Part

01

of one

Part

01

Crypto Exchanges - SWOT Analysis

Key Takeaways

- Coinbase was ranked No. 1 by CryptoCompare Exchange Benchmark Report in August 2021.

- Binance is the largest cryptocurrency exchange in trading volume as ranked by CryptoCompare in February 2021. It also currently ranks number 1 with an exchange score of 9.9 as assigned by CoinMarketCap.

- Kraken ranks first with a perfect cybersecurity score in the Top 100 Exchanges Cybersecurity Rating by security review site CER.

- eToro is the best platform for trading both cryptocurrencies and fiat currencies.

- Exchanges compete on features such as the variety of digital assets, trading volume, pricing structure, secure platform, real-time processing speed, user-friendly, accessibility, and customer service.

Introduction

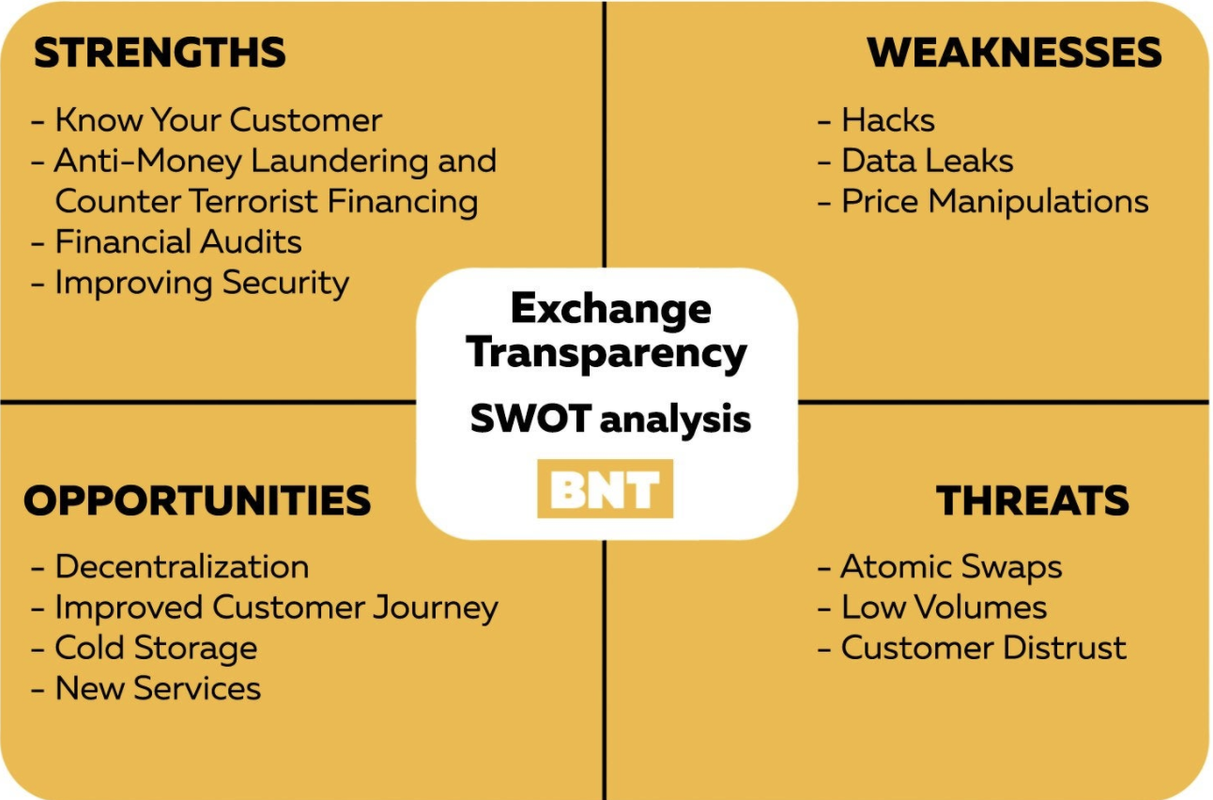

The research brief presents a SWOT Analysis of Coinbase, Binance, Crypto.com, Kraken, and eToro leveraging on credible and reputable sources in the public domain. Information and data on the strengths, weaknesses, opportunities, and threats of the 5 crypto exchanges are adequate in the public domain. The research identified the top considerations for choosing a crypto exchange as security, a wide selection of crypto assets, trading liquidity, transaction pricing, payment options, user-friendly platform, customer support, and geographical coverage. The research strategy at the end of this brief outlines the research process.

How Do Top Crypto Exchanges Rank?

- Business Insider lists the best crypto exchanges in September 2021 as Coinbase, Binance.US, Kraken, Cex.Io, Gemini, and Bittrex.

- GlobeNewsWire and SFGate define the best crypto exchanges as follows: Binance as the best overall with low fees, Kraken with the best customer service and top bitcoin exchange, Coinbase as the best for beginners, eToro with crypto to forex, Crypto.com with great signup bonus, Coinmama with simple brokerage services, Bisq for privacy with no ID verification, Bittrex with attractive trading volumes, Robinhood with a low-cost crypto exchange, Trade Station with best trading options, and Gemini with strong security features and best for US crypto traders.

- CryptoCompare utilizes 34 metrics based on Geography, Legal/Regulatory Assessment, Investment Funding, Team/Exchange Quality, Data Provision Quality, Trade Surveillance, and Market Quality to rank over 100 active exchanges. It assigns a grade based on the total cumulative score in comparison to the ranked exchanges.

- Based on the metrics and total cumulative score, Coinbase was ranked No. 1 by CryptoCompare Exchange Benchmark Report in August 2021. It is great for beginners and long-term Investors.

