Part

01

of one

Part

01

Companies with a Mature Data Orientation

American Express and Starbucks are two companies with a mature data orientation. American Express began its data journey in 2010 and has utilized a "test and learn" approach to achieve the desired results from the use of data in the organization. Starbucks began its data journey in 2008 and engenders a corporate culture that is receptive to the use of Big Data by linking the application of technology to improvements in the human connection.

American Express

The Company

- American Express was rated number one in the J.D. Power U.S. Credit Card Mobile App Satisfaction Study in 2020. The company has over 114 million credit cards in force, assets of $198 billion, and transacted $1.2 trillion in business in 2019. American Express is one of the most recognizable brands in the world.

- As a company operating in the financial sector it is required to submit required filings with the Securities and Exchange Commission, ensure the data of its customers is secured, and as a publicly traded company, ensure company information is readily accessible.

- American Express operates a closed-loop system that allows it to issue its own cards through banking subsidiaries.

American Express Data Approach — Technical

- American Express began building Big Data capabilities in 2010 when it upgraded from a traditional database technology to a Hadoop infrastructure, and opened a technology lab in Palo Alto, California. At initiation the transformation to be engendered from the application of Big Data was expected to take ten years.

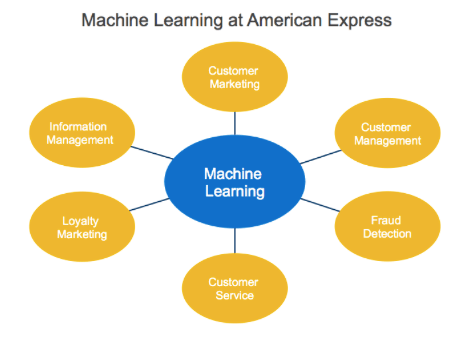

- Since it has embraced the use of Big Data, company representatives at American Express has stated that Big Data analytics helps the company to detect fraud, service customers more effectively and to drive commerce.

- Big Data capabilities at American Express is enabled by the closed-loop system that it operates. In this system, the company acts as both the card issuer and acquirer because it only issues cards through its banking subsidiaries.

- The closed-loop system allows the company to see all the transactions completed in real time from both the customer and merchant sides, allowing it to be responsive to trends in cardholder spending. This information is used to build algorithms designed to customize offers to customers.

American Express Data Approach — Building a Data Culture

- American Express faced three challenges along the way to becoming data mature. The first challenge was to adapt the organization and engender cultural transformation while adopting new and immature technologies.

- Second, the company needed to recruit talent equipped with skills in Big Data solutions and approaches. In recruiting new talent, American Express had to contend with a talent scarcity, new recruits obtaining a proper understanding of the business context, which is only obtained from experience, and to counteract retention challenges with millennial talent.

- Third, American Express had to embark on a "marketing process journey," where the company undertook continuous improvement to refashion the customer experience.

- Former President for Global Credit Risk and Information Management at American Express, Ash Gupta, stated that for an organization to be effective in transforming into a data driven organization, investments must be made into capabilities, technology and analytics, and people. He believed that it is a synthesis of technology and human intuition that provided superior results at American Express.

- Key to achieving these results is a "test-and-learn" culture that enables experimentation and the challenging of entrenched beliefs. Listening and learning is promoted and then synthesized into institutional knowledge and experience. This is infused into every step of the process from acquisition to customer management.

- The data generated at American Express is synthesized with partner and third party data in the pursuit of insights to further develop personalization and excellence for customer service and risk management.

- The commitment of the executive suite along with the intent to invest in people and capabilities to advance customer outcomes is important in achieving a data driven culture of success. Mr. Gupta also noted that a successful data driven organization must be able to attract the best talent.

- To assist with the building of a Big Data culture, American Express created an internal democratizing of data with the goal of empowering business to "act locally", by putting Big Data tools and techniques into the hands of decision makers.

