Part

01

of one

Part

01

2022 Global and Regional Predictions

Key Takeaways

- According to the most recent (2021) data on vaccine procurement and inoculation, the “baseline assumes staggered and uneven distribution of vaccines across regions, with broad vaccine availability in advanced economies. In some emerging market economies, broad vaccine availability is expected for the summer of 2021 and in most countries by the second half of 2022.”

- Kuwait’s exports will likely drive the country’s economic growth to a steady rate of 2.4% in 2021 before climbing to 3.2% in 2022-23. Likewise, Qatar’s economy is forecasted to expand by 3%, 4.1%, and 4.5% in 2021, 2022, and 2023, respectively.

- Global income projections for 2022 and beyond show that the per capita income growth in EMDEs will reach 3.6% in 2022; however, among Low-income Countries (LICs), the per capita income growth is anticipated to reach 2% in 2022.

Introduction

Below are in-depth analyses of three positive and three adverse macroeconomic, political/legislative, regulatory, or social events that experts forecast over the next 12-18 months on a global level. Equally, there are reviews of the macroeconomic, political/legislative, regulatory, or social environments across various global regions, including the United States, Europe, Middle East, China, and Southeast Asia. For each, two positive and two negative macroeconomic factors forecasted to happen in the next 12-18 months have been provided.

1. MAJOR GLOBAL MACROECONOMIC OUTLOOK

POTENTIAL POSITIVE FORCES

Global manufacturing recovery, differentiated fiscal support, and positive per capita income growth are three examples of headwinds (potential positive forces) that experts forecast over the next 12-18 months on a global level.

Global Manufacturing Recovery

- During spring 2020, global manufacturing declined sharply than during the 2008-09 recession; however, the contraction was short-lived, with “synchronized V-shaped recoveries across both advanced and emerging market economies in the second half of the year.”

- Both the near-term and long-term outlooks are favorable for the sector, based on the February 2021 “global manufacturing purchasing managers’ index indicators,” which suggest the sector will continue recovering, though at a slower pace.

- While the resurgence of COVID-19 cases and variants could undermine the near-term growth of the global manufacturing landscape, social distancing measures witnessed in late 2020 and early 2021 suggest a “relatively limited impact on manufacturing activity.”

- The machinery and motor vehicle industries are among the biggest beneficiaries of the global manufacturing recovery, with the metals and aerospace sectors benefiting the least. In some regions like China, manufacturing activities have rebounded strongly, indicating a more positive outlook for the sector in near and long-term forecasts.

- According to the World Bank Group report published in June 2021, the global manufacturing activity has “firmed, with industrial production surpassing its pre-pandemic level….” Likewise, the global manufacturing output is anticipated to remain approximately 2% below the pre-pandemic forecast.

Differentiated Fiscal Support

- The global fiscal support is expected to remain accommodative throughout 2021 in advanced economies. On the other hand, fiscal support has been more limited in emerging markets and developing economies (EMDEs); thus, deficits are anticipated to decline in the near-term and long-term as revenues and crisis-related expenditures improve.

- GDP growth projections for “2021 and 2022 are 0.8 percentage point and 0.2 percentage point stronger than in the previous forecast, reflecting additional fiscal support in a few large economies and the anticipated vaccine-powered recovery in the second half of 2021.”

- Near-term prospects indicate that “economies are anticipating quicker and possibly more intense monetary policy tightening,” which would likely significantly impact demand and reverse savings rates.

- For the case of the U.S., the “Biden administration’s $1.9 trillion rescue package is expected to further boost GDP over 2021–22,” indicating additional fiscal support legislation, whose impact is expected to spill over to other trading partners, including the European Union and the United Kingdom.

- Unfortunately, smaller and susceptible economies can potentially suffer from extreme economic damage because the pandemic policy could stretch their “fiscal capacities and diminish their ability to cope with disaster-related risks health care needs.”

Per Capita Income Growth

- The near-term and long-term outlook regarding per capita income growth is mainly positive following rebounding economies, including the adoption of better income distribution policies to foster equal opportunities for all.

