Part

01

of one

Part

01

Crypto or Blockchain applications for Community Associations

Extensive searches uncovered information to create two case studies regarding blockchain use within homeowners' associations and another example from a Florida county using blockchain technology to develop a digital ID. Likewise, in the real estate sector, one case study explores Miami's first real estate tokenization platform, while the other one looks into how a tech-enabled investment banking firm sold real estate property using a blockchain-based tokenization process.

Blockchain Use Within Community Associations and Local Public Sector Entities

Case Study #1

Avanta's Factom Blockchain for HOA Document Verification

- In 2019, Avanta Risk Management, which specializes in analytics, data acquisition, and real estate services integrated Factom blockchain technology for homeowners' association (HOA) document verification.

- The property technology company announced in December 2019 that it had gone live with resBlock 3.0, which includes new functionalities and improvements aimed at enhancing clients’ online experiences, improving transparency efforts, and accelerating the blockchain technology towards the future.

- The solution allows HOAs and its partners to "verify document timestamps and document integrity on the public Factom blockchain using Factom’s Harmony Connect," which adds blockchain solutions to applications without managing cryptocurrencies. The privacy solution advances verifiability without revealing real content or data to increase trust in processing measurements and document authenticity.

- Avanta's blockchain solution for HOAs "integrates workflow principles with data visualization tools" to establish end-to-end solutions that "eliminate risk, improve efficiency, and provide complete client oversight throughout the HOA research, resolution and payment process."

- Importantly, Avanta's blockchain platform can be leveraged to include primary client data to create visualizations to help them manage key performance Indicators to better manage their properties and businesses to create a "complete proactive, transparent and client-centric solution for HOA management."

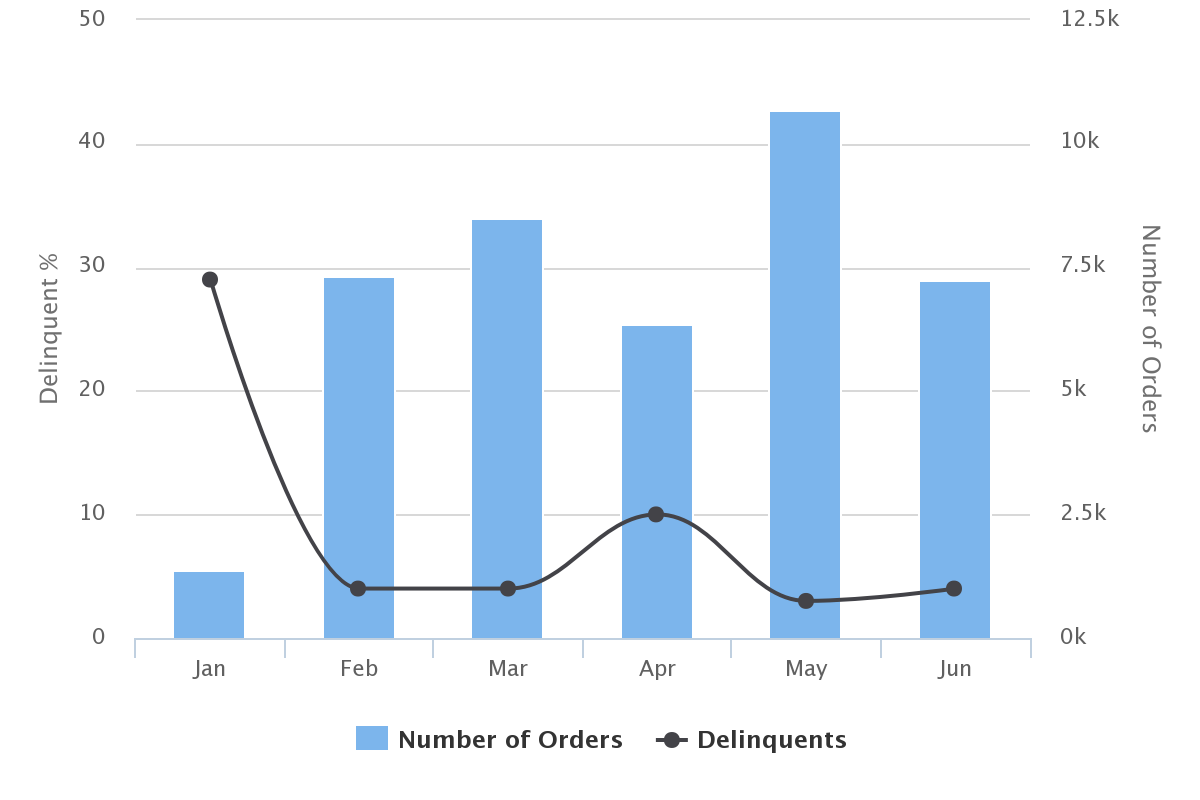

- The proactive solution allows for early detection of delinquent HOA accounts , trending analysis to inform future strategies, and real-time data sharing via advanced-API Technologies. HOAs using Avanta's blockchain solution benefit from streamlined access to information, visualizations of data insights for loan decisions, reducing risk for clients and their customers, and supporting regulatory compliance.