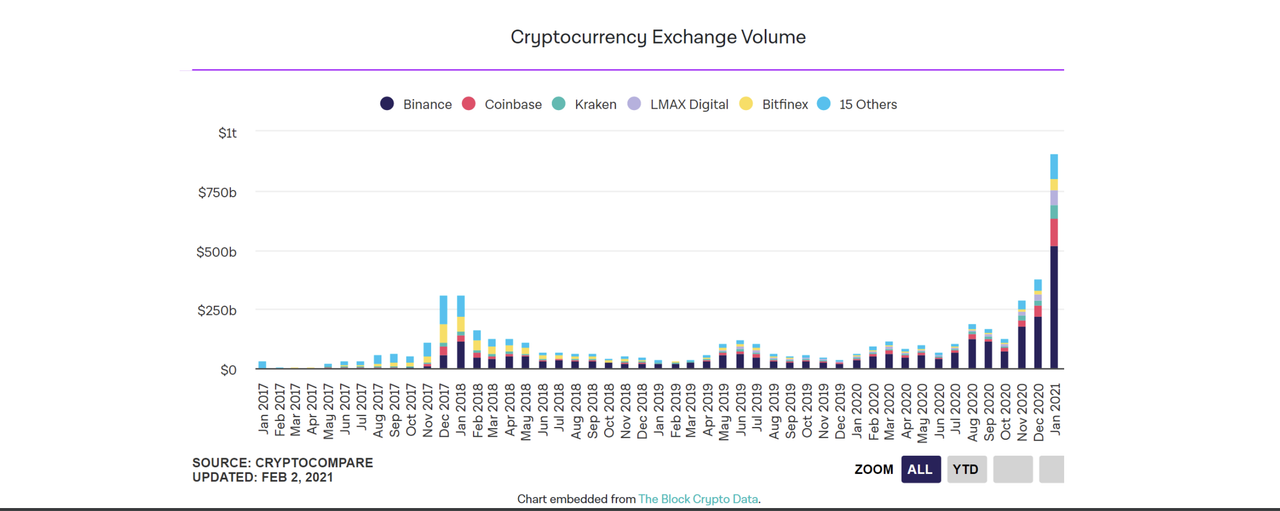

- Binance is the largest cryptocurrency exchange in trading volume due to geographical exposure in Asia, greater breadth of assets, and support of futures.

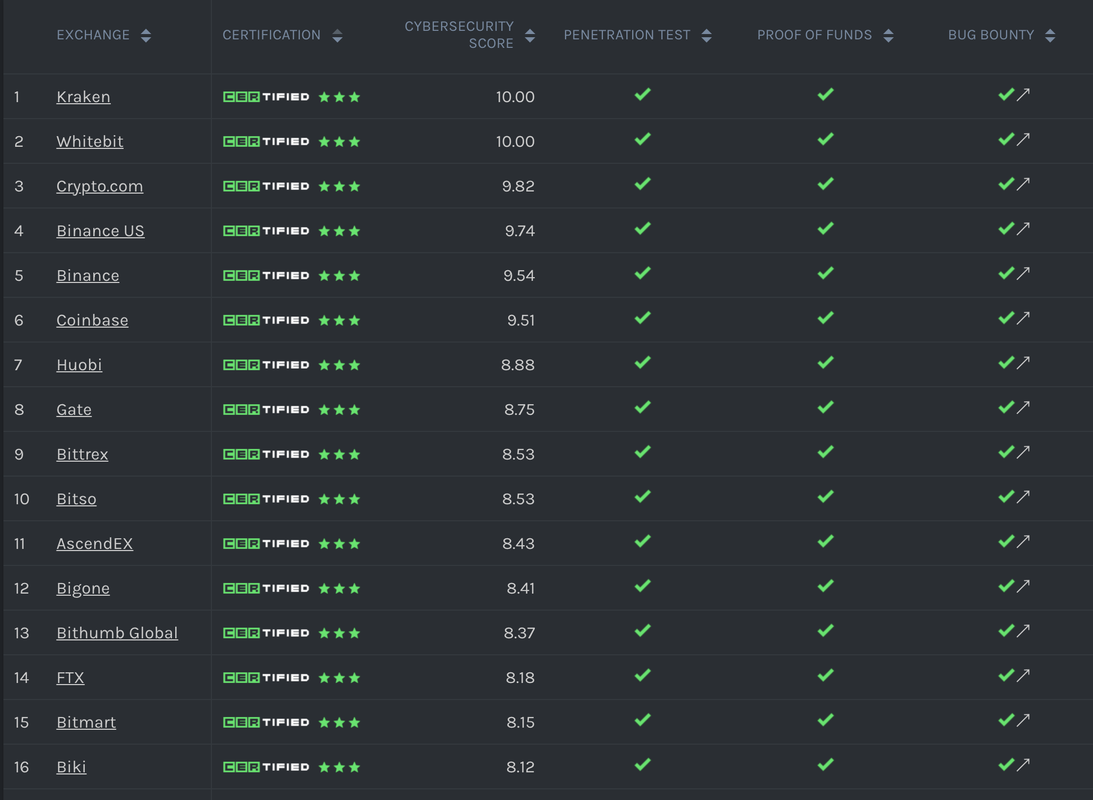

- Kraken ranks first with a perfect cybersecurity score on the Top 100 Exchanges Cybersecurity Rating by security review site CER.