- COVID-19 has exacerbated income distribution inequality and is anticipated to leave a long-term impact on income. For example, the pandemic has unevenly hit the services sector that employs most of low-skilled and low-income employees and has given “further impetus to e-commerce and technological adoption more broadly, including in working arrangements.”

- Nevertheless, global income projections for 2022 and beyond show that the per capita income growth in EMDEs will reach 3.6% in 2022; however, among Low-income Countries (LICs), the per capita income growth is anticipated to reach 2% in 2022.

- The World Bank group data findings show that all per capita income losses in 2020 won’t be recovered by 2022 in an estimated two-thirds of EMDEs, including about 75% of “fragile and conflict-affected LICs” as the impact of job losses and increased uncertainties continues.

POTENTIAL NEGATIVE FORCES

Corporate solvency risks, uneven access to vaccines, and rising global inflation are three examples of tailwinds (potential negative forces) that experts forecast over the next 12-18 months on a global level.

Corporate Solvency Risks

- As global economies begin recovering, corporate insolvencies emerge following the easing of fiscal and monetary policies that sustained corporate entities during the pandemic. Most corporations, including financial institutions, claim that their capital buffers have been hit and could potentially “constrain the supply of credit to healthy firms and dampen business investment.”

- The near-term global outlook for corporate losses will impact some sectors more than others. In particular, the recreation, trade, transport, social services, and construction sectors will be hit hard, while manufacturing, utilities, real estate, and the information sectors will be least impacted.

- In the near-term, World Bank Group data suggests that the gradual withdrawal of government support programs that shielded corporations from failing during the pandemic can potentially lead to corporate solvency crises in regions with high corporate indebtedness and weak recoveries constrain profits and in countries with more “zombie firms dependent on low interest rates.”

- Overall, a persisting COVID-19 pandemic could result in a “wave of corporate bankruptcies or financial market stress” that can derail the recovery. The World Bank Group data indicates that the lingering impacts of COVID-19 on households and corporate & bank balance sheets would slow growth in the fiscal year 2022/23 to 7.5%.

Uneven Access to Vaccines

- According to the most recent (2021) data on vaccine procurement and inoculation, the “baseline assumes staggered and uneven distribution of vaccines across regions, with broad vaccine availability in advanced economies. In some emerging market economies, broad vaccine availability is expected for the summer of 2021 and in most countries by the second half of 2022.”

- It is expected that “effective protection, combined with improved testing and tracing,” will likely result in reduced local transmissions to low levels globally by the end of 2022. This is because vaccine deployment remains largely staggered across countries; therefore, some countries or regions will likely exit the pandemic earlier, whereas others will exit later, considering the new virus variants that force localized lockdowns in some regions.

- The uneven rollout of vaccines across regions will likely undermine growth recovery in the near-term. For instance, earlier and widespread vaccine rollouts in advanced economies have led to economic and social gains; therefore, the short-term prospects for containing COVID-19 are in jeopardy in many EMEs.

- Data shows that the pace of vaccine rollouts remains uneven, with advanced economies, including Brazil and Russia, likely to vaccinate their entire populations by the end of 2021. Equally, most middle-income countries will likely vaccinate their entire populations by mid-2022, whereas low-income countries are expected to vaccinate their people fully by mid-2023.

Rising Global Inflation (131)

- The World Bank Group data estimates show that global inflation is anticipated to continue rising through 2021. Higher inflation can potentially complicate inflation policies in EMDEs that are at risk of “persistently breaching their inflation targets while also relying on expansionary policies to ensure a durable recovery.”

- Experts predict stable short-term inflation rates, with low and stable inflation rates in the long-term, i.e., 2021 and beyond. However, economic factors, including fading demographic changes and global supply chain changes, can increase and make short-term inflation more persistent, diminishing long-term inflation forecasts.

- In low-income countries, inflation challenges are expected to be severe because of rising food prices. In the near term, increases in global agricultural prices will likely add to inflationary pressures in LICs. Moreover, “potential pressures to finance large fiscal deficits can risk ingraining higher rates of inflation” in LICs.

