Part

01

of one

Part

01

Cryptocurrency DeFi Major Players

Key Takeaways

- NFTX's mission is to be a black hole for NFT assets, i.e., be the main issuer of NFT vault tokens and "allowing anyone to trade & invest in NFT markets without needing the underlying knowledge and expertise required when investing in individual assets."

- According to a post on Medium by JPEG'd, the company aims to transform Cryptopunks from static investments and make them able to earn yields by enabling users to "deposit their Cryptopunks into a smart contract and be able to mint a synthetic stablecoin, PUSd effectively giving them liquidity on their punks and able to earn yield in DeFi."

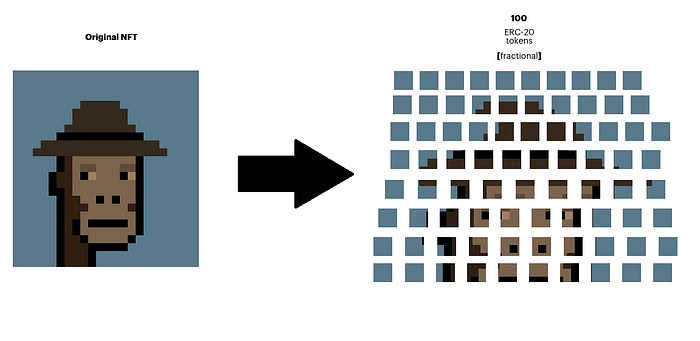

- Fractional is a platform where people can buy, sell, and mint fractions of NFTs. According to its Medium page, "Fractional is a decentralized protocol where NFT owners can mint tokenized fractional ownership of their NFTs. These tokens then function as normal ERC20 tokens which have governance over the NFT that they own."

Introduction

We have provided an overview of the following major players in the cryptocurrency/DeFi landscape: Arcade, NFTX, JPEG'd, Fractional, NftFi, Fraktion, Solvent, Honey, SharkFi, and Pawnshop Gnomies.

Arcade

- The Arcade Network is the "world's first decentralized platform providing cross metaverse asset interoperability."

- By using blockchain technology and NFTs, Arcade creates a unified bridge that helps with the smooth movement of in-game assets.

- The Arcade Network has the following features and benefits:

- It enables the "transfer of in-game assets from one metaverse to another."

- Has SDKs that are easy to plug in and use for game developers.

- All assets from various multiverses are aggregated in one place.

- The network claims to be the world's first-ever metaverse money market. The platform has partnered with many gaming companies, investors, and technology and marketing partners as it seeks to launch more features this year.

- According to ArcadeNetwork CEO Chinka G. "ArcadeNetwork envisions to open a whole new dimension and create abundant opportunities in the Gaming world."

NFTX

- According to the company website, "NFTX is a platform for making ERC20 tokens, also called vault tokens, that are backed by NFT collectibles. These tokens are fungible and composable. With NFTX, it is possible to create and trade tokens based on your favorite collectibles such as CryptoPunks, CryptoKitties, and Avastars, right from an exchange."

- NFTX users can load an NFT into an NFTX vault and proceed to mint a fungible ERC20 token (vToken) which represents a claim on a random asset from within the vault and can be used to redeem a specific NFT from a vault.

- NFTX's mission is to be a black hole for NFT assets, i.e., be the main issuer of NFT vault tokens and "allowing anyone to trade & invest in NFT markets without needing the underlying knowledge and expertise required when investing in individual assets."

- Below are some of NFTX's benefits:

- "LP and stake minted vTokens to earn yield rewards."

- "Better distribution and price discovery for NFT projects."

- Users can "instantly sell any NFT by minting it as an ERC20 and swapping via Sushiswap."

- NFT Investors and speculators get increased liquidity.

- According to the company, NFTs in their basic form do not yield value for the holder. NFTX enables NFT collectors to use decentralized finance to unlock the value of their NFTs by "earning protocol fees, earning trading fees as a liquidity provider, and farming with stablecoins using vTokens as loan collateral."

