Part

01

of three

Part

01

Compoundly: TAM

The global retail investment industry rose from about 25% of trades in 2009 to about 44% in 2020 and this increase was accelerated by the global lock down caused by the COVID_19 pandemic making retail investment ‘the biggest casino on earth’.

The amount of retail investments in Europe grew from about $2 trillion in 2011 to about $3.5 trillion in 2017 and per capita, retail investment rose from about $3,900 in 2011 to $7,000 in 2017. Retirement investment in the 22 largest pensions markets rose by about 15% in 2020 and the US, Mexico, and Canada are the top countries in retirement investments.

Retail Investors

- A study conducted by Nasdaq Corporate Solutions covering both institutional and retail investors revealed that in the 2019-2020 financial year, there was an increase in the value of retail investment in sectors that were the most affected in the March equity sell-off. Nasdaq indicated that between December 2019 and June 2020, the average retail investor ownership for cyclical sectors rose from about 11.8% to about 16.4% of shares in issue.

- According to Equedia, the global retail investment industry rose from about 25% of trades in 2009 to about 44% in 2020. Equedia indicates that the global lock down caused by the COVID_19 pandemic led to the increase in retail investment and described this as ‘the biggest casino on earth’.

- According to CNBC, about 99% of Americans, including retail investors do not consult financial advisers because the think they can do it themselves or that the cost of consulting is high. Winnie Sun, a certified financial planner says that it is more costly to make an investment error than to pay for financial consultancy services.

- The head of execution services at Citadel Securities, Joe Mecane, highlighted that retail investments accounted for only about 10% of the stock market in 2019 and that this figure rose to about 25% in 2020. According to Joe Mecane, this increase may have been caused by several factors, including the COVID-19 panic, increased knowledge on retail investment, and increased access to investment products.

- EFAMA reported that the amount of retail investments in Europe grew from about $2 trillion in 2011 to about $3.5 trillion in 2017 and per capita, retail investment rose from about $3,900 in 2011 to $7,000 in 2017. Germany, Italy, and the UK were the top countries with respect to retail investment in 2017.

- According to Reuters, there was a massive increase in the number of retail investors in Asia and this increase was caused by the crashing of the Asian stock market caused by the COVID-19 pandemic. This trend was reported in various Asian countries including India, Philippines, Japan, Korea, and Malaysia. A brokerage in India, Zerodha, reported that it opened about 140,000 new accounts in March 2020 and this was twice its monthly average.

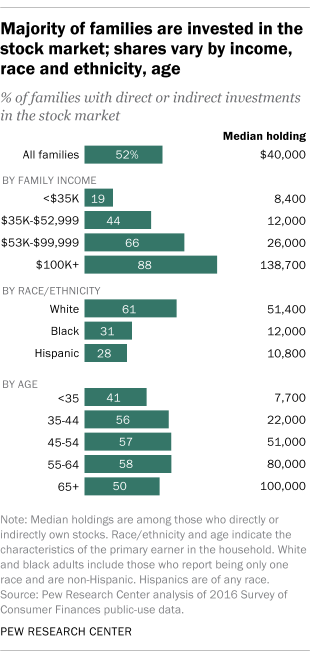

Retirement Accounts

- A study by Pew Research indicated that only about 14% of American families have individual investments but about 52% of American families have some form of investment, especially in retirement accounts like 401(k)s. The level of investment was determined by several factors, including age, ethnicity, and family income.

- A study by Finra revealed that about 33% of American families own taxable investment accounts and that about 89% of these families also have retirement accounts like a 401(k) or IRA. The study further showed that about 29% of American families only have retirement accounts, like 401(k) and IRAs.

- CNBC reported that close to 4.7 million taxpayers in America invested the maximum permitted amount of $18,000 in their 401(k) accounts in 2016 and the majority of these were people aged over 50 years.

- According to a report by the Thinking Ahead Institute, retirement investment in the 22 largest pensions markets rose by about 15% in 2020. Thinking Ahead Institute indicates that the US, Mexico, and Canada are the top countries in retirement investments recording growth of about 18%, 22% and 19% respectively.