Part

01

of six

Part

01

AI Agent Landscape

Summary

The global AI agents market is rapidly expanding, with estimates for 2023-2024 ranging between $3.86 billion and $5.1 billion and projected to grow to over $47 billion by 2030. North America leads the market, with significant contributions from the U.S., while Europe, particularly the UK and Germany, is expected to follow suit due to government initiatives supporting AI adoption. The enterprise sector currently holds the largest share, but the industrial segment is expected to show the highest growth. Companies like Microsoft, Google, IBM, and emerging startups are leading the charge, with advancements in multi-agent systems, conversational AI, and no-code platforms making AI agents more accessible and efficient. Despite challenges such as security concerns and orchestration complexity, the AI agent landscape is evolving quickly, offering transformative potential across various business functions.

Creative Solutions

- Information specific to the U.S. and market and enterprise AI agents was not available in reputable public sources. As an alternative, we provided the market size for the global AI agent market, covering the entire sector rather than just enterprise agents, given that North America and enterprise solutions represent a significant portion of the market.

- Similarly, the information specific to the UK and EU markets was not available. We provided a qualitative finding about the growth in those markets.

- Innovations were provided in two sections: one within the key players section, highlighting product launches and partnerships, and another offering a broader perspective on market trends.

- While we couldn't find detailed industry-specific adoption data due to the early stage of the technology, we included available insights on specific sectors and overall adoption trends. The information regarding key player capabilities is based on company claims.

Complete Findings

The AI Agent Market

- The global AI agents market is poised for significant expansion in the coming years. Estimates for the market size in 2023-2024 range between $3.86 billion and $5.1 billion. By 2030, projections place the market size between $47.1 billion and $50.31 billion, reflecting a compound annual growth rate (CAGR) of 44.8% to 45.1% over the 2024 to 2030 period.

- Currently, North America holds over 40% of the global AI agents market, driven by the US' leadership in technology and early adoption of AI across various industries. Major companies like Google, Microsoft, and IBM are driving advancements in AI agents, supported by a strong startup ecosystem that focuses on AI innovation in sectors such as finance and education.

