Part

01

of one

Part

01

COVID-19 Spirits Market Overview

This report collects data points related to the alcohol and spirits industry and the impact of COVID-19 on current and projected operations, along with insights as to which types of beverages are anticipated to attract a greater market share moving forward. The spirits market has generally increased (namely for retail venues) as a result of COVID-19, but that increase may be driven by stockpiling behavior that will level out or cause a decrease moving forward. Retail sales do not appear to be able to make up for the loss of on-premise sales. Certain segments will continue to do well, including premium tequila, spirit aperitifs, and canned wines, with the latter having significant advantage due to its convenient format and the need for portability during COVID-19.

The Spirits Market, 2020 and Beyond: COVID-19 Financial Overview

- From March 7 through April 18, 2020, total alcohol sales increased 24.4 percent over the previous year; however, this is viewed as an early spike in retail sales due to stockpiling.

- According to Nielsen, off-premise sales would need to continue to increase by 73 percent to make up for the loss of on-premise sales this year, if 90 percent of on-premise establishments stay closed.

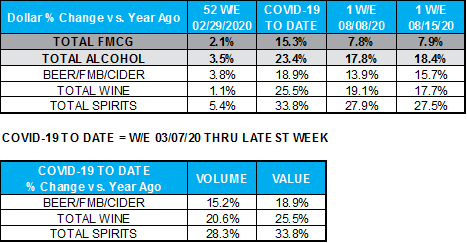

- According to a Nielsen report with data for the week ending August 15, 2020, retail alcohol sales in the U.S. increased by 18.4 percent year-over-year. This indicates retail sales continue to be high. Below is a chart indicating sales across alcohol types (demonstrating spirits are selling best):

- Total off-premise spirit sales have increased by 33.8 percent year-to-date, according to Nielsen in August 2020.

- Technavio released a market report on August 30, 2020 anticipating that the global market for alcoholic drinks will increase at a CAGR of 1 percent from 2020 to 2024. This is a shift from its April 2020 report that predicted a 3 percent CAGR from 2019-2023.

- Spirits that are premium level and above will see their global market share increase to 13 percent by the end of 2024, according to a post-COVID-19-outbreak report.

- 85 to 95 percent of bars have closed as a result of COVID-19, and an estimated 20 percent won't reopen.

- Increases in sales are believed to be most attributable to stockpiling rather than an increase in consumption, though there is anticipated to be an increase in consumption as well. Once stockpiling behavior has run its course, there will be a decrease in sales. As an example the rate of increase of alcohol sales declined in March, even as sales still increased by more than 20 percent.

- A June 2020 survey indicates that the majority of Americans are either drinking the same amount as they were before COVID-19 (35 percent) or they are now drinking less (28 percent).

- Craft distillers in particular were heavily impacted by COVID-19 and saw a 41 percent sales decrease as of August 2020.

Premium Tequila is Popular and Expected to Grow

- 2018 was the ninth consecutive record-setting year for tequila exports from Mexico, according to Greg Cohen, formerly head of global communications for Patron.

- Tequila sales have been growing in part due to the international market, which has had traditionally low demand but now has ample potential for growth.

- During the COVID-19 lockdown from March 7 to April 18, 2020, tequila led the market share of spirits sales. It had a growth rate of 54.2 percent over the prior year.

- Patron, known for its premium tequilas, came in third place for tequila sales during this time.

- Prior to COVID-19 in 2020, Patron was the top-selling tequila brand on the West Coast, according to Jeff Feist, category lead, spirits and more, for BevMo!

- Premium drinks are being ordered 50 percent more often on-premises by consumers following the COVID-19 outbreak as consumers treat themselves while going out.

Spirit Aperitifs Continue to Grow in Popularity with Younger Consumers

- Spirit aperitifs are spirits with less alcohol in them; typically they have half as much alcohol and their typical counterparts.

- In 2017, spirit aperitifs rose in sales by 7.4 percent while full-strength liquors struggled.

- Though spirit aperitifs suffered a slump during COVID-19 as a result of on-trade closures, the market is anticipated to recover and begin growing again in 2021.

- Sales volumes of spirit aperitifs are anticipated to increase by approximately 16 percent over 2019 levels in 2021.

- The growth in spirit aperitifs is fueled by younger consumers who are aware of their appearance on social media and want to appear more in control and responsible. Social media will continue to be a leading factor for these consumers regardless of COVID-19's ongoing presence.

COVID-19-friendly Canned Wines Ignite the Market and Keep it Hot

- Canned wines were growing rapidly in popularity prior to COVID-19. In December 2019, sales of canned wine increased 79.2 percent over the prior year, according to Nielsen.

- During the week ending March 21, Republic National Distributing Company reports that canned wine sales in the U.S. were up 95 percent as a result of the COVID-19 lockdown.

- The loss of restaurants and bars for the indoor drinking market will prompt drinkers of all ages to shift to more convenient methods of drinking with their portable meal. Canned wine stands to benefit from that shift.

- Sales of canned wine have increased from $2 million a year in 2012 to $183.6 million a year as of July 2020.

- Canned spirits overall are up 140 percent in the U.S. for year-over-year growth, according to Nielsen in August.

- With its steady growth, level of convenience and promise of hygiene, canned wines are anticipated to continue to do well during the COVID-19 pandemic and beyond as a result of the normalization of canned spirits.