Part

01

of one

Part

01

Boot Barn Company Analysis

Key Takeaways

- While reporting results for Q4 FY 2022, Jim Conroy, President and CEO of the company, stated, “Looking forward, I am excited to announce that, based in part on a third-party study, we have updated our estimated total addressable market to $40 billion, compared to our previous $20 billion estimate. Additionally, we have established a new long-term store count target and now believe we can triple from our current base to 900 stores. We believe our progress in expanding our business and attracting new consumers to our brand is proving successful and has established a strong foundation for future growth.”

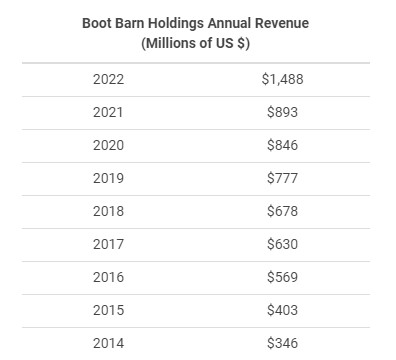

- In FY 2014, the year before the company went public, their revenue was $346 million. For FY 2022, revenue reached $1.488 billion. This represents a CAGR of 20% during that period. Of note, the growth from FY2020 to FY 2022 was 109% at the retail stores. Additionally, every store turned a profit in 2022.

- In addition to the primary Boot Barn brand which focuses on cowboys, they also have Work, Just Country, and Wonderwest brands. The Work segment primarily focuses on boots for any industry; Just Country is their outdoor adventure brand; and Wonderwest is their newest segment, which is a mainstream and western-influenced fashion line for women.

- According to the company website Boot Barn "celebrate[s] the values of honesty, hard work, ingenuity, and perseverance." This is expanded on in the company's environmental policy and they list their core values as integrity, teamwork, accountability, professionalism, dedication, and productivity.

- Around 2019, Boot Barn implemented the Range Finder kiosk in about 50 stores. The application allows both customers and employees to find boots that meet certain requirements. The focus could be only on boots in stock in a particular store, or can be expanded to cover all inventory. The kiosks were rolled out to all stores in early 2020. However, the kiosks now function as a digital hub for retail locations, as they can be used to open credit cards, access the endless aisle solution, check loyalty points, handle buy online return in store transactions, and help with seasonal training.

Introduction

Provided in this report on the digital transformation strategy of Boot Barn are a company overview (founding history, financials, and products); mission and values; customers/target market; strategic initiatives; executive commentary; marketing tech stack; and corporate challenges.

There were few publicly available details on the company's digital strategy. It was not mentioned at all in either the 2020 or 2021 annual reports, and a search for actions taken by, or interviews conducted with, John Hazen, the chief digital officer since 2018, only uncovered limited information. Therefore, instead of providing information on digital strategy, we provided some details on the company's marketing approach. Additionally, the executive commentary provided is related to the company's overall priorities and strategies, rather than being specific to digital.

Company Overview

- Boot Barn started with one store in 1978, and was initially focused on the western lifestyle. While Boot Barn focuses on cowboys, both on the ranch and in the rodeo, there are other business segments as well. Boot Barn Work focuses on American workers in a range of industries including oil & gas and agriculture; Boot Barn Just Country focuses on outdoorsmen; Wonderwest by Boot Barn is a women's fashion brand that fuses mainstream and western fashion; and Boot Barn Commercial Accounts supports large purchases made by corporations for their workforce.

- Currently, the brand has grown to 300 stores in 37 states, while also growing their e-commerce business. In both FY2021 and FY2022, ecommerce accounted for 14% of sales, as the company continues to focus on its brick & mortar strategy. This is three times as many stores as their nearest direct competitor.

- As of the end of FY 2021 (March 27, 2021), Boot Barn reported having 1,500 full-time and 3,400 part-time employees. Of those, 4,300 are store employees, while the remainder work either in distribution centers or the Store Support Center.

- While reporting results for Q4 FY 2022, Jim Conroy, President and CEO of the company, stated, “Looking forward, I am excited to announce that, based in part on a third-party study, we have updated our estimated total addressable market to $40 billion, compared to our previous $20 billion estimate. Additionally, we have established a new long-term store count target and now believe we can triple from our current base to 900 stores. We believe our progress in expanding our business and attracting new consumers to our brand is proving successful and has established a strong foundation for future growth.”

- In FY 2014, the year before the company went public, their revenue was $346 million. For FY 2022, revenue reached $1.488 billion. This represents a CAGR of 20% during that period. Of note, the growth from FY2020 to FY 2022 was 109% at the retail stores. Additionally, every store turned a profit in 2022.

- The following chart shows the revenue for each fiscal year since 2014.

