Part

01

of one

Part

01

Auto Insurance Rate Increases

Key Takeaways

- State Farm filed to increase its personal auto rate by 6.5% in Texas.

- In Michigan, only Allstate has publicly requested rate increments by 11.6%.

- Allstate (12%) and Geico (8.6%)have also received approvals for rate increments in Texas.

Introduction

The research provides the personal auto insurance rate increments made by State Farm, Allstate, Progressive, Geico, and Travelers in California, Texas, and Michigan between October 1, 2021, and June 7, 2022. However, the requested data was unavailable for some of these companies across some states, as it was not provided in the primary resource we leveraged - the System for Electronic Rates and Form Filing (SERFF), as well as other third-party sources. Therefore, we alternatively provided available rate increments filed before October 1, 2021, as well as extended the research scope to include increment rates by the companies for New York and Georgia. All findings can be found in the attached spreadsheet while the sources can be accessed from the attached document. Below is a summary of our findings and research strategy for more details.

Summary of the Findings

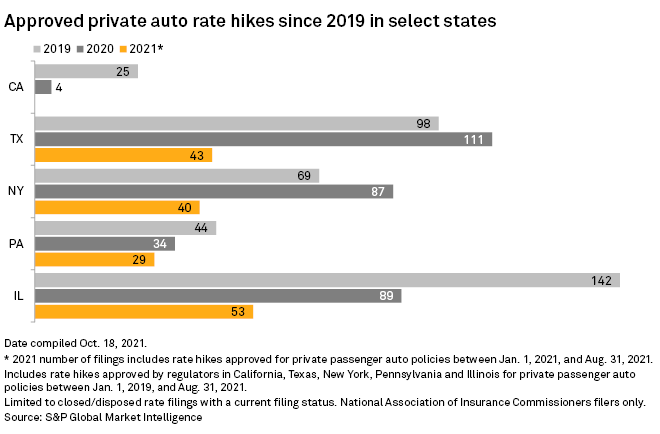

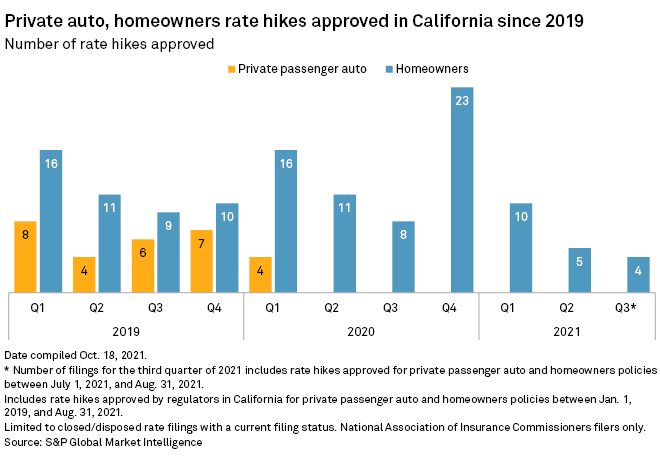

- In California, there wasn't a single approved or rejected personal auto rate change filing in California by any of these companies (or any others) in the requested period, according to comprehensive research through SERFF and rate filings spreadsheets made available by the state regulator. California has been representing the counter-trend to rising personal auto insurance for the last few years, as noted by S&P Global.

- In Texas, State Farm filed to increase its personal auto rate by 6.5%. It was filed in June 2022 but the approval is pending. Allstate and Geico have also received approvals for rate increments. Although the filing dates are unknown, they were mostly effective in 2022.

- In Michigan, only Allstate has publicly requested rate increments by 11.6%. It was filed in December 2021. Generally, Michigan either doesn’t disclose or require rate change history in filings, which is why we were only able to provide requested rates.

Research Strategy

For this request on 'Auto Insurance Rate Increases', the research team primarily leveraged the System for Electronic Rates and Form Filing (SERFF) Filing Access database through the specific search engines for the requested states in the US: California, Texas, and Michigan. For each state, we searched for the filings provided by each of the requested companies: State Farm, Allstate, Progressive, Geico, and Travelers. And for each company, we searched through the files available in Rate/Rule filing type results for 'Private Passenger Auto' and reviewed available memos, exhibits, and other relevant documents, to identify whether they've increased their personal auto insurance rates between October 1, 2021, and June 7, 2022. Through this, we provided available data in the attached spreadsheet and screenshots of the sources - in the attached document. This is because the SERFF database does not allow visitors to obtain direct links. Note that we also include the companies, such as Progressive, that file for rate increments through their subsidiaries.

For those instances where data was unavailable, we searched other third-party media sources, such as S&P Global. However, we hardly found any useful data. Hence, we alternatively provided, where available, other rate increments filed before October 1, 2021. These cases have clearly been highlighted in the spreadsheet, otherwise, we marked N/A accordingly.

Lastly, in order to provide additional value through helpful findings, we provided available details for each of these companies in New York and Georgia. They can as well be accessed from the attached spreadsheet.