Part

01

of one

Part

01

BC Life-Sciences and Biomanufacturing Provincial Hub Revision

Key Takeaways

- BioTalent Canada provides market intelligence on labor in the bio-economy in Canada. Some of their talent-focused initiatives include providing a database for potential students to find bio-tech programs, a Student Work Placement Program, and the Career Starter program which provides employers with C$20,000 toward the salary for barriered youth for three to nine months.

- In 2021 the Canadian government published Canada's Biomanufacturing and Life Sciences Strategy. There are five priorities in the strategy, and number two is, "Laying a Solid Foundation by Strengthening Research Systems and the Talent Pipeline." An example of the type of investment that is being made as part of the strategy is a C$92 million investment in adMare BioInnovations that was announced in March 2022. Innovation centers created by adMare in Vancouver and Montreal will benefit from the investment. "...entrepreneurs, academic researchers, innovators and emerging Canadian small and medium-sized enterprises (SME) can access a full spectrum of services, including scientific expertise, research infrastructure and business development support, as well as funding for new research and development projects with strong commercial potential."

- The global pandemic made clear the connection between the economy and public health. The life sciences sector plays a crucial role in supporting public health, as can be seen by the vaccines and treatments developed. Therefore, one way an innovation hub can impact the economy is by improving/maintaining the public health, which leads to a stronger economy.

- In NYC, the LifeSci Innovation initiative is expected to bring high quality talent to the city, attract businesses in other sectors that will support the life sciences hub, and attract startups and entrepreneurs that can benefit from the infrastructure.

- From 2021-2029, it is expected that 39,000 immigrants with bio-economy related degrees will immigrate to Canada. If there are programs in place to match these immigrants with potential employers, it could do a lot to address the pending shortage. (page 30)

Introduction

Provided in the attached report are insights into the life sciences sector in British Columbia and Canada in general. The areas covered include support for talent acquisition; the impact innovation hubs have on the economy, workforce, and businesses; the potential and actual benefits of establishing a life sciences innovation hub; and the status of immigrant talent in the bio-economy.

While this report provides in-depth details, the insights have been summarized on slides 10-17 of the attached presentation.

Support for Talent Retention/Attraction/Development

Michael Smith Foundation

- The Michael Smith Foundation for Health Research BC (MSFHR), along with the British Columbia Academic Health Science Network (BC AHSN), partnered to create a support framework for growth and evolution/innovation in the "health research system and life sciences sector."

- Talent development is a core focus for MSFHR, and one way that they support the sector in this area is through their Research Trainee Program. The goal of the program is to prepare "post-doctoral researchers for successful careers in research, biotech, health policy and more."

- Recipients receive C$45,000 per year, along with a research and travel allowance of C$4,500. The reward will be provided for up to three years.

BioTalent Canada

- BioTalent Canada provides market intelligence on labor in the bio-economy in Canada.

- Many Canadian life science companies are members of BioTalent, including LifeSciences BC, Medtech Canada, PEI BioAlliance, and Innovative Medicines Canada.

- Some of their talent-focused initiatives include providing a database for potential students to find bio-tech programs, a Student Work Placement Program, and the Career Starter program which provides employers with C$20,000 toward the salary for barriered youth for three to nine months. This is to encourage diversity in the sector and to encourage employers to bring in promising candidates while they are young.

Canadian Government

- In 2021 the Canadian government published Canada's Biomanufacturing and Life Sciences Strategy. There are five priorities in the strategy, and number two is, "Laying a Solid Foundation by Strengthening Research Systems and the Talent Pipeline."

- An example of the type of investment that is being made as part of the strategy is a C$92 million investment in adMare BioInnovations that was announced in March 2022. Innovation centers created by adMare in Vancouver and Montreal will benefit from the investment. "...entrepreneurs, academic researchers, innovators and emerging Canadian small and medium-sized enterprises (SME) can access a full spectrum of services, including scientific expertise, research infrastructure and business development support, as well as funding for new research and development projects with strong commercial potential."

