Part

01

of one

Part

01

Airlines Pricing and Content Distribution

KEY TAKEAWAYS

- There is no specific information about how companies are adopting dynamic pricing but the reviewed sources indicate that this pricing method is gaining momentum among airlines, mostly fueled by the positive experience of some front-runners that are aggressively adopting the NDC schema and customer-centric business models. Nevertheless, the implementation of truly dynamic pricing is still at early stages with just a few innovative airlines already applying the concept within their overall marketing strategy. Lufthansa and Delta Airlines are two examples of implementation of dynamic pricing.

- Although some surveys reveal that there is consensus about the importance of implementing dynamic content to maintain a competitive advantage in a world dominated by BigTechs, adoption by airlines is still a work in progress. The wide range of initiatives around the issue favors the expectation of having different levels of implementation by many companies in the near future, especially when more parties adopt the NDC schema and the technology brings new possibilities. While traditional GDSs can only share prices and schedules, NDC supports rich content that can include a variety of extra details, optional ancillary services, and images and text.

- The adoption rate of IATA NDC was positive until 2020 but, in 2021, the unprecedented damage caused by the long pandemic to the airline industry proved to be a relevant factor behind a slower adoption. IATA represents 290 airlines in 120 countries, carrying 83% of the world’s air traffic. The current status of NDC certification as shown on IATA's website is 59 airlines with the highest level of active certification and 10 other airlines with active certification at lower levels. Although the number shows relatively few airlines, the certificated group includes the world's five biggest airlines by the number of flights. Mass adoption will take years so any NDC installation will necessarily work side-by-side with a GDS aggregation.

- Airline sales in 2020 were mainly distributed through direct channels (60%) according to 62 airlines surveyed by Accelya at the end of 2020. GDSs and tech aggregators take 42% and 4% respectively, while others have 4%. Over the next three years that distribution will favor direct sales as some large firms demonstrate. The NDC adoption and the need for a more customer-centric approach are relevant drivers behind the trend.

- NDC does not directly work on dynamic pricing but allows the airline to gather data that is very useful for the pricing decision and to distribute the offer as an overall product rather than simply a fare. Getting away from the legacy fare-filing system is a requirement to have a world where prices are generated dynamically. According to Marco Contento from IBS Software Services, NDC will have a very positive impact on how the overall offer will be built for the customer but its purpose is not to deal with dynamic pricing.

INTRODUCTION

This research is structured in five sections. The first and second sections explore how airlines have adopted dynamic pricing and dynamic content with some examples and data extracted from surveys. The third section describes three trends surrounding the IATA NDC schema. They are slower adoption of NDC, varied levels of adoption, and operations in a hybrid world. The fourth section focuses on channel distribution with estimates for 2020 and forecasts for 2023. The fifth section explains thoroughly the correlation between NDC and dynamic pricing. Since most of the sources do not include quantitative data and information about company strategies is very high-level, the research focuses on insights from experts, surveys, and examples extracted from the public domain to build a comprehensive picture of each requested topic.

1. ADOPTION OF DYNAMIC PRICING

Status

- There is no specific information about how companies are adopting dynamic pricing but the following sources indicate that this pricing method is gaining momentum among airlines, mostly fueled by the positive experience of some front-runners that are aggressively adopting the NDC schema and customer-centric business models. Nevertheless, the implementation of truly dynamic pricing is still at early stages with just a few innovative airlines already applying the concept within their overall marketing strategy.

- As shown in the survey results explained in the following bullet points, companies are aware of the importance of dynamic pricing but several factors still deter firms from implementing it.

- In 2018, Pros said that 11 of the company's airline clients were already using its software to generate real-time dynamic offers within direct sales channels. Those channels included their websites. Some of those clients are making the price offers by adjusting from their published fares, while others are generating offers from scratch. Pros is a revenue management software provider which worked at that time with around 80 airlines worldwide, including Southwest, Lufthansa, Emirates, and Aeromexico.

- A survey conducted at the end of 2020 for Accelya reported that 50% had "embracing dynamic/continuous pricing" as the third-highest priority for revenue management in the next 24 to 36 months.

- Although not necessarily related to dynamic pricing, revenue management is commonly the driver behind the adoption of dynamic pricing. According to a Pros' report published in 2019, revenue management was one of the three main areas of planned investment in digitization: 61% of airlines responded the website and app improvements for selling tickets, 58% implementation of artificial intelligence (e.g., revenue and fuel efficiency management), and 52% customer experience (e.g., using Alexa to book a ticket).

- In an article published by July 2020, Marco Contento from IBS Software Services says that companies typically have proprietary algorithms, and the finer details are kept under wraps to preserve a competitive advantage. But according to Contento's words, at the core is a pre-computed approach that simply searches for a pre-calculated fare based on predefined scenarios. This means that truly dynamic pricing involves on-the-go calculation.