- Overall, the global inflation rates in advanced economies is expected to decline to about 2% in 2022, while in EMDEs, the rate is expected to drop to slightly above 3%.

2. MAJOR MACROECONOMIC OUTLOOK FOR COUNTRIES

Extensive searches through the national economic and financial data for the respective regions did not include in-depth analyses regarding the widespread impact of the forecasted headwinds and tailwinds on companies with revenues beyond $1 billion. Equally, in some instances, the reports provided a detailed overview of the most affected and least affected industries by the forecasted headwinds and tailwinds. In some reports, the information was unclear; hence, the macroeconomic factor helped make some assumptions.

i. UNITED STATES

POTENTIAL POSITIVE FORCES

Accelerated Economic Recovery

- According to the World Bank Data, the U.S. economy is recovering fast than other countries, supported by increased fiscal relief. Growing personal incomes have increased consumption as more people reduce savings.

- Continued fiscal support and increasing vaccination rates across the U.S. are some factors supporting the rebounding economy, which is projected to reach 6.8% in 2021, the fastest growth rate since 1984; however, the growth is expected to slow to 4.2% in 2022 as the fiscal support starts to fade.

- Improved economic growth will boost all sectors, particularly the consumer goods and services industry and companies are set to benefit more, as consumers reduce savings and increase spending.

Federal Spending Fiscal Boost

- The Biden administration’s fiscal boost of $1.9 trillion in federal spending would boost economic activity by about 4% in 2021 and 2% by the end of 2022.

- The fiscal boost would improve economic activity and recovery. By mid-2022, the fiscal boost would lead to a “temporary and shallow decline and then grow at an annual rate of about 1.5%, coming close to the path projected just before the pandemic,” as shown in the image below.

- According to a Brookings Education report, in the “near-term and without additional federal resources to contain the resurgence of the pandemic and distribute vaccines, the economy will face substantial headwinds.” Overall, the health services sector will benefit most from the $750 billion for COVID-19 containment and vaccination measures.

POTENTIAL NEGATIVE FORCES

Stringent Corporate Bailout Measures

- The depressed U.S. economy coupled with a slow recovery across industries and increased protests outside the U.S. demanding “shared rewards in exchange for bailing out corporate giants” forced the Biden administration to attach strong conditions for corporate bailouts.

- Corporations receiving funds were required to pay workers a minimum wage of $15 per hour, maintain payrolls, provide one board seat to workers, mandatory shareholder approval of political spending. They were also “permanently banned from engaging in stock buybacks and barred from paying out dividends or executive bonuses until 2024,” or face criminal penalties for violating any rule.

- Overall, in the near-term and long-term outlook, these corporate bailout conditions are expected to affect all corporations in the U.S., including all industries, regardless of their annual revenues.