- Since academic institutions are at the forefront of talent development, part of the government's strategy is to invest in the research infrastructure of academic institutions in order to support them in the talent development process.

- The BC Provincial Nominee Program allows for foreign workers, entrepreneurs, and foreign students to be nominated to work in Canada. When someone is nominated, they and their family are eligible to apply to become a permanent Canadian resident.

Impact of Innovation Hubs on Business, the Economy, and/or the Workforce

Workforce - Cascadia Innovation Hub

- The Cascadia Innovation Hub links Vancouver, Seattle, and Portland together to take advantage of the strengths of each area, and to create an economic zone that is a leading "global hub of innovation and commerce."

- Cascadia published their Vision 2050 in 2020, and it addresses many ways that the innovation hub can impact businesses, the economy, and the workforce. They used the characteristics of sustainable cities put out by the World Bank in order to develop the characteristics of a sustainable mega-region.

- As can be seen on the right of the above figure, the three pillars of the vision are affordable housing and development, growth without increased traffic congestion, and reduce the environmental impacts of growth.

- For Washington-based businesses, access to a talented workforce was the top reason given for wanting to pursue cross-border integration. In BC, workforce access was the fourth most important reason given, after access to an expanded market, geographical proximity, and complementary knowledge and skills.

- One way Cascadia plans to achieve their goal of a sustainable mega-region is through the use of hub cities. These would be cities located 40-100 miles from urban cores, which would utilize high density housing. Anchor employers would commit to placing portions of their workforce in each hub city, allowing employees to work where they live, and reducing transportation issues.

Business Impacts

- According to a report published by the Province of British Columbia, changes in the life sciences sector are resulting in an increased need for collaboration between sectors. Some sectors that have seen increased collaboration are big data, quantum computing, digital health, and precision medicine. These collaborations are moving some businesses to more collaborative models that focus on partnerships and outsourcing tasks.

Economic Impacts

- The global pandemic made clear the connection between the economy and public health. The life sciences sector plays a crucial role in supporting public health, as can be seen by the vaccines and treatments developed. Therefore, one way an innovation hub can impact the economy is by improving/maintaining the public health, which leads to a stronger economy.

- One company, adMare, that trains leaders in the bio-space to drive large-scale growth is located in BC, and helping to supply the region with growth-focused executives can lead to economic growth.

Benefits of Creating Life Sciences/Biomanufacturing Innovation Hub

LifeSci NYC

- New York City is in the process of developing a life sciences hub as part of the LifeSci NYC initiative. With a commitment of $1 billion, investments will be made in spurring new research, constructing new labs and incubators, and building a talent pipeline.

- This growth will bring high quality talent to the city, attract businesses in other sectors that will support the life sciences hub, and attract startups and entrepreneurs that can benefit from the infrastructure.

- Along with the hub development, there is currently a reinvention of the real estate market in NYC. As more life science tenants look for space, it is driving renovation projects to retrofit buildings to accommodate new purposes. This grows the construction and renovation sector.

North Carolina

- North Carolina got involved in the life sciences space early, in 1984.

- The industry went from just a few companies to over 700 in the state in 2021. With these companies came jobs. In 2020 alone, there were at least 3,000 new life sciences jobs in NC.

- As the sector grew in the state, there was a lot of employee poaching happening, because there was not enough talent to meet the needs of employers. In order to change that dynamic, a network of community colleges developed programs to train the workers for the new companies. This brought more students into the state, and many of them stayed, helping to grow the state's population.

Spokane

- Since establishing itself as an innovation hub in the life sciences sector, Spokane has seen job growth, increased college enrollment, and a tripling of federal research dollars awarded to area universities.

- The Eastern Washington life sciences sector is projected to be worth $2.5 billion in 10 years.

Immigrants with Life Sciences, Biotech, and/or STEM Skills

- Based on data from 2016, there were almost 500,000 immigrants working in STEM fields in Canada. Foreign students also accounted for a higher percentage (27%) of those pursuing STEM degrees than the number of international students in general (12%).