- Since NFTs are illiquid and difficult to price, NFTX simplifies the market for investors and speculators by giving them access to the most liquid markets for NFTs and tracking the price of particular categories of NFT.

- NFTX targets "investors, arbitrageurs, and NFT liquidity providers."

- Some of NFTX's features include:

- Contracts are on-chain and fully permissionless.

- The interface is "built and maintained by the NFTX DAO," and there are plans to make it open-sourced.

- Users are not charged any fees to use NFTX V1. However, "NFTX V2 allows vault creators to charge fees based on minting and redeeming NFTs in and out of the vaults."

JPEG'd

- JPEG'd is a protocol that in the future the NFT space extends to music royalties and albums. JPEG'd's mission is to bridge the gap between NFTs and DeFi to enable holders of Cryptopunk to use their punks as collateral to open NFDPs.

- In October 2021, JPEG'd announced a "Token Generation Event (TGE) that will launch a new DeFi primitive: NFDPs (non-fungible debt positions). The pillar of DeFi is the permissionless and trustless collateralized debt position, enabling users to obtain liquidity using their capital as collateral. This model has proven to be resilient, scalable, and the cornerstone of DeFi. The center of NFTs are Cryptopunks with the most liquid market and highest capitalization."

- According to a post on Medium by JPEG'd, the company aims to transform Cryptopunks from static investments and make them able to earn yields by enabling users to "deposit their Cryptopunks into a smart contract and be able to mint a synthetic stablecoin, PUSd effectively giving them liquidity on their punks and able to earn yield in DeFi."

- JPEG, a governance token, will manage, "administer, and change parameters to the protocol."

- In the future, JPEG'd will expand to accommodate other NFTs and expand to music royalties and albums to enable artists "to own the rights to their music as an NFT and obtain a line of credit in the form of PUSd."

Fractional

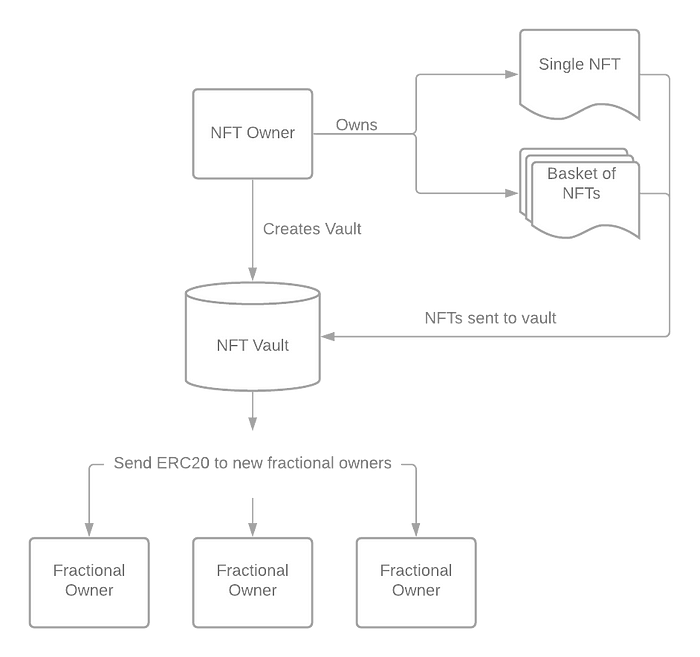

- Fractional is a platform where people can buy, sell, and mint fractions of NFTs. According to its Medium page, "Fractional is a decentralized protocol where NFT owners can mint tokenized fractional ownership of their NFTs. These tokens then function as normal ERC20 tokens which have governance over the NFT that they own."

- The platform gives users the ability to own a fraction of the most popular NFTs in the world. The platform "reduces entry costs, increases access, and enables new communities."