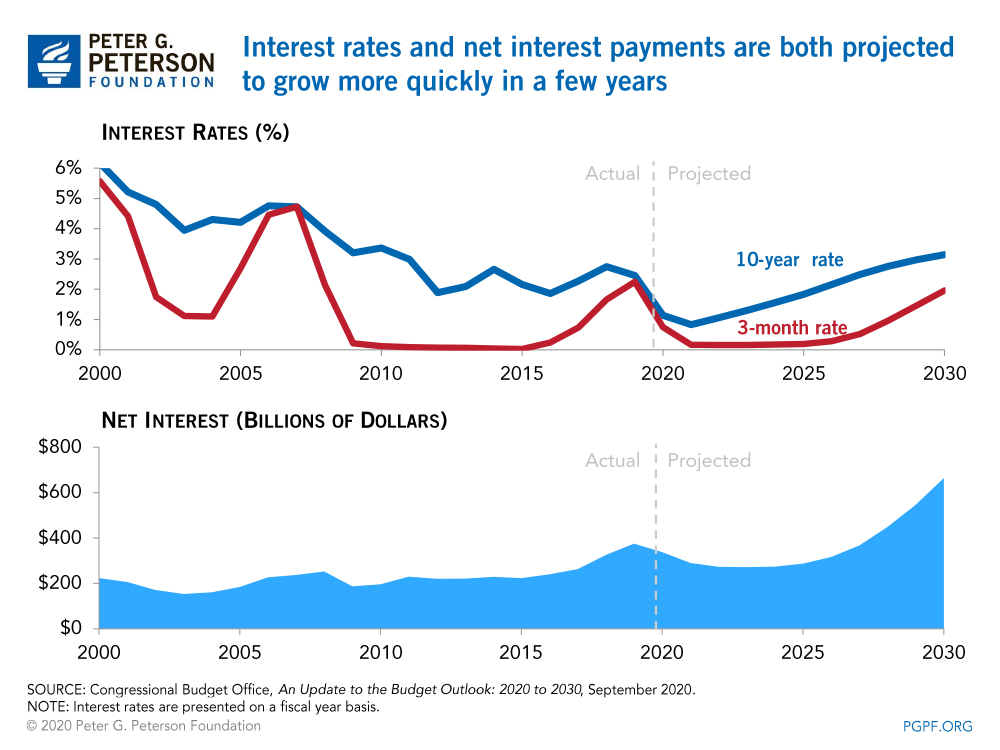

Growing National Debt

- The U.S. national debt has climbed fast since the COVID-19 pandemic and is anticipated to continue rising from 2021 through 2030. National debt held by the public was expected to “equal the size of the economy by the end of 2020.”

- Experts warn that by 2023, the U.S. debt held by the public will hit 107% of gross domestic product (GDP) and will be the highest rate in U.S. history and exceed the previous record set right after World War II. The rising rates are shown in the image below.

- Overall, the growing debt will significantly increase interest costs, implying that the impact will be greater across all sectors, particularly financial institutions that are sensitive to interest rate changes.

ii. EUROPE

POTENTIAL POSITIVE FORCES

Basel III Reform and EU Process

- The Basel III reform and EU process agreement was reached in 2017, with reforms concerning prudential banking regulations and included “consistency and trust in the calculation of risk-weighted assets (RWA), and it strikes a sound balance between standardized and internal model-based approaches.”

- However, following the COVID-19 pandemic, the Basel Committee decided to delay the implementation of the policy from the beginning of 2022 to the beginning of 2023. Full implementation of the Basel III reform will generate considerable benefits in resilience and improved credibility in Europe’s banking sector.

- Overall, the reform will significantly impact Europe’s banking sector and less impact across other industries. Importantly, no details show the impact of the reforms on businesses generating over $1 billion annually.

Strong Economic Recovery

- According to World Bank Group data, the Euro area faces a slow and inconsistent vaccine rollout and the rising Delta variant is constraining the region’s pace of recovery during the first half of 2021; however, the pace of recovery was expected to increase in the second half of 2021.

- The World Bank data anticipated a stronger recovery in the second half of 2021, alongside the expected increase in vaccinations and easing of pandemic restriction measures. The region’s 2021 growth is anticipated to reach 4.2% and accelerate to a further 4.4% in 2022, following the easing of restrictions to release pent-up demand.

- Overall, the recovery will likely impact the green infrastructure, including water management activities and digital infrastructure, including mobile telecom, broadband, internet backbone, etc.

POTENTIAL NEGATIVE FORCES

Potential Risk of Corporate Solvency

- Economic forecasts in Europe point to a potential risk of corporate insolvency as COVID-19 measures put by governments unwound in 2022. While more support is expected to arise from economic recovery and resilience facility plans, the possibility of corporate insolvency remains.

- In 2020, insolvencies across Europe declined due to the temporary suspension of “notifications, either through insolvency moratoria or the closure of courts.” In this regard, very few authorities anticipate more increases in insolvencies in 2021 and 2022. The majority of member countries expect insolvency rates to fall to pre-crisis levels in 2021 and beyond.

