Part

01

of one

Part

01

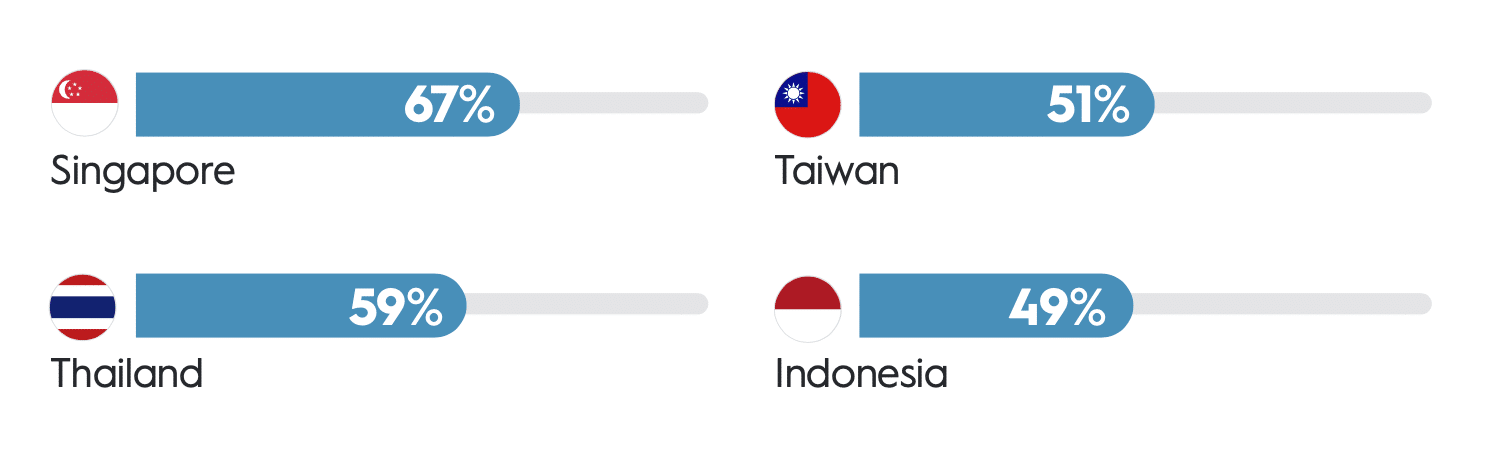

AdTech Revenue is Southeast Asia

Southeast Asia comprises eleven countries including Brunei, Burma (Myanmar), Cambodia, Timor-Leste, Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. The total number of internet users in Southeast Asia reached 400 million people (70% 0f the population) in 2020. A global survey conducted by Criteo in September 2020 indicates half of the world’s consumers are shopping online more during the COVID pandemic, especially in Asia Pacific region (SEA), with Vietnam at 76%, India at 52%, and Australia at 50%. E-Commerce has increased during the pandemic, with 53% of people discovering at least one form of online shopping (buying through mobile apps or picking up online orders in-store) that will continue. The majority of shoppers (85%) plan to continue purchasing from a new online store because of the ease and convenience of locating products. Interestingly, the small country of Taiwan expects to see an increase of 51% in online sales. For this report, much of the data needed for annual revenues, specifically for the Southeast Asian region, is located behind pay walled sources, resulting in only providing the data for those companies whose information is publicly available. For those companies whose annual reports do not disclose region-specific data, we were able to provide the total global revenue from their most recent reports, or through information gathered in public articles (if available).

- In 2019, Google, Temasek, and Bain and Company predicted that 2025 e-commerce volumes would reach $150 billion, offering bigger opportunities for growing ad tech companies. Consequently, as of 2021, e-Marketer estimates worldwide digital ad spending is at $389.29 billion, and projects that figure to grow to $526.17 billion by 2024.

- For many brands, their share of online sales on total sales have reached higher thresholds due to marketing through ad tech platforms- some have a 5% share, others are at 10%, with those who have surpassed 20%.

