Part

01

of one

Part

01

Automation as a Service

Automation as a Service (AaaS) is a service that vendors offer to enterprises that are seeking to implement large-scale automation projects or scale automation across their organization. The service typically involves the identification of automation use cases and candidates, the development, testing, and deployment of automated solutions, and the provision of production support services. Not much information can be found specific to the banking industry, but use cases in said industry include fully automating cash disbursement, general operations, and revenue management processes.

Definition of Automation as a Service

- Based on the definitions provided by market research firm Reports and Data and software development firm N-iX, Automation as a Service (AaaS) is a service offered by vendors or providers to businesses or organizations to help them implement large-scale or enterprise-level automation projects and realize significant productivity gains.

- Reports and Data defines AaaS as "adaptive automated services offered by technology companies to various industry verticals in order to automate their process workflow and increase their productivity by a substantial margin," while n-IX defines it as "a set of services offered by technology companies to enterprises in order to automate their process workflows and increase their productivity."

- Several market reports, including those published by 360iResearch and Prescient & Strategic Intelligence Private Limited, indicate that there are two types of AaaS, namely, knowledge-based automation and rule-based automation. Knowledge-based automation is largely powered by artificial intelligence (AI), while rule-based automation is largely defined by if-then rules.

- If AaaS were to be explained using the Pizza as a Service analogy shown below, it would be wider in scope relative to Software as a Service (SaaS) in that it is not just discrete software services but enterprise-level or end-to-end process automation services and solutions that are being provided. Compared to SaaS, AaaS is more holistic considering that it is meant to help enterprises scale automation across their organization.

- Although it is often discussed with AaaS, RPA appears to be just a component of AaaS. Reports and Data presents RPA as one of the two components of AaaS, with the other component being AI and cognitive automation. According to Reports and Data, RPA accounts for 64.4% of the global AaaS market.

- The fact that the banking, financial services, and insurance (BFSI) industry is the industry with the largest share of the global AaaS market suggests that AaaS has plenty of applications in the BFSI industry.

Examples and/or Applications of Automation as a Service

- SMA Technologies, a company whose AaaS offering is called Managed Automation Services (MAS), cites a few examples of applications or use cases of AaaS in the banking industry.

- According to this company, AaaS can be used in banking to shorten bank automated clearing house (ACH) processing times, improve ACH exception handling, and reduce ACH-related errors. It can also be used to simplify mortgage or loan processing and free up bank employees' time for more productive work.

- AaaS can be implemented to make the banking experience faster and error-free for customers. Moreover, banks may rely on AaaS vendors to support their contingency or disaster recovery plans.

- The McKinsey Global Institute found that 40% of activities in the financial services industry can be completely automated. Cash disbursement, general operations, and revenue management are great candidates for full automation.

Requirements to Set Up Automation as a Service

- What can be gathered from the limited information that is available is that the vendor and the client, together, need to identify automation use cases so they can finalize which processes will be fully automated.

- The vendor, being the expert or specialist, is expected to help the client in this process by listing the most common use cases. The client, on the other hand, is expected to use these common use cases as basis in identifying their own unique automation use cases.

- The vendor is also expected to advise the client on any infrastructure requirements.

- AaaS entails collaboration between the vendor and the client, so each side must identify their representatives or point persons.

Implementation of Automation as a Service

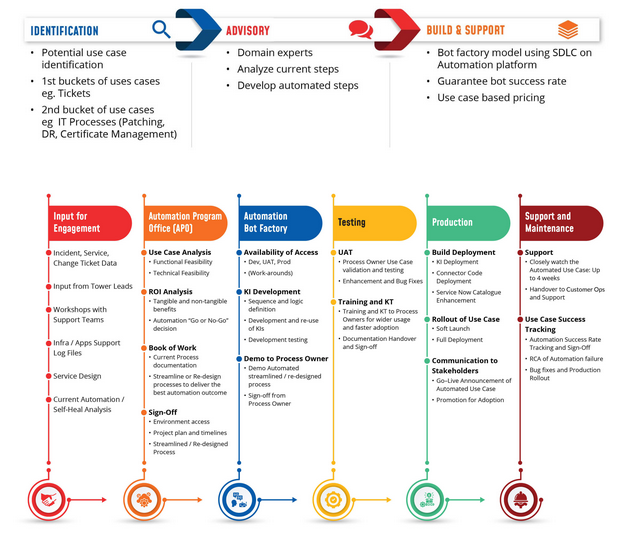

- Based on how providers or vendors describe their AaaS offerings, it appears the implementation of AaaS is divided into three key stages, namely, the use case identification, advisory, and build and support stages.

- For example, Hexaware, a company that offers AaaS and that serves the banking industry, divides its AaaS offering into three stages, namely, the use case identification stage, the advisory stage where domain experts analyze current steps and develop automated steps, and the build and support stage where bots or automated solutions are developed, tested, deployed, and maintained. It divides these three stages further into the following six sub-stages: input for engagement, automation program office, automation bot factory, testing, production, and support and maintenance.

- Micro Focus, an enterprise software provider, presents its AaaS offering in a similar manner. It divides its AaaS offering into the following phases: use case and automation candidate identification, automation factory, and governance.

- In the first phase, automation candidates are drawn from a pool of common use cases submitted by the vendor and unique use cases submitted by the client. In the second phase, automation solutions are planned, analyzed, prioritized, and built in sprints. Lastly, in the third phase, operation and support services, KPI and ROI measurement services, and demand management services are provided.

- Calligo, another AaaS provider, describes its AaaS offering as a fully-managed service that starts with initial scoping and ends with continuous optimization.

- AaaS is deployed either on premise or via a private or public cloud. On-premise deployment accounts for 66.9% of the global AaaS market.

Benefits of Automation as a Service

- Companies derive several benefits from leveraging AaaS. Among these benefits are improved speed, agility, and service delivery, reduced manual processing, reduced IT spend, improved productivity across departments, and faster troubleshooting.

- Tangible results include a 40% increase in the ability of full-time employees to concentrate on customer outcomes, at least a 40% decrease in cycle or handling times, and a 30% to 80% decrease in processing costs.

- AaaS facilitates enterprise-level automation, as it does not require large upfront payments and is provided on a more affordable subscription or pay-per-use basis. It is scalable, and costs vary depending on the level of automation required. Additionally, users need not make separate payments for upgrades of software.

- Historically, banks have faced difficulties in implementing enterprise-level or end-to-end automation. Some banks have found it difficult to scale up their automation projects. They do not have the right internal resources, for example, the right people or talent, to carry out massive automation projects.

- McKinsey recommends that struggling banks enlist the help of AaaS vendors, as these vendors have the training, experience, and expertise to help these banks implement enterprise-level automation.

Drawbacks of Automation as a Service

- Not much can be found on this topic apart from the potential employee displacement or loss of jobs.

- Large-scale automation projects could lead to substantial layoffs, which could be mitigated by upskilling or reskilling.

Research Strategy

To find the desired information, we examined the websites of AaaS providers such as Micro Focus, Calligo, and Hexaware, and we reviewed articles and reports about AaaS as well. To better understand AaaS, we also looked at how the AaaS market is segmented by type and deployment model. Unfortunately, even though there is plenty of information about automation and RPA in banking, information specific to AaaS in banking is limited.