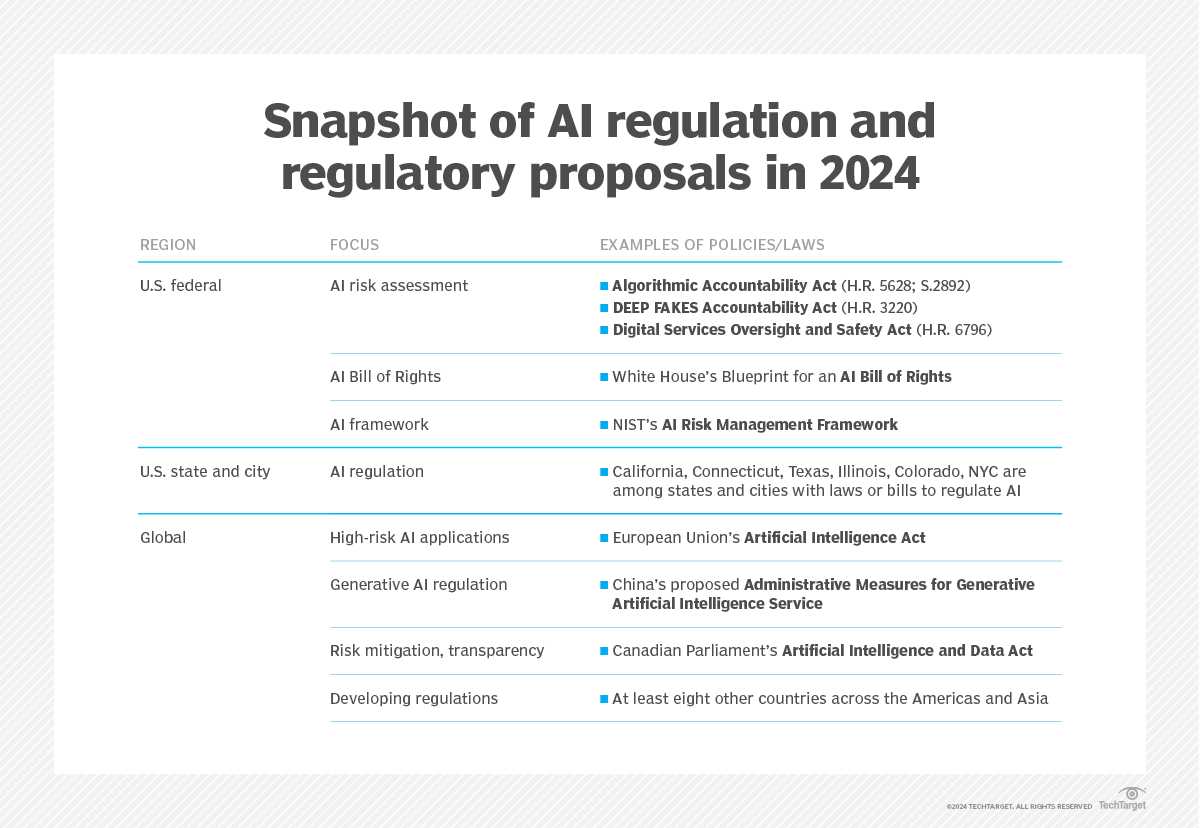

- In Europe, the AI agents market is expected to grow significantly over the next decade, driven by the UK and Germany. This growth is supported by government initiatives, including the European Union's AI strategy, which encourages research, innovation, and the ethical application of AI agents in various industries.

- The enterprise segment accounted for the largest market revenue share in 2023, but the industrial segment is anticipated to exhibit the highest CAGR over the forecast period.

- The machine learning segment currently leads the market, accounting for over 30% of global revenue. The deep learning segment is anticipated to exhibit the highest CAGR through 2030.

- Based on deployment type, cloud dominates the market, accounting for 53% of the total market share, driven by its flexibility, lower costs, and scalability compared to on-premise solutions.

- Ready-to-deploy agents hold the highest market share due to their lower costs, ongoing support, and minimal setup time compared to custom solutions, making them particularly appealing to small- and medium-sized companies. Many solutions offer intuitive interfaces requiring little technical knowledge, making them accessible to a broader range of users.

- The build-your-own agents segment is expected to show the highest CAGR, as they can be integrated with legacy systems, ensuring smoother workflows. Industries like healthcare and BFSI tend to favor build-your-own agents to maintain strict control over data and security protocols, enabling them to implement customized data handling and privacy measures.

- The single-agent systems segment currently holds the largest market share due to their ease of implementation and lower development costs compared to multi-agent systems. These solutions allow businesses to enhance efficiency quickly without extensive customization. However, multi-agent systems are expected to experience substantial growth in the next five years, driven by their ability to handle complex problem-solving, real-time decision-making, and improved collaboration across industries, particularly in applications like emergency response, where coordination among agents is essential.

Market Growth Drivers

- The demand for automation, rising investments, a thriving startup ecosystem—particularly in the U.S.—and companies' willingness to adopt new solutions are key factors driving growth in the AI agent market.

Demand for Automation

- A key driver for the adoption of AI agents is the rising demand for automation solutions that enhance efficiency, scalability, and decision-making across various sectors. Businesses are increasingly under pressure to streamline operations while reducing costs, and AI agents present a viable solution by automating repetitive tasks, analyzing large datasets, and delivering real-time insights.

- Seventy-one percent of organizations expect AI agents to drive automation, with most also believing agents will offload repetitive tasks from human operators, allowing employees to focus on more value-added activities.

- In industries like investment banking and healthcare, AI agents are employed for data analysis and pattern detection, helping professionals make timely, accurate decisions. This automation not only boosts operational efficiency but also allows companies to scale their services without needing to increase their workforce, making AI agents essential for sustaining growth and competitiveness.

The limitations of RPA and iPaaS solutions

- Unlike earlier software focused on low-level, sequential tasks. modern cognitive architectures enable dynamic, end-to-end automation. While platforms like UiPath and Zapier proved the demand for rules-based automation, scaling these systems exposed several limitations: the need for significant manual work in setup and maintenance, the fragility of UI automations, limited API integrations, and challenges in processing unstructured data. Traditional RPA and iPaaS solutions are constrained by deterministic architectures, even when incorporating LLMs.

- AI agents differ fundamentally from traditional RPA bots and earlier generation AI tools by serving as adaptive decision engines within application workflows. As AI agents mature and their capabilities grow, they will be increasingly capable of dynamic decision-making, complex reasoning, multi-step processes, and exception handling, unlike the static, hard-coded logic of RPA bots or retrieval-augmented generation (RAG) systems.

