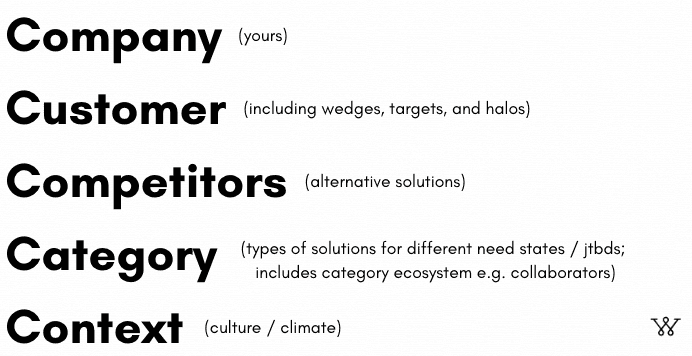

What no one taught us about the 5 Cs

Of all the frameworks and abbreviations out there, the “5Cs” might be the most timeless.

Different companies and teams use different language, but the gist is the same:

But if our decade of working with the world’s strongest companies, monitoring best practices and emerging thinking, and analyzing the many components that go into each of these has taught us anything, it’s this:

🛑 How companies tackle the 5Cs makes or breaks their success.

Here’s why.

First, these aren’t just for good marketing.

They’re behind every smart business and growth decision, especially:

👉 Who to serve

👉 Where to play

👉 How to win

🛑 Notice this order.

Most companies start with “how to win.” Good companies are thoughtful about “where to play” – picking the right ocean, to borrow the famous thinking. Winning companies start with the end-user, and this includes the reality that surrounds them (and the company).

Winning companies don’t chase product-market fit, they arrive at it by starting with problem-solution fit (i.e. the audience’s problem, which needs to be big enough across users, painful enough to warrant an action, and not sufficiently met by existing solutions).

Which brings us to the right way to leverage the 5Cs. Here’s why order matters:

1️⃣ It all starts with the customer, whether existing or potential. That could mean a wedge – your beachhead – or it could mean your target segments.

Who are they? What do they do, think, and feel (as relates to your category and beyond)? What are their pains, gaps, challenges, and/or needs (which are not sufficiently met, but something they’d like to address)?

2️⃣ Next, winning companies consider the context their audience is operating in. This includes the culture and climate – the world around them.

How are society, trends, the economy, the political / legal environment, the actual environment, technology, and other consequential factors influencing their lifestyle, wallet, and preferences?

3️⃣ From there, we consider the category(ies) they engage with, remembering buyers think in terms of need states and jobs to be done – not the clear-cut NAICS codes or carefully crafted category name we obsess over.

Looking across demand spaces, day parts, and the like, what are they trying to achieve, how do they see the world of solutions as relates to those needs, and how do they make decisions within those different types of solutions?

* from a company’s perspective, awareness of the full ecosystem surrounding a category creates opportunities for resonance and stickiness: partnering, collaborating, and otherwise building relationships with other key players

4️⃣ Then, we assess competitors. This doesn’t mean obsess over them, but any defensible product or strategy requires awareness of “category adjacent,” incumbent, emerging / disruptive, and alternative solutions.

Who or what else is meeting this need? How? How is it better or different? What's working and what's not for customers?

5️⃣ Only then do we turn to our own company. Of course this is always top of mind, but starting here – with the offer you think you want to sell, with the revenue target you’re chasing, or otherwise – has proven time and again to be a fast track to flatlining, if not failure.

What can we uniquely do or offer to solve this problem? How and why are we uniquely equipped to do so? How can we best socialize, monetize, and distribute this solution?

Consider your team or company’s biggest successes vs. biggest flops.

I’m willing to bet this flow was either behind them or would’ve led to a more fruitful outcome, as is true for so many leading brands.

Here's to making better decisions, building stronger strategies, and placing smarter bets through better, stronger, smarter information across ALL of the Cs!

Victoria

P.S. Looking to accelerate your time to insight around any (or all!) of these? Wonder taps the speed and horsepower of AI and the rigor and quality of humans to deliver robust strategy and innovation research reports in hours. Let’s chat.