Part

01

of one

Part

01

At-Home Wellness Testing

Research Strategy:

- This report focuses on the global and US market research including market size, forecast, and growth rates, market segmentation, consumer research, and market strengths, weaknesses, and threats analysis of the 'at-home health diagnostics testing market.'

- Given that the market segments and the at-home products are too diverse, it was difficult to narrow down the search. The demographics pertaining to consumer research utilizing at-home health diagnostics were not directly available; however, this can still be addressed if a target product sector has been identified.

- Using a case-study of glucose monitoring devices (GMD), we estimated an increase in the diabetes-dependent market demand of GMD in the USA. For future research in this arena, it is recommended that the client may specify the type of product launch, which will help us to tailor the market research accordingly.

Background:

- At-home diagnostic tests (also known as in-vitro diagnostics, or in-home health diagnostic testing, or self-diagnosis tests) can be performed on human bodily fluids including blood, saliva, and urine can be used for the detection of diseases or diagnosis of medical conditions.

- The test has various merits including convenience, non-invasive, cost-effective, prompt results, and confidentiality.

- The home diagnostic systems are found in the form of a strip, digital monitoring instruments, dip cards, cups, and cassettes.

Market size, growth rate, and forecast

- According to Fior Market Research, the global home diagnostics market is expected to grow from USD 4.78 billion in 2017 to USD 6.53 billion by 2025, with a compound annual growth rate (CAGR) of 3.98% during the forecast period 2018-2025.

- A similar market size predictions were reported by Futurewise Research (of 2020), indicating the global at-home diagnostics market was estimated to have worth over USD 6 billion by the end of 2027, with a compound annual growth rate (CAGR) of over 3%, during the forecast period of 2020-2027.

- The majority of the at-home diagnostics global market has been dominated by North America and Europe; where the US accounts for nearly 90% of the market share. In the European market, UK, Germany, and France hold a major share, due to generally high health awareness and high penetration among the general population.

- In 2017, the North American region emerged as the largest market for home diagnostics, with a 39.79% share of market revenue.

- The high prevalence of cardiometabolic diseases such as obesity, diabetes, and hypertension, from teenagers to senior citizens, has created a demand for quick test kits that can be used at home.

- The US is the leading market with a multitude of home diagnostic kit manufacturers.

- Another category of at-home testing includes collecting sample at home and dispatching it to manufacturing laboratories for infectious disease or genetics tests. According to a 2016 market research, the key U.S. players in the home-health testing market include Quest Diagnostics, LabCorp, Theranos, and 23andMe. The U.S. market value for direct-to-consumer laboratory testing has been calculated between 2010 to 2016, and projections estimates are shown for the years 2016 to 2020.

Market Segmentation

- Based on the type of diagnostic test market segment is divided into glucose monitoring devices, infectious disease test kits (such as COVID, STD's, and HIV), pregnancy and ovulation predictor test kits, cholesterol detection kits, drug abuse test kits, and others.

1. Glucose monitoring devices:

- The glucose monitoring devices (GMD) segment represented a market value of USD 2.10 billion in revenue in 2017. The GMD represented 43.92% of the global home diagnostics market revenue share (in 2017).

- The global blood glucose monitoring devices market size is estimated at USD 12.64 billion (in 2020) and is projected to expand at a compound annual growth rate (CAGR) of 7.6% during the forecast period (from 2021 to 2028).

- The North American region held the GMD segment's total global market share of 39.1% (in 2020).

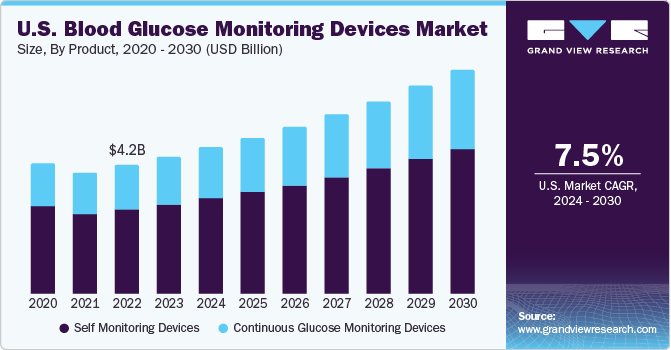

- The figure below represents the U.S. Blood glucose monitoring devices' market share trends and projections (from 2016 until 2028).

Glucose Monitoring Devices Consumer Research - Case Study:

- The National Diabetes Statistics Report (2020), presented the overall prevalence of Diabetes and Pre-Diabetes patients in the US in 2017.

- Diabetes population in the USA: 34.2 million people (or 10.5% of the US population)

- Prediabetes population in the USA: 88 million people aged 18 years or older have prediabetes (or 34.5% of the adult US population)

- The increasing prevalence of diabetes and the growing need for monitoring sugar levels among diabetes patients are responsible for this increase in demand. The National Diabetes Statistics Report (2020), presented the overall percent prevalence of Diabetes and Pre-Diabetes patients in the US in 2017.