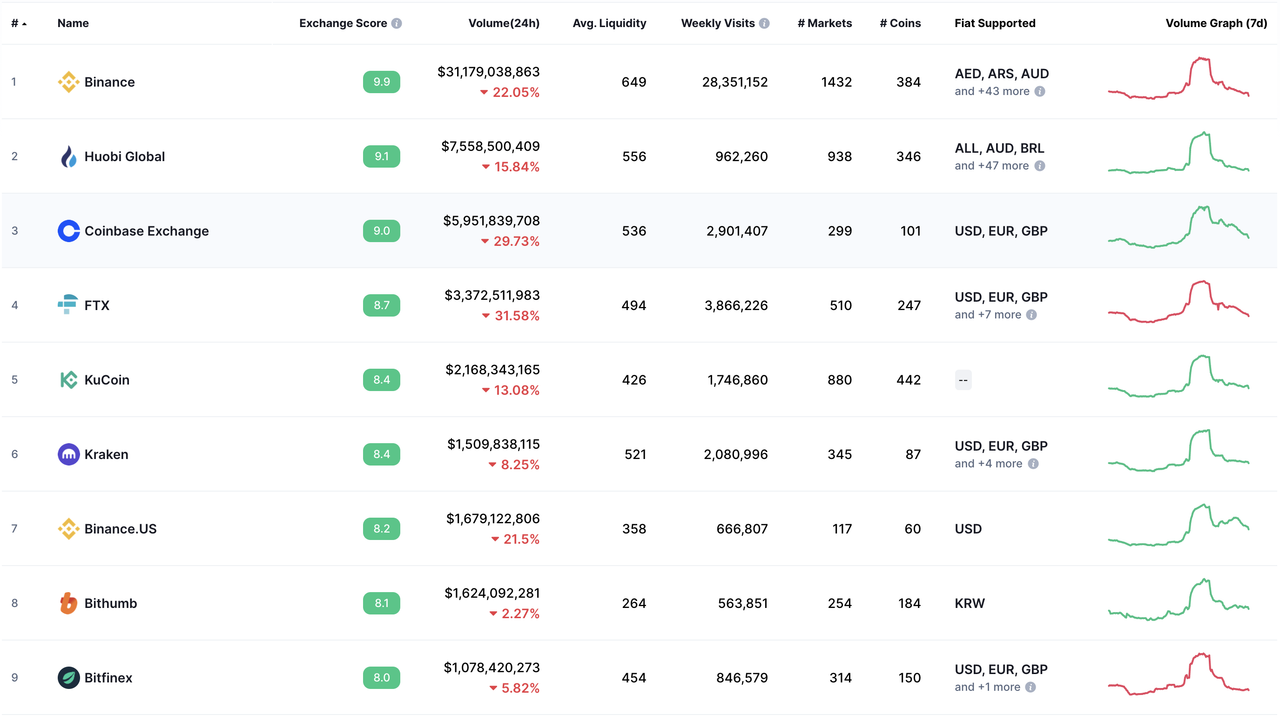

- CoinMarketCap currently lists 305 cryptocurrency exchanges that it ranks and scores based on traffic, liquidity, trading volumes, and confidence in the legitimacy of the reported trading volumes. Binance ranks number 1 with an exchange score of 9.9.

How Advanced Are They In Providing Crypto Liquidity?

- Liquidity refers to the ease and speed at which an asset can be bought or sold at a stable price on a given market. The quicker you can buy and sell an asset closest to the bid or ask price, the more liquid is the exchange.

- Coinbase is a very high liquidity exchange with a trading volume of about $462 billion per quarter.

- Binance is a high-frequency exchange platform with a $2 billion average daily trading volume, and 1, 400,000+ transactions per second.

- Kraken is a high liquidity exchange that offers deep liquidity with spreads as tight as 1 pip. It is the "largest exchange by Euro volume" in the world hence among the top exchanges by bitcoin liquidity.

- eToro has an advanced cryptocurrency exchange with deep liquidity and tight spreads, an "expanding list of crypto assets and stable coins", and unique tokenized assets.

How Do Consumers Choose Which Exchanges For Crypto Liquidity? Why Does A Consumer Choose Coinbase vs. Binance vs. Crypto.com?

- According to Statista research regarding the problems that traders face in crypto exchanges, 40% of the respondents considered security as the biggest problem, 37% complained of high trading fees, 36% believed its lack of liquidity, and 33% identified with customer support.

- They consider ease of access of the crypto market by analyzing the efficacy of the hot wallet, liquidity, and its capacity to instantly match orders; compounded transaction fees against earnings; and the credibility and reputation of the exchange with regard to regulatory compliance.

- GlobeNewsWire and SFGate recommend that the following factors are considered in choosing a crypto exchange platform: "security features, region jurisdiction, selection of cryptocurrencies, buying limits and liquidity, payment methods", "platform ease of use, insurance fund, and transaction fees,"

- Exchanges compete on features such as the variety of digital assets, trading volume, pricing structure, secure platform, real-time processing speed, user-friendly, accessibility, and customer service.

What Are Their Strengths and Weaknesses? What Advantages Does Each Exchange Have? How Do They Serve Different Customers' Needs?

Coinbase

- Coinbase Global Inc. is a cryptocurrency exchange platform that was founded on 20 June 2012 and is based in San Francisco, California. Its founders are Brian Armstrong and Fred Ehrsam.

- It was the first major cryptocurrency to be publicly listed on the NASDAQ in April 2021 giving it an initial market cap of $99.6 billion on a fully diluted basis and is currently valued at $257 billion. It reported revenues of $1.8 billion in the first quarter of 2021 and $2.2 billion in the second quarter of 2021.

