Part

01

of one

Part

01

Collectibles Market: Top Segments

Key Takeaways

- Top collectibles categories include fine art, trading cards, and sneakers, all of which are high value, growing, and available online.

- The next tier of collectible categories includes coins, vintage watches, comic books, and stamps, which are still popular, but not experiencing the explosive online growth of the top 3 categories.

- In some cases, higher net worth individuals are driving growth in collectible categories, particularly for fine art, vintage watches, trading cards, and rare coins.

Introduction

The below research details 7 leading collectibles categories, all of which are growing and available online (to varying degrees). These include fine art, trading cards, collectible sneakers, coins, vintage watches, stamps, and comics. These categories were selected from more than 40 collectibles categories based on a number of factors, including size, popularity, availability online, and growth. The selection methodology is detailed in the research strategy.

Fine Art

- Collectible art includes any type of art that is rare or popular, including paintings, sculptures, prints, or drawings. Fine art sub-categories may include Asian, Old Masters, Impressionist and Modern, and post-war and Contemporary. Artworks by female artists and artists of color are currently trending.

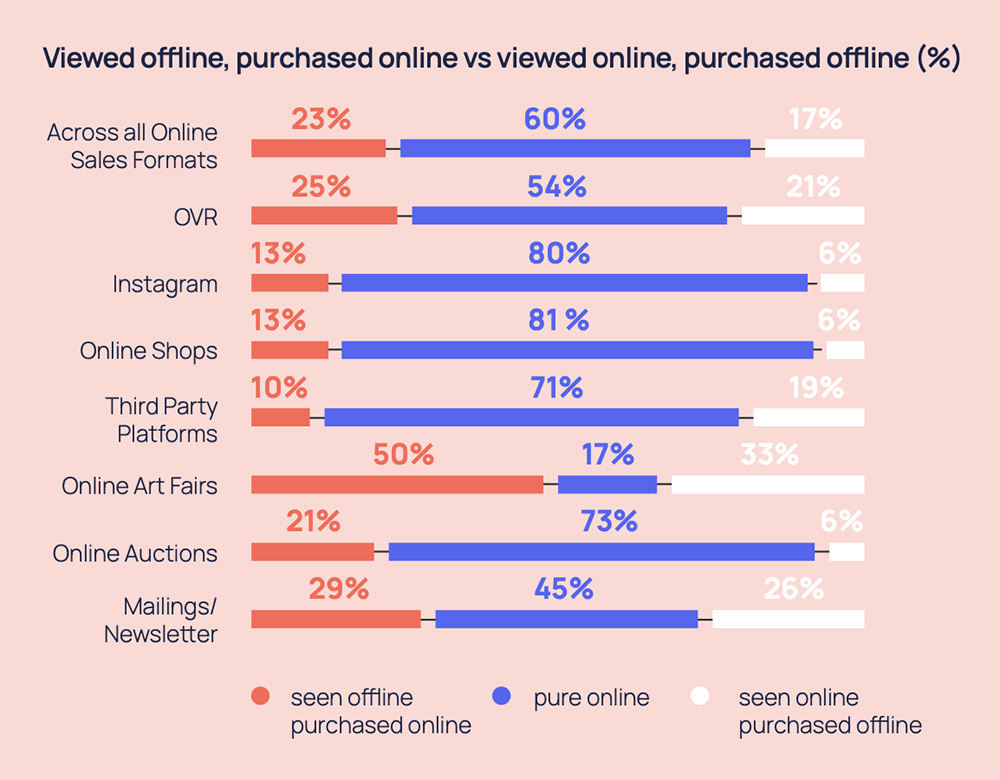

- Online art sales increased from $6.0 billion in 2019 to $12.4 billion in 2020, accounting for 25% of total art sales. An Art+ TECH report found that 40% of online purchases combined online and offline elements.

- Credit Suisse notes that Fine Art is one of the top two collectible categories for its Ultra-High Net Worth Individuals (defined as total net worth over $50 million).

- Business Insider highlights fine art as one of five collectible segments offering the strongest returns, driven by one-of-a-kind pieces.

- 66% of HNW (high net worth) investors across 10 markets revealed an increased interest in collecting post-COVID, according to an Arts Economics and UBS Investor Watch survey. 29% preferred to purchase from online channels.

- This article highlights several private art collections worth over $1 billion.

Trading Cards

- Trading cards include sports cards, collectibles, and non-sport cards. Trading cards are largely sold online.

- eBay reported 142% growth in domestic trading card sales in 2020 and global growth of 162% Pokemon trading card sales increased 574% in 2020, while soccer (1586% 2020 sales growth) and basketball (373% growth in 2020) were the leading sports cards.

- Trading card collectible trends include increasing interest in nontraditional cards (e.g., Bumblebee Tuna “The Rock” card), investment in vintage cards, interest in Kobe Bryant cards, game tickets as collectibles, and lower grade (poorer condition) purchases to access specific cards.

- One estimate places the sports trading card sub-segment of the trading card market at over $5 billion, but this includes items such as sports memorabilia (such as signed sports jerseys).

- Recent market developments include trading card-manufacturer, Topp's, announcing its intention to go public (estimated deal value of $1.3 billion), with rare cards such as a "one-of-a-kind Mike Trout card" selling for $3.96 million and a LeBron James rookie card selling for $1.8 million.

Sneakers

- According to Business Insider, sneaker collectors seek unworn shoes that offer "supple leather or fabric uppers, spotless soles, and zero scuffs." Collectors prefer limited-edition sneakers and brands such as Nike, Air Jordan, Yeezys, and Adidas.