- Fractional allows for a "collective ownership of iconic and historic NFTs" and is a unique way to unlock NFT liquidity while building a community around the most sought-after NFTs in the world.

- Some of the benefits users get from using the platform include:

- Accessibility: users can own part of an NFT, which they could otherwise not afford.

- Freedom: users have the freedom to choose what to do with the NFT fractions they own.

- Creativity: Fractional users have the option of owning fractions of the most iconic digital art collections with one or more NFTs.

- Diversity: Users can "deliver imaginative distribution events and novel post-purchase community experiences for their fraction owners."

NFTfi

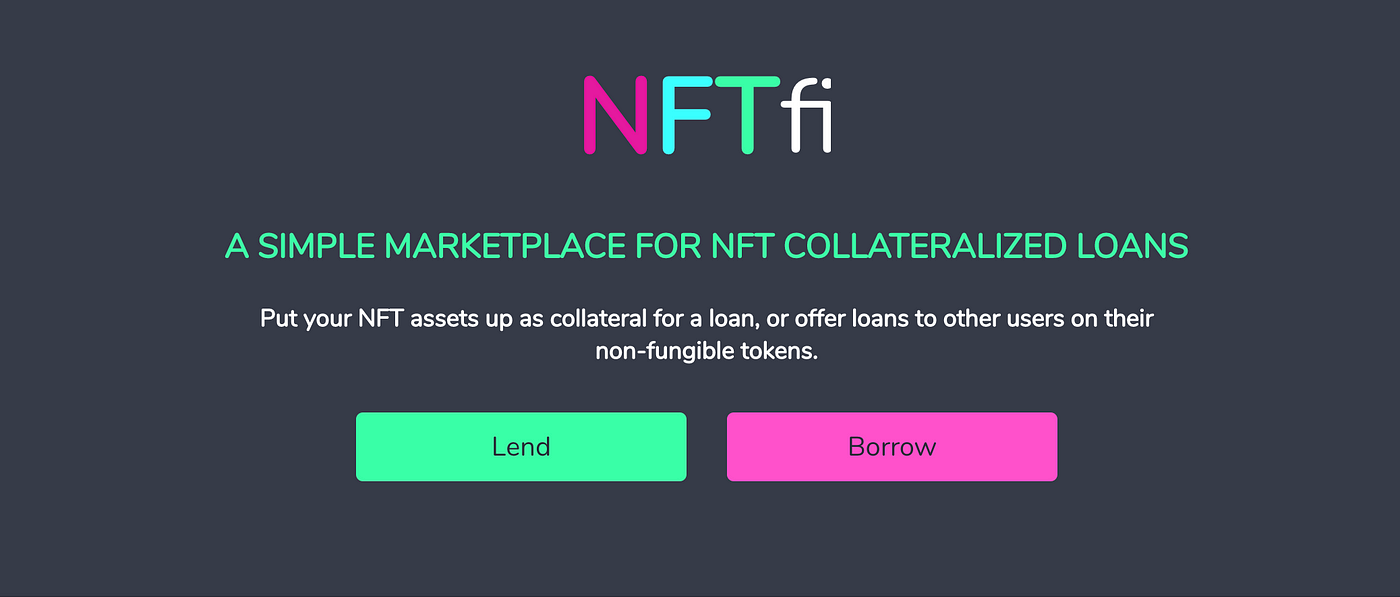

- NFTfi is a "marketplace for NFT collateralised loans" where users can take out loans using their NFTs as collateral for a loan or "offer loans to other users on their non-fungible tokens."

- Borrowers can use any ERC-721 token as collateral for a loan from other users. Once they accept the loan, the ETH is paid out from the lender's account to the borrower's account, and their NFT is locked in the NFTfi smart contract.

- When the loan is repaid, the NFT asset is transferred back to the borrower. If the borrower defaults on the total repayment amount, the asset is transferred to the lender.