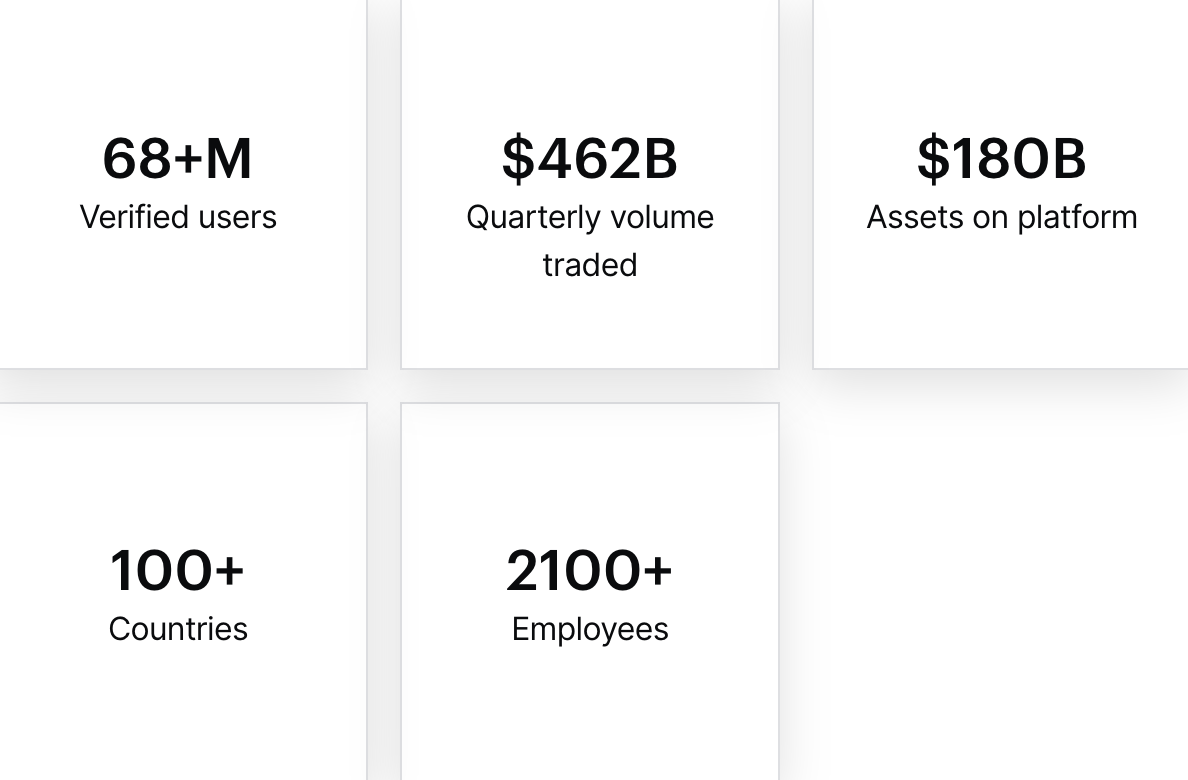

- Coinbase is the largest and most popular platform for trading and storing cryptocurrencies in the United States and Europe. It has "approximately 68 million verified users, 9,000 institutions, and 160,000 ecosystem partners in over 100 countries" including Australia, Canada, Singapore, and the United Kingdom.

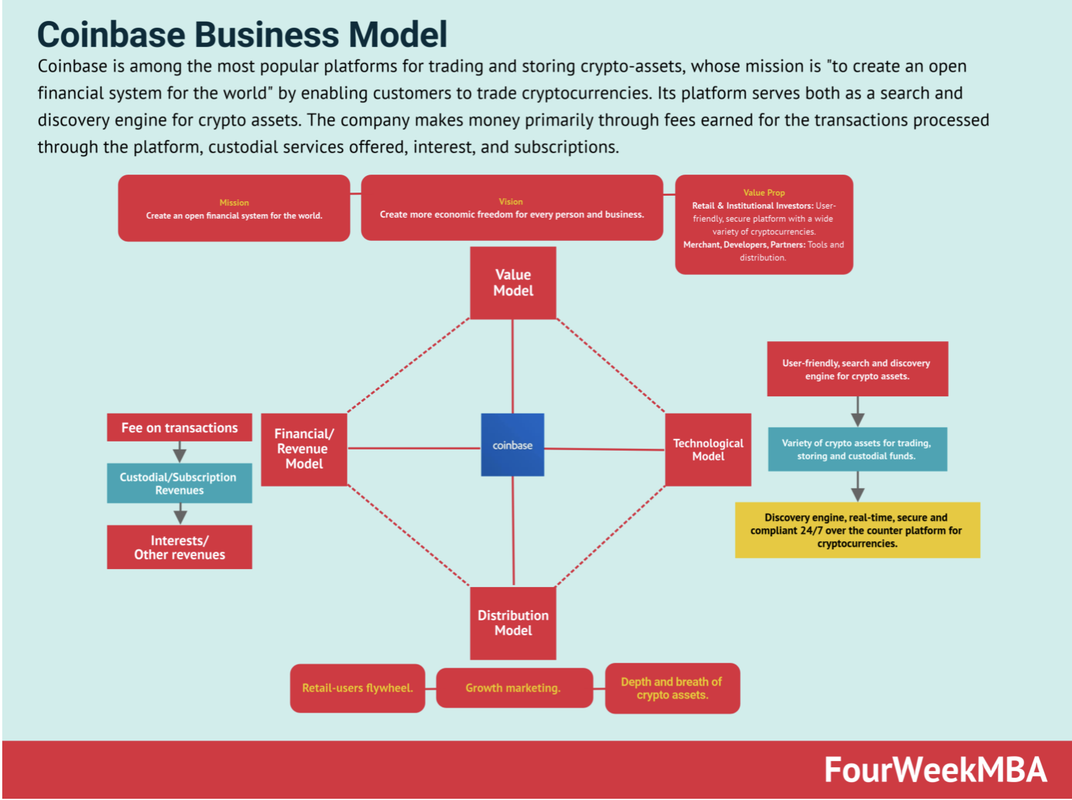

- It operates a business model that aims to offer an open financial system for the world. Its competitors are Gemini, Kraken, Bittrex, Binance, and Bitstamp.

- Coinbase Commerce has 10,000 monthly users, over 2000 merchants, and processes $50 million transactions.

SWOT Analysis of Coinbase

Strengths

- "It serves many roles in the traditional financial sector such as fiat on-ramp, exchange, broker, bank and custodian". Coinbase offers comprehensive services and products via a single platform that is user-friendly and accessible through the website and mobile applications that run on Android and Apple devices.

- It supports 66 cryptocurrencies popular digital currencies such as Bitcoin, BitcoinCash, Etherium, Ripple, Litecoin, Dogecoin, and Cardano.

- It is a very high liquidity exchange with a trading volume of about $462 billion per quarter ($317 billion by institutional and $145 billion by retail).

- Coinbase stores 98% of its digital assets in secure offline storage known as cold storage. It offers secure and segregated custody services for institutional partners and corporate customers to invest and store digital funds and cryptocurrencies under the regulation of NY State Banking Law.

- Coinbase ensures top-notch security with two-step verification, "AES-256 encryption, and multi-signature wallets," bio-metric logins, data encryption, "the use of a bug bounty program", and is compliant with regulations for operations in the United States.

- Coinbase "maintains crypto-insurance with all USD cash balances covered by FDIC insurance up to a maximum of $250,000" and the platform is insured against damage or theft.