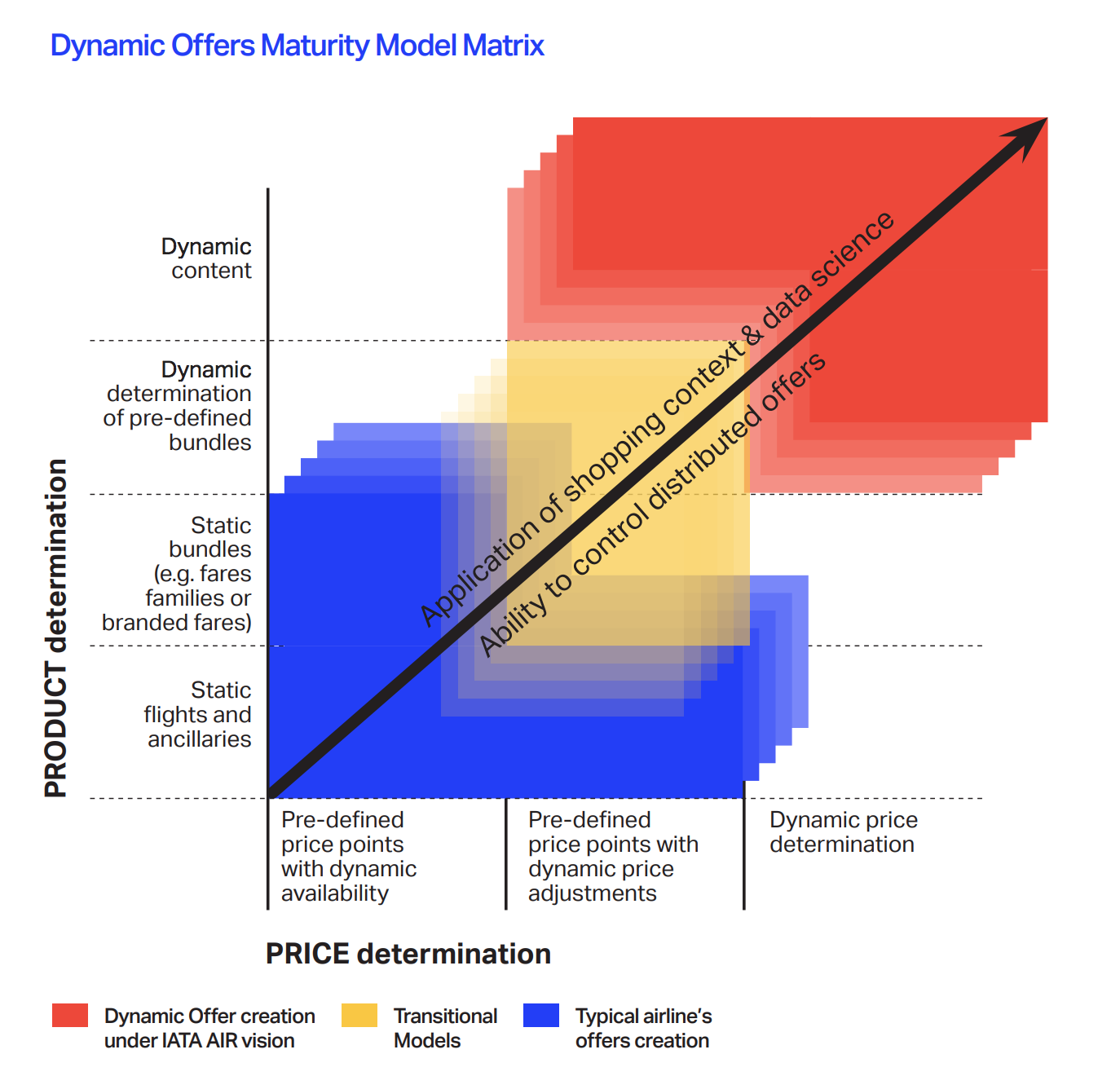

- In 2021, airlines mostly rely on traditional fare distribution, making poor forecasts, ignoring ancillaries, and struggling to update decade-old technology, says a report from AltexSoft. As the following matrix reveals, the industry must go out from the current phase (flights and ancillaries are priced statically, price points are predefined with some dynamic availability and price adjustments involved) and advance toward transitional models (not total dynamic pricing yet, but systems can choose the best-fitting fares among predefined bundle) before fully embracing dynamic pricing (the desired stage is having both fares and offer content defined on real-time thanks to data analytics and machine learning models).

Examples

- The first adopter of a new fare distribution model was Lufthansa. After heavily investing in the NDC technology, the company started experimenting with dynamic offers on direct and indirect channels in 2020. Other big airlines like Air France-KLM and Singapore Airlines collaborated with Amadeus and Travelport to work on adoption as well.

- Lufthansa Group has been a pioneer of dynamic and continuous pricing and has openly shared how the strategy has enabled it to be more responsive to changing market conditions and evolving passenger needs. For example, Lufthansa Group is seeing customers travel closer to the time of booking than before the Covid crisis. Continuous pricing can accommodate this by offering more attractive pricing closer to time-of-departure than can be implemented via fare filing/RBDs. “Our collaboration with Pros began with developing dynamic pricing algorithms with groups and then expanding the science and functionality to individual revenue management," says Simon Rimrod, Head of Commercial Offer and Pricing for Lufthansa Group.

