Online fitness platform users are interested in health, personal fitness, digital technology, and wellness. They are willing to spend money monthly to subscribe to on-demand fitness and/or yoga training and practice, and some are willing to invest in specialized fitness equipment. They want personalized, immersive, professionally-coached workout experiences. More women than men participate in online fitness workouts, and the Millennial cohort is an important focus of online fitness marketing efforts.

Interests of Online Fitness Platform Consumers

- Personal health and fitness are major interests of consumers who purchase and use online fitness apps, subscriptions, wearables, on-demand streaming services, and other products.

- The health and fitness industry, in response to the growing awareness of wholistic health from fitness consumers, has expanded the definition of fitness to encompass "mental wellness and whole-body health. This includes meditation, stretching and nutrition, etc." Some apps include yoga, meditation, diet, and nutrition in their workout programs.

- Fitness app users understand fitness training and are interested in getting certain types of exercises through their on-demand classes. Descriptions of popular app workout activities include terms like "high intensity", "low impact", "functional strength", "balanced strength and cardio", "interval training", "training circuit", "mixed martial arts", "bodyweight", "core", "fitness level", "resistance training", and "muscle groups". Consumers choose workout apps based on the kinds of exercises that are included.

- These consumers are interested in digital technology and are comfortable using it.

- Users of online workout apps are interested in wellness. Many do a combination of strength and cardio workouts as well as yoga to achieve a sense of wellbeing.

Spending Levels of Online Fitness Platform Consumers

- Online fitness consumers are willing to spend money on health and fitness. The costs of apps for fitness workouts and yoga practice in 2020 vary from zero (for free apps) to $60 per month to $2,250 for a Peleton bike and $100 per month for yoga lessons and gear.

- Consumers are willing to purchase services and goods in an on-demand or subscription model.

- A magazine called aSweatLife that serves the fitness community surveyed its readers and found that they spent an average monthly total of $112.48 in 2018, down from $125.50 in 2016. The magazine's readers are primarily Millennials.

- Part of the current success of on-demand workout apps is their cost that is lower than gym memberships. On-Demand workouts are cheaper than gym memberships, according to research by CNBC.com. The average user spends about $48 per month for on-demand workout access, compared to "$59 per month for traditional gyms and $136 for boutique studios."

- The COVID-19 pandemic and strict stay-at-home rules for millions of consumers have led to a spending increase in the health and fitness sector of the economy. During the last week in March 2020, "consumers spent $59 million on health apps and $36 million on fitness apps" according to Appannie.com.

Likes of Online Fitness Consumers

- According to market research firm Lincoln International, consumers want to have physical human interaction to the extent possible, "but often schedules, travel and other issues impede their ability to get to a physical gym." The new, internet-based "connected offerings provide fitness, training, social interaction, gamification and many forms of engagement for the consumer."

- Many fitness enthusiasts like to communicate with others, even within the isolation of the COVID-19 stay-at-home requirements. To facilitate this, some fitness platforms have acquired large social media followings. For example, on Facebook, Peleton has a member page with 322,000 members. (https://www.facebook.com/groups/pelotonmembers/) Social media can help marketers create "niche fitness communities, where members share updates on fitness goals and support one another through the process".

- Many fitness enthusiasts using on-demand technologies enjoy "immersive and entertaining fitness experiences through enhanced gamification". They can compete with others online as they go through their workout routines, just as they would through online games.

- These consumers also want personalization in their workouts. "Technology-enabled workouts offer personalized options to users based off their preferences, such as preferred instructors, virtual location, music genre, style of fitness and duration", according to Lincoln International.

- Consumers want "professionally-coached classes", even though they are doing their workouts at home or in hotels while traveling. This is possible through streaming technology.

- These consumers like "natural treatments to improve chronic conditions and ailments...."

Demographic Information That Reflects Attitudes

- Millennials' positive feelings about diversity have influenced their participation in fitness activities. They constitute the largest cohort of online fitness platform users. "Fitness has become more inclusive for people of all ages and backgrounds...."

- These consumers want to work hard to achieve physical fitness and a sense of well-being. Their average age is about 39 according to Consumer Selects.