Case Study #2

Seminole County Tax Collection Via Blockchain Technology

- In 2019, Seminole County tax collecting system uses blockchain technology to build a digital identification system to enable individuals to manage all their personal information, which can be encrypted. The blockchain technology also allowed the users to select what to share without disclosing all their information.

- For example, the new digital ID allows people to disclose their date of birth while not revealing their home address. According to the county, the digital ID can allow individuals to share their driver's license to a police officer via bluetooth using their phones.

- The county is confident that the blockchain technology is the most secure technology currently available due to its capabilities to decentralize data, store encrypted information on many devices as opposed to a single central server that can be hacked.

- Overall, Seminole County believes the blockchain-based digital ID solution is the most secure platform to build identity on top because the only way to update it is to commence the process a fresh, i.e., adding another block on top.

- The success of the digital ID has attracted other Seminole departments that have shown interest in the blockchain based ID solution. The interested parties include the "Seminole County Sheriff's Office, Seminole County Property Appraiser, and Seminole County Clerk of Courts."

Blockchain / Cryptocurrency Use Within the Real Estate Sector

Case Study #1

Blokhaus

- Blokhaus is the first real estate tokenization platform to launch in Miami. The platform showcases how modern financial technology is revolutionizing "real estate, real estate development management, financing, leveraging, and trading."

- It leverages innovative technologies like blockchain and other distributed ledger technologies (DLT) to expedite the democratization of finance and joining the fragmented and highly restricted financial ecosystem. Blokhaus is focusing on "tokenizing South Florida’s highly sought-after real estate market" with the aim of digitizing investments in real estate.

- The tokenization platform seeks to democratize real estate by offering liquidity solutions via asset digitization by implementing fintech into real estate services, which in turn extends new real estate investment opportunities and "fractional ownership through security tokens.” The new solution can help forge access for any investor to purchase and own Miami's attractive assets in its portfolio driven by "returns paid through security tokens.”

- Blokhaus is the first "Miami-based fintech real estate brokerage operating on the Blockchain" seeking to revolutionize how real estate is being transacted with "complete disintermediation resulting in endless investment opportunities.”

- Overall, Blokhaus will leverage leading tokenization platforms, transfer agents, and top legal counsel to power the digitization of real estate in the city to protect investors and cover their investments just like in conventional real estate markets.

Case Study #2

Tokenizing Real Estate Deals: Inveniam Capital Partners (ICP)

- Inveniam Capital Partners (ICP) is another example of a real estate firm seeking to establish a standardized blockchain-based process for debt and real estate transactions. Initially, the firm tokenized four deals worth $260 million.

- To showcase the power of tokenization, ICP made an initial deposit on a building in Miami, Florida using Bitcoin Core (BTC) to buy shares from the building in an undisclosed deal amount. The building was initially occupied by WeWork and was valued at $65.5 million.

- The sale accepted cryptocurrency payments from the top 50 tokens by market capitalization. Shares were awarded in order of bid amount from the highest to the lowest bidders. However, the deal had a minimum amount of $10 million in cryptocurrency and a strict minimum purchase amount of $500,000.

- The tokens were available on the Ethereum blockchain; however, the property was sold via a Dutch auction. In this regard, interested bidders had to bid by stating the number of tokens they intended to use for the purchase, including the amount they were willing to pay for each, and the type of cryptocurrency they preferred to use.

- Again, ICP noted that each share included information regarding its origins and all the transactions done with it, which amounted to decades of information. Therefore, each share sold on the blockchain will include all the information recorded and can be accessed instantly.

- Overall, unlike existing processes where all shared information is converted into PDFs and shared online, the blockchain solution will have all the information in one system that is instantly searchable. Other buildings ICP planned to tokenize include a student housing facility in North Dakota valued at about $90 million; a North Dakota water pipeline estimated at $50 million; and a multi-family housing facility in southwest Florida quoted at $75 million.