Part

01

of one

Part

01

Alcohol Alternatives Market

KEY TAKEAWAYS

- A majority of the sober-curious movement is largely driven by generation Z and millennials aged 21-34 years old. Men are more likely to be sober-curious than women.

- Sober-curious consumers are college-educated, Caucasian, have no kids, and live in urban centers such as New York City, Chicago, Los Angeles, San Francisco, and Austin.

- The trends driving the growth of the alcohol alternatives market include a greater focus on health and wellness by millennials, an increase in 'Better For You' ingredients in the market, the introduction of low alcoholic and non-alcoholic syrups and concentrates, and a rise of sober-curious friendly communities and spaces.

- Popular brands such as Seedlip, Ritual Zero Proof, Curious Elixirs, Kin Euphorics, and Heineken 0.0 are some popular non-alcoholic brands on the market.

INTRODUCTION

A demographic profile for the sober curious consumer has been provided below along with 4 trends in the US alcohol alternatives market. While compiling the demographic profile, we used White Claw Hard Seltzer a low-alcoholic drink, and Humm Kombucha a non-alcoholic drink as a proxy to determine the education, family, and race profile of a would-be "sober curious" consumer.

Seltzer has become a popular drink for consumers wanting low calorie and low alcoholic options while kombucha has quickly become the second fastest-growing non-alcoholic beverage in the US.

DEMOGRAPHIC PROFILE

Age:

- While research shows that adults of all ages are cutting back on drinking and adopting low/non-alcoholic drinks, a majority of the sober-curious movement is largely driven by generation Z and millennials aged 21-34 years old.

- Nearly half of drinkers have tried non-alcoholic offerings representing the biggest consumer base for the non-alcoholic market.

Gender

- Men are more likely to be sober-curious than women according to a survey by Civic Science.

- An online study of social media exchanges posting about low/alcohol-free lifestyles also showed that men are more likely to talk about being sober curious compared to women.

Education Level

- When looking at the demographics of low alcoholic brands such as White Claw, as a proxy, the majority of consumers are college-educated or have advanced college degrees. To cross-reference, the demographics of Humm Kombucha a popular non-alcoholic drink were used and they confirmed the education level.

Family

Race

- Again, looking at the demographics of White Claw, the drink is most popular with Caucasian drinkers. To cross-reference, the demographics of Humm Kombucha were used, and they confirmed this as well.

Location

- Sober-curious consumers live in urban centers such as New York City, Los Angeles, San Francisco, Austin, and Chicago.

TRENDS

Greater focus on health and wellness

- Growing awareness of the harmful effects of alcoholic beverages on the body is driving the mindful drinking movement. In fact, 40% of drinking-age adults said they’re drinking less than they were five years ago.