- It operates Coinbase Pro that offers a more robust charting and trading experience for professional traders where they can instantly transfer funds for free between Coinbase and Coinbase Pro. It also offers Coinbase Prime for institutions and high-net-worth customers with at least $1 million.

- Coinbase developed USD Coin, a stable coin (1 USDC:1 USD) that investors can hold to earn a 0.15% annual percentage yield. It also accepts "bank deposits, bank transfers, Paypal, and credit/debit cards payments".

- "Corporate customers can use its plug-ins and API for easy access and integration with e-commerce stores such as Shopify, WooCommerce" and Magento. Coinbase customers can pay for the purchase of online products through the digital wallet and corporate customers can receive payments through cryptocurrencies such as Bitcoin and Ethereum and convert them to USD or USD Coin through the exchange and wallet services.

- It runs a venture capital fund called Ventures for new startups offering full technical and financial support to develop new digital assets towards an open financial system.

- Coinbase is a search and discovery engine for cryptocurrencies with a library of information about trading cryptocurrencies. It has a referral program where a user can invite a friend and earn $10 of Bitcoin and taking a course or lesson earn users $3 — $10 in cryptocurrency.

Weaknesses

- It has been slow in adding cryptocurrencies for trading on its platform compared to its top competitors impacting on new customer acquisition and trading volume. It also lacks options and futures.

- It charges a flat rate or variable fee based on user location or transaction/payment/funding type. This pricing structure is costly for retail customers whose trading transactions are high and are not on Coinbase Pro.

- Its revenue stream is highly volatile as it is pegged to the price and adoption of cryptocurrencies. Its revenue sources are transaction revenue at 86%, other trading fees at 4%, and subscription and services revenue at 11%.

- Coinbase transaction revenue is over-reliant on the trading volume of Bitcoin and Ethereum comprising 72% of assets traded in 2019 and 56% of assets traded in 2020.

- Sluggish customer support with no live support chat and response to emails takes 1-3 days.

- Breach of security with reports of hacks draining customers' accounts.

Opportunities

- Its valuation could hit $500 billion in 2-3 years and $1 trillion in 5 years.

- In 2020, it doubled cryptocurrencies for trading on its platform but there is still an opportunity to expand further since several cryptocurrencies are in existence.

- "Leverage on its size and reputation and vertically integrate to provide a competitive advantage over its competitors." It can expand its crypto assets, products, and geographical coverage to Asia and Latin America.

- Adoption of cryptocurrencies as an investment diversification and inflation protection presents opportunities for additional crypto assets and new products such as Decentralized Finance Applications, futures, and options.

- Expand its revenue stream and sources. Opportunities lie in "monetizing its 63+million retailer base through custodial fees for dedicated cold storage, staking revenue from staked cryptocurrencies, commission revenue from educational campaigns by crypto-asset insurers, interest income on customers' cash, and license revenue from Coinbase Analytical Service."

- "Upcoming Coinbase Visa debit card where users can earn up to 4% in rewards on every purchase."

- "Purchase and own a credit union or bank and vertically integrate for seamless integration between fiat currency and digital currency." This will increase its brand and trust since some card providers and banks block cryptocurrency transactions

Threats

- It is subject to several heightened regulations and laws around the world and extensive monitoring of trades, especially in the United States.

- The heightened taxation and tax treatment of cryptocurrency trades can affect the profitability of traders in the United States.

- It aims to decentralize the financial system including the decentralization of money hence lacks support from the traditional financial sector.

- It faces several litigation cases around the world.

- Several new entrants in decentralized exchange services such as commission-free online brokers like eToro and Robinhood.

Binance

- Binance Holdings Limited is a cryptocurrency exchange that was founded in China in 2017 but recently moved its headquarters to Valletta, Malta. It was founded by Changpeng Zhao and Yi He and currently has over 2000 employees in over 20 locations.

- In 2019, Binance.US was launched in San Francisco to solely serve U.S. customers after Binance halted its services in the United States. However, it does not serve the residents of Connecticut, Hawaii, Idaho, Louisiana, New York, Texas, and Vermont.

SWOT Analysis of Binance

Strengths

- It supports around 200 cryptocurrencies such as Bitcoin, Ethereum, BitcoinCash, Litecoin, Dogecoin, Ripple, and Cardano.