- Solvency risks are expected to have a significant impact on the banking and financial sectors of Europe than other sectors. Overall, while European governments continue to extend the deadline for liquidity and solvency support, the impact would be greater once the support is lifted in the near term.

Rising Delta Variant

- Growing COVID-19 infection rates in Europe, accelerated by the fast-spreading Delta variant, has forced the re-imposing of COVID-19 mitigation measures that could further slow economic recovery.

- The delta variant accounts for over 95% of new cases screened in the United Kingdom and about 90% of all diagnosed cases in Portugal. Forecast data indicated that over 90% of all COVID-19 cases in Europe would be the delta variant.

- The fast-rising delta variant of COVID-19 will significantly impact the tourism and travel sectors of Europe, including restaurants across the region.

iii. MIDDLE EAST

POTENTIAL POSITIVE FORCES

Rebounding Oil Exports

- Oil exports are expected to continue boosting economies in the region. An OPEC deal to increase oil production is expected to help Middle East economies, particularly the Gulf Cooperation Council (GCC).

- According to Monica Malik, chief economist at Abu Dhabi Commercial Bank, a longer-term deal would enable the region to raise its 2022 forecasts; thus, allow countries like UAE, Kuwait, Saudi Arabia, and the UAE to increase oil production.

- Kuwait’s exports will likely drive the country’s economic growth to a steady rate of 2.4% in 2021 before climbing to 3.2% in 2022-23. Likewise, Qatar’s economy is forecasted to expand by 3%, 4.1%, and 4.5% in 2021, 2022, and 2023, respectively.

- The region's largest economy — Saudi Arabia's GDP in 2022 will grow at 4.3%, with 2023 growth revised to 3.3%. Overall, rebounding oil prices and production will likely impact the regions oil & gas and the export sectors.

Increased Hiring

- Within the next year, most businesses in the UAE are expected to hire new employees as the region's labor market improves. By September 2022, approximately 72% of businesses in the UAE plan to hire new employees.

- Over half of job seekers in the UAE plan to switch careers following new opportunities in the job market. The top hiring sectors in the region are healthcare and medical services at 66%, human resources at 65%, and consumer goods at 64%.

- 25% of companies in the region plan to hire customer service representatives, 19% want to fill sales executive gaps, and 17% plan to hire human resources managers and receptionists. The roles to be filled are shown in the image above.

POTENTIAL NEGATIVE FORCES

Fiscal Deficits

- Middle East fiscal deficits are projected to continue through 2023. Bahrain, Kuwait, and Oman have the largest deficits in the region; however, the ratio to GDP is expected to shrink than during the 2020 pandemic.

- Data published by the World Bank Gulf Economic Update (GEU) indicates that the region's goods and services exports declined 8.1% due to the four-year-low average global oil price of $41.30 per barrel and supply cutbacks.

- Overall, the oil export market is anticipated to be in deficit in 2021, with supplies expected to moderate in 2022 s in the region following an anticipated production stabilization. In this regard, the Brent oil price is forecasted to average $64pb in 2022 and $60pb in 2023.

- The oil & gas sectors of the Middle East will be most affected by the deficits.

Varied Vaccine Capacities in the Region

- The ability of countries to recover in 2021 varies greatly due to different vaccine capacities. Experts believe vaccines have an important role to play in contributing to about “one additional percent of GDP in 2022.”

- Unfortunately, some countries in the region, including the GCC states, Kazakhstan, and Morocco, began vaccinating their populations earlier and will likely vaccinate a huge percentage of the population in 2021.

- On the other end, slow inoculators, including Egypt, Iran, Iraq, and Lebanon, will manage to vaccinate a significant percentage of their population by the end of 2022.

- Overall, vaccine rollouts will lead to the easing of health restrictions; thus, they will have a significant impact on the tourism industry that has remained dormant for a while. Further, the region’s oil & gas sector is set to benefit, as well.

iv. CHINA

POTENTIAL POSITIVE FORCES

Common Prosperity Policy

- China is shifting its current policy from a “growth-first development model to one of balanced growth and equality.” The shift would also ensure that wealth redistribution does not affect the importance of wealth creation.