- For instance, in an invoice reconciliation workflow, an RPA bot may struggle with mismatches or edge cases, often escalating issues to human intervention. In contrast, AI agents can adapt to new data formats, execute multi-step investigations (e.g., scanning emails for price changes), and handle complex considerations like currency exchange and transaction timing. They are also robust against exceptions, leveraging contextual understanding to resolve issues autonomously, thus truly reducing reliance on human involvement.

Companies are willing to explore new solutions

- Capgemini found that organizations are "eager to adopt AI agents, with a strong majority (82%) intending to integrate them within 1–3 years." Security and trust concerns remain key barriers to widespread adoption of AI agents, but businesses of all sizes increasingly recognize the need to engage with the booming AI agent market to stay competitive and capitalize on advancements in automation, efficiency, and decision-making capabilities.

- Another recent survey found that 72% of decision-makers are open to engaging with startups for AI agent solutions, favoring them for their innovative and tailored offerings, as well as their speed and agility, which often surpass what incumbents can provide.

Investor Interest

- Recent reports indicate that AI agents are experiencing a "ChatGPT moment" as investors shift their focus beyond chatbots. Grace Isford, a partner at Lux Capital, noted a "dramatic increase" in investor interest in startups developing AI agents. Accel's latest Euroscape report also identifies enterprise AI agents as a major upcoming trend. Michael Treskow, a partner at London-based VC firm Eight Roads, highlights that investments are shifting towards AI agents that go beyond answering questions and are now performing tasks based on available information.

- AI agent startups are indeed attracting substantial investments, albeit not on the scale of billion-dollar financings seen with AI model companies, but valuations are still rising. Some recent examples:

- Adept, led by former OpenAI and Google employees, raised $350 million in 2023, with a valuation exceeding $1 billion. The company announced in June that it will focus exclusively on solutions that enable enterprise agentic AI.

- Cognition AI, the company developing the "first fully autonomous AI software engineer," raised $175 million in April 2024, led by Founders Fund, pushing the company's valuation to $2 billion.

- French startup H raised $220 million in a seed round backed by Amazon, Samsung, UiPath, and Eric Schmidt in May. Artisan AI, a Y Combinator-backed startup positioning AI agents as "AI employees for enterprise," secured $7.3 million in funding and has already onboarded over 100 companies.

- CrewAI has secured $18 million in funding, including backing from boldstart ventures and Insight Partners. The funding will be used to support the development and launch of its new Enterprise Cloud platform, which enables organizations to build and deploy AI agents tailored to their unique workloads. The platform builds on CrewAI’s existing open-source framework, which already powers over 10 million AI agents per month.

- DeepOpinion, a startup "specializing in enterprise agentic process automation," raised €11 million in a Series A funding round In September.

Big Tech is focusing on Agents

- “Every major company is now doing [AI] agents,” states Ruslan Salakhutdinov, a computer scientist at Carnegie Mellon University who is working on AI agents. According to AI expert Andrew Ng, “AI agent workflows are going to drive tremendous progress in AI this year, probably more so than the next generation of foundational models. This is a significant trend, and I urge everyone working in AI to pay attention to it.” Research suggests that they are.

- Microsoft CEO Satya Nadella mentioned during an earnings call earlier this year that the company aims to provide an AI agent capable of handling more tasks on behalf of users, though he acknowledged that there is still "a lot of execution ahead." Similarly, executives from Meta and Google have highlighted their efforts to enhance the productivity of AI agents, signaling a broader industry push towards more capable and autonomous AI systems.

Innovations

- AI agents still face numerous challenges and limitations, such as memory, data quality and accuracy. However, recent innovations expanded the applicability of LLMs to more complex workflows, driving the AI agent landscape. Improvements in model accuracy, memory structures (both short and long-term), logic frameworks, and answer evaluation mechanisms have significantly enhanced their capabilities. LLMs now have the ability to self-evaluate and correct errors to some degree, and when combined with human oversight, they can deliver higher accuracy and productivity.

- Moreover, generative AI applications are transitioning from custom-built solutions to more standardized frameworks. This shift toward "packaged software" is improving implementation speed and cost efficiency, making it easier to deploy these technologies across a wider range of real-world use cases, including enterprise long-tail tasks.

- One of the most notable trends is the increased autonomy of AI agents. These agents are starting to become capable of making complex decisions and taking independent actions without the need for human input. This is particularly evident in industries like autonomous vehicles, robotics, and finance, where AI agents handle tasks such as navigation, operational management, and trading strategies, showcasing their ability to function without constant oversight.