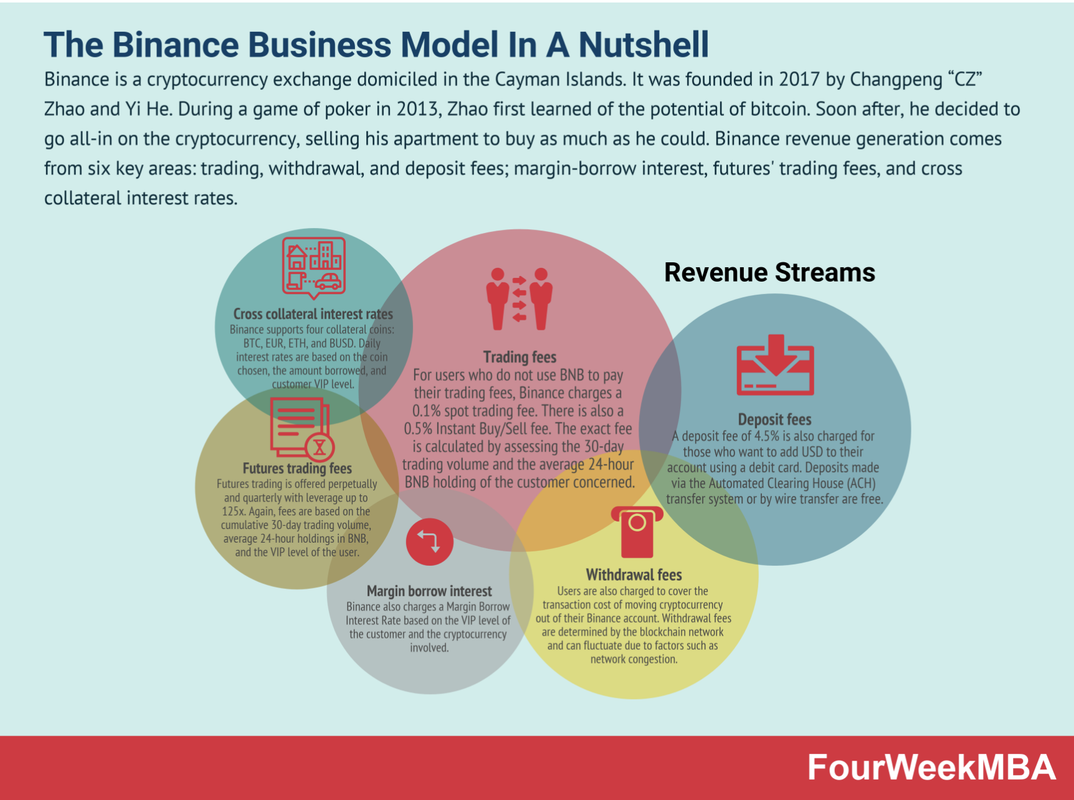

- It enables a high-frequency exchange platform with a $2 billion average daily trading volume, 1, 400,000+ transactions per second, and 24/7 customer support.

- It has over 13.5 million customers, very low fees at 0.1% flat trading fees, and a Binance Coin whose initial coin offering raised $15 million in July 2017.

- Binance provides staking rewards of 0.5%-10% through Binance Earn, has a dedicated Binance Pool for improving income of miners, Binance Card with up to 8% cashback on eligible purchases, Binance Peer to Peer Exchange, Stock Tokens for trading equity shares, Binance Pay for shopping and spending crypto at zero fees and Binance NFT Market Place. It also gifts prizes to its top traders such as iPhone and MacBooks.

- Binance insures customers against theft of funds via Secure Asset Fund for Users (SAFU), employs two-factor authentication on its platforms, and provides mobile access to its trading platform through Apple and Android devices.

- It allows bank deposits, bank transfers, and credit/debit card payment services for more convenient trading of cryptocurrencies.

- It offers margin trading for Bitcoin and Etherium, futures trading and coins future trading with leverage up to 125x, and options trading.

- There are two versions of the trading platform on Binance namely Basic to perform simple trades and Advanced for detailed technical analysis.

- Binance.US offers staking rewards of 1-10% for holding different crypto assets, a 25% trading fee discount if paying via Binance Coin, an automated investment feature, an Over The Counter (OTC) trading portal, and stable coins that are backed by US dollars. It also offers institutional customers with Websocket feed that produces real-time market data, a trading API, monthly staking rewards, and 24/7 customer service.

Weaknesses

- The website is difficult to navigate especially for beginners with no knowledge of cryptocurrencies.

- Poor and slow customers service with no live chat support and support bot services for general inquiries.

- Potential problems with ID verification and glitches with the two-factor authentication process.

- A deposit fee of 4.5% is charged on debit card deposits to the account.

- Binance.US is not available in seven states namely Connecticut, Hawaii, Idaho, Louisiana, New York, Texas, and Vermont.

- U.S. customers must use Binance.US with only 80 cryptocurrencies compared to around 200 cryptocurrencies in Binance.

Opportunities

- Binance has the potential of attracting huge investors and enhance the growth of the Binance Coin (BNB). It is estimated to be currently valued at $86 billion.

- "As Binance rolls out more features like staking, leveraged tokens, and DEXs, there will be more utility for Binance Coin."

Threats

- Binance is centralized and Binance still owns over 80% of Binance Coin. "This is a regulatory risk that can cause a serious hurdle for Binance Coin listing on other exchanges or being allowed to grow its utility on American or European soil."

- Technical and legal issues could cause a drop in demand and value of Binance Coin. It is exposed to a downside risk since more than 80% is under the custody of Binance. It could be subject to United States security laws as it is solely controlled by a private company.

- Binance has "engaged in regulatory arbitrage claiming to have no permanent headquarters in an attempt to avoid restrictive regulatory laws."

- Binance operations are under scrutiny in over 10 countries across Europe and Asia. In May 2021, Binance was under investigation by the U.S. government for tax fraud and money laundering.

- In June 2018, customers reported discrepancies and missing funds following a planned system upgrade.

- The exchange was hacked in June 2019 and crypto assets worth $40 million were stolen from its coffers.

Crypto.com

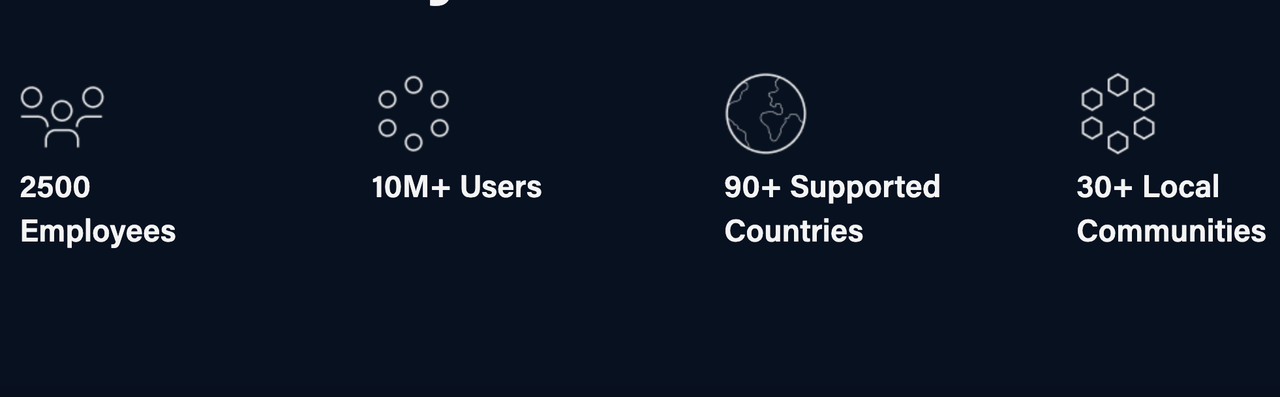

- It is a one-stop exchange for all cryptocurrency transactions with over 10 million users in over 90 countries including the United States., Australia, Singapore, Canada, and the United Kingdom. It is headquartered in Hong Kong Island, Hong Kong.