- Experts warn that China cannot fully embrace the new common prosperity approach when its per capita is one-fifth that of the U.S.; thus, the country needs to strike a balance between dual circulation to grow the economy and common prosperity, which focuses on equitable sharing of economic benefits.

- Overall, income distribution and gaps in development in China’s urban and rural regions remain varied and large; therefore, promoting common prosperity will likely be a long-term goal (beyond 2022) that would affect many sectors, particularly the retail sector and the nation’s social fabric.

Broadening Economic Growth

- China’s economic activities continue broadening and normalizing, with economic growth projected to reach 8.5% by the end of 2021 and 5.4% in 2022.

- Demand side factors, including positive consumer sentiment, business confidence, and an improved labor market conditions are expected to support a change from public investments and exports to private domestic demand. Likewise, on the supply side, factors driving economic growth are anticipated to shift from industrial production toward services.

- With the recovery consolidating, economic policies are also anticipated to shift from an accommodative stance to a more neutral one. The manufacturing and industrial sectors are expected to be impacted the most by broadening economic activity.

- Overall, Sebastian Eckardt, World Bank Lead Economist for China said, in the near-term forecast, policymakers should focus on growth-enhancing structural changes and drive the economy to a “greener, more resilient, and inclusive development path.”

POTENTIAL NEGATIVE FORCES

Energy Use Curbs

- Strict measures to curb electricity use in China will likely result in negative economic outcomes. Local governments across China have been cutting electricity to meet emission targets and attain energy efficiency; however, these cuts are causing prices to rise and overseas orders canceled by many manufacturers.

- China’s state planning agency plans to toughen penalties for provinces that fail to meet energy use targets. The country’s near-term energy strategy is under watch following upcoming international climate talks. In this regard, China is under scrutiny to increase its efforts in tackling coal consumption and reduce carbon emissions.

- Climate watchers in the region claim that China’s 2021 – 2025 energy plan will likely adopt an interim national energy cap and permit a steady increase in consumption during the forecast period.

- Overall, data shows that the manufacturing and industrial sectors that utilize high energy will be the most affected by the energy caps.

Residential Property Market Slowdown

- China’s residential property market is facing a slowdown following regulatory tightening and an exacerbating crisis involving the nation’s most indebted developer are affecting buyer sentiment. Home sales in August declined by 20% compared to a year earlier.

- Increased mortgage rates, tightening regulation for home sales, measures to mitigate excess borrowing by developers, and softness in the country’s housing sector are all hurting the property market, coupled with the nation’s worsening cash crunch.

- The property market crisis can expose many sectors to credit risks, including small banks and developers, implying that the two are examples of sectors worse hit by the housing market slowdown.

- Overall, China’s real estate shares dropped on September 15, with the Shanghai Stock Exchange Property Index plummeting about 2.5% following earnings forecasts cut by Morgan Stanley’s by as much as 13% through 2023.

v. SOUTHEAST ASIA.

POTENTIAL POSITIVE FORCES

Positive Economic Outlook

- Data published by the Asian Development Bank (ADB) indicates that South Asian economies will rebound at a slower rate. Resurging COVID-19 outbreaks have necessitated the reimposing of containment measures that hamper economic activity.

- Experts indicate that Southeast Asia economy will expand by 5% in 2022. Concerns around the COVID-19 delta variant in the region have fueled lowered economic outlooks, with experts indicating that the region will expand slowly through 2022.

- In August 2021, over 163,000 new daily cases of the delta variant were recorded in the region, marking a decline from the 430,000 peak daily cases witnessed in May.

- Lowered economic outlook for Southeast Asia suggests that the region’s economy will grow at 3.1% for 2021 and 5.0% in 2022. Overall, the Southeast Asia economy is expected to contract 0.6% in 2021 before expanding 4.8% in 2022. The image above shows economic growth projections for developing Asia.