- Enhanced NLP is another significant advancement. Improvements in NLP have allowed AI agents to better understand and generate human language, making virtual assistants, chatbots, and customer service agents more effective at handling complex interactions and responding to user queries with higher accuracy and nuance. For example, financial services company Klarna reported that its AI agent, powered by OpenAI, took over two-thirds of customer chats within its first month of use. During this period, the AI agent performed the equivalent work of 700 full-time agents.

- Finally, human-AI collaboration is gaining momentum, as AI agents are increasingly designed to work alongside humans to enhance productivity and decision-making. This collaboration is particularly impactful in fields like healthcare, where AI agents support doctors in diagnosing diseases, recommending treatments, and analyzing patient data, leading to better outcomes and more informed decisions. For example, ServiceNow AI agents are designed to work with each other and humans to "proactively and predictly" resolve tasks.

Function-Specific Agents

- A report from May, which analyzed 94 AI agent companies, found that these tools generally fall into three main subsectors. The first category includes agents that focus on general tasks, such as improving workplace productivity. The second category consists of function-specific agents, which are designed to perform specialized jobs, like acting as sales development representatives. Lastly, the third category is industry-specific agents, which aim to automate various tasks within a specific profession.

- According to the report, function-specific agents are the ones expected to win over the market first. According to the report, these AI agents are essentially trained or instructed to handle tasks that are as clearly defined as a job description. This clarity in task definition is seen as a key factor driving excitement and progress in the field, as it allows these agents to function effectively in specific roles. One example of a function-specific AI agent gaining traction is 11x, a London-based startup that develops "digital workers"—AI agents designed to perform the duties of SDRs, effectively automating a key part of the sales process.

- 11x.ai, which completed a Series A funding round of $24 million and a Series B round of $50 million in 2024, is now valued at $350 million. The company currently offers two AI bots, referred to as "automated digital workers." The first, Alice, is an AI Sales Development Representative (SDR) designed to manage sales lead generation, conduct research, and handle customer outreach. Recently, 11x.ai introduced Jordan, an AI phone sales representative capable of speaking over 30 languages. Jordan can handle both inbound and outbound conversations with potential buyers, further expanding the company's AI-driven sales automation capabilities.

Multi-Agent Architectures

- While AI agents have traditionally been supportive tools, they are now evolving into independent entities capable of executing complex tasks with minimal human oversight. Multi-agent systems are expected to further enhance these capabilities by enabling AI agents to collaborate and solve tasks collectively, improving efficiency and productivity for enterprises.

- The technology is still in its infancy, but according to Cognizant, Multi-agent AI is “set to revolutionize enterprise operations.” The future of software will likely be shaped by these agent architectures, leading to the creation of AI agent marketplaces that allow dynamic integration and collaboration between specialized agents across different platforms.

- Multi-agent systems excel in complex tasks by utilizing specialized sub-agents, which enhance both accuracy and modularity. Although still in early development, multi-agent architectures are gaining traction in enterprise applications like customer service and software development, with both major tech companies and startups working on new frameworks and tools. Startups, including well-funded companies like Ema and Sierra, are building multi-agent architectures for industries like healthcare and customer service. Major tech companies, such as Microsoft, are also releasing multi-agent frameworks, fueling increasing media interest in 2024.

- Despite the potential, widespread adoption faces challenges, including agent reliability and orchestration complexity. However, advancements indicate a future where AI teams, managed by AI systems and guided by humans, will handle increasingly intricate workflows.

Key players

Note: Key players have been selected based on market reports and recent developments in the space. The landscape map below was published in September, prior to several announcements made by incumbents that are covered in the following insights. An more up-to-date list of AI agents can be found here, dividided by vertical. We provided the version below as it provides a curated list of key players and emergent, offering a clear and easy-to-visualize breakdown of where each player falls within their respective industry segments.

- The AI agent landscape is highly fragmented and evolving rapidly, with a diverse mix of established incumbents and emerging startups driving innovation. Over the last few weeks, numerous companies have made announcements or launched new solutions that are moving the market.

Salesforce

- On September 12, Salesforce announced Agentforce, a platform that integrates autonomous AI agents across its core clouds, including Sales, Service, Marketing, and Commerce. The platform includes new AI agents like Sales Qualification, Service Agents, and Campaign Optimizer, designed to assist with complex workflows such as customer engagement, sales support, and marketing automation.