- Its legal name is MCO Malta DAX Limited and was founded in June 2016 by Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo.

SWOT Analysis of Crypto.com

Strengths

- It supports popular and favorite 100+ cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Cardano, Dogecoin, and Polkadot.

- It offers Crypto.com Coin (CRO) that provides investors with a "10% — 20% discount for staking up to 49,999 CRO for at least 6 months".

- "It offers several products such as Crypto.com Visa cards with reward tiers of 1%- 8% CRO cashback on certain purchases, "Crypto.com Pay at checkout at certain retailers", Crypto.com Earn up to 12% to 14% p.a. on staking deposits, and "Crypto.com Credit up to 50% of crypto collateral for non-U.S. customers."

- It also avails Crypto.com DEFI wallet for secure crypto storage, tax support through Crypto.com Tax, buying and selling of NFTs through Crypto.com NFT, and payment/merchant options via Crypto.com Pay for Business.

- It is cheaper with low fees and earning opportunities for customers with large holdings of CRO. The maker-taker pricing structure "rewards customers with higher trading volumes and awards opportunities to earn crypto and interest on deposits". It has regular promotions and offers up to $50 sign-up bonus.

- Secure platform with top-notch security with two-step verification, "AES-256 encryption, and multi-factor authentication wallets," "use of a bug bounty platform to detect weaknesses" and "strict controls on access to funds in both cold and hot wallets".

- It holds "100% of user cryptocurrencies offline in cold storage", "maintains an insurance coverage of $360m against damage or theft", and "provides FDIC insurance on USD balances of up to $250,000."

- It offers web-based and mobile application trading that runs on Android and Apple devices along with a digital wallet. There are no fees for trading on the mobile application.

- Crypto.com boasts of 24/7 customer care with "in-app live chat, email, and phone support".

Weaknesses

- It does not offer educational resources for trading cryptocurrencies.

- The trading interface and complex application system can be overwhelming to beginners.

- Poor customer service with limited and slow live support and unanswered calls or delayed services.

- Higher fees for low-volume traders especially those without holdings of CRO.

Opportunities

- Tweak the application system and trading interface to introduce educational materials for beginners.

- Improve the turnaround time of customer support to retain customers.

Threats

Kraken

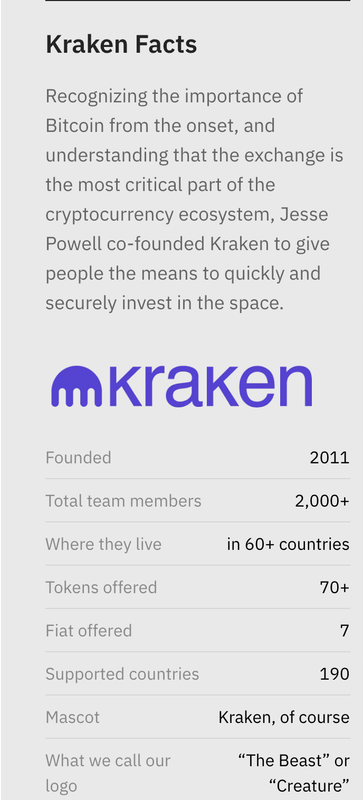

- It is the first and oldest crypto exchange founded on 28 June 2011 by Jesse Powell, two years after the launch of Bitcoin. Its legal name is Payward, Inc.

- It has over 2000 team members that live in 60+ countries and support 190 countries mainly in Europe. Its headquarters are in San Francisco, California.

SWOT Analysis of Kraken

Strengths

- It supports 70+ cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple, Dogecoin, Cardano, and Polkadot.

- It is a high liquidity exchange that offers deep liquidity with spreads as tight as 1 pip driven by high trading volumes, low maker fees as low as 0%, "versatile funding options, and more active traders with over 4 million customers. It is the "largest exchange by Euro volume" hence among the top exchanges by bitcoin liquidity.

- Its user interface platform is stylish and easy to use, offers four account types with fast verification, requires ID for deposit verification, provides the ability to stake rewards, and prides in fast bank withdrawals worldwide.

- Kraken keeps 95% of all deposits in an "offline, air-gapped, and geographically distributed cold storage", maintains 24/7 surveillance of servers, encrypts sensitive data, undertakes penetration testing of attacks, and "runs a bug bounty program."

- Kraken has a strong reputation for maintaining "rigorous security standards" that have not been hacked in its history. This includes 2 Factor Authentication (Google Authenticator and Yubikey), No Phone/SMS Account Recovery, Email Confirmations for Withdrawal with Self-Serve Account Lock, Global Settings Time Lock for Extreme Security, and SSL Encryption.

- It offers margin trading of crypto assets with 5x leverage and low rollover fees and futures trading with 50x leverage for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple futures.

- It offers Over-The-Counter (OTC) trading with deeper liquidity to institutions and high net-worth individuals that need to fill large orders.

- Kraken offers excellent customer service with institutions and high net-worth customers receiving expert market insights on daily trade and market recaps, one-on-one expert consultations, account management services that are real-time and personalized, and 24/7 global customer support on live chat and email in the Americas, Europe, and Asia-Pacific.

- Kraken provides robust cryptocurrency indices for Bitcoin, Etherium, Ripple, Bitcoin Cash, and Litecoin.

Weaknesses

- The exchange has a small selection of altcoins and is not beginner-friendly as Instant Buy Platform has high fees for beginners.

- Slow account verification for the pro account and difficult to fund account as debit or credit card payments are not allowed.

- Bugs and issues that have the potential to generate losses.

- It facilitates discreet trading through dark pool features and no tax support service on the platform.

- It does not operate in the States of New York and Washington.