Positive inflation Forecast

- Southeast Asia is anticipated to witness headline inflation rates at 2.2% and 2.7% in 2021 and 2022, respectively. Previous data findings indicate that inflation in the region has accelerated but remains in check.

- Inflation rate has declined steadily (0.8%) from January to 2.3% in June because of increasing food and energy prices. Nevertheless, inflation rates in the region remain insignificant and close to country targets, with a few exceptions, including Malaysia, the Philippines, and Thailand.

- Overall, the Asian Development Bank revised down inflation in Southeast Asia because of declining growth and the region’s deteriorating economic forecast catalyzed by the recent delta variant COVID-19 outbreaks.

POTENTIAL NEGATIVE FORCES

Uneven Vaccination Rates

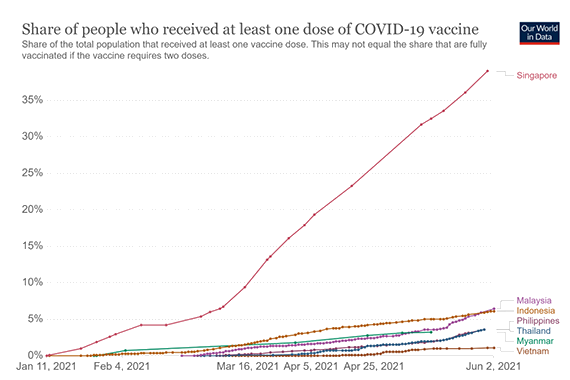

- Southeast Asia vaccination efforts remain largely uneven and lags behind compared to advanced economies. For example, by end of August 2021, an estimated 28.7% of the region’s population had received full vaccine protection, versus 51.8% of the population in the U.S. and 58.0% in the European Union.

- According to ADB Acting Chief Economist Joseph Zveglich, Jr., country policy measures should focus on vaccination, containment measures, and continued business and household support to help businesses and individuals adapt to the new normal. The image below shows vaccination rates in the region.

- Slow vaccine rollouts, continued lockdown, restrictions, and new virus variants are the primary factors undermining the Southeast Asia economy. Overall, economies that managed to roll out vaccines earlier include “Hong Kong, China; the People’s Republic of China (PRC); Singapore; and Taipei, China.”

Prolonged Containment Policies

- Prolonged COVID-19 containment measures in Southeast Asia have been projected to hurt the economy’s fiscal and debt sustainability because as government spending to contain outbreaks increases, tax revenues continue shrinking further.

- The continued tightening of social distancing and movement measures will have a major impact on quarterly and annual economic results. For instance, recent national lockdowns in Malaysia and below capacity factory operations in Vietnam, all undermine the economy’s potential to recover.

- Southeast Asian economies require “internal discipline on mobility and social distancing measures,” better testing and contact tracing resources and millions of vaccines to help mitigate the COVID-19 outbreaks.

- Overall, large scale vaccination efforts in Southeast Asia will unlikely yield positive results because some countries in the region identify with bureaucratic practices, funding constraints, and more dispersed populations.

Research Strategy

For this report, the research team reviewed global economic data analyses provided by the World Bank Group, the International Monetary Fund, the European Union, Brookings Institution, ESRB Ratings, the Institute of Chartered Accountants in England and Wales, Bloomberg, Reuters, and the Asian Development Bank (ADB), among other business news publishers like Forbes, CNBC, and the South China Morning Post, among others. These reports featured near-term and long-term outlook projections covering the 12 – 18 month range, i.e., forecast ranges reaching 2022 to 2023.

Unfortunately, these reports and data analyses did not include information showing the extent of damage of the macroeconomic factors to businesses with over $1 billion annual revenues. Some contained information regarding the sectors that will be impacted most, while the majority did not feature that information. The analysis did not include such information in cases where available data could not help identify the potential industries that these macroeconomic factors would impact the most. For instance, information relating to Southeast Asia economies did not include detailed analyses compared to information focusing on other regions.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/BATOMUV445EDBEZQWLJ4IGORHA.png)