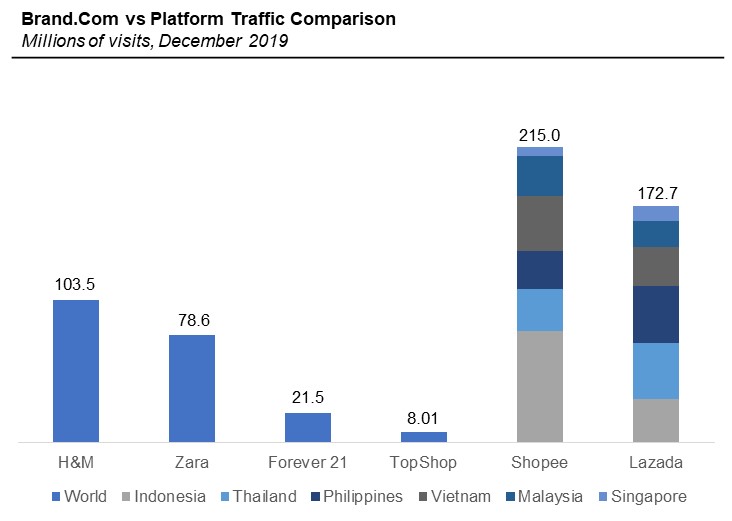

- The graph below shows platform traffic for year-end 2019 indicating growth for e-commerce brands that use advertising platforms in the SEA region:

AdTech Companies Operating in the SEA Region

- Criteo reported a revenue decline of 10% year-over-year, or 14% at constant currency, to $116 million in the entire Aisa-Pacific region (includes SEA), representing 18% of total revenue. The company's revenue ex-TAC declined 15% year-over-year, or 18% of constant currency, to $49 million that represents 19% of total revenue for the fiscal year 2020.

**Note: From here, the data gathered is not specific to the SEA region, but is used as a proxy to show total global revenue for each company from their most recent annual reports.

- The TradeDesk indicates 2020 enabled the company to secure a larger share in their fastest growing channels such as CTV and Audio, helping to drive record ad spend of $4.2 billion on the platform. The company's 2020 annual report shows total global revenue at $836 billion, up 48% year-over-year. Although we were not able to locate the revenue specifically for the Southeast-Asian region, the company does expect a 4% increase in CAGR in the Southeast-Asia region in online video revenue for 2021.

- Smartly.io provides companies with a software platform that automates and optimizes social media marketing operations The company's annual report for 2020 indicates total global revenue at $82.9 million for the first quarter 2021.

- Marin's platform offers digital advertising management solutions for search, display, social media and mobile advertising. It offers advertisers and agencies an easier way to measure, manage, and optimize billions of dollars in annualized ad spend across the web and mobile apps. The company's total global revenue reached $30 million for year-end 2020.

- Adroll (annual total revenue of $375 million in 2020) is a division of NextRoll Inc., that recently announced a new suite of marketing tools for direct-to-consumer (D2C) brands. Adroll's RollWorks now has 67% of its revenue tied to SaaS contacts. AdRoll's projected subscriber growth for its Growth Marketing Platform was 73% quarter-over-quarter for Q3 in 2020, fueled by a free approach that allows direct-to-consumer marketers to start with a free plan.

- The Adobe digital cloud experience segment's includes Adobe Marketing Cloud, Adobe Analytic Cloud, and Adobe Advertising Cloud. Adobe's total global revenue for this segment reached $3.40 billion for the year-end 2020, with subscription revenues at $696 million (14% year over year), driven by accelerated adoption of the Adobe Experience Cloud platform and app services.

- Google's Doubleclick (DoubleClick advertiser products and Google Analytic 360 Suites' are now under the brand Google Marketing Platform) is an integrated ad technology platform enabling advertisers to create and manage digital marketing campaigns. The company's marketing platform generated ad revenue in excess of $146.92 billion in 2020.

Research Strategy

We begin our research by locating relevant sources to provide annual revenues for the companies listed in the research. Sources include Statisa, PRNewswire, company 10-k reports and websites, relevant news publications, Business Wire, Yahoo Finance, and Macrotrends. We have attempted to ad as much information relating to the revenue for each company that may serve as a proxy for estimating market size.