Part

01

of one

Part

01

Corporate Philanthropy Trends and Competitive Analysis

Key Takeaways

- Corporate giving trends include a shift towards recurring giving, blurring business and philanthropy boundaries, and cause-focused giving.

- Workplace philanthropy trends include community-focused giving, viral trend-inspired giving, and new-generation led workplace giving.

- Benevity's annual revenue is about $100 million and was valued at about $1.1 billion at the end of 2020.

Introduction

A competitive analysis of Benevity, YourCause, Bright Funds, Cybergrants, Charityvest, SmartSimple, Submittable, and Blackbaud has been provided in the attached spreadsheet. Tennaxia, Enablon, Point Systems, and CyberSWIFT were replaced by Charityvest, SmartSimple, Submittable, and Blackbaud because further research showed that Tennaxia, Enablon, Point Systems, and CyberSWIFT are not true competitors to Benevity, YourCause, Bright Funds, and Cybergrants. Although these solutions have some form of CSR reporting solution, they generally lack employee, grant, and corporate giving management and administration platforms.

Corporate philanthropy and workplace (employee) giving trends include a shift towards recurring giving, blurring of business and philanthropy boundaries, community-focused giving, viral trend-inspired giving, new-generation led workplace giving, and cause-focused giving.

CORPORATE GIVING TRENDS

Shift Towards Recurring Giving

- Companies are gradually shifting from one-time giving to recurring giving.

- The shift is due to more companies recognizing that year-round support can have a longer-lasting impact and digital platforms today make it easy for corporations to coordinate year-round efforts at a minimal cost.

- Research on the state of modern fundraising found that “recurring donors have the highest lifetime financial return, 42 percent above fundraisers and 440 percent above one-time donors.”

- This was selected as a trend because about 85% of the biggest enterprise companies now operate a year-round giving program. According to CAF America, this is a remarkable shift compared to just five years ago.

- The trend was reported by CAF America, Double the Donation, and Givinga.

Blurring Business and Philanthropy Boundaries

- In the last couple of years, for-profit businesses have been created for the sole purpose of their profit been used for charity or philanthropic activities.

- According to industry analysts, "the creation of the Chan Zuckerberg Initiative (CZI) in late 2015 as a charitable LLC — a forprofit entity being used for non-profit, philanthropic purposes — was a signal moment in this trend."

- This trend of increased blurring of business and philanthropy continued in recent years and accelerated in 2020. Notable examples include Laurene Powell Jobs (Apple's founder Steve Job's wife) and John and Laura Arnold converting their family charity foundation to LLC.

- Social-impact investing and the rise of socially responsible B Corps are further examples of this trend.

- Another example of a company leading this trend is AmazonSmile, which makes combining shopping and charity easy.

- This was reported as a key trend because it was reported in multiple industry analysis reports, such as those from Campden FB, Johnson Center, and Norfolk Foundation.

Cause-Focused Giving

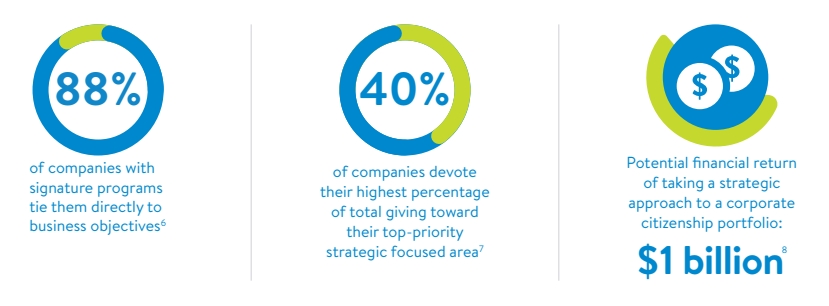

- More corporations are now adopting cause-focused giving rather than just general giving. This has resulted in corporations donating more to fewer non-profits and charities than before.