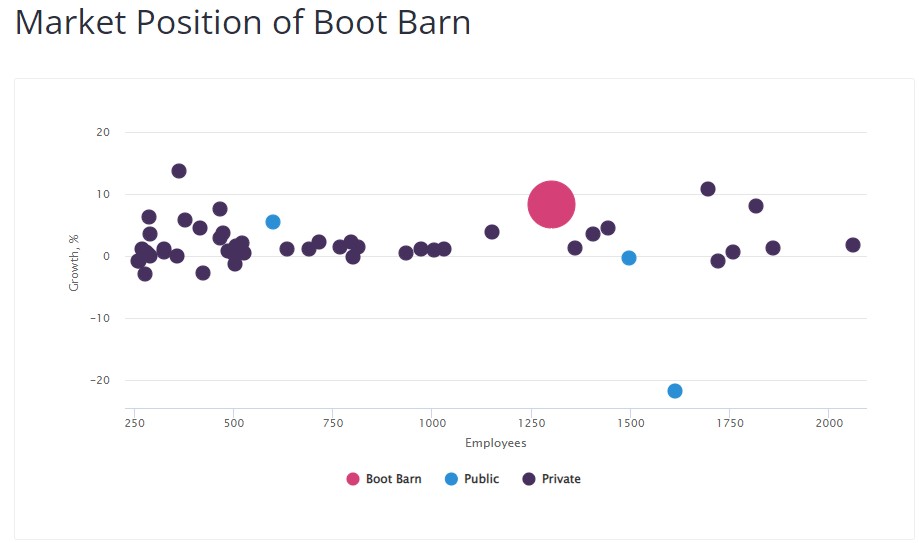

- The company has a strong market position compared to other brands in their space.

- In 2021, Boot Barn's profit was $100.5 million.

- Boot Barn has made two major acquisitions, Baskins in 2013 and Sheplers in 2015. The Baskins acquisition allowed Boot Barn to enter the Texas and Louisiana markets with a core of stores already in place. The Sheplers acquisition was largely seen as a way to expand their ecommerce business, as Sheplers had "an industry-leading e-commerce business."

- Boot Barn's signature category is boots, and the segment accounted for a little more than half of revenue in FY2021, with apparel accounting for 32%. That means somewhere under 20% of sales come from categories such as hats and accessories.

- Two-thirds of sales come from western styles, including boots, clothing, hats, accessories, and home goods.

- The stores offer close to 200 brands, including at least seven private label brands. In FY2021, private label sales accounted for 23.7% of total sales.

- In addition to the primary Boot Barn brand which focuses on cowboys, they also have Work, Just Country, and Wonderwest brands. The Work segment primarily focuses on boots for any industry; Just Country is their outdoor adventure brand; and Wonderwest is their newest segment, which is a mainstream and western-influenced fashion line for women. Pictures of the various types of products from each segment can be seen below.

Founding History

Financials/Investments/Acquisitions

Products & Services

Mission and Corporate Values

- The company's vision is "to offer a piece of the American spirit."

- According to the company website Boot Barn "celebrate[s] the values of honesty, hard work, ingenuity, and perseverance." This is expanded on in the company's environmental policy and they list their core values as integrity, teamwork, accountability, professionalism, dedication, and productivity.

- As part of their ESG (environmental, social and governance) platform, Boot Barn works with veteran outreach groups, sponsors rodeos, and launched the Back On Air Movement to support aspiring country musicians.

- Generally, ESG does not appear to be a major focus of the brand, as no ESG reporting was found to be publicly available. They did publish brief (generally one page) documents highlighting their focus in various ESG areas, and those can be seen here.

Customers/Target Market

- According to Seeking Alpha, "Boot Barn targets western and country enthusiasts, and workers looking for dependable, high quality apparel and footwear. The company carries an extensive line of the leading names in branded merchandise, and sees much of its products as consumer necessities that don't tend to frequently change in fashion options.

- The company is primarily a US-focused brand, with only 0.6% of total sales coming from outside the US in 2020.

- As of March 2021, there were 4.7 million members in the company's loyalty program, all who had made at least one purchase in the last three years. These customers account for the majority of their sales.

- Men's merchandise accounts for 65% of sales.

- The brand has broadened their customer base from those living a western lifestyle, to casual country customers who may wear western attire at a concert or other event.

Strategic Initiatives & Digital Priorities

- According to the most recent annual report, Boot Barn's four strategic initiatives are:

- Driving same-store sales growth

- Strengthening omni-channel leadership

- Increasing private label penetration and expanding their merchandise margin

- Expanding their store base

- Around 2019, Boot Barn implemented the Range Finder kiosk in about 50 stores. The application allows both customers and employees to find boots that meet certain requirements. The focus could be only on boots in stock in a particular store, or can be expanded to cover all inventory. The kiosks were rolled out to all stores in early 2020. However, the kiosks now function as a digital hub for retail locations, as they can be used to open credit cards, access the endless aisle solution, check loyalty points, handle buy online return in store transactions, and help with seasonal training.

- At the end of 2017, Boot Barn upgraded their e-commerce platform, although no details were publicly available on the vendor being used.

- According to the most recent annual report, the company believes that one of the primary uses for their ecommerce site is to drive traffic to store locations. This is primarily because consumers want to try on boots for proper fit and comfort before making a purchase.