- Korean Air is also in the trend. It markets relevant offers to its customers in dynamic display ads by applying dynamic pricing.

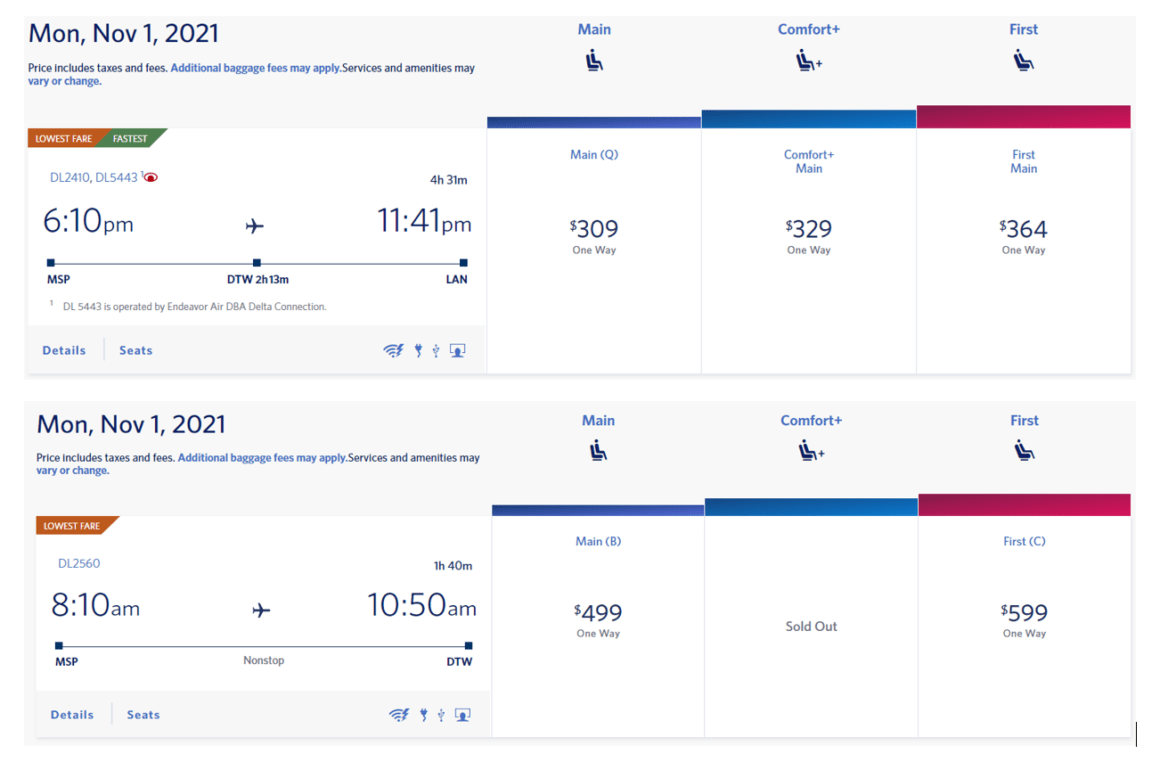

- According to AIMultiple, Delta Airlines applies dynamic pricing. This is an example of how it works. Ticket prices are higher when there is no competition out there. Based on AIMultiple's research, Delta charges for a trip from Minneapolis-St. Paul (MSP) to Detroit Wayne Country (DTW) airport US$200 more than a trip from MSP to Lansing (LNS) airport, although both are approximately 650 miles away from MSP. Delta exploits the fact that it is the only airline that flies direct from MSP to DTW, whereas there are several airlines that fly from MSP to LNS.

- Delta also applies higher prices for frequent fliers. Time Magazine has reported that for a period of three weeks in 2012, Delta has charged frequent travelers $300 more than the economy rate for the exact same flight. Forbes analysts claim that this overcharge is the exploitation of frequent fliers’ necessity to travel more often than others. Despite the profits, Delta’s vice president for eCommerce stated that these overcharges are a glitch in the system and that very idea goes against the grain of how Delta treats its customers. Three weeks later, the algorithm was claimed to be fixed.

Ancillary Products

- When it comes to pricing ancillary products, the use of dynamic pricing is even scarcer. There is no quantitative data for 2021 but an In Diggin Travel's 2019 Airline Digital Retailing Survey provides a reference. At that time almost 25% of the surveyed airlines applied simple static pricing to ancillary products, 41% did segmented pricing, and only 7% applied dynamic pricing for ancillary products. The survey represented the views of 45 carriers (40% large, 40% medium, and 20% small, from all geographies). The percentage of airlines applying dynamic pricing to ancillary products is surely higher today, but it is likely that most of the firms are still out of the trend.