- To ensure dissemination of data, American Express operates Cornerstone, which is a global, Big Data ecosystem wherein the data the company generates is housed centrally and shared with all employees. Cornerstone democratizes usage across functions and geographies. This is in recognition that for innovation to be optimized from data analytics, the change must be infused in the company's DNA, not driven by management.

Growth from Big Data

- Using machine learning, American Express identified $2 billion in potential annual incremental fraud incidents before a single cent was lost.

- The cost of customer acquisition was reduced within a few years of implementing Big Data as new customer acquisitions increased to 40% from web and targeted marketing developed using machine learning models, compared to direct mail campaigns accounting for 90% of new customer previously.

- American Express shares were valued at $41.78 on 1 October 2010. The value of the share increased to $105.98 on 16 September 2020. In the ten years that American Express has been using a data driven approach in its business the value of a company share increased by $64.20. During this time frame company shares attained the highest value of $135.11 on 24 January 2020.

- Annual revenue increased during the period 2010 to 2019 from $30 billion in 2010 to $47 billion in 2019.

Starbucks

The Company

- Starbucks is a publicly traded company operating 30,000 retail stores in 80 markets. It is one of the most recognizable brands in the world.

- Starbucks began its transformation into a data driven company after the company was forced to close several stores during the 2008 economic recession.

- The company has used data to develop personalized promotions, create insight-driven products, engage in real estate planning, evolve menus, and optimize machine maintenance.

Starbucks Data Approach — Technical

- After having to close several stores during the 2008 economic recession, then CEO Howard Shultz decided that the location of a store would be decided upon using an analytical approach.

- Location-analytics company, ESRI, was contracted with to provide a technology platform that allowed for the analysis of maps and retail locations. Among the data points used to determine store location were traffic patterns, population density, and average household income.

- Inputs are sourced from both local and corporate teams for factors such as store design and location. The company can estimate the profitability and economic viability of a new store location based on this exercise.

- Starbucks uses artificial intelligence to run analytics on an aggregate level for all stores, as well as on a granular level on a store by store basis. Known as Deep Brew, the AI platform helps store managers to create a unique personality, culture, and human connection. Deep Brew powers the personalization engine, performs inventory management, and optimizes store labor.

- Artificial intelligence is used to determine customer order preferences and buying patterns, and then use this to develop personalized offers to the customer, concurrent with mass promotional campaigns.

- Data driven insights has resulted in the famed pumpkin spice flavored drinks, as well as the creation of new sales channels as Starbucks began to sell its products in supermarkets.

- Starbucks has developed the Clover X cloud connected coffee machine which is characterized by remote fault diagnostics, and in certain cases remote repairs.

- The Starbucks mobile app deploys machine learning to use insights derived from data for decision-making using external feedback in unpredictable environments.

Starbucks Data Approach — Corporate Culture

- The CTO at Starbucks, Gerri Martin-Flickinger, noted that the role of tech is to "amplify that human connection, not get in the way of it." With brand messaging centered around the customer having an "experience", Ms. Martin-Flickinger considered a tech enabled human connection as critical to the company's use of tech.

- Starbucks employs a dedicated team of data scientists. Led by Jon Francis, senior vice president of enterprise analytics, data science, research data, and analytics, the team is charged with using the data generated by the company to "elevate" the human experience. The digital tools are not only deployed in the service of convenience or increased sales.

Growth from Big Data

- In 2018, Starbucks derived 11% of its sales from mobile orders and payments, while 14.2 million members of the reward programs accounted for 37% of company operated sales in the US.

- In 2010, annual revenue for Starbucks was $10.7 billion. By 2019, this had increased to $26.5 billion.

- On 17 September 2010, a Starbucks share cost $12.76. On 16 September 2020, a Starbucks share cost $88.38. During the period 2010 to 2020, a Starbucks share increased in value by over $75.00.

- Starbucks saw an increase in active members in its Loyalty program by 15% year-over-year to 18 million at 31 December 2019.