Executive Commentary

- “Five years ago, we were squarely focused on a rancher, Western customer, and each successive year we’ve expanded the aperture to be more inclusive. The Just Country initiative was part of that. And that came at a perfect time when customers from all sorts of retail channels, and some mainstream retailers, were looking to dress more casually, and we had what we would call casual Western product, but it hit a pretty broad swath of the U.S. population.” John Conroy, President & CEO

- "There’s a perfect marriage between what we’re looking to do with offers and what Cordial does. With over 6.5 million contacts, plus the ability to segment our audiences like never before, we are going to be sending a ton of highly personalized outreach. We’re potentially looking at something like 2 to 3 billion emails a year." John Hazen, Chief Digital Officer

- "Sometimes shopping for boots can be an overwhelming experience if you don’t know what you’re looking for. An added benefit of Range Finder is that it helps new or seasonal store associates train on how to sell boots. It allows these associates to quickly look through all the attributes of a particular work boot or Western-style boot." John Hazen, Chief Digital Officer

- While discussing the company's focus on buy-online-pickup-in-store (BOPIS), Hazen mentioned how the digital team developed their own software and then 3D printed IoT devices for every store. "We named the devices Annie; there is one in every store now. Those Annie devices combined with the touchscreens from Elo in every store have created a BOPIS experience that I believe could stand tall against any of the big players out there.”

Annual Report Digital Strategy and Marketing Highlights

- Technology and digital is not a major focus in the 2021 annual report, and there are few details on actions in this area. In fact, digital strategy is not mentioned at all in the 2021 report.

- Regarding technology, Aptos Retail is the enterprise resource planning system utilized by Boot Barn, and that is responsible for "integrated point-of-sale, merchandising, planning, sales audit, customer relationship management, inventory control, loss prevention, purchase order management and business intelligence."

- The 2020 Annual Report does not have any additional details on the company's digital strategy. In fact, the technology information in the two reports is essentially identical. This may be because the company has a physical store focus rather than a focus on e-commerce.

- In a 2020 article, Hazen indicated that driving BOPIS was a digital priority for the company, and they were using IoT tech to drive the strategy.

- In FY2021, the e-commerce websites had a total of 69 million total visits, which was an increase from 63 million visits the previous fiscal year.

- Marketing efforts include pay-per-click, radio, television, outdoor advertising, direct mail, email, social media, and event sponsorship. It is common for the company to establish pop-up shops at events they sponsor so customers can make purchases on site. Based on what was reported in the 2020 annual report, it is possible that pay-per-click was added in 2021.

- They have ongoing partnerships with Brad Paisley and Miranda Lambert, and high engagement on social media. There are 2.3 million Boot Barn followers on Facebook, and 425 thousand followers on Instagram.

- Although it is not clear when this partnership occurred, Boot Barn worked with Cordial to establish a cross-channel messaging strategy

Digital Strategy

Marketing Highlights

Marketing Tech Stack

- In order to find details on Boot Barn's marketing tech stack, we utilized a variety of websites that generally provide this data. Following is the publicly available information from each site examined.

- Slintel: The publicly available marketing tech on this website is Optimizely, Bronto, Twitter, Skillport, and Flexengage.

- Built With: Ecommerce tools are Demandware, Salesforce Commerce Cloud, and Global-e; Content Management tools are Atlassian Cloud and My Salesforce; and Advertising tools are DoubleClick.net, Criteo, Facebook Custom Audiences, Movable Ink, and Adscale;

- G2 Stack: No results for Boot Barn. However, Crunchbase states that HTML5, Google Analytics, and jQuery are part of Boot Barn's tech stack, and references G2 Stack as the source.

- Awesome TechStack: Ecommerce tools are Salesforce Commercial Cloud, Cart Functionality, and Global-e; Customer Relationship Management tools are Salesforce Service Cloud; Marketing Automation tools are Pushnami and Bronto; and Advertising tools are Criteo and Pinterest Ads.

Challenges

- One challenge facing Boot Barn is competition. While they don't have any direct competitors in the space that have similar revenue and/or a similar demographic footprint, there are many regional competitors across the country. The company estimates that there are thousands of independent specialty stores that directly compete with them. Additionally, farm supply stores and some mass merchants also sell western gear and can be considered competitors. The primary areas of focus to win business from competitors are "product quality, brand recognition, price, customer service and the ability to identify and satisfy consumer demand."

- As mentioned above, increasing private label penetration is one of the company's strategic objectives. There are inherent risks in this strategy. The company will need to divert resources to the establishment of new private-label brands, as well as continue to promote the existing brands. If the new brands are not successful or are not seen as quality brands, this could hurt both the company's bottom line and its reputation. Additional resources may be needed to implement this strategy.

- Rising costs for raw materials, labor, and transportation are likely to impact merchandise costs. There are risks to either passing these costs on to customers or to eating those costs resulting in lower margins.

Other Helpful Findings

- Due to the fact that Boot Barn sells work apparel, they were able to stay open as an essential retailer during shutdowns caused by the pandemic.

- Some partnerships the brand has are with Todd Gilliland, Zane Smith, Miranda Lambert, and NASCAR.

Research Strategy

For this research on the digital transformation strategy of Boot Barn, we leveraged the most reputable sources of information that were available in the public domain, including company websites, annual reports, LinkedIn, Seeking Alpha, and social media sites.