- In 2021, the prototype Nike x Yeezys worn by Kanye West to the 2008 Grammy's sold for $1.8 million.

- Sneaker resale platform, StockX, estimates the secondary resale sneaker market at $10 billion (growing to $30 billion by 2030). StockX European senior director, Derek Morrison, says that growth will be driven by "growing numbers of collectors invest[ing] in limited edition "deadstock" items -- shoes that "must be new and unworn, with the aim of reselling or displaying them as prized possessions."

- A slightly older (2019) North American estimate by research firm, Cowen, provided a slightly more conservative estimate of the collectible sneaker market ($2 billion), but with a similarly aggressive growth trend (reaching $6 billion by 2025).

- Collectors include those who purchase collectible sneakers as an investment and those that "want to own the stories and lifestyles behind them."

- Below is a visual of collectible sneakers on display at London's Design Museum.

Coins

- Coin collecting includes the collection of coins and other legal tenders. Collectors are often interested in those that have been in limited circulation, those with errors, and those with aesthetic or historical value.

- Numismatists study and collect coins, and may extend their collections to other forms of currency (traded goods, currency, jewelry).

- American Collectors notes that coins are "some of the most popular collectibles that are gaining value" and Business Insider highlights coins as one of the top 5 collectibles in terms of returns. This segment of collectibles appeals to a wide range of collectors, with BI saying that "there's more than enough room for investors at every level."

- The size of the U.S. coin collection market ranges from $3.5 to $4 billion (all channels), according to the Professional Numismatists Guild (PNG).

- In 2021, PNG found that the U.S. rare coin and paper money market in 2020 was "one of the strongest U.S. rare coin and paper money markets in recent years."

- PNG also noted that "the market for rare coins expanded globally as well."

- Heritage Auctions, the largest auction house in the U.S. (offering online auctions as well), reported $337.4 million in Q1 2021 sales (16% growth), driven in part by record-breaking sales of U.S. and World & Ancient Coins. This included a $9.4 million record-breaking gold coin and a $2.28 million British coin (the world's most expensive).

Vintage Watches

- Vintage watches are considered "untouchable" for collectors, driven by scarcity.

- Chubb notes the market for vintage watches has been growing in popularity.

- The pandemic drove sales online, with auction houses such as Sotheby's successfully entering the online market for vintage watches in 2021.

- Josh Pullan, the global managing director of Sotheby’s Watches, says people are "confident to buy vintage, highly unique, specialized pieces online."

- This 2019 New York Times article highlights vintage watches as a "strong investment vehicle for wealthy people."

- An older (2016) market size estimate placed the global vintage watch market at ~$2 billion.

Stamps

- Stamp collections are valued for their image on the face, edges or perforations, origin country, denomination, history, and errors. This article notes that avid stamp collectors are known for their love of history, with the rare, British Guiana Once-Cent Magenta stamp, considered most valuable.

- The number of stamp collectors globally ranges from 60 to 200 million. Business Insider notes that stamps are one of the top 5 categories that have historically offered strong investor returns.

- The high-end market for stamps is increasing (with those investors focusing on ultra-rare stamps), but changing generational interests and declining values (due in part to online channels increasing price transparency) have led to a decrease in the overall stamp collection segment.

- More recently, BBC notes that tech-savvy collectors are turning to online communication channels (Twitter, Instagram) for stamp collecting, with the Guardian also highlighting the increased interest in stamp collecting among millennials due to its Instagram appeal.

Comic Books

- Forbes notes that vintage comics and comic book art have seen strong growth in 2020.

- The industry was valued at $1.1 billion in 2019.

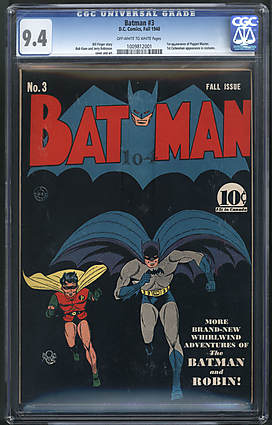

- Metropolis Comics highlighted some leading sales in 2020, including Flash Comics #1 CGC 4.0 ($83,000), Batman #3 CGC 9.4 ($75,000), and Marvel Comics #1 CGC 6.0 R ($65,000).

Research Strategy

We leveraged market reports, news articles, surveys, consultancy reports, market size estimates, and expert insights and rankings to conduct this research. To identify the top 5 segments of the collectibles market, we reviewed a number of rankings focused on popularity (GoBankingRates, MoneyCrashers), investment value (Business Insider), most "in-demand" collectibles, segments that were frequently highlighted by online retailers (Sotheby's, eBay) and categories highlighted by consultancies (Deloitte) as trending or popular among a key segment (e.g., UHNW individuals). There was no consistent metric available to select the top 5 segments; therefore, we selected the segments that were noted most frequently across the numerous sources consulted. Given the variability in available and consistent metrics across segments, we provided detail on 7 segments in total. Some segments that were also considered but not profiled (due to either a judgment that they were not frequently found to be most popular or were found to be very targeted) include vintage toys, classic autos and fine wine (targeted), music, movie posters, vintage clothing, celebrity memorabilia, and antique furniture.

The seven segments profiled were ranked based on an assessment of several variables, in order of consideration: online market size and growth, total market size, online availability, and qualitative insights suggesting relatively high or increasing demand (online or in total). When possible, we focused on global insights; in some cases, US insights were more abundant and were included when relevant. The sports memorabilia market was not broken out separately because it was most commonly discussed as part of the overall trading cards and memorabilia market (and appears to be included in the market estimates uncovered).