Part

01

of two

Part

01

What does the comparison of the lending landscape leading up to the 2008/09 financial crisis to the current lending landscape in the US look like?

Introduction

This research compares the lending landscape leading up to the 2008/09 financial crisis to the current lending landscape in the U.S. It explores the preliminary signs or indicators based on the lending landscape predicting a recession and uncovers the characteristics of the lending landscape leading to a recession, including the most affected industries by the financial crisis.

1. 2008/09 Financial Crisis Lending Landscape

Factors that Showed the Recession Was Coming

- The housing market bubble started in 2007, eventually leading to the global financial crisis. Lending institutions offered low-interest rates and encouraged many home buyers to take out mortgages they could not repay.

- The subprime loans packaged as mortgage-backed securities and originated with high loan-to-value (LTV) ratios posed the most significant risk factor. Moreover, issuing loans without proper documentation of income or assets increased the risk factors for massive defaulting.

- Deregulation of the Glass-Steagall Act by allowing large mergers and separating commercial and investment banking led to a nationwide expansion of corporations that swallowed smaller banks and brokerage firms, making people believe they were "too big to fail."

- As 2007 got underway, many subprime borrowers were stuck with mortgages they could not pay. Consequently, subprime lenders started filing for bankruptcy, one after another. From February through March 2007, over 25 subprime lenders went under. For example, New Century Financial filed for bankruptcy and laid off 54% of its staff.

- Risky financial behaviors at Wall Street securitized and bundled poor security loans and sold them to institutions that later repackaged and resold them as collateralized debt obligations (CDOs). Banks also insured subprime loans using credit default swaps (CDS), making it hard for investors to assess the actual risk.

Characteristics of the Lending Landscape

Increased Interest Rates

- The Federal Reserve kept interest rates low throughout the early 2000s and started hiking them in 2004 when the federal funds rate was 1.25%, and by 2006 it reached 5.25%.

- At the same time, home prices were peaking while the market was slowing down. Hence, when supply exceeded demand, home prices declined.

- The increasing interest rate and falling home prices wiped home values and made it difficult for subprime borrowers to repay their mortgages.

Loose Lending Standards

- Real estate was booming in the decade leading to the 2008/09 recession. To encourage more buyers, lenders approved as many loans as they could, including subprime mortgages.

- The new move opened a window for new home buyers who did not qualify for conventional mortgages. While the interest rates were lower during this period, they rose after the recession, leaving many subprime buyers unable to afford their homes.

Poor Loan Rating System

- A report by Senate later found that the actions of the nation's financial watchdogs, S&P, Moody’s Corp, and Fitch Ratings Inc., contributed to the financial crisis.

- The watchdogs rated many subprime loans AAA, which they later cut to junk status. During that period leading to the crisis, the agencies rated many securities AAA, even though they contained risky mortgages.

Most Impacted Industries by the Recession

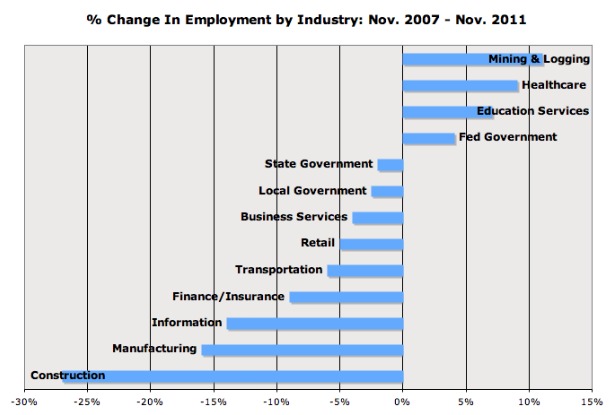

- The most impacted industries by the recession include

- The building material, construction, and supplies sector.

- The manufacturing industry.

- As shown in the image above, the construction and manufacturing sectors saw the biggest decline in employment from 2007 to 2011.

- The construction sector's employment shrunk by over -25%, while manufacturing shrunk by over -15%. Each sector lost about two million employees.

2. Current Lending Landscape (2021-2023)

Indicators Indicating a Recession Is Coming

- The U.S. recession probability index for January 024 is predicted at 57.13%. The probability had been climbing from 7.08% in June 2022.

- Declining small business lending and softening loan demand indicate fewer consumers seek loans amid fears of an imminent recession. In 2022, demand for loans at small and large banks declined by 2% and 5% across mid-sized banks.

- Increasing interest rates have caused concerns about a recession. As a result, the Fed recently hiked the federal funds rate by 75 bps to curb inflation. The higher rates make borrowing expensive, and rising credit cards, mortgages, auto loans, etc., will reduce Americans' disposable income.

