Part

01

of two

Part

01

Automation as a Service: Insights

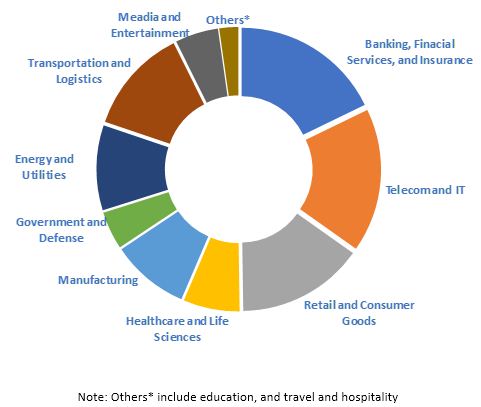

This research provides additional insights into Automation-as-a-Service as it relates to the banking sector. Although not all these insights are specific to the banking sector, our research has revealed that since a large part of this technology is implemented in the banking, financial services, and insurance sector, these insights should hold true across the industries that it is implemented in. As a re-do of the previous research, the definition of RPA and AaaS have been provided in the "Case Study Analysis" report. Although it can be used together AaaS, RPA cannot be used interchangeably with AaaS. Although information specific to the banking sector or insights into setup for the sector is not publicly available, this research has provided insights that would add value to this request.

Great Growth in Banking Sector

- The banking, financial services, and insurance (BFSI) category have witnessed the greatest implementation of automation as a service. This technology has played a critical role in processes such as "customer service, compliance, invoice digitization, credit card approval, mortgage processing, detection of fraud, know your customer (KYC) processing, updating ledger, report build-up, and account closing process."

- The APAC region is forecast to have the highest amounts of AaaS implementations generating a forecast revenue of $2,444.9 million by 2023.

- Key players in the AaaS market include "NICE Ltd., Kofax Inc., Automation Anywhere Inc., Micro Focus International plc, and Blue Prism Ltd."

- In 2017, North America had a 40% share of this market in the BFSI category.

AaaS Infrastructure

- IoT devices will play a great role in AaaS because of the massive flow of data. The more data is available, the greater the extent of automation, providing greater value for both the customer and the company. This also ensures that managing AaaS is easier and more practical.

- Although the previous research focused on RPA (Robotic Process Automation), this research has revealed that AaaS is sometimes combined with RPA to improve the management of business processes.

- As automation is widely implemented, a constantly increasing number of companies are implementing it. However, many are still wondering how to do so successfully. A critical component of here is focusing on the client. A customer-centric platform will be of higher value to the company and the process. Companies should also educate/train their employees as would be required. According to a survey, only 44% are planning to do so.

Accelerated Service Delivery

- Implementing AaaS means that services can be delivered much faster to clients/customers. It eliminates the burden of manual processing and requests. Although automation has already begun across industries and in big and small companies, AaaS comes in as a package. One has the option of scaling up and will only need to pay for what they use. This consumption-oriented model presents options such as monthly payments and level of complexity, based on the company processes and requirements.

- AaaS plays a critical in enhancing "innovation, increasing agility, and reducing operational complexity." As ML and AI are increasingly implemented, AaaS plays a great role in optimizing these technologies in order to enhance growth. Just as in automation, AaaS optimizes the company's performance, it enhances relationships with customers, and it reduces risk by enhancing accuracy.

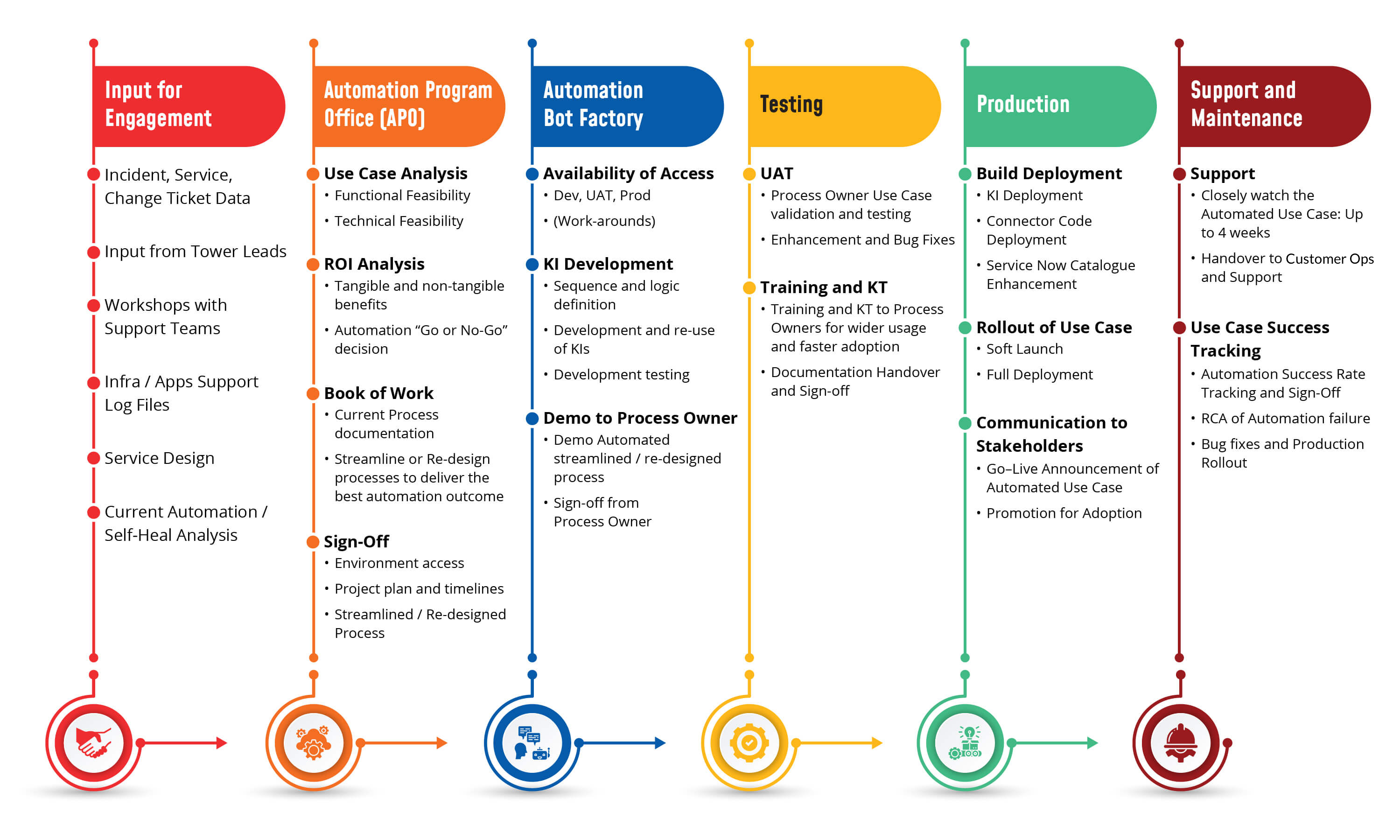

- The following chart/table provides an overview of the analysis before implementing AaaS.