Part

01

of one

Part

01

Credit Scores Correlation to Loan Defaults

Key Takeaways

- A FICO score is a credit score developed by the Fair Isaac Corporation (FICO). It is a popular credit-scoring model used by the majority of top lenders in the US to assess the credit risk associated with a particular borrower and "determine whether to extend credit" to that borrower.

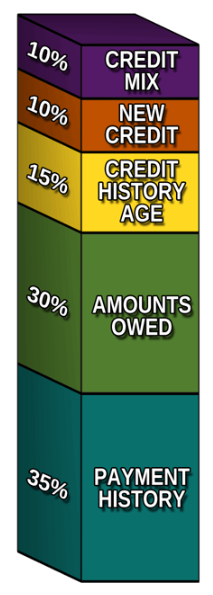

- FICO credit scores quantify and determine the creditworthiness of a borrower by considering five key parameters: payment history (35%), current level of indebtedness (30%), length of credit history (15%), new credit accounts (10%), and types of credit used (10%).

- Data provided by FICO shows that lower FICO scores correspond to higher interest rates. Hence, borrowers having lower FICO scores have to pay more money over the time period of their loan.

- An analysis of the Great Recession of 2008 has shown that by the fall of 2008, a large percentage of US borrowers were defaulting on their subprime mortgages "as all of the creative variations of subprime mortgages were resetting to higher payments while home prices declined." This resulted in the collapse of the stock market and the Great Recession. However, the underlying cause of borrowers failing to repay their loans was because Freddie Mac and Fannie Mae had "made home loans accessible to borrowers who had low credit scores and a higher risk of defaulting on loans."

Introduction

While historical data providing a breakdown of credit score ranges correlating directly with loan defaults over the years in the US is not available in the public domain, the research brief has provided an overview of the correlation between FICO credit scores and consumer loan defaults in the US. Provided herein are an overview of FICO credit scores, the correlation between FICO credit scores and loan defaults, correlation of credit scores with mortgages, auto loans, and personal loans, and information regarding how credit scores and default rates have changed during the great recession of 2008.

Overview of FICO Credit Scores

- A FICO score is a credit score developed by the Fair Isaac Corporation (FICO). It is a popular credit-scoring model used by the majority of top lenders in the US to assess the credit risk associated with a particular borrower and "determine whether to extend credit" to that borrower.

- FICO credit scores quantify and determine the creditworthiness of a borrower by considering five key parameters: payment history (35%), current level of indebtedness (30%), length of credit history (15%), new credit accounts (10%), and types of credit used (10%).

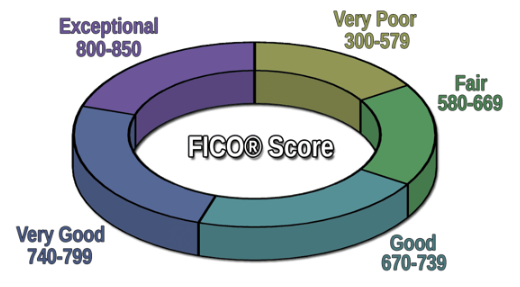

- FICO scores range from 300 to 850. Scores in the range 300-579 are considered poor and risky for lenders, while scores in the range 580-669 are considered fair. On the other hand, scores from 670 to 850 indicate good creditworthiness of the borrower.

- Borrowers having high FICO scores tend to have an excellent payment history, have various credit accounts, and keep their credit card balances below limits. "Maxing out credit cards, paying late, and applying for new credit haphazardly are all things that lower FICO scores."

Correlation Between FICO Credit Scores and Loan Defaults

- Default probability, also known as probability of default, is defined as "the likelihood that a borrower will fail to pay back a debt." For individual borrowers, a FICO score is an indicator of default probability and is used to measure credit risk.

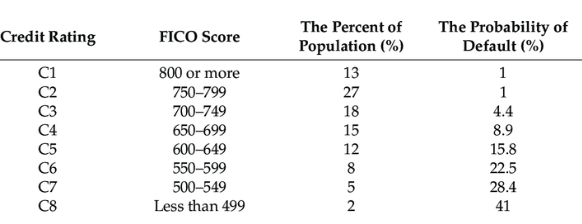

- While a breakdown of credit score ranges correlating directly with loan defaults over the years in the US is not available in the public domain, the following table shows the probability of default for different FICO score ranges in the US between 2000 and 2002. As expected, the probability of default for borrowers having higher FICO scores are less compared to borrowers having lower FICO scores.

