Part

01

of one

Part

01

CARES ACT - Deferred Payroll Tax Program

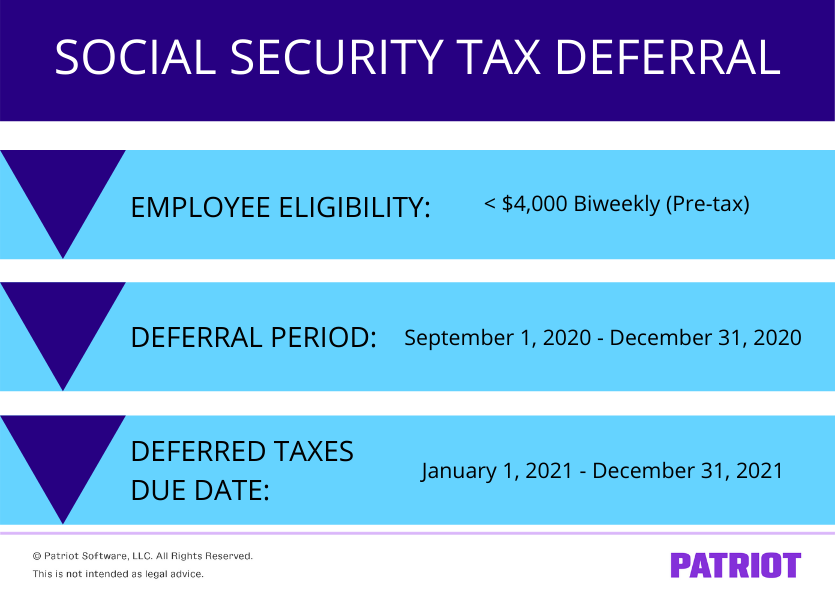

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allows employers and employees to defer payroll taxes as a direct economic help for American workers, small businesses, and families. The Act provides a new schedule of paying the deferred taxes, which must be adhered to. Only employees who earn less than $4,000 biweekly are eligible for the deferment. All employers are eligible.

- Section 2302 of the Coronavirus Aid, Relief, and Economic Security (CARES) Act permits employers to defer their payroll taxes, otherwise required to be paid between March 27 and December 31, 2020.

- As a result of the deferment, the employers are required to pay the taxes in two installments. The first installment of 50% of the payroll taxes is due December 31, 2021, while the remaining 50% is due December 31, 2022.

- However, the deferral does not affect employer tax withholdings from employees or Medicare taxes. Moreover, self-employed people are eligible to defer 50% of their social security tax charged on their net earnings from self-employment.

- All employers, including government entities, and self-employed people qualify to defer the payment of payroll taxes. The applicable payroll tax is the employers' share of the social security tax. The tax is 6.2% of the ages up to a wage base of $137,700.

- The deferral is optional for most employers but mandatory for military service members and federal employees. The employer is required to make the deferred payments through the Electronic Federal Tax Payment System or by credit or debit card, money order or with a check.

- Not all employees are eligible for payroll tax deferral. As such, employees with a pay of less than $4,000 biweekly before tax equivalent to $104,000 annually can opt into the deferral. The limit is applied pay period-by-pay period irrespective of the amount of wages paid for the previous periods.

- If an employee earns more than $4,000 biweekly, he or she is not eligible for the deferment under the President’s memorandum on the CARES Act.

- Employees payroll tax deferment runs from September 1, 2020, to December 31, 2021. Employers are required to collect the taxes by quoted date, without which additions to tax, penalties, and interest will start to accrue. The deferred payroll tax will be paid ratably from employees’ wages through the Electronic Federal Tax Payment System.