Opportunities

- In 2018, Kraken shut down its cryptocurrency platform in Japan citing operational costs just when Japan's Financial Services Agency (FSA) was beefing up efforts to scrutinize exchanges offering services in the country. Kraken was then not registered with FSA and there is an opportunity for Kraken to register so that it can resume operations.

- In March 2020, Kraken pledged to reopen services in India after a two-year ban that barred banks from providing services to crypto exchanges was overturned. There is an opportunity for Kraken to rebuild its services through new features and offerings.

Threats

- Damage to image reputation when it was "hit with Distributed Denial of Service (DDoS) attacks" in May 2017 leading to losses for customers who filed a lawsuit seeking over $5 million.

eToro

- It was established in 2007 in Tel Aviv, Israel as a social trading exchange. Its headquarters are in London with more than 20 million users in 140 countries.

- It was founded by Yoni Assia, Ronen Assia, and David Ring.

SWOT Analysis of eToro

Strengths

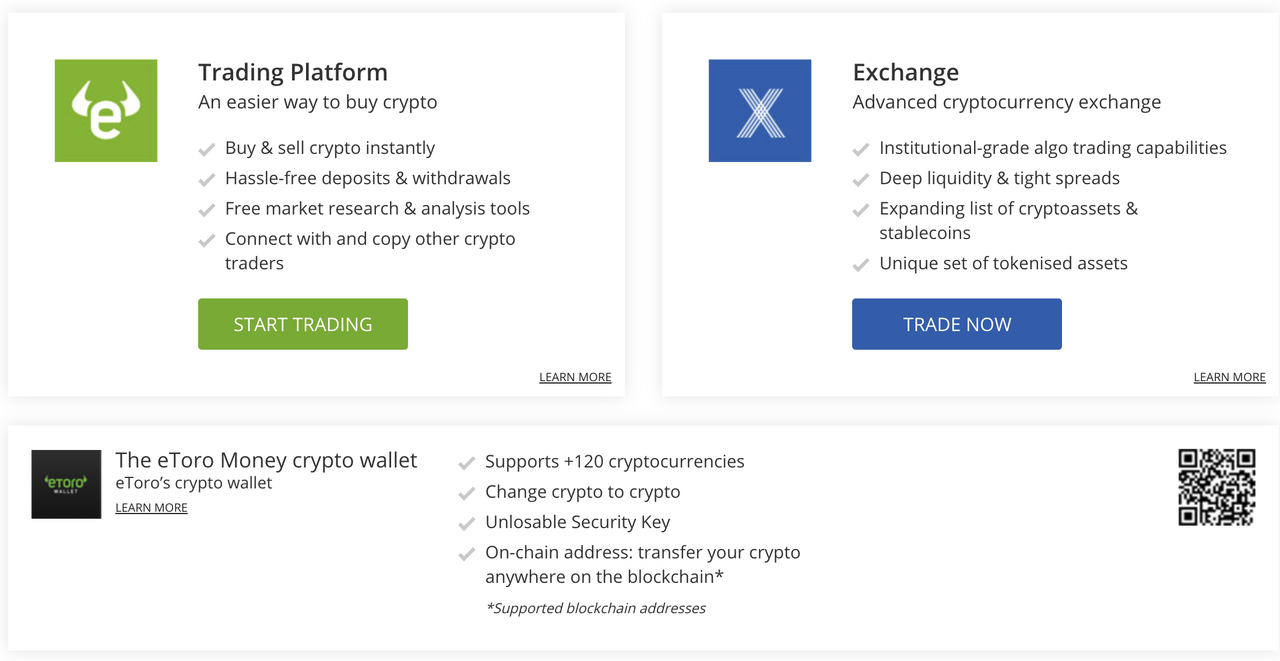

- It is the best exchange for trading both cryptocurrencies and fiat currencies.

- eToro has a user-friendly and secure trading platform that provides real-time insights, free market research and analysis tools, and allows copy trading of other crypto traders. It also provides a wide variety of payment options such as credit cards, PayPal, Skrill, and Neteller and a virtual demo account of $100,000 to practice strategy before trading real money.

- eToro has an advanced cryptocurrency exchange with deep liquidity and tight spreads, an "expanding list of crypto assets and stable coins", and unique tokenized assets.

- It provides eToroX, a professional crypto exchange service for "corporate and institutional-grade crypto traders" with the security and transparency of a regulated crypto powerhouse.

- eToro Money crypto wallet is an "easy-to-use, multi-crypto, and secure digital crypto wallet" that supports over 120 cryptocurrencies such as Bitcoin and Etherium, and "changes more than 500 crypto pairs to other crypto assets." The crypto wallet utilizes multi-signature authorization for added security when investing with other parties.

- It has built a credible reputation and provides both web and mobile versions of its platform.

- It only charges spreads with no commission on cryptocurrencies,

- In 2018, it launched a cryptocurrency platform in the United States to encourage United States crypto investors to sign up.

Weaknesses

- It is not a crypto-specific website or application hence only supports the popular 14 cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, Ripple, and Litecoin.

- Only USD deposits are allowed and take about 7 days to be verified. Other foreign currency deposits and withdrawals are subject to a fee.

- It is not available to all States of the United States and only supports 17 cryptocurrencies in the United States with a minimum of $50 to invest.

- It does not provide margin accounts.

Opportunities

- Improve on turnaround time for verification of deposits and eliminate the fee for other foreign currencies.

- Expand the geographical scope and the number of coins supported in the United States.

Threats

- eToro USA has a C rating by Better Business Bureau because of more than 50 complaints filed against the exchange which it failed to resolve.

Research Strategy

To conduct a SWOT Analysis of Coinbase, Binance, Crypto.com, Kraken, and eToro, the research leveraged on credible and reputable sources in the public domain such as the companies' websites, review sites, financial news, crypto news, and articles by industry experts including Business Insider, Investopedia, Forbes, Bloomberg, Statista, GlobeNewsWire, CoinDesk, and CoinMarketCap. Information and data on the strengths, weaknesses, opportunities, and threats of the 5 crypto exchanges are adequate in the public domain. The research brief presents the findings in detail with statistics, figures, and diagrams.