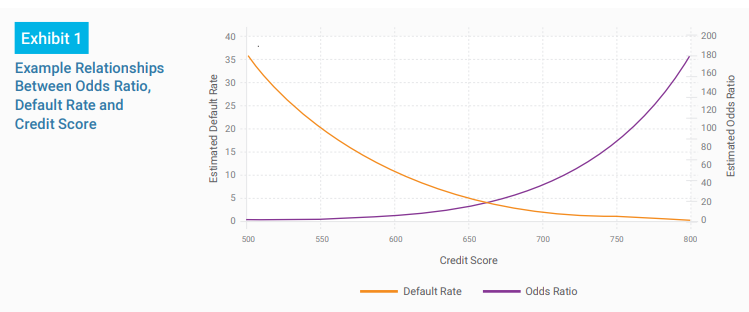

- A white paper by FICO has shown the inverse relationship between FICO scores and loan defaults. The graph showing the relationship is presented below.

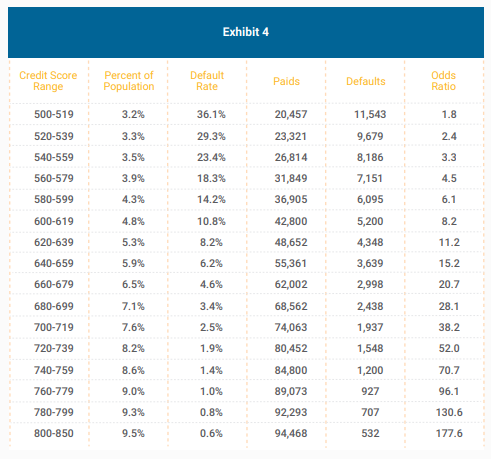

- While historical data showing the default rates for various FICO score ranges over the years in the US is not available in the public domain, the above white paper contains data showing the average default rates for a borrower population of one million based on their FICO scores (500-850). The table is presented below.

- Other research papers that show the mathematical correlation between FICO credit scores and loan defaults can be viewed here, here, and here.

Correlation of Credit Scores With Mortgages, Auto Loans, and Personal Loans

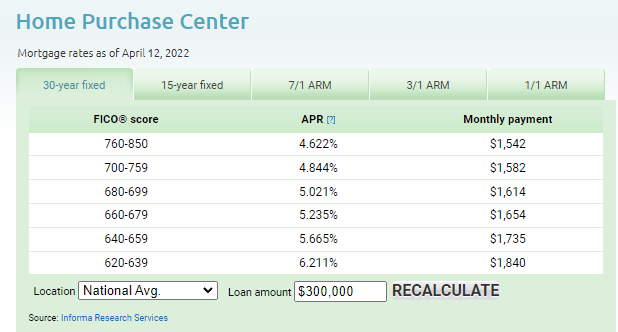

- Data provided by FICO shows that lower FICO scores correspond to higher interest rates. Hence, borrowers having lower FICO scores have to pay more money over the time period of their loan.

- The following table shows the variation of the national average mortgage APR with the FICO score for a 30-year fixed-rate mortgage of $300,000. The data is as on April 12, 2022.

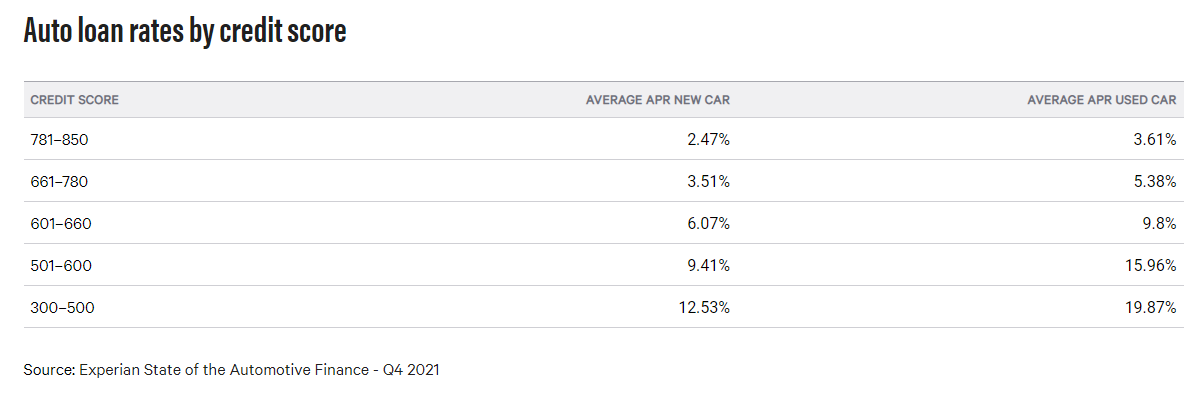

- Lower FICO credit scores attract higher average APR for both new and old cars. Whereas borrowers having higher FICO credit scores can avail larger loans at lower APR and with a "broader selection of repayment terms." The following table shows the national average auto loan rates for different FICO credit scores as of Q4 2021.

