Part

01

of two

Part

01

Construction Materials Software Market: US

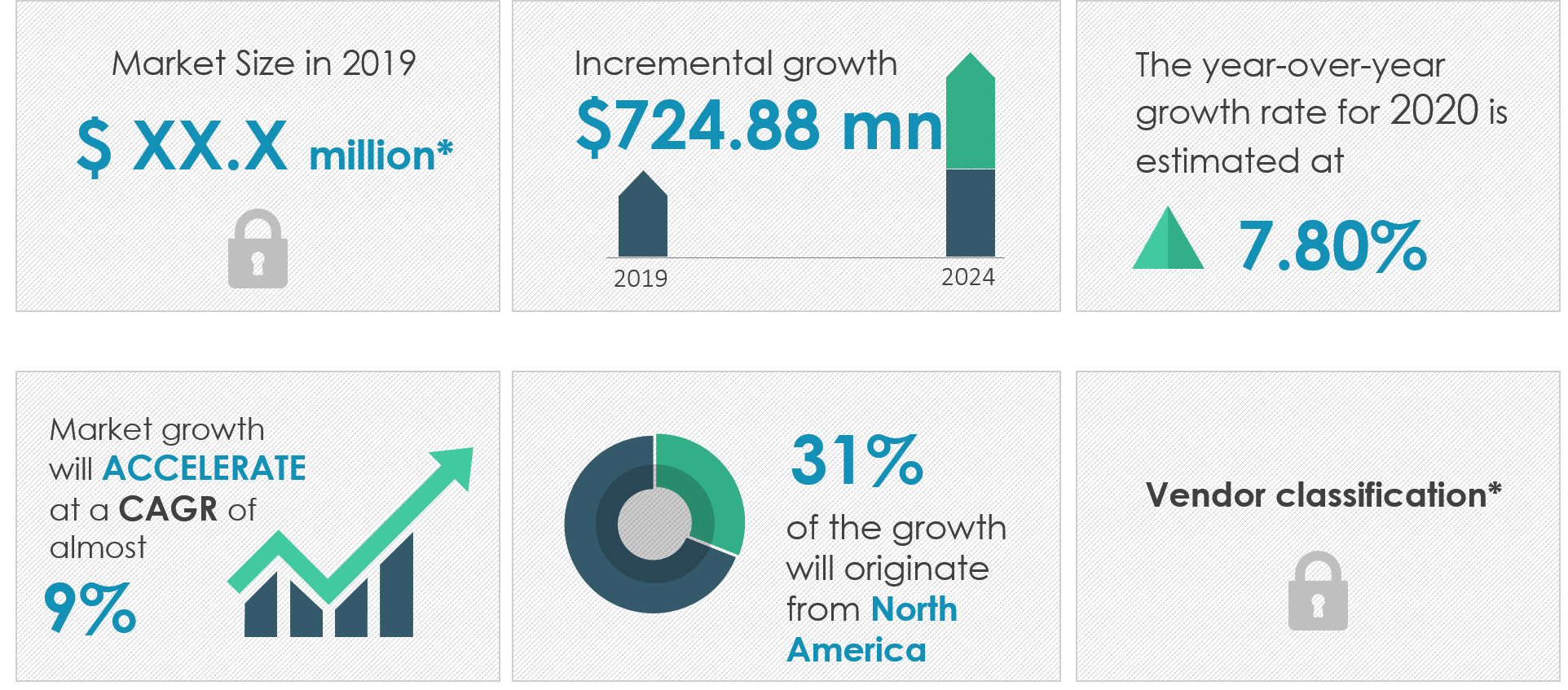

The construction management software market is estimated to grow by $724.8 million at a CAGR of 9% from 2020 to 2024. The cloud-based segment is expected to take the major share of the market thanks to wide adoption from small businesses and startups. These and other findings are outlined below.

Construction Management Software Market Size and Growth

- Technavio reports that the construction management software market is estimated to grow by $724.8 million from 2020 to 2024.

- The market is set to grow at a CAGR of 9% from 2020 to 2024.

- The market's year-over-year growth in 2020 was estimated at 7.8%.

- 31% of the projected market growth will come from North America.

- However, Europe and Asia Pacific will be the fastest-growing markets for the industry.