- At Dreamforce 2024, Salesforce emphasized that Agentforce moves beyond simple generative AI assistants (like Copilot) to fully autonomous agents capable of handling multi-step tasks. Central to this is the Atlas Reasoning Engine, which simulates human planning and decision-making to refine and execute user queries. Data Cloud serves as the platform’s core, unifying Salesforce applications and customer data.

- Agentforce offers native integrations with MuleSoft, Salesforce Flow, and Apex to further enhance agent functionality. Salesforce partners, including AWS, Google, and IBM, are already building agents for the platform. Agentforce is expected to compete with other AI solutions in the market, such as ServiceNow's Xanadu release and Google's AI agents, with some components launching as early as February 2025.

Microsoft

- Melius Research’s Ben Reitzes has identified Microsoft as an early driver in the development and adoption of AI agents. According to Reitzes, Microsoft is positioned to drive advancements in this space, leveraging its existing capabilities and investments in AI technology to accelerate the integration of AI agents across various applications.

- Microsoft reported that 60% of Fortune 500 companies are using its Copilot technology. Examples include Lumen Technologies, projecting annual savings of $50 million through AI-driven improvements for its sales teams, and Honeywell, which achieved productivity gains equivalent to adding 187 full-time employees.

- On October 21, Microsoft introduced ten new autonomous agents in Dynamics 365, including agents for Sales Qualification, Order Processing, Supplier Communications, and Financial Reconciliation. The launch also featured Copilot Studio Preview, which allows companies to create custom AI agents without coding, backed by robust security and governance features.

- The company is positioning its autonomous agents as “apps for an AI-driven world,” distinguishing them from traditional chatbots by their ability to operate with minimal human intervention. The agents are designed to perform a variety of tasks, including handling client queries, identifying sales leads, and managing inventory.

- Internal tests showed significant improvements in several business functions through the use of Copilot and AI agents. A sales team achieved a 9.4% increase in revenue per seller and 20% more closed deals. Customer service saw a 12% faster case resolution, while the marketing team improved the Azure.com conversion rate by 21.5% using a custom AI agent. In Human Resources, an AI-powered self-service agent increased the accuracy of responses by 42%, demonstrating enhanced efficiency across departments

- In a demo, McKinsey, which had early access to the tools, created an AI agent capable of managing client inquiries by checking interaction history, identifying the appropriate consultant for the task, and scheduling follow-up meetings.

- The new launches position Microsoft to compete directly with Salesforce's Agentforce. According to CNBC, "Microsoft is doubling down on AI agents at a time when competition is intensifying up in the red-hot artificial intelligence space, after Salesforce launched its own 'agentic' AI system last month."

- In April 2024, Google Cloud introduced Vertex AI Agent Builder, a platform designed for creating and deploying no-code conversational AI agents. This tool is particularly focused on customer engagement, allowing businesses to build task-specific AI agents that can execute complex workflows across multiple systems. The agents are capable of natural voice interactions and grounding responses in enterprise data, enhancing their relevance and accuracy.

- Google Cloud’s Vertex AI Agent Builder introduces key features like a no-code console for building AI agents with natural language, integration with Gemini models, and the ability to ground outputs in enterprise data and Google Search. It also supports complex workflows through multi-agent linking and adheres to stringent compliance and security standards such as HIPAA and ISO 27000-series

- In September. the company launched a series of updates, including the new Gemini 1.5 Flash and 1.5 Pro models with a 2 million context window. These models feature grounding through Google Search, premade "Gems" in Google Workspace, and a range of AI agents focused on customer engagement and conversational tasks.

- At the Gemini at Work event, Google Cloud outlined how its agentic AI push integrates across its platform. The goal is to allow enterprises to leverage Gemini’s models, create custom AI agents, and deploy them with enterprise data grounding on optimized infrastructure. This unified stack facilitates seamless customer engagement solutions across web, mobile apps, call centers, and point-of-sale systems, using both chat and voice interaction.

- On October 21, Honeywell announced a partnership with Google to integrate Google’s AI-powered agents into its systems, aiming to automate tasks for engineers and assist technicians with maintenance issues. Honeywell emphasized that while generative AI is already in use within the industrial sector, this collaboration will elevate its application beyond current "gen AI point solutions" by linking Google AI with the Honeywell Forge IoT platform. “We’re moving from automation to autonomy,” said Suresh Venkatarayalu, Honeywell’s CTO and president of Honeywell Connected Enterprise, in a Google blog post. “Our goal is to provide AI agents that offer real-time support to workers, both on factory floors and in the field.”