- According to Tom Bacon, airline pricing and revenue management consultant, “Communication of ancillary is already a challenge – some travelers are surprised by the fees... over time, travelers will become accustomed to more variance in ancillary fees". Changing and surprising prices might indeed be perceived unfavorably by customers, so firms must manage this issue not only considering revenue but also the impact on demand.

Challenges

- Several factors explain the slow adoption and partial application of dynamic pricing in the industry. Revenue management requires sophisticated demand forecasting. IT systems need to access many data sources and employ algorithms to pinpoint demand signals in real-times. Currently, the distribution ecosystem keeps airlines from using precious data from external sources given their limited control over the offer construction on indirect channels (GDSs and aggregators). Another important factor is the airline’s ability to price flights within the legacy distribution mechanisms. Prices can not be adjusted in real-time in the indirect channels, at least, not without full implementation of NDC. Lastly, base flight products and ancillary products are managed in separate processes and through separate IT systems (revenue management and merchandising systems), which make it impossible to apply dynamic pricing for an overall product through the existing systems.

- In the future, it is expected to have many more airlines adopting dynamic pricing but the evolution will depend on how fast they will allocate investments on NDC and other advanced technologies. Given the still unfavorable economic context for airlines, advancements are likely to be slow over the near future.

2. ADOPTION OF DYNAMIC CONTENT

Relevance of the Topic

- There is no quantitative information about the current adoption of dynamic content by airlines in the public domain. All sources only provide information about the topic in general and cases of airlines where dynamic content is involved.

- The surveys mentioned below indicate that there is consensus about the importance of implementing dynamic content to maintain a competitive advantage in a world dominated by BigTechs. Nevertheless, there are obstacles to overcome to invest in the trend, especially those related to the legacy systems where indirect channels still operate and the financial difficulties confronted by most of the companies as a result of the pandemic.

- Personalization and customer-centricity were already at the top of most airline digital retailing professionals’ agendas in 2019, as published in the Digital Retailing report. Personalization is the reason behind the adoption of dynamic content so this survey reveals the relevance of the topic at that time. The two biggest gaps that were seen by the carriers to pursue personalization (around 50% of respondents) were customer-centricity & user experience, and data-driven & analytics. Additionally, the two areas in which the carriers planned to invest the most (increase) were personalization & personalization engines, and data & analytics. Aligned with those results, 78% of airlines listed customer centricity and personalization as key skills for digital retailing.

- Despite the relevance of the topic for airlines, the Digital Retailing report also said that only 16% offered dynamic products or dynamic bundles (for example, dynamic branded fares for families or businesses). This is not surprising, as providing a custom booking experience is definitely more difficult to do than creating dynamic content and messaging in email campaigns.

- According to the responses of another survey conducted in 2019, 84% of airlines felt confident in digitalization efforts related to personalization, although other kinds of efforts such as mobile experience enhancement, website enhancement, IT upgrades, and digital retail obtained higher percentages.

- Since digital content is part of greater initiatives, it is notable to see how confident firms feel about engaging in AI-related eCommerce projects. 93% of airlines reported having launched that kind of initiative in 2019, although only 49% had been engaged in these activities for more than two years, and 90% of respondents thought that their organization had the technological capability to build and manage the necessary end-to-end eCommerce systems.

Examples

- In 2019, American Airlines presented its American Airlines vacations case. The company now markets 10,000 hotels in 320 locations by applying SEO and dynamic destination content with SEO-optimized landing pages.

- Also in 2019, Lufthansa announced a partnership with Hopper, an innovative online travel agency that excels at artificial intelligence. About the partnership, Christian Langer from Lufthansa Group said that the goal is to provide our customers with even better data-driven, tailor-made offers in the future", and that "it will utilize AI to learn customers' preferences on a much deeper level in order to provide personalized recommendations about additional services or upgrades.”

- In 2021, United Airlines announced that its NDC-piped content, which includes continuous pricing and dynamic bundles, would be available to subscribers. United works in partnership with Amadeus to fully integrate the inline booking flow, so the shopping and booking look the same whether you are sourcing EDIFACT content, NDC content, or other XML-proprietary APIs.

- Iberia Airlines uses dynamic creative optimization to target and serve ads to specific viewers who had already been recommended by existing customers on an email campaign. Using data feeds, the company presents an appropriate destination to its potential buyers.

- For a marketing campaign, AirSerbia used video production tools to produce high-impact video posts and story format ads (See the figure below) for Facebook and Instagram users. The campaign promoted unique offers in social media and used the subsequent activity on the Air Serbia site to re-target the customers. During the campaign, more than 1400 image ads and 120 video ads were produced and fully automated at scale.