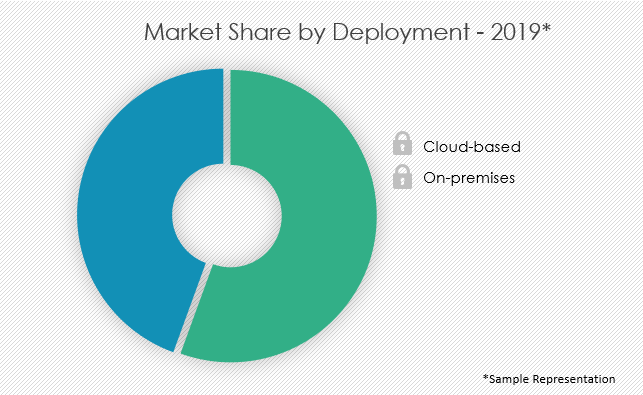

- The market is segmented by on-premise deployment and the cloud-based sector.

- End-users of construction management software include contractors, builders, construction managers, architects, and engineers.

Market Drivers and Trends

- The market will be driven by a trend towards digitization, with cloud-based deployment taking the bigger share.

- This is due to the proliferation of startups and SMEs which prefer cost-effective software solutions.

- Small businesses and startups as well as large businesses value ease, agility, innovation and profitability offered by SaaS vendors.

- Technavio's report states that "...the forecast period will witness an increasing preference among end-users for cloud-based construction management software, and market growth in this segment will be faster than the growth of the market in the on-premises deployment segment."

- Another market driver in North America and the US is the presence of advanced economies which heightens demand for infrastructure development and in turn, construction management software.

- Specifically, business and leisure travel markets will drive the demand for lodging and accommodation construction projects.

- Lastly, the construction management software market will meet the demand for reduced response time, automated processes, and efficient output to achieve lean management in the construction industry.

- Lean management helps reduce wastage in the site and manage product/materials portfolios which in turn increases project profitability.

- Rhumbix notes that the need to quickly pinpoint project inefficiencies as well as necessary resource reallocation will fuel demand for construction management software.

- Rhumbix observes, "With today’s construction workforces spread out between job sites and offices, it’s critical to access timelines and deliverables from anywhere using digital technology."

- Interestingly, Technavio forecasts that the ongoing COVID-19 pandemic will increase demand for the construction management software market.

Major Players and Top Software

- The market report names the major players as Autodesk, Bentley Systems, BuilderTrend Solutions, Computer Methods International, ConstructConnect, Odoo, Oracle, Procore Technologies, Sage Group, and Trimble.

- BigRentz listed the top reviewed construction management software in 2020 as Procore, CoConstruct, BuilderTrend, ProjectSight, RedTeam, Quick Base, Projul, PlanGrid and Sage 300 Construction and Real Estate.

- According to BigRentz, the best construction management software provide end-to-end solutions for RFIs, compiling data, sharing files, mobile deployment, budget, document drives, payroll, HR, inventory tracking and project management.

- The most popular construction management software solutions also have capability for integration, scalability, customization, and upgrades among others.

Construction Management Tech Landscape

- SelectHub interviewed construction management experts for their insights regarding the technology landscape for the industry.

- One key takeaway is that the industry is moving towards digitization in spite of older construction companies hesitating to switch from manual management.

- Sage VP Dustin Anderson shares, "A lot of times, [contractors] look at it and say, ‘All right, I have $100,000 to spend. Should I buy a new piece of equipment or should I invest in technology?’ So it’s a difficult battle to win."

- However, large construction enterprises are starting to look for automation solutions and technology-powered management.

- Construction contractors are also looking forward to using advanced technologies such as RFID tagging and equipment tagging to digitize materials tracking.

- Other technology segments such as smart devices, sensors, wearable construction tech and on-site cameras can also be used in conjunction with construction management software according to key market player Autodesk.

- Autodesk stated, "This integration will affect not only the flow of a project, but also provide vital data that can be examined after handover to become a part of operational management."

- Fellow key market player ConstructConnect states that technology is reshaping the construction industry and helping to build stronger, taller and smarter infrastructure.

- ConstructConnect anticipates that most construction software solutions will be cloud-based including management tools that will streamline communication and collaboration in real-time.

- AI and machine learning will also work with construction management software to track materials and analyze how workers interact with them.

- This will help optimize equipment placement to make them more accessible to workers and increase overall productivity for construction projects.

- CoConstruct Director Spencer Padgett believes that there is no turning back for the construction industry: "It’s a foregone conclusion. We’re climbing the tech adoption bell curve... The [companies] who are going to survive and thrive any future downturn are the ones who are efficient because they’re using [technology]."