- Age-adjusted, percent-prevalence of total diabetes demonstrates an increasing trend from 9.5% (in 1999–2002) to 12.0% (in 2013–2016).

- The total diabetes percent-prevalence is representative of both diagnosed and undiagnosed diabetes. A five-year trend of total diabetes percent-prevalence is shown here: 11.3% (during 2009–2012), to 11.5% (during 2011–2014), to 12.0% (during 2013–2016).

- Factors such as the growing diabetic population in the USA, increasing preference for self-diagnosis as well as technological advancements in the diagnostic technology are some factors that are driving the global home diagnostics market. Here, we estimated the growth trends in the market size of glucose marketing devices (GMD) from 2012 to 2016.

- 313.9 million (U.S. population in 2012)* 0.113 (percent prevalence of total diabetes in 2012) = 35,470,700 = 35.47 million GMD.

- 323.1 million (U.S. population in 2016)* 0.120 (percent prevalence of total diabetes in 2016) = 38,772,000 = 38.77 million GMD.

- The US market demand for glucose monitoring devices (GMD) increased from 35.47 million GMD (in 2012) to 38.77 million GMD (in 2016); with an average four-year growth rate of 9.3% (between years 2012 to 2016).

- Some leading players operating in the diabetes diagnostics market include Medtronic plc, Abbott Laboratories, F.Hoffmann-La-Ltd., Bayer AG, Lifescan, Inc., B Braun Melsungen AG, Lifescan, Inc., Dexcom Inc., Insulet Corporation, Ypsomed Holdings, Companion Medical, Sanofi, Valeritas Holding Inc., Novo Nordisk, and Arkray, Inc., among others

2. Cardiometabolic Disorders Detection Kits

- Owing to the increasing incidence of cardiometabolic disorders, the cholesterol detection kits segment is anticipated to grow at a robust pace over the forecast period.

- Product example include 'Cardiometabolic Profile Home Blood Spot Test Kit (by ZRT lab),' which is available online at the Live Well Testing platform.

3. Infectious Disease at-home kits

- Currently, the global COVID-19 diagnostics market size is valued at USD 19.8 billion (in 2020) and is expected to grow at a compound annual growth rate (CAGR) of 3.1% (from 2021 to 2027).

- The increasing demand for repeated testing for COVID-19 has increased the potential for at-home COVID testing kits and point-of-care devices.

- In 2019, the global market worth of home test kits pertaining to infectious diseases was USD 16.4 billion.

- The global COVID-19 detection kit market size is worth USD 3.28 billion (in 2020) and expected to reach $4.63 billion (by 2027), with a projected CAGR of 5.05% during the forecast period (2021-2027).

- Currently, in the US market, there are over 12 at-home coronavirus tests that have either been authorized or under approval phase by the FDA under the emergency use authorization. As of February 2021, there are 9 at-home COVID-19 tests available to the US market. Additional 6 companies will be joining the effort to making COVID-19 testing widely available. The White House plans to boost the production of 60 million home tests by summer 2021.

- The test kits are ordered (online) either by prescription or available over-the-counter. The test kit is based on a sample by oro-nasal swab or saliva collection, to be sealed, and shipped to a lab for results in about 3-5 days. The test costs about USD 100 to 200 and, if prescribed, insurers have provided reimbursement.

- The three pioneering manufacturers of at-home COVID test kits which have been approved by the FDA-EUA include (i) Lucira Health, (ii) Ellume, and (iii) Abbott Laboratories.

- The BinaxNow (Abbott), Lucira, and Ellume tests all offer slight variations on a similar approach: swab, insert and get results in 30 minutes or less. The at-home tests are covered by insurance if they're recommended by a health care clinician.

- Recently, Ellume (an Australian-based company) signed a contract with US federal government, receiving federal funding of USD 230 million to deliver 8.5 million at-home tests nationwide and will be able to produce even more than that when the factory is working at full capacity.

- Both Ellume and Abbott have contracts with the US government to deliver millions of at-home COVID tests in the first quarter of 2021. Recently, Abbott completed a federal government order of 150 million BinaxNOW tests in mid-January, and on-track to deliver additional 30 million more tests for the government by March 2021.

- The overview of each test and the cost breakdown is as follows:

- (I) The Ellume test is available without a prescription, available online and in-stores, and costs up to USD 30.

- (II) Lucira is more sensitive, using molecular technology, and is only available by prescription, costing around USD 50.

- (III) BinaxNow (by Abbott) is the cheapest COVID at-home rapid antigen test but requires a prescription. Patients are required to answer questions through an app to confirm their coronavirus symptoms. The test kit is then shipped to the customer's doorstep for USD 25, plus overnight shipping.