- Rather than giving generally, organizations are increasingly looking to donate to causes that align with their strategic interest and vision.

- For instance, the energy and tech sector are increasingly focused on supporting non-profits that promote STEM education while healthcare and pharmaceutical enterprises support healthcare-related charities.

- A survey found that 36% of CEOs stated that they were looking to increase the impact of their giving by working with fewer non-profits but providing bigger donations.

- About 88% of companies stated that they have a signature charity program that ties directly to their business objectives.

- This was selected as a key trend because it was reported in multiple industry analysis reports, such as those from CAF America, Johnson Center, and Global Giving.

Community-Focused Philanthropy

- Employees are increasingly leading the conversation of giving back to their community.

- According to SalesForce, "82% of medium and large companies say their employees have inquired about starting a workplace giving and volunteering program."

- Over 90% of surveyed employees say they want to give back to their community.

- This trend sharply increased since the COVID-19 pandemic, with 65% of surveyed employees saying the pandemic made them more sensitive to their community's needs.

- Increasingly, employees say they prefer to be with community-conscious, proactive, and transparent companies, with philanthropic programs that draw their employees in and provides engaging philanthropic experiences.

- About 75% of millennial employees say that it is important for the company they work for to match employees' charitable contributions via a workplace philanthropy program.

- This was selected as a key trend because it was reported in several industry analysis reports, such as those by SHRM, Johnson Center, and Givinga.

Viral Trends and New Generation-Led Workplace Philanthropy

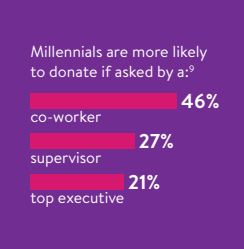

- Millennials (and to a lesser extent Gen Zs) are increasingly having more influence in workplaces and workplace giving culture. The next generation of givers "want to be more hands-on and to learn and give with their peers."

- In fact, they are more likely to give and support a cause their peer recommends than by their boss. See chart below:

- The dynamics of what motivates the new generation of employees to give their dollars, volunteer their time, or cause to support is different today than in previous generations.

- This new generation also looks to social media to find causes worth giving to supporting and are more likely to give to causes that are popular on social media.

- Gamification of giving is also growing popular, with 43% of employees saying they would give more if competition (a.k.a. “gamification”) is incorporated.

- This was selected as a key trend because it was reported in multiple industry analysis reports such as those by Salesforce, Johnson Center, and CAF America.

Research Strategy

To select the key trends in corporate philanthropy and workplace (employee) giving, we analyzed a number of industry and expert reports on recent trends and selected key trends that appeared in at least three independent reports. For each trend reported above, we have also provided statistics and quotes that help explain the trend.

For the competitive analysis aspect of the research, we first analyzed the four companies you provided and provided the required information where available. However, further research revealed that the other four companies suggested during the initial hour of strategy are not true competitors of the four companies you provided. Charityvest, SmartSimple, Submittable, and Blackbaud simply have a CSR reporting solution but lack employee giving, grant administration, or/and corporate giving solutions. Hence, we decided to find another four true competitors of the companies you provided to ensure a more accurate apple-to-apple comparison. So we discarded Tennaxia, Enablon, Point Systems, and CyberSWIFT and replaced them with Charityvest, SmartSimple, Submittable, and Blackbaud.

Most of the companies are private companies and as such some of the requested data was not always publicly available for some of the companies. In such cases, we have entered "NA" in the attached spreadsheet. We have also entered "NA" where a requested data point doesn't apply to a company, such as a company that has no history of funding. In terms of valuation, PE Hub reported that Benevity was valued at 10x its revenue in its most recent valuation. So although we entered "NA" where we couldn't find the valuation of some of the competitors, we have also provided a rough estimate of what the company would be valued, assuming 10x revenue valuation was standard in the industry. The competitive analysis of the eight companies has been provided in the attached spreadsheet.