- Fitness app consumers are willing to try new things. Gallup research reports that 19 percent of Americans "say they currently use a wearable fitness tracker, with the same percentage saying they currently use a mobile health app."

- Gallup also found that "More than one in four Americans currently use one product or the other: 8 percent are actively using only a fitness tracker, 9 percent are actively using only a mobile health app, and 10 percent are actively using both."

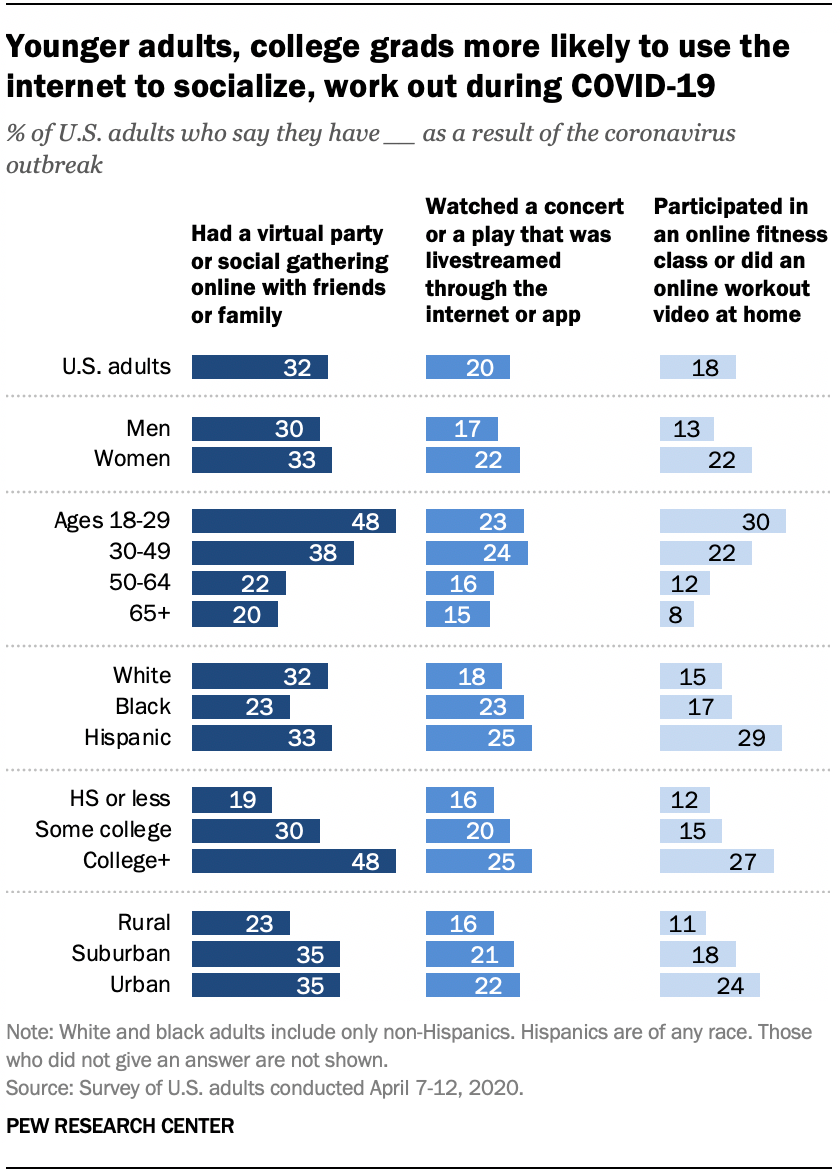

- Younger, suburban women seem more willing to accept at-home fitness routines than older men. "Fitness trackers and health apps are a bit more popular among women than among men. ...[A]dults younger than 55 are about twice as likely to have used these products as are adults aged 55 and older."

Research Strategy

So far, not much published research is available on the psychographics of consumers of online fitness platforms. Some marketing research on this sub-sector of consumers has been done, but it is behind substantial paywalls. We first searched for direct research on consumers of online fitness platforms, but when we realized there would not be any available, we switched to indirect efforts. We checked business news, statistics, market research, industry blogs, published surveys, financial news, and niche blogs. These sources provided bits of information that we used to create a profile of four aspects of these consumers: interests, spending, likes, and demographic influences on attitudes.