IBM

- The IBM’s WatsonX.ai platform serves as an enterprise-grade AI studio aimed at building and deploying agentic services. It offers a comprehensive developer toolkit that supports the full AI development lifecycle. The platform provides flexible options, catering to both pro-code solutions for experienced developers and no-code platforms for business users, enabling a wide range of users to leverage its capabilities.

- On September 17, IBM and Salesforce announced a partnership to develop pre-built AI agents that integrate IBM WatsonX with Salesforce’s Agentforce platform. These AI agents are specifically designed to automate processes in regulated industries, focusing on enterprise data workflows. By embedding WatsonX into Salesforce’s ecosystem, this collaboration extends its capabilities to areas like customer relationship management (CRM) and other data-intensive operations.

- On October 21, IBM introduced Granite 3.0, an enterprise AI model. In the announcement, the company stated that it is planning to release new tools to help developers and deploy agentic frameworks and said that it is focused on developing AI agent technologies which are capable of greater autonomy, sophisticated reasoning and multi-step problem solving.

- “The initial release of the Granite 3.0 8B model features support for key agentic capabilities, such as advanced reasoning and a highly-structured chat template and prompting style for implementing tool use workflows. IBM also plans to introduce a new AI agent chat feature to IBM watsonx Orchestrate, which uses agentic capabilities to orchestrate AI Assistants, skills, and automations that help users increase productivity across their teams. IBM plans to continue building agent capabilities across its portfolio in 2025, including pre-built agents for specific domains and use-cases.”

- IBM’s expansion of its AI-powered platform, IBM Consulting Advantage, now includes specialized offerings for Cloud Transformation and Management, and Business Operations. These new modules integrate domain-specific AI agents, applications, and methods, enabling consultants to accelerate cloud and AI transformations, such as code modernization and quality engineering, and streamline operations in areas like finance, HR, and procurement.

Amazon

- Amazon and AWS are advancing their AI agent development with offerings designed for both retail and enterprise use cases. The company, though trailing behind Google and Microsoft in AI development, is increasing its investments in AI agents to close the gap. Amazon Bedrock Agents are among the key developments, enabling execution of multistep tasks across company systems. The agents incorporate RAG, which improves their ability to retrieve and generate relevant data, making them more efficient for complex queries. Additional features include code interpretation, memory retention across interactions, and chain-of-thought reasoning, which provides transparency in decision-making.

- In June, Amazon hired executives and top talent from the AI agent startup Adept and licensed its AI technology to bolster its AI agent portfolio. By leveraging Adept’s technology, Amazon seeks to enhance AI-driven automation, particularly in helping users navigate and operate enterprise software more efficiently.

- In August, reports indicated that Adept's investors would receive their money back, despite no change in the company’s ownership.

- Amazon is also developing AI shopping agents designed to recommend products to customers and even add items to their carts automatically. “It’s on our roadmap. We’re working on it, prototyping it, and when we think it’s good enough, we’ll release it in whatever form makes sense,” said Trishul Chilimbi, VP and distinguished scientist at Amazon.

Amelia

- Developed by IPsoft, Amelia offers advanced conversational AI and automation solutions for enterprise applications. Unlike broader AI systems, Amelia's AI agents are designed with a deep contextual understanding, enabling them to manage complex, multi-turn conversations. By combining natural language processing, machine learning, and process automation, Amelia’s AI agents can simulate human-like interactions with precise responses.

- Amelia’s AI agents are widely deployed across industries such as finance, healthcare, and telecommunications, where they assist in tasks like loan processing, handling customer inquiries, patient management, and executing administrative functions. Amelia’s ability to integrate with existing IT systems and offer highly customized AI solutions for businesses positions it as a leading player in the AI agent market.

- Amelia has been recognized as a leader in the Everest Group's Conversational AI PEAK Matrix for three consecutive years, holding the highest position across both the Vision & Capability and Market Impact axes. Recently awarded the XCelent Advanced Technology 2024 Award for retail banking solutions, Amelia stands out for its advanced capabilities in the financial sector. It is one of only two vendors acknowledged as a top provider across all major industries, with the largest client base among vendors in the banking sector and a strong retention rate with tier 1 banks.

Oracle

- In September, Oracle announced at CloudWorld the launch of over 50 role-based AI agents within their Fusion Cloud Applications Suite, designed to automate business processes and enhance productivity across multiple departments.