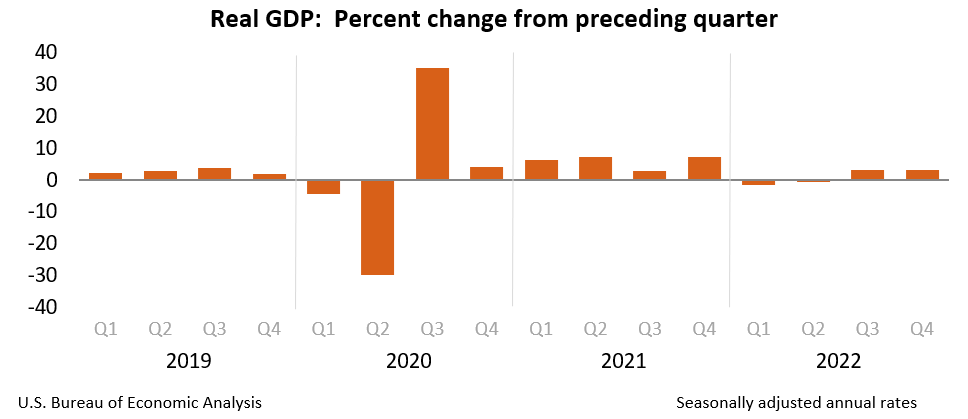

- The declining U.S. gross domestic product plunged by 1.4% in Q1 and 0.9% in Q2, making people worried that the economy is slowing down. While a slowing economy could be good for easing inflation as spending becomes curbed, continued slowing down can lead to a recession.

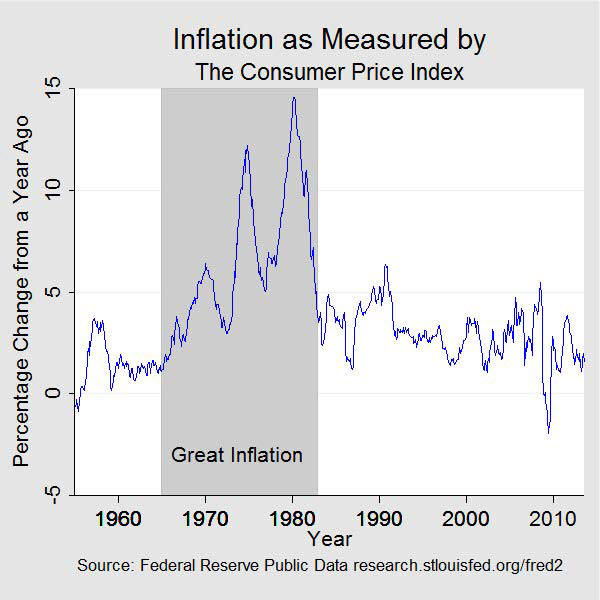

- Higher inflation remains the biggest threat to the U.S. economy. In 2022, the inflation rate was 7.48%, declining to 6.41% by January 2023. The higher inflation causes employees' pay to drop, and people of color bear the most pain since they struggle to afford necessities.

Characteristics of the Lending Landscape

Declining Demand for Loans

- Higher interest rates and forecasts for slower economic growth have led to decreased demand for loans as consumers and commercial clients become worried about a potential recession.

- The recent increase in interest rates by the Federal Reserve to curb inflation resulted in a decrease in borrowing and spending. As a result, bankers and analysts expect loan demand to slow in the year ahead.

Negative Yield Curve

- The current Negative Yield Curve (a measure of investors' returns on bonds) does not point to a good direction for the U.S. economy.

- It has been flattening, and in early April 2022, it dropped to the negative territory, fluctuations that cast doubts on the economy's direction.

Rising Delinquency Rate for Mortgages

- The Mortgage Bankers Association noted that by the end of 2022, economic headwinds and inflationary pressures caused delinquency rates for residential property loans to rise.

- Mortgage delinquency rates reached 3.96% in Q4, up 51 basis points from Q3. The weaker economy and ongoing inflationary pressures contribute to the rising delinquencies across all loan types.

Most Impacted Industries by the Current Lending Landscape

- According to Acorns, the real estate sector suffers a lot during recessions, with many activities, from construction to supplies coming to a standstill.

- The banking sector is also significantly affected by a recession. Demand for new loans slows, and consumers fear taking loans due to job insecurity during economic downturns.

Research Strategy

For this research about comparing the lending landscape leading up to the 2008/09 financial crisis to the current lending landscape in the U.S., we leveraged the most reputable financial and economic reports available in the public domain and published by renowned players like Acorns, American Banker, AP News, Brookings Education, Business Insider, Corporate Finance Institute, Forbes, Investopedia, LiveMint, Reuters, Statista, The Atlantic, The Balance Money, U.S. News, and Y Charts.