), Litecoin (38%), Bitcoin Cash (31%) and EOS (25%)."

- The report concludes, "About half of crypto hedge funds trade derivatives (56%) or are active short sellers (48%). Crypto hedge funds are also involved in cryptocurrency staking (42%), lending (38%) and borrowing (27%)."

- Nickel Digital Asset Management employs 2 distinct crypto asset management strategies. Their "Digital Gold Institutional Fund is a secure, liquid and cost-efficient way to invest in the digital assets market. This recently launched, daily dealing, Bitcoin-tracking fund offers unleveraged exposure to Bitcoin, while providing solutions that address the risks and difficulties associated with the purchase of cryptoassets and storage of private keys." While their "Digital Assets Arbitrage Fund runs a market-neutral cryptocurrency strategy, which has generated uncorrelated and consistently positive returns since its launch in 2019."

- In a hedge against an anticipated inflation of 5%, Stan Druckenmiller is hedging crypto as a result. "From an investment management perspective, there's a strong case for holding BTC in a diversified portfolio. Analysis by Messari shows that BTC offers the highest risk-adjusted returns, the lowest correlation to most markets"

- Ankush Jain, a partner at Aaro Capital, explains the reasoning and strategy behind crypto's inclusion by specific institutional investor class. He proposes: "Direct investments: these can be risky, however, especially when investing in larger amounts, given storage and execution risks. Futures: available if one has the expertise to trade them . Passive funds: for example, through exchange-traded products. These offer capacity but are a blunt instrument. They have concentration risk (because of the dominance, for the time being, of Bitcoin) . Active hedge funds: These are a better option because of the inefficiencies presented by the market: “Active, agile approaches can best exploit return opportunities and manage risk effectively. They are often small and difficult to source and diligence.” Venture capital funds: these can offer purer forms of DLT exposure, but often have long lockups. Multi-managers: these can offer a diversified portfolio of active managers that employ a range of different strategies."

- Ido Sadeh Man, founder of Saga Monetary Technologies, points out that the cryptosphere is populated with cryptocurrency products – all geared towards delivering value through their approach to solving different issues – but their value is not being driven by demand for cryptocurrency per se, but by user demand for the solution they provide. “It’s correct to say that barriers to creation are low, he says. “But it’s what comes after creation that really sets them apart from each other, and exercises and demonstrates where their true value proposition lies.”

- "Strategists have started to expand or initiate coverage of Bitcoin, sensing more demand for crypto analysis in the financial industry. One example is U.S. brokerage BTIG LLC, whose chief equity and derivatives strategist Julian Emanuel wrote last month that cryptocurrency will come of age in part due to the policy response to the economic hit from the pandemic."

- BitWise Investments details its recommended strategy for institutional investors. Their whitepaper shows "bitcoin would have contributed positively to a diversified portfolio’s cumulative and risk-adjusted returns in 74% of one-year periods, 97% of two-year periods, and 100% of three-year periods since 2014, assuming quarterly rebalancing. In addition, the size of that positive impact has been significant: On average, assuming quarterly rebalancing, a 2.5% allocation to bitcoin would have boosted the three-year cumulative return of a traditional 60% equity/40% bond portfolio by an astonishing 15.9 percentage points."

- Their paper "examines the impact of adding a bitcoin allocation to a traditional, diversified portfolio of stocks and bonds (the “Traditional Portfolio”). The Traditional Portfolio features a 60% allocation to the Vanguard Total World Stock ETF (VT) and a 40% allocation to the Vanguard Total Bond Market ETF (BND). VT holds a market-cap-weighted portfolio of global stocks covering 98% of the world’s market capitalization, while BND holds a market-value-weighted portfolio representing all taxable, investment-grade U.S. bonds."

- SkyBridge Capital's founder Anthony Scaramucci stated, "bitcoin will be a "very strong asset class" over the next decade given the monetary supply and current central banking coordination." His view is shared with other institutional investors looking at cryto assets as a strategy to store value. In addition, "Guggenheim filed to reserve the right for 10% of its $5.3 billion Macro Opportunities Fund to invest in the Grayscale Bitcoin Trust. Other firms like MassMutual have invested in the cryptocurrency as well. Meanwhile, billionaire investors such as Stanley Druckenmiller and Paul Tudor Jones have publicly discussed their bitcoin purchases."

- "Paul Tudor Jones, a leading hedge fund manager, revealed earlier this month that he has a firm crypto investment strategy in place, allocating 1-2% of his assets in Bitcoin."