Part

01

of one

Part

01

Cold Storage Manufacturing Industry

The United States medical and scientific cold-storage industry, also referred to as the medical and lab refrigerator market, includes sub-sectors such as the ultra-low temperature freezers market and the vaccine storage equipment market, and continues to see high-demand primarily due to the ongoing coronavirus pandemic. There is no evidence that U.S. specific market-data related to the market's size or growth rate exists in the public domain. However, there exists limited data covering the vastly intertwined global market. The industry's major players are all international companies.

Market Insights: market size, growth rate, growth drivers

- The global market size for the medical and lab refrigerator market was estimated to be $2.27 billion in 2019, with a CAGR of 3.9% through 2027.

- Growth drivers for this market include a "growing demand for safe storage of blood and blood derivatives from hospitals, pharmacies, clinics, and diagnostic centers", as well as, "Increasing awareness about blood donation and government initiatives to encourage donations will also foster business growth."

- The Insight Partners report, "Both in medical research and pharmaceutical sector, rising government funding is expected to increase the demand for medical and laboratory refrigerators further."

- An increase in the "number of accidents, surgical interventions such as cancer, organ and bone marrow transplants, cardiovascular surgery, general surgery, nephrology, and dialysis" will lead to increased demand for blood components, resulting in market growth for medical and laboratory refrigerators.

- Similarly, the vaccine storage equipment segment is estimated to grow to $1.83 billion by 2027 at a CAGR of 10.6%.

- Meticulous Research reports, "The growth in the vaccine storage equipment market is majorly propelled by large scale vaccination programs implemented by the global health agencies (such as WHO, UNICEF, GAVI (Global Alliance for Vaccines and Immunization), Vaccine for Children Program), high incidence of infectious diseases, launch of COVID-19 vaccines, among others. However, the high cost of cold storage equipment and stringent vaccine storage requirements are expected to hinder the growth of the vaccine storage equipment market to some extent.

- Significant volume deliveries of millions of doses of the coronavirus vaccine are expected to greatly impact the need for cold-storage units over the next few years.

- "North America commanded the largest share of the global vaccine storage equipment market in 2020 and is expected to maintain its dominance throughout the forecast period."

- Another segment of the larger market, ultra-low temperature freezers, was estimated globally to be $470 million in 2019, with the U.S. market at $210 million. These include freezers used for the Pfizer and Moderna vaccines, and the segment is expected to grow at 3.7% CAGR through 2026.

- "Increasing funding in biomedical industry for drug discovery will contribute to significant rise in demand for ultra-low temperature freezers. These freezers are used by life science and molecular biology labs for long-term cryopreservation and it includes cold chain infrastructure. The ultra-low temperature freezers market will obtain considerable gains with strong demand from forensic research application."

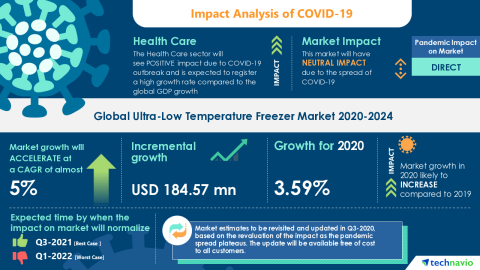

- Berkshire Hathaway reports, "The ultra-low temperature freezer market is expected to grow by $184.57 million, progressing at a CAGR of almost 5%" through 2024.

Growth Segments

- Biobanks: "The need for clinical specimens for translational research, particularly for cancer research, has increased the demand for biobanking. Biobanks require strong cold storage solutions as they are involved in the collection, preparation, processing, handling, recovery, storage, and distribution of tissue and cell samples for therapeutic and research purposes. The increase in collaborations between biobanks and research institutions will drive the demand for ultra-low temperature freezers to maintain and preserve samples that will enhance the development of quality solutions."

- Advances in biotechnology and pharmaceutical research, as well as the substantial demand for COVID-19 vaccines, promise to add significant growth to the industry for the foreseeable future.

- U.S. states scrambled to acquire or rent ultra-cold storage refrigerators this past fall due to a need to store millions of Pfizer and Moderna vaccines.

- Healthcare organizations, life-science companies, and pharmacies are other segments of growth for the market.

- "Funding and investment programs to expand the biomedical and life sciences approaches globally are expected to boost the market growth in the near future. The further growth can be attributed to the increasing adoption of vaccine cold storage owing to a rising cases of covid-19 across globe. Moreover, rising prevalence of various infectious diseases and cancer along with presence of major healthcare manufacturers is further expected to fuel the market growth."

Trends

- Social demand for energy efficiency is forcing cold-storage manufacturers to create and adapt new energy saving technologies and incorporate them into their products.

- "At least 58,000 ultralow temperature freezers (-70°C), 74,000 -20°C freezers, and 94,000 refrigerators exist within the scientific sector in California alone, consuming a combined conservative estimate of 780 Gwh/year. In California alone. That is the approximate energy use of 63,000 homes over the course of a year."

- The result: "a global competition seeking to curb the energy consumption of this type of laboratory equipment. The International Laboratory Freezer Challenge, now in its fifth year, seeks to help scientists realize the variety of benefits that result from dedicating a small amount of time and effort to their refrigerators and freezers each year." "Entrants came from 218 labs across 88 organizations in Austria, Australia, Canada, Sweden, the United Kingdom, and the United States."

- Helmer offers energy efficiency in it new GX Solutions cold-storage units.

- Once a niche market, the requirement for extremely low storage temperatures for the Pfizer and Moderna COVID-19 vaccines have made the ultra-low storage products segment a trend in its own right. Among the trending features found in this segment are automated freezers, which eliminate freeze-thaw cycles, limit entry of moisture into the system, and continuously monitor internal environment.

- Compressors installed in medical-grade refrigerators provide greater efficiency for reaching and maintaining target temperatures and allow for more even temperature control through automated electronic technologies, which include digital data loggers that log the unit's historical temperatures. The result: better cold chain regulation.

- Pharma-Mon by AKCP is a provider of these types of automated systems and sensors, which include data loggers.

- As well, Thermo Fisher Scientific offers wireless monitoring solutions that provide 24/7/365 continuous monitoring and alarm notification for ultra-low storage products, even during a power outage.