- The AI agents are embedded throughout Oracle's ecosystem, providing personalized insights, recommendations, and automated task completion capabilities. These agents support various business functions including finance, supply chain, HR, sales, marketing, and service, enabling organizations to reimagine their workflow processes.

- "This is the use case that we've really been wishing for," said Mark Beccue, an analyst at TechTarget's Enterprise Strategy Group. "These are very pragmatic and practical ideas. Something helps me get something done."

Anthropic

- Anthropic, the developer behind the AI model Claude, is expanding into the AI agent market. On October 22, the company introduced AI agents tailored for specific business functions, built on large AI models and customizable for various tasks. Anthropic’s latest innovation, the "Computer Use" capability, enables its technology to interpret computer screens, click buttons, enter text, navigate websites, and execute tasks across any software, including real-time internet browsing.

- According to Jared Kaplan, Anthropic’s chief science officer, this tool allows AI to "use computers in basically the same way that we do," capable of completing complex tasks involving "tens or even hundreds of steps." Amazon had early access to this tool, and early customers and beta testers included companies like Asana, Canva, and Notion. Kaplan also noted that the company has been developing the tool since early this year, with plans to make it available to both consumers and enterprise clients in the coming months or early next year.

Ema

- Ema offers a universal AI employee solution that can assume multiple roles across various business functions. The platform features a Generative Workflow Engine for building specialized AI employees, with capabilities in customer support, data analysis, and employee assistance. The startup, which emerged from stealth in March, has raised $61 million from Accel and Section 32.

- It offers enterprise no-code AI agents, referred to as “universal AI employees,” designed to operate across multiple business functions. "Our goal at Ema is to automate most of the mundane tasks human employees perform today, freeing them up for more valuable work in the enterprise. Ema is built as a universal AI employee, capable of taking on any role in the organization—from customer support and employee experience to sales, marketing, legal, and compliance," said Surojit Chatterjee, CEO and co-founder, in an interview with VentureBeat.

- The company offers a no-code platform with pre-built AI employee templates. Users select an AI agent for a specific use case, then fine-tune and deploy it through a guided process. These AI employees (or "Ema personas") make decisions, create plans, and orchestrate workflows while collaborating with humans. To ensure accuracy, the platform uses EmaFusion, a 2T+ parameter model combining over 100 public LLMs and custom domain-specific models, optimizing performance and cost.

Sierra AI

- Sierra's AI agents are designed to deliver natural, empathetic conversations across text and voice channels, ensuring a consistent brand tone and personality. The agents seamlessly integrate with a variety of business systems, including CRM case management, order management, subscription services, and customer service platforms, enabling efficient automation across multiple functions.

- Built on the AgentOS platform, Sierra’s technical architecture leverages multi-LLM processing for complex tasks, long-term memory capabilities, and API integration with enterprise systems. The platform also includes built-in supervisory AI systems that monitor and manage agent behavior, ensuring the accuracy and reliability of the AI agents' performance.

- On October 9, Sierra announced that its AI agents had gained voice capabilities, enabling them to handle customer calls. In the announcement, the company highlighted the multitasking abilities of its agents, stating, “Behind the scenes, Sierra agents have multitasking superpowers. While your agent communicates updates and chit-chats, it can quickly retrieve relevant information, securely access internal systems, and take appropriate action. In the context of a return, for example, a Sierra agent can pull up a customer’s order while it checks their address. Then, in a fraction of a second, it can locate the three nearest return centers, calculate walking directions for each, and tell the customer which has the shortest walk.”

- Founded in 2023 by OpenAI's chairman Bret Taylor, the company reached unicorn status in February 2024 following a $110 million venture round led by Sequoia Capital and Benchmark. On October 9, Bloomberg reported that the company was in discussions to secure additional funding, potentially valuing it at over $4 billion.

AI Agent Adoption

- A July 2024 report from Capgemini reveals that while only 10% of companies are currently using AI agents, 82% plan to integrate them within the next 1-3 years. This surge in adoption is driven by the anticipated benefits of enhanced automation and efficiency, particularly in industries such as customer support and financial services.

- Adoption may be currently low, as it is a new technology, but AI agents are expected to reshape business dynamics. According to Bill Gate, "Agents are not only going to change how everyone interacts with computers. They are also going to upend the software industry, bringing about the biggest revolution in computing since we went from typing commands to tapping on icons."