- Borrowers are not charged by NFTfi since they already pay fees to the lenders. NFTfi "takes is a 5% share of the interest that the lender has earned on a successful loan."

Fraktion

- Fraktion is an "open source protocol that anyone can use to fraktionalise or break into parts an NFT token on Solana. It was built by the team behind Frakt.art with help from the team at Metaplex and it is part of the Frakt ecosystem."

- Fraktionalization is breaking up an NFT into fraktions/smaller parts. The Fraktion protocol locks the original NFT in a vault and releases tokens to represent parts of the original NFT. These tokens are then emitted to the owner of the NFT, so they maintain ownership of all the fraktions of the original NFT.

- While people can fractionalize an NFT, "Fraktion.art has a built-in security mechanism that only allows fraktionalisation of NFTs belonging to the original collection. That means we check NFTs for authenticity in order to prevent scams."

- Some of the benefits offered by the platform to users include:

- Accessibility: the platform has lowered the "barrier to entry for the NFT ecosystem and blue chips."

- Flexibility: users can share, buy, or sell their fraktions.

- Decentralized: the platform is "open and community-driven by FRAKT DAO."

- NFT owners can "free up capital to explore new ventures whilst still having the luxury of owning their NFT."

- So far, Fraktion has 52 NFTs worth $595,300.75 locked in vaults and has issued 122.6 billion tokens.

Solvent

- According to the website, "Solvent is a platform to convert your NFTs to fungible tokens known as droplets, giving you instant liquidity. Droplets can be traded on AMMs for any other crypto token on Solana."

- "Droplets are fungible tokens like $SOL or $USDC" and each NFT project has its own unique droplet.

- NFT owners can use the droplets from the NFTS to trade in the NFT projects/collections on Solvent buckets, swap them for $SOL or $USDC, stake them in liquidity pools and earn liquidity rewards or use them for lending.

- So far, there are 5 NFT projects locked in Solvent with $424,704.52 in value locked.

Honey

- Honey Finance offers liquidity solutions for NFTs and illiquid assets and "is the easiest and most intuitive liquidity protocol which implements the power of Non-Fungible Tokens into DeFi."

- According to Honey Finance, non-fungible tokens are "illiquid, lead to unrealised gains, and present their holders with a massive opportunity cost, relative to what the same capital would yield if passively invested in DeFi."

- Honey's protocol provides liquidity solutions for NFTs and tackles the opportunity cost bottleneck by enabling NFT owners to collateralize their NFT assets on peer-to-and other staking programs such as farms and pools.

- The platform creates a DeFi protocol for NFTs, "allowing users to have access to a variety of financial use cases ranging from liquidity mining, to lending and borrowing." Honey believes that NFTs will push the limits of DeFi financial services, and they are trailblazers in developing these expected use cases.

SharkFi

- According to Etherscan, Shark Fi is a token with a maximum total supply of 90 million tokens.

Pawnshop Gnomies

- The Gnomies are "highly educated creatures who run a DAO-based NFT Pawnshop on Solana." The Gnomies are "5,555 unique, smart, algorithmically generated creatures stored with a proof of ownership on the Solana blockchain."

- Holders of NFTs can use their assets as collateral for loans and get them back once they are done repaying the loan.

- Pawnshop Gnomies's mission is to develop financial services that benefit the community.

- The platform offers its users the following benefits:

- "IDO lending protocol tokens as part of the community allocation."

- "Private liquidation sales."

- "The ability to receive airdrops from the loaned asset without repaying a loan first."

- "The use of Oracle AI for free to evaluate any assets and explore forecasts."

- "Early access to lending protocol."

- "An opportunity to be part of the DAO and take decisions on how to use royalties from the secondary market and profits from the pawnshop business."

Research Strategy

To provide the requested information, we searched through the official websites of the players in this request, the official documentation and whitepapers, social media platforms, as well as third-party company profile sources and press articles.