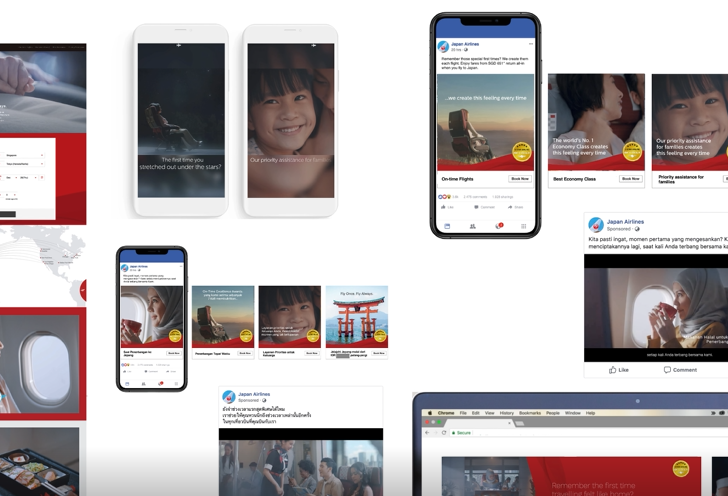

- In 2019, Japan Airlines used dynamic content optimization for the Fly Once, Fly Always campaign. The project married hyper-personalization, and dynamic rules to generate nearly 3,000 unique creative assets. See the figure below.

Perspectives

- There is no available forecast in the public domain of how fast dynamic content will be embraced over the next years. The wide range of initiatives around the issue favors the expectation of having different levels of implementation by many companies in the near future, especially when more parties adopt the NDC schema and the technology brings new possibilities. While traditional GDSs can only share prices and schedules, NDC supports rich content that can include a variety of extra details, optional ancillary services, and images and text. Certainly, competition in this field is probable to be fierce. As Zach Rachins from Hopper said in 2019, "Personalization is really overwhelming. Instead of personalization, we should talk about incrementally improving relevance."

3. TRENDS SURROUNDING USE OF IATA NDC SCHEMA

Slower Adoption of NDC

- IATA's NDC schema was initially presented in 2013. The adoption rate was positive until 2020 but, in 2021, the unprecedented crisis caused by the COVID-19 proved to be a relevant factor behind the slower NDC adoption. At the end of 2020, a survey echoed excitement concerning the NDC since 68% of the 27 respondent airlines used or intended to use NDC as part of their retailing and distribution strategies. Nevertheless, the length and depth of the crisis seemed to be harmful in 2021.

- IATA represents 290 airlines in 120 countries, carrying 83% of the world’s air traffic. The current status of NDC certification as shown on IATA's website is 59 airlines with the highest level of active certification and 10 other airlines with active certification at lower levels. Although the number shows relatively few airlines, the certificated group includes the world's five biggest airlines by the number of flights, which comprise approximately 60% of global flights according to July 2021 figures. Four of them have already reached the highest certification level whilst one - Delta Airlines - announced in September 2020 that it would halt its NDC development to focus those resources on their existing ecosystem.

- By March 2019, 65 airlines had adopted NDC to some extent. This number says that, in approximately 20 months from March 2019 to November 2021, the number of airlines actively embracing NDC decreased from 65 to 59.

- The total number of companies (airlines, aggregators, sellers, and IT providers) with some level of NDC certification amounts to 162 in 2021 since many companies (58) did not continue the process and now their certifications are expired. This number reflects a slower adoption rate in 2021 when compared to previous periods. At the end of 2020, 185 companies held NDC certification, up 22 from the beginning of 2020 when IATA aimed to have reached mass adoption by 2025.

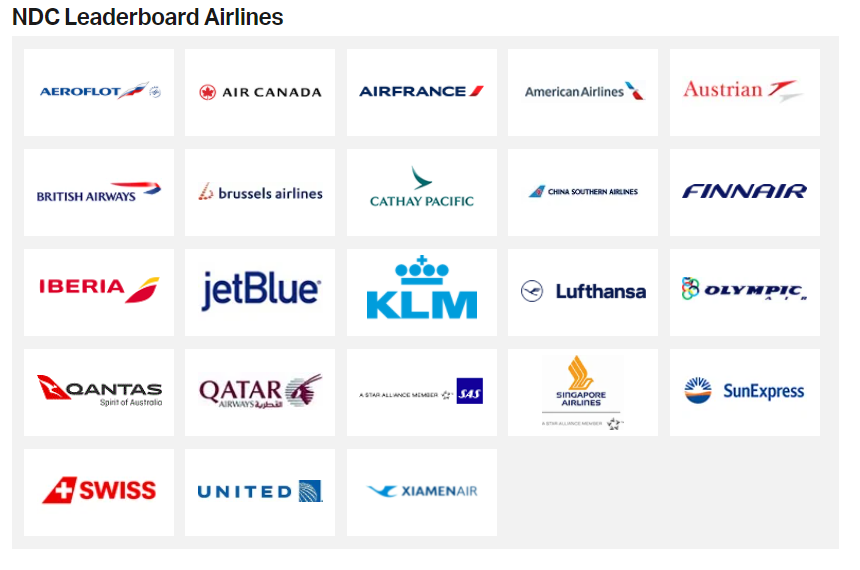

- The NDC Leaderboard comprises a group of airlines committed to the NDC schema as shown in the figure below. They carry over 30% of IATA passenger volumes.