- The test kits are sold by several different labs, including Quest diagnostics, Everlywell, LetsGetChecked, RapidRona, Binx health, Pixel, Picture by Fulgent Genetics, DxTerity, and a Spectrum Solutions test (sold through Forhims.com).

- DxTerity - available on Amazon, claims to provide 95% of the results within 24 hours of the sample shipment.

Examples of major at-home COVID-19 diagnostic manufacturers and potential clients/consumers

- 1. LetsGetChecked is a leading personal health testing and insights company that offers more than 30 at-home testing kits for coronavirus, STDs, hormone or cholesterol tests, and vitamin deficiencies.

- LetsGetChecked partnered with United Healthcare and ConcertoHealth to provide coronavirus at-home tests for vulnerable patients.

- LetsGetChecked sales have increased (especially in the coronavirus diagnostics sector) by 880% since the onset of the pandemic in March (during the fiscal year 2019-2020).

- LetsGetChecked signed a mutually beneficial partnership with American Airlines, to enable safe air travel through the use of coronavirus testing. American Airlines now offers travelers to show proof of negative COVID test using at-home LetsGetChecked coronavirus testing service.

- LetsGetChecked also formed strategic partnerships with professional sports leagues to provide at-home testing services for various sports players, teams, and during tours.

- 2. EverlyWell was the first company to receive an Emergency Use Authorization from the FDA to sell an at-home COVID-19 test.

- EverlyWell also offers 35 different diagnostic testing panels ranging from food sensitivity, fertility, cholesterol, heart health, STI's, lyme disease, testosterone, thyroid and more.

- EverlyWell partnered with Humana health insurance company with more than 20 million members, to provide at-home tests to patient's homes to screen for a variety of health concerns.

Market Segmentation based on Sample type

- Based on the sample type, the at-home testing is segmented into urine, blood, saliva, and others.

- Urine tests are the most common type of diagnostic tests that are utilized for the purposes of detecting pregnancy, ovulation, or drugs. The urine sample type market segment dominated the global home diagnostics market share with a 38.72% share (in 2017).

- The urine sample type segment led the global home diagnostics market with USD 1.85 billion revenue in 2017.

- Emerging sectors for the global home diagnostics market include swabs and saliva samples due to the increasing demand for COVID at-home diagnosis.

Market Players:

- Key U.S. market players in the manufacturing of both laboratory and at-home diagnostics include Thermo Fisher Scientific, SYNLAB, Siemens Healthcare Private Limited, Roche Diagnostics, Drägerwerk AG & Co. KGaA, Beckman Coulter, Inc., and Abbott Laboratories.

- The major competitors that only manufacture at-Home Health Testing platform include Everlywell, AIDE Mobile App, 23andMe, Modern Fertility, ixlayer, Future Family, Pixel by LabCorp, LetsGetChecked, Cue Health, and UDoTest.

- Global players in the home diagnostics market include Abbott Laboratories, ACON Laboratories Inc., BTNX Inc., ARKRAY Inc., Assure Tech (Hangzhou) co. Ltd., Becton Dickinson & Company, Bionime Corporation, Roche Holding AG, Quidel Corporation, True Diagnostics Inc, Bayer AG, Siemens AG, Abaxis Inc., Beckman Coulter Inc., Alere Inc., Trinity Biotech Plc, and Danaher Corporation among others.

- Most market players are inclined towards manufacturing diabetic test kits, as well as infections test kits owing to the COVID-19 pandemic.

SWOT Analysis

(I) Strengths:

- Rising awareness about the importance of self-monitoring and self-diagnosis of diseases

- Increasing prevalence of lifestyle-associated diseases such as diabetes

- Growing geriatric population around the world

- Increasing acceptability around at-home tests and point-of-care diagnostic devices.

- Immediate benefits: faster results, receive more accurate diagnoses, non-invasiveness, cost-effective, less complex, can be available to masses in rural and remote areas.

(II) Weaknesses:

- High-cost of the self-diagnosis kits

- Stringent regulatory approval process

(III) Opportunities:

- Ease in FDA regulations for mass COVID testing (including the provision of Emergency Use Authorization legislation)

- Technological advancements in the diagnostic technology

- Increasing demand from the Asia-Pacific region

- Demand is increasing for rapid diagnostic and point-of-care (POC) devices for immediate tests.

- Increasing approvals of immunoassay tests by regulatory agencies

- Ongoing seroprevalence epidemiological surveys to assess the COVID infection rate, and expanding implementation of POC and rapid testing are some key driving factors of the COVID-19 detection kits market.

(IV) Threats:

- The high cost of the self-diagnosis kits and stringent regulatory approval process are anticipated to hamper the market growth over the forecast period.

- Concerns related to the accuracy (sensitivity and specificity) of the home diagnostic kits

- Low penetration in the developing economies