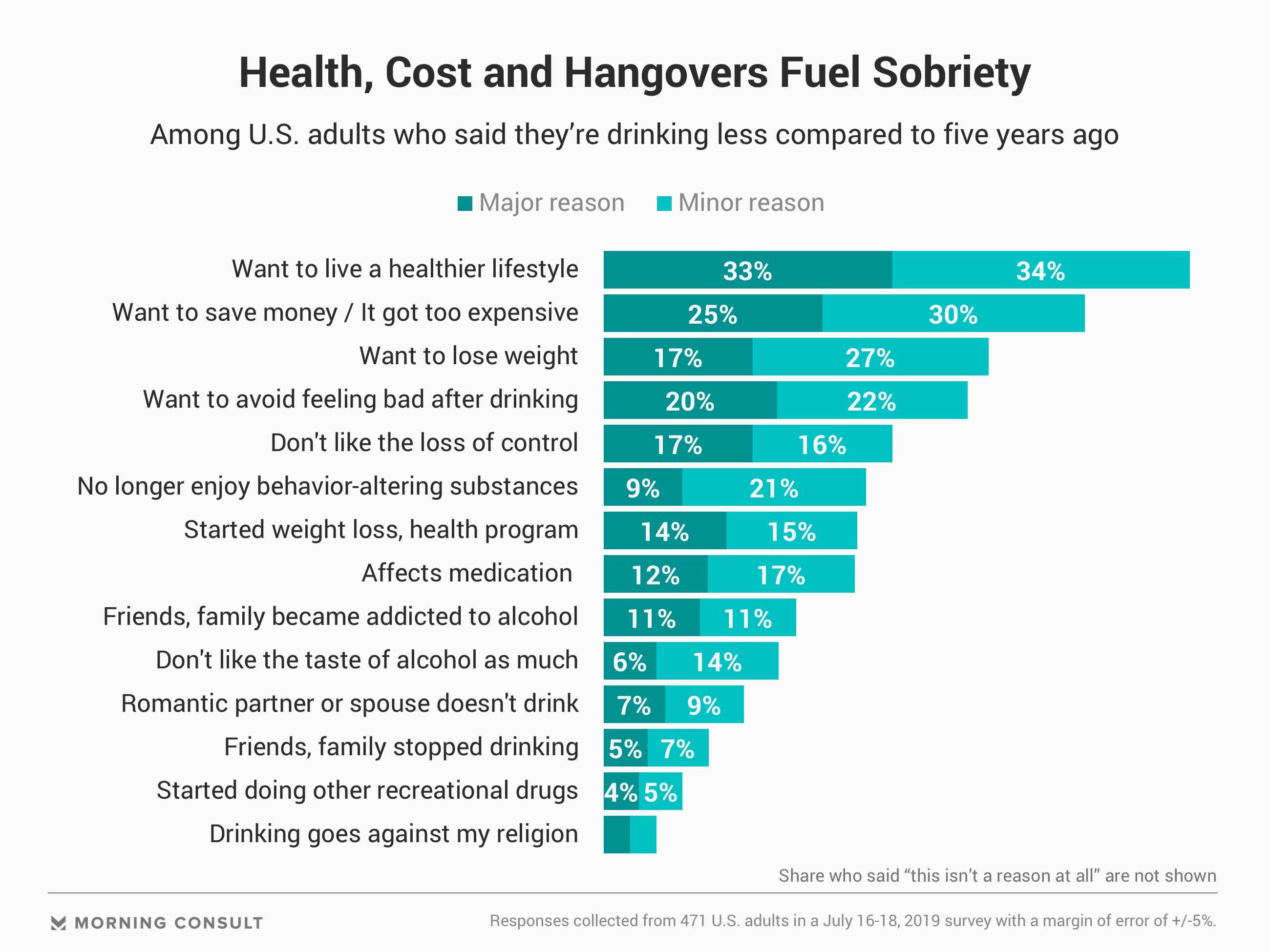

- According to research by Morning Consult, 67% of consumers are drinking less to lead a healthier lifestyle, whereas 55% drink less to save money and 44% drink less to lose weight.

- The majority of consumers are applying a wellness-oriented mindset to drinking by recognizing their drinking habits and acting on that understanding. For many, this means cutting out alcohol completely or reducing the frequency of alcohol consumption.

- Brands like Seedlip, Ritual Zero Proof, Curious Elixirs, Kin Euphorics, and traditional brands like Heineken 0.0 are some popular non-alcoholic brands on the market.

- The category is expected to grow by 32% between 2018 and 2022 as more brands continue to proliferate the market.

'Better For You' Ingredients in the Market

- As sober-curious consumers move away from alcoholic drinks, new non-alcoholic alternatives containing healthy feel-good ingredients such as allspice, grapefruit, green cardamom, ginger, rosemary, and oak are becoming increasingly popular.

- Consumers want natural, non-modified functional ingredient products that support their healthy lifestyles. Brands like Goldthread, Kin Euphorics, and Proteau are among some leading brands using functional ingredients.

- CBD ingredients, electrolytes, adaptogens (herbs used to counteract the effects of stress), fruits, vegetables, and botanicals are also trending among the category.

Introduction of Low Alcoholic and Non-Alcoholic Syrups and Concentrates

- While most of the products in the alcohol alternatives market are ready-to-drink, innovative products in the form of syrups and cordials have emerged created to partner with non-alcoholic drinks.

- Cotswold Distillery is a popular brand that has a concentrated gin essence meant to be added to a tonic that allows one to experience the same flavors as a traditional gin and tonic with 90% less alcohol.

- Nonsuch Shrubs and Shrub and Co also have a product range of fruit and vinegar-based syrups that are added to non-alcoholic drinks to add flavor and depth.

Rise of Sober-Curious Friendly Communities and Spaces

- While a majority of millennials have been consuming low/non-alcoholic drinks in the comfort of their own homes, the rise of sober spaces has allowed sober-curious consumers to consume alcohol alternatives in social environments.

- Hotels, restaurants, and bars in urban areas such as New York City are offering zero-proof menus filled with botanical elixirs and mocktails. Many restaurants and bar owners report an increase over the last few years in consumers ordering these kinds of drinks.

- Additionally, online communities such as Loosid that cater to individuals in recovery, those looking for non-alcoholic alternatives, or just the sober curious are providing individuals with the opportunity to socialize with one another without feeling the pressure to consume alcohol. The platform offers sobriety tools, a dating site, travel tips and packages, chat groups, and hosts in-person events.

Research Methodology

For this research on the alcohol alternatives market, we leveraged the most reputable sources of information that were available in the public domain, including marketing publications, food, and beverage publications, news articles, research reports, and media articles such as Morning Consult, Food Bev, Nielsen, CNET, Vox, Spirited Biz, Bev Industry, Beverage Daily, and Fast Company. Using this research strategy we were able to find adequate information on the demographic profile and trends impacting the alcohol alternative market. As noted in the research we utilized proxy brands (White Claw and Humm Kombucha) to find the demographic profile information as there was little demographic information specific to consumers who purchase brands like Seedlip or Ritual Zero Proof for example.