- Since NDC has the potential to allow airlines to avoid GDSs, they reacted by adopting the NDC themselves. All three GDSs (Sabre, Amadeus, and Travelport) embraced NDC to maintain their positions, although at different paths. According to a survey, 31% of airlines willing to use NDC have negotiated agreements with some or all of their GDS partners, and 19% already had agreements with all their GDS partners. Under the existing system, airlines have to pay GDSs, and GDSs would pay the travel agents, for each segment booked. But this process is now changing. Airlines will be charging each travel agent a distribution fee to access their NDC content through the GDS pipes.

- The GDS Amadeus has been actively promoting the NDC adoption. In 2021, approximately 80% of its distribution airline partners have achieved IATA Level 4 certification, and its NDC airline partners together represent nearly 25% of global passenger numbers in 2019. Recent milestones for Amadeus include a wider distribution agreement with Qatar, NDC agreements with British Airways and American Airlines, and an agreement with Air France-KLM. As of September 2021, Amadeus shares the following status related to its NDC development: five airlines live in the Amadeus Travel Platform with many more expected in the coming months; 10 Airlines live with Altéa NDC today, 20 more airlines being implemented, more than 2,500 travel sellers live across 50 markets, and NDC-enabled content available for Amadeus travel sellers around the world by the end of 2021.

- The GDS Sabre appears to be less excited about the NDC future. Dave Shirk from Sabre Travel Solutions said in July 2021 the vast majority of airlines had paused or completely stopped their NDC activity at this point in time.” In the meantime, Sabre has been working on its Airline Storefront platform and recently announced a value-based distribution partnership with Delta.

- The slow NDC adoption rate made IATA launch in November 2021 a new initiative called Airline Retailing Maturity Index, or ARM Index, that replaces the NDC certification. By the time of the announcement, 25 companies have made the transition into the ARM index, including Amadeus, United, American, and British Airways. A registry is also needed for the Index. The new initiative consists of two other "pillars", according to IATA. The first pillar is the "partnerships deployment". It tracks airlines' network reach, customer access to offers and orders, and volumes. Airlines' retail partners confirm the live capabilities in their specific deployment with each carrier and provide a satisfaction score. The second pillar is the "value capture compass." This is for the development of carriers' indirect digital retail strategies. An attempt to measure how successfully an airline is offering new and enhanced kinds of content through NDC is included in the effort. As presented by IATA, the Index aims to help the industry in the full realization of the revenue potential that could be unlocked by modern merchandising.

- ARM Index registry still details the specific NDC capabilities of companies in the airline merchandising value chain, but without the certification level designations. The One Order fulfillment capabilities of companies are embraced by the Index, which until now have been maintained in a separate public registry.

- Opinions about future NDC adoption are diverse. IATA and other front-runners are very optimistic but there was no evidence of public forecasts or goals for the next years. Meanwhile, less relevant players seem to be focused on adapting their business models to the challenging realities, without necessarily having short-term plans with the NDC.

Varied Levels of Adoption

- NDC implementation is not homogeneous among those airlines that have entered the NDC race. Nevertheless, no measure is available in the public domain concerning the extent of the adoption among firms.

- Implementation has to either depend on their Passenger Service System Providers (PSSs) or NDC Certified IT Providers. But the real problem is that each PSS provider may have a different version for each airline, and each IT provider may use its particular version and IATA NDC Schema to consume and expose. This means many "unique" approaches as well as the creation of many "unique" APIs and Airline Agent Platforms. The current situation means that all other parties would need to integrate with each airline, and/or travel agents will end up logging into each Airline Agent Platform, which will be extremely inefficient. This has created a need for standardization and aggregation of the different NDC channels.

- Aside from the approach, there are also differences in the extent of the NDC adoption since this largely depends on the particular long-term strategy. Some large airlines have been at the front of the development driven by aggressive digitalization and retailing strategies. As Phocuswright's Senior Analyst Norm Rose states, the airlines that tend to be more aggressive with the NDC adoption are the stronger carriers.

- There were found some examples of how airlines have implemented NDC but the available information is high-level and therefore not enough to understand the extent of the adoption. Emirates announced in 2021 an NDC-enabled direct-connect platform, Emirates Gateway, with exclusive content and services. Lufthansa Group manages NDC content deals with Sabre and American Express Global Business Travel. American Airlines, which is an NDC pioneer, announced new NDC bundles for its NDC-capable agents. British Airways and other IAG airlines opened access to travel agencies and TMC partners for NDC content through the Amadeus Travel Platform.

- According to Amadeus, some airlines are already implementing innovative strategies thanks to NDC capabilities. A good example is American Airlines. NDC-enabled travel sellers using the Amadeus Travel Platform can now book an American Main Plus offer, which includes the Main Cabin Extra or Preferred Seat along with an extra free checked bag and Group 5 boarding privileges on any American operated flight. Another example is Qantas. Travel sellers booking Qantas offers via NDC now have access to seamless shopping, re-booking, re-issuing, and refund processes as part of an end-to-end flow.