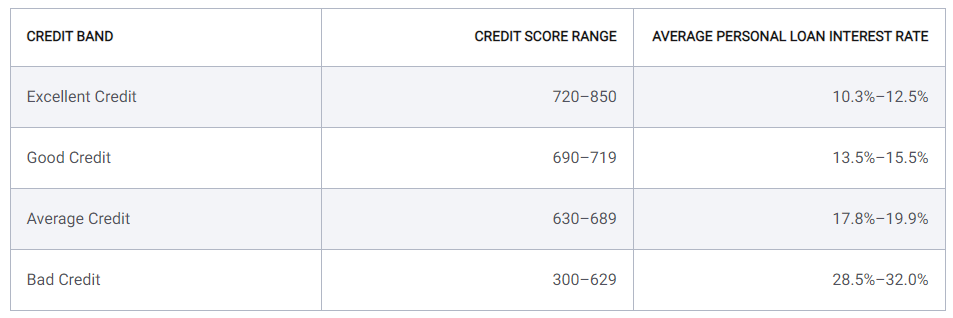

- Borrowers having higher FICO credit scores are more likely to "qualify for a personal loan with the lowest interest rate available." The following table shows the national average personal loan interest rates for different FICO credit scores as of January 31, 2022.

How Credit Scores and Default Rates Changed During the Great Recession of 2008

- Data taken from FICO shows that the average national FICO credit score in the US has steadily improved since 2005 except for a fall during the Great Recession that started in 2008. This is because a large number of consumers in the US declared bankruptcy or defaulted on their loans during this period that caused their individual credit scores to decline and brought about a fall in the overall national average.

- Data released by RealtyTrac, the leading online marketplace for foreclosure properties in the US, showed that foreclosure proceedings on almost 1.3 million properties had been initiated in 2007 due to loan defaults and bankruptcies. This was an increase of 75% from 2006. In 2008, foreclosure proceedings on over 2.3 million properties had been initiated, an increase of 81% from 2007.

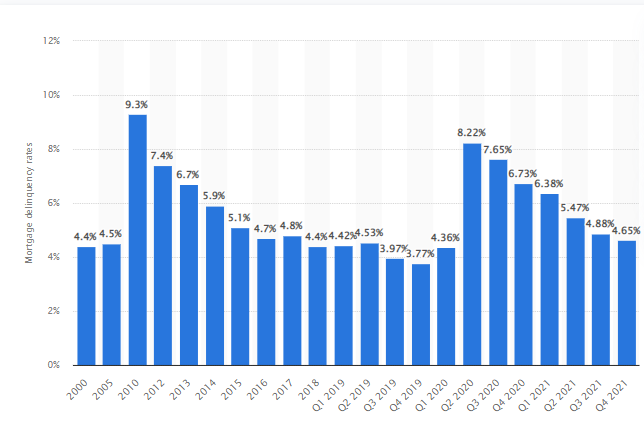

- As of August 2008, "9.2% of all US mortgages outstanding were either delinquent or in foreclosure." This had risen to 14.4% by September 2009. The increase in default rates during this period perfectly correspond to the fall in the average national FICO credit score as seen above.

- An analysis of the Great Recession of 2008 has shown that by the fall of 2008, a large percentage of US borrowers were defaulting on their subprime mortgages "as all of the creative variations of subprime mortgages were resetting to higher payments while home prices declined." This resulted in the collapse of the stock market and the Great Recession. However, the underlying cause of borrowers failing to repay their loans was because Freddie Mac and Fannie Mae had "made home loans accessible to borrowers who had low credit scores and a higher risk of defaulting on loans."

- According to Statista that contains the historical record of mortgage delinquency rates in the US from 2000 to Q4 2021, sharp increase in mortgage delinquency rates in the US have been seen twice during the last two decades: during the Great Recession of 2008 and during the onset of the COVID-19 pandemic in 2020.

Research Strategy

For providing an overview of the correlation between FICO credit scores and consumer loan defaults in the US, the research team has leveraged the most reuptable sources of information in the public domain, such as the websites of FICO, Lending Tree, BankRate, Investopedia, Value Penguin, and other research papers, among others. Some dated sources have also been used to provide a comprehensive and robust research brief.

:max_bytes(150000):strip_icc():format(webp)/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)