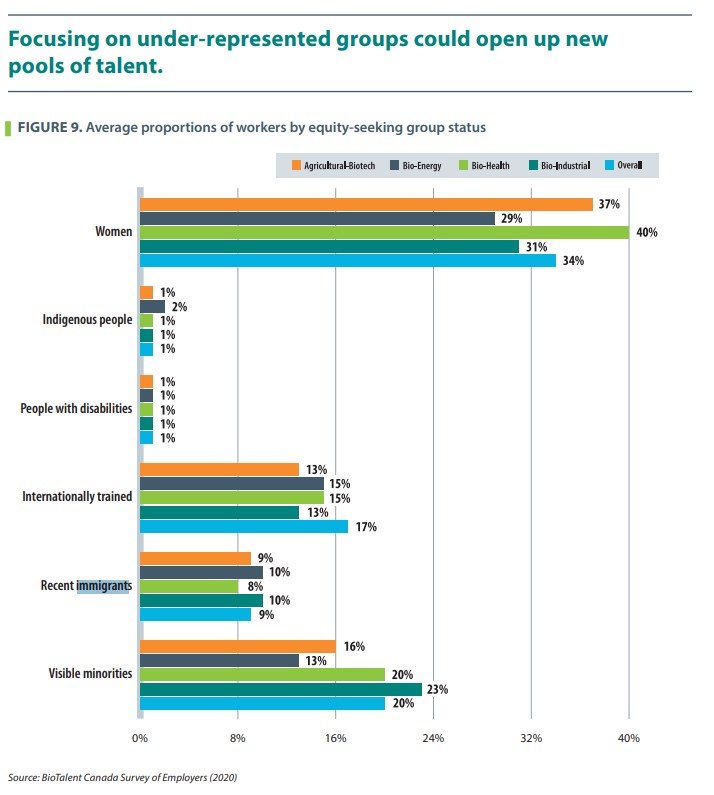

- According to an article from April 2022, recent immigrants make up nine percent of the life science workforce in Canada, while internationally educated professionals (who may or may not be immigrants) make up 17% of employees in the sector.

- Although based on older data (2017), one study on the bio-economy found that 56.8% of respondents (which were made up of immigrants to Canada looking for work in the bio-economy) had worked in the biotech sector prior to coming to Canada, and about 67% of respondents had at least a master's degree. However, almost 70% did not find employment in the industry in Canada. This would seem to indicate that there was, at least at that time, untapped immigrant talent.

- This is one area where the data does not necessarily support the hypothesis that there is a strong business case for a company to establish a life sciences/biomanufacturing hub in British Columbia. This is mainly because "current estimates indicate there will not be enough workers to meet the labour need of 65,000 additional workers by the end of the decade, with significant pressure starting within the next three years and job-opening-to-candidate ratios reaching 4:1 in some cases." (page 6)

- There are however strategies that can mitigate the projected shortage, and skilled immigrants can play a key role. Employers often associate hiring immigrants with an increased risk, and some sort of wage subsidy program for immigrants may lessen that concern. (page 7)

- The following chart shows that internationally trained workers and recent immigrants are under-represented in the bio-economy in Canada.

- From 2021-2029, it is expected that 39,000 immigrants with bio-economy related degrees will immigrate to Canada. If there are programs in place to match these immigrants with potential employers, it could do a lot to address the pending shortage. (page 30)

- In order to employ more immigrants in the bio-economy in Canada, employers will have to expand recruitment beyond personal connections and employee referrals. This severely limits the scope of talent available and ensures many highly skilled immigrants will be missed. (page 50)

Research Strategy

For this research on the life sciences sector in British Columbia/Canada, we leveraged the most reputable sources of information that were available in the public domain, including the Michael Smith Foundation for Health Research BC, BioTalent Canada, Fierce Biotech, and Canadian government resources.

All the data found supported the hypothesis that there is a strong business case for a company to establish a life sciences/biomanufacturing hub in British Columbia, except for data on the workforce, which indicated there is currently expected to be a shortage of talent in the industry. However, there are ways to mitigate the issue and this should not stand in the way of establishing a hub if properly dealt with.