- As explained in Section 4 of this research, NDC is enabling a shift toward direct sales. Several airlines that have been leading the NDC adoption are prioritizing direct sales as a strategy to gain control over their businesses and reduce costs. Nevertheless, there is no consensus about how fast NDC will be included in the digitalization plans of airlines that are less relevant in the global market.

Operations in a Hybrid World

- According to Pass Consulting CEO Michael Straus, the hybrid world where the NDC standard lives together with the existing ecosystem will take years to disappear. This happens because of several challenges faced by all companies when trying to adopt the new standard. Mass adoption will take years, and any NDC installation will necessarily work side-by-side with a GDS aggregation. Forecasts about the time when the transition ends are absent, at least in the public domain, maybe because the NDC adoption has been more complicated and long than initially expected.

- "We need to be mindful that it will be a hybrid world for quite a while with NDC content and traditional GDS content living together side-by-side”, says Ludo Verheggen from Amadeus. Those that have invested in the standard, such as some large airlines and their GDS partners, remain optimistic but still believe a multi-year transition period is required, as reported by Michelle McKinney Frymir, CEO of CWT.

- A big challenge is associated with the duration and cost of the implementation. In 2019 a Pros survey reported that 59% of carriers had been engaged with NDC projects for more than a year. At that time, only 23% of respondents said IATA’s NDC was a primary motivating factor in pursuing digitization programs.

- Another challenge is the lack of standardization. NDC is called a "standard" but the reality is that the implementation is very diverse. Such diversity adds huge complexity to NDC's implementation and means little value to each offering, according to Amadeus.

- Commercial agreements are also an important challenge to overcome. The existing system consists of numerous entities that have diverse roles and interests. Developing new business models and commercial agreements requires years of effort from many players.

4. OVERVIEW OF IATA NDC SCHEMA

Current and Expected Direct/Indirect Split

- The sales distribution by channel in 2020 and the expected distribution for 2023 is the following, according to responses of 62 airlines surveyed by Accelya at the end of 2020:

- This channel-share mix doesn’t account for passenger traffic growth, which could cause the actual expansion of bookings through direct channels to be even greater, as reported by Accelya. No specific forecast for 2026 was available in the public domain.

- In 2019, Pros reported that direct sales reached approximately 56% of seat sales. But for the same year, Accelya reported that direct sales were approximately 45%. According to Accelya, travel management agencies and online travel agencies are just two of the indirect players ruling the industry and their relative importance may vary widely across regions. For example in the US, Online Travel Agencies represented 33% of indirect sales, while taking a share of nearly 80% in China.

- There is a shift toward direct sales. Certainly, sales in all channels were devastated by the pandemic, but the air passenger demand in 2020 favored domestic and leisure and, as a result, disfavored the GDS channel. On the other hand, airlines prefer many elements of selling direct. It's less costly on a per-transaction basis. The airline can control the booking experience and "own" the customer via direct channels. Additionally, the aggregated comparison display that takes place in indirect channels and that is based solely on price, can be eliminated.

- The shift is partly driven by NDC thanks to its supposed ability to allow airlines to bypass the GDSs. With NDC, airlines will directly share dynamic content with all other parties either through their APIs or through their own Airline Agent Platforms. Those platforms allow travel agents to access the airline's content exactly like how customers do it through their website. The only difference is that payment methods are more restrictive through online direct channels.

- The following three cases are examples of how airlines are prioritizing direct sales, Air Serbia, Lufthansa Group, and Finnair.

- Air Serbia is introducing in 2021 a €4-tax on each ticket segment sold via all distribution systems other than the airline’s own sales channels. The airline says it wants to establish more direct contact with its passengers and to offer the best prices through its own sales distribution channels which are Air Serbia's website, mobile app, phone contact center, and physical offices. From May to December 2020, less than half of all tickets were bought directly from Air Serbia but that represented a major increase compared to the same period in 2019.

- Lufthansa Group decided to penalize GDSs and the travel agencies that use them. In 2019, the airline group reported its direct-booking share surpassed 50% for the first time in history, up from 30% in 2015. Lufthansa Group CEO Carsten Spohr expected further increases since Lufthansa's vision is more use of NDC-enabled direct channels.

- Similarly, Finnair announced a new charge of €12 per-way surcharge on EDIFACT bookings at European points of sale beginning July 2022, as part of its long-term strategy. It will also pipe its "best" content and prices to the trade solely through NDC connections, according to the carrier. Van Enk from Finnair said surcharges on GDSs have become the norm in Europe.

But not all airlines showed the same kind of strategy within the pandemic crisis. Sabre reported that some companies that had exclusively sold direct in recent years initiated relationships with its GDS, including Norwegian and Indonesia's Lion Air. Similarly, Southwest Airlines expanded the agreement with GDSs in hopes of reaching more corporate travelers. Meanwhile, some analysts suspected the Covid crisis last year could draw airlines closer to any channel that could drive demand and revenue.

NDC distribution

- No data points related to the percentage of offers distributed via NDC and to how those offers connect with shopping, purchasing, and price points are available in the public domain.