- The pharmaceutical and healthcare sector currently leads in AI agent adoption, with 23% of organizations already using the technology. However, in the next year, a substantial portion of high-tech (77%) and retail (66%) organizations are expected to adopt AI agents, demonstrating growing acceptance and integration of AI across diverse industries.

Note: There is significant discrepancy in reports about which sectors are leading AI agent adoption. Some reports highlight BFSI (Banking, Financial Services, and Insurance) as the leader, while others point to consumer services or healthcare. We selected Capgemini’s report as the most reliable source, as it is based on a comprehensive survey of hundreds of organizations globally, providing traceable and robust data.

- AI agents offer organizations versatility, facilitating deployment across various functions. Approximately 75% of businesses plan to implement this technology for tasks such as code generation and continuous code improvement, underscoring its practical applications in streamlining and enhancing development processes.

- As noted in the survey, AI agent adoption is still limited, but Capgemini, Deloitte and SHRM provides industry-specific projections for future growth:

- In pharma/healthcare, AI agents are expected to manage healthcare services, including appointment scheduling, patient monitoring, and personalized care, improving service delivery and reducing errors.

- In financial services, AI agents will continuously monitor account activity, detecting anomalies in real time to reduce fraud. Deloitte estimated the potential for different types of “agent modes” in which “humans and AI interact to implement the operating improvements that can deliver financial impact.”

- In customer service, they will handle natural language interactions, providing personalized assistance and allowing human agents to focus on more complex tasks. This seems to be the most widespread adoption currently.

- In human resources, AI agents will manage administrative tasks like onboarding, payroll, and benefits, freeing staff to work on strategic initiatives. For example, ServiceNow integrates AI into its digital workflow technology with its latest release, Xanadu, which includes NowAssist for employees, an AI-driven manager hub, and a redesigned HR agent workspace, integrating AI across the employee and manager experience.

- For IT service desks, they will resolve repetitive issues, improving productivity and reducing response times. In IT software development, AI agents are anticipated to autonomously develop software, from analysis to monitoring, ensuring quality assurance and shifting the role of engineers toward collaboration with AI.

- Furthermore, despite the early-stage development of AI agent technology, some organizations are already leveraging its potential:

- LG has integrated AI agents with robotic, AI, and multi-modal technologies to enable mobility, active learning, and complex conversation engagement. These agents can autonomously manage smart-home devices, patrol homes, monitor pets, and improve domestic security and energy efficiency.

- Torq has implemented a cybersecurity AI agent into its security hyper-automation platform, automating the triaging of contextual alerts, incident investigation, and response. This technology allows security teams to focus on more pressing issues, reducing staff burnout. Torq aims for the AI agent to independently resolve 90% of tier-1 and tier-2 security tickets in the future.

Adoption by Function

- A survey found that IT operations are the top priority for AI agent investment, with 23% of respondents planning to focus on this area in the next one to two years. Key areas of emphasis include enhanced system monitoring, predictive analytics, and automated maintenance, all aimed at reducing downtime and improving operational efficiency. HR was the second most prioritized function, followed by cybersecurity, project management, accounting, marketing management, and customer complaint resolutions.

- According to Accel, AI agents are enabling the automation of increasingly broad and complex business challenges, as they allow AI models to orchestrate workflows with minimal or no human involvement, managing tasks such as document queries, handling, engineering workflows, and security processes autonomously.

- The next generation of frontier action models will be specifically designed for task automation and decision-making, further enhancing their capacity to independently tackle complex business problems. In addition, some functions may be better suited for agents than others, which could affect adoption in the future.

- Still, organizations trust in AI agents for specific tasks. A majority (63%) indicated they would trust AI agents to analyze and synthesize data, while half would trust them to compose work-related emails. Additionally, 60% of organizations believe that within the next 3–5 years, AI agents will be responsible for generating most of the coding within their operations.

Research Strategy

Information on the market size for AI enterprise agents, geographic breakdowns, and adoption trends remains limited, likely due to the early-stage nature of the market. To address this, we consulted multiple sources, including market reports, surveys, investment trends, expert interviews, industry publications, news outlets, and vendor landscape reports. Overall, the AI agent market is still nascent, with key developments occurring in recent weeks and the technology in its infancy, making granular data scarce. Insights about adoption across industries and functions, for example, tend to be based in theories and the potential observed by experts. Therefore, we expanded the research to include the global AI agent market. For adoption trends, we provided estimates from reputable sources, focusing on future projections given the current limited adoption.