- The only data point found is what IATA said regarding the NDC participation in the indirect channel. According to IATA, the target of 20% of NDC bookings in the indirect channel was reached by June 2020. However, some analysts highlight that it was for mostly domestic leisure bookings as a consequence of the pandemic. The percentage hovered at just below 11% in December 2019 according to IATA.

- IATA's representatives declined to set a new goal for the percentage of NDC sales in 2021 considering the current climate but the long-term goal is to have 100%.

- In a public announcement, Lufthansa Group affirmed that one out of three tickets was sold through NDC by November 2021.

5. CORRELATION BETWEEN DYNAMIC PRICING AND NDC

- NDC does not directly work on dynamic pricing but allows the airline to gather data that is very useful for the pricing decision and to distribute the offer as an overall product rather than simply a fare.

- According to Marco Contento, who is VP Aviation Business Services at IBS Software Services, NDC will have a very positive impact on how the overall offer will be built for the customer but its purpose is not to deal with dynamic pricing. NDC allows airlines to gain greater control over their products and how they are offered to the customers, including the price component. Nevertheless, NDC does not touch upon the real-time context rules that are essential for dynamic pricing. Contento states that NDC fixes the transmission/plumbing problem but doesn't fix the "engine" problem.

- With the "engine" problem, Contento wants to say that truly dynamic pricing involves real-time calculation by considering the buyer´s context and connecting it with the product offering. The pricing decision must be made in real-time and generated from scratch. The airline must describe the business rules they wish to apply and use the available technology to do it. Some examples of which factors may drive pricing decisions of the products (seats, ancillaries) are day and time, nature of the destination, ancillary purchasing, size of the group making the booking, and load factor on the economy cabin.

- A report published in 2020 by Phocus Wire provides useful information to understand how NDC works and how dynamic pricing might be inserted in the complete process, as described below.

- Personalization in the NDC world works in this way:

- The NDC search contains data about the trip, purpose of travel, sales channel, travel preferences, and customer preferences. NDC provides the input.

- This data goes to the airline offer engine and, powered by AI, is combined with elements such as price, product catalog, and availability, in addition to request context, customer profile, and historical data. AI can be applied to multiple historical transactions to identify key customer behaviors and analyze multiple data from different variables. Once the customer is identified and put into a specific persona or category, the technology is there to help create a relevant offer based on business rules set by the airline. As the number of rich-detail searches increases, the AI will calibrate itself so that the next time a similar person comes in with a similar request you can make a better offer.

- The output is the personalized offer, where the price is one of the elements that might be personalized and adjusted to the context. Depending on how the engine is designed, the price received by the customer will be constructed or not in a truly dynamic way.

- NDC is a data standard for exchanging information. The ultimate purpose is to encourage buyers to book tickets, based on having greater information on the value proposition of the offer. NDC opens up a world of possibilities to help airlines present their product in a way that better allows differentiation.

- The purpose of dynamic pricing is to increase revenue and NDC is key to applying dynamic pricing across distribution channels. It is also key to feed the data with customer information and therefore to have prices adapted to customer profiles. Boyan Manev, Principal, Travel Strategy at Pros, explains that in the past when the requests were coming in, they were anonymous requests transmitted through the GDS. And when the prices were set by the airlines, they had to be delivered through numerous parties without being enriched with other components of the product. But now NDC provides the data input to transmit richer information and the standard to distribute the offer homogeneously.

- The legacy distribution system allows for just 26 fare classes. Airlines set prices and restrictions to each fare class, then file those classes with ATPCO for dissemination to GDSs. Under the current system, updating prices in each fare class can be done four times per day on domestic flights and hourly on international flights, Tom Gregorson from ATPCO said. But in practice, most airlines typically keep their set of price points for weeks at a time and mainly manage fare offerings by altering the fare classes that are up for sale at any given time, according to Peter Belobaba from MIT.

- According to a 2018 paper prepared by PODS Research, moving into a world of dynamic price offerings has proven technologically difficult for the airline sector, in large part due to the legacy distribution system that has been in place for decades. Getting away from the legacy fare-filing system is a requirement to have a world where prices are generated dynamically, Gregorson said. In this regard, implementing the NDC standard would mean solving much of that problem.

RESEARCH STRATEGY

For this research on Airlines Pricing and Content Distribution, we leveraged the most reputable sources of information that were available in the public domain, including reports and surveys from consulting firms, company websites, specialized magazines, and IATA's official data Much of the available information is high-level and qualitative since many sources focus on explaining concepts and highlighting benefits and challenges as well as recommendations to apply one strategy or another. Since the availability of quantitative data and details about how companies are implementing their strategies (i.e. dynamic pricing and dynamic content) is low, numerous sources were carefully reviewed to extract useful qualitative information from real-life cases, insights, surveys, and opinions from industry experts with the purpose of providing a clear picture of each topic. No qualitative data were found regarding forecasts of the requested topics, probably because industry experts are still wondering how the near future will be after the devastating